Dipeptidyl Peptidase 4 (DPP-4) Inhibitors Market

Global Dipeptidyl Peptidase 4 (DPP-4) Inhibitors Market Size, Share & Trends Analysis Report by Drug Type (Sitagliptin, Vildagliptin, Saxagliptin, Linagliptin, Gemigliptin, Anagliptin, Teneligliptin, and Others) Forecast, 2020-2026 Update Available - Forecast 2025-2035

Dipeptidyl peptidase 4 (DPP-4) inhibitors are a class of oral hypoglycemics that block the enzyme dipeptidyl peptidase-4 (DPP-4) and are primarily used for the treatment of particularly diabetes mellitus type 2. The global dipeptidyl peptidase 4 (DPP-4) inhibitors market is projected to grow at a modest CAGR of 3.5% during the forecast period (2020-2026). The key aspect that drives the growth of the market includes the rising incidences of diabetes among the people across the people. Besides, these inhibitors aids in the release of insulin secretion.

There has been an inclination witnessed in the cases of diabetes across the globe. As per the WHO, the prevalence of diabetes is been rising gradually over the last three decades. As per the IDF, the diabetic population in 2019 was nearly 463 million which is projected to reach 578 million by 2030, which will further raise to 700 million by 2045. These numbers specify a gradual rise in the prevalence of diabetes which will demand the proper treatment options and in turn will positively impact the demand for the dipeptidyl peptidase 4 (DPP-4) inhibitors over the forecast period.

Changing eating habits and sedentary lifestyles are the major cause leading to obesity which in turn leads to diabetes among the people. Hence, the increasing obese population is at a risk of diabetes which in turn will create a scope for the market growth over the forecast period. However, the factor that hinders the growth of the market is the adverse effects of the dipeptidyl peptidase 4 (DPP-4) inhibitors such as headache, nausea, skin reactions, heart failure, nasopharyngitis, hypersensitivity, and even sometimes cancer.

Segmental Outlook

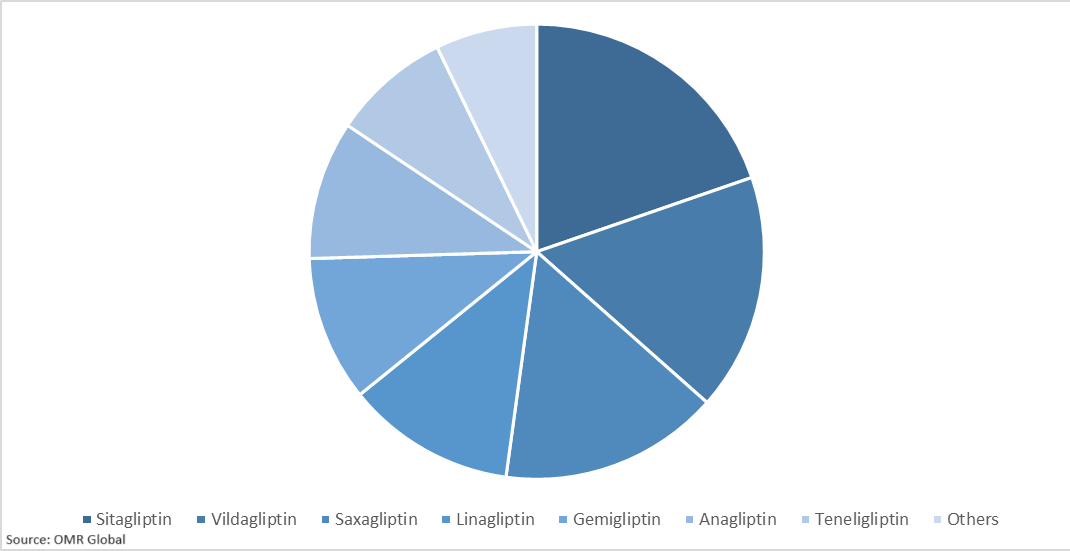

The global dipeptidyl peptidase 4 (DPP-4) inhibitors market is segmented on the basis of drug type. Based on the drug type, the market is segmented as Sitagliptin, Vildagliptin, Saxagliptin, Linagliptin, Gemigliptin, Anagliptin, Teneligliptin, and Others. Amongst these drug types of the global dipeptidyl peptidase 4 (DPP-4) inhibitors, the Sitagliptin and Saxagliptin are projected to hold the most lucrative share in the market. The segmental growth of the market is accredited to the effectiveness of the drug on the diabetic patient. Sitagliptin is a US FDA approved drug which is marketed by Merck & Co. as Januvia. The drug was approved by the US FDA in 2006. Whereas, Saxagliptin is a US FDA approved drug marketed by Bristol-Myers Squibb Co. with AstraZeneca Plc as Onglyza.

Global Dipeptidyl Peptidase 4 (DPP-4) Inhibitors Market, by Drug Type 2019 (%)

Regional Outlook

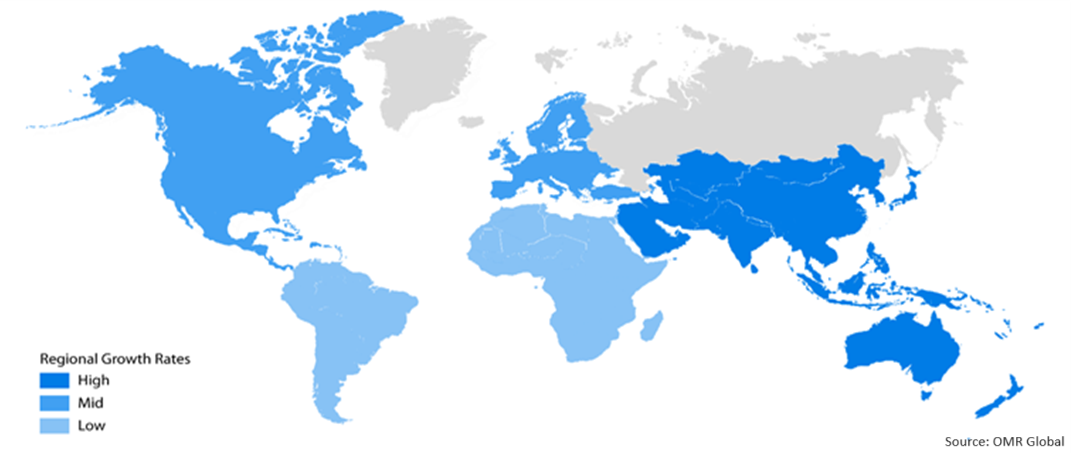

The global dipeptidyl peptidase 4 (DPP-4) inhibitors market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America region is projected to hold a significant market share. The US and Canada are primarily driving the growth of the dipeptidyl peptidase 4 (DPP-4) inhibitors market in the region. The regional growth of the market is accredited to the rising prevalence of diabetes across the region. As per the IDF, the prevalence of diabetes in the US is approximately 11.1% of the total population in the region which is projected to reach up to 12.3% in 2030 which is further projected to reach 13% in 2045. Such an increased prevalence of diabetes provides growth opportunities for the market in the region over the forecast period.

Besides, the presence of key players, technological advancements, availability of a broad range of products, and their wide distribution network are some other factors that drive the growth of the dipeptidyl peptidase 4 (DPP-4) inhibitors market across the region. Further, the Asia-Pacific region is also estimated to witness a significant value for the market, attributing to the rising geriatric population in emerging economies such as Japan and India.

Global Dipeptidyl Peptidase 4 (DPP-4) Inhibitors Market, by Region 2019 (%)

Market Players Outlook

The prominent players functioning in the global dipeptidyl peptidase 4 (DPP-4) inhibitors market include Boehringer Ingelheim International GmbH, Bristol Myers Squibb Co., Merck & Co., Eli Lily & Co., GlaxoSmithKline Plc, LG Life Sciences Ltd., Novartis AG, Phenomix Corp., and Takeda Pharmaceutical Co. among others. These key manufacturers are adopting various strategies such as new product launches and approvals, merger and acquisition, partnerships and collaborations, and many others in order to thrive in a competitive environment.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global dipeptidyl peptidase 4 (DPP-4) inhibitors market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Dipeptidyl Peptidase 4 (DPP-4) Inhibitors Industry

• Recovery Scenario of Global Dipeptidyl Peptidase 4 (DPP-4) Inhibitors Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Merck & Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Novartis AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Eli Lily &Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Boehringer Ingelheim International GmbH

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Dipeptidyl Peptidase 4 (DPP-4) Inhibitors Market by Drug Type

5.1.1. Sitagliptin

5.1.2. Vildagliptin

5.1.3. Saxagliptin

5.1.4. Linagliptin

5.1.5. Gemigliptin

5.1.6. Anagliptin

5.1.7. Teneligliptin

5.1.8. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AstraZeneca Plc

7.2. Boehringer Ingelheim International GmbH

7.3. Bristol Myers Squibb Co.

7.4. Eli Lily & Co.

7.5. GlaxoSmithKline Plc

7.6. Kowa Co. Ltd.

7.7. LG Life Sciences Ltd.

7.8. Merck & Co.

7.9. Novartis AG

7.10. Pfizer Inc.

7.11. Phenomix Corp.

7.12. Sanofi SA

7.13. Sanwa Kagaku Kenkyusho Co. Ltd.

7.14. SatRx LLC

7.15. Takeda Pharmaceutical Co.

1. GLOBAL DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

2. GLOBAL SITAGLIPTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL VILDAGLIPTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SAXAGLIPTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL LINAGLIPTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL GEMIGLIPTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ANAGLIPTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL TENELIGLIPTIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL OTHERDRUG TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

13. EUROPEAN DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

1. GLOBAL DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SHARE BY DRUG TYPE, 2019 VS 2026 (%)

2. GLOBAL DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

5. UK DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

14. ASEAN DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

15. SOUTH KOREA DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC DIPEPTIDYL PEPTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD DIPEPTIDYL PEPsTIDASE 4 (DPP-4) INHIBITORS MARKET SIZE, 2019-2026 ($ MILLION)