Directed Energy Weapons Market

Directed Energy Weapons Market Size, Share & Trends Analysis Report by Technology (High Energy Laser, High Power Radio Frequency, Electromagnetic Weapons, and Sonic Weapons), by Laser (Chemical Laser, Fiber Laser, Free Electron Laser, and Solid -State Laser), by Application (Homeland Security, Military, and Defense), and by Platform (Land, Airborne, Naval, and Space) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Directed energy weapons market is anticipated to grow at a significant CAGR of 9.5% during the forecast period. The rising geographical conflicts and increasing demand for advanced military devices in combat applications are propelling the demand for a globally directed energy weapons market. Additionally, the growing investments by several defense and military organizations in the modernization of existing infrastructures to enhance national security are also augmenting market growth. According to the US Department of Defense in 2023 the regulatory body allotted a budget of $773 billion. This budget represents a $30.7 billion or 4.1% increase over 2022. Compared to the 2021 level, 2023 shows a growth of nearly $70 billion or 9.8%. On the other hand, high development costs and restrictions on anti-personnel lasers are expected to obstruct market growth.

Segmental Outlook

Directed energy weapons market is segmented based on technology, laser, application, and platform. Based on technology, the market is segmented into high energy lasers, high power radio frequency, electromagnetic weapons, and sonic weapons. Based on laser the market is categorized into a chemical laser, fiber laser, free electron laser, and solid-state laser. Based on application, the market is segmented into homeland security, military, and defense. Based on the platform, the market is divided into land, airborne, naval, and space. Based on application, the homeland sub-segment is anticipated to grow at a favorable rate, owing to the high adoption rate of directed energy weapons for various homeland security applications.

Based on technology, the high-energy laser segment has registered substantial growth in the global directed energy weapons market. The application of high-energy lasers as part of missile defense systems is expected to increase, with major defense spenders increasingly adopting these solutions and showing interest in developing such solutions. For instance, in March 2021, MBDA and CILAS collaborate with SIGN4L to explore co-development opportunities in high-energy laser weapons systems to destroy drones. In addition, to combat airborne threats such as missiles and drones, the demand for high laser weapons in the navy is rapidly rising across the globe. For instance, the IIA DDG Arleigh Burke destroyer is scheduled to have Lockheed Martin's High Energy Laser with Integrated Optical-dazzler and Surveillance, or HELIOS, permanently installed on board in 2021.

Regional Outlooks

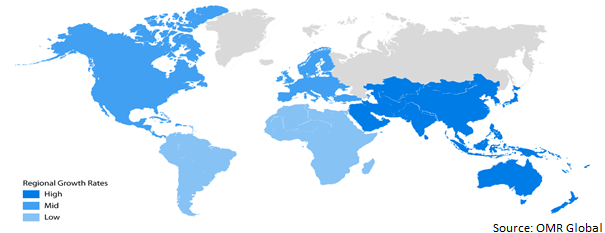

The global directed energy weapons market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. The European region is anticipated to witness considerable growth in the market. Increasing funding by regulatory bodies to the defense, and weapons sectors, coupled with border disputes among the region drive the market growth. For instance, in 2021, the MDA’s directed energy demonstrator development program received $42 million in funding from the department of defense.

Global Directed Energy Weapons Market Growth, by Region 2023-2030

The European Region Leads in the Global Directed Energy Weapons Market

The European region is anticipated to hold a prominent market share in the market. The growth is mainly attributed owing increasing government expenditure for the military and defense sector, along with the presence of major market players such as Boeing, Moog Inc, Rafael Advanced Defense Systems Ltd., and others in the region that are providing an immense range of new and innovative energy weapons. According to the European Defence Agency (EDA)2022, in 2021, the total defense expenditure of the 26 EDA Member States amounted to $216 billion. In 2021, 18 MS increased their defense expenditure compared to 2020, six MS raised their defense expenditure by more than 10%.

Market Players Outlook

The major companies serving the global directed energy weapons market include Lockheed Martin Corp., MBDA, Honeywell International Corp., Thale Group, The Boeing Co., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in November 2022, the UK Defence Science and Technology Laboratory (DSTL) completed its first long-range laser-directed energy weapon (LDEW) test at Porton Down. The test validated the performance and viability of high-energy laser and related technologies, such as its beam director, to intercept ranged targets.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global directed energy weapons market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. ByRegion

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Lockheed Martin Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. MBDA-Systems, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Thales Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Boeing Co.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Directed Energy Weapons Market by Technology

4.1.1. High Energy Laser

4.1.2. High Power Radio Frequency

4.1.3. Electromagnetic Weapons

4.1.4. Sonic Weapons

4.2. Global Directed Energy Weapons Market by Laser

4.2.1. Chemical Laser

4.2.2. Fiber Laser

4.2.3. Free Electron Laser

4.2.4. Solid -State Laser

4.3. Global Directed Energy Weapons Market by Application

4.3.1. Homeland Security

4.3.2. Military

4.3.3. Defense

4.4. Global Directed Energy Weapons Market by Platform

4.4.1. Land

4.4.2. Airborne

4.4.3. Naval

4.4.4. Space

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3Harris Technologies, Inc

6.2. BAE Systems

6.3. Kord Technologies

6.4. Leonardo US Inc,

6.5. Moog Inc.

6.6. Northrop Grumman

6.7. QinetiQ

6.8. Rafael Advanced Defense Systems Ltd.

6.9. Raytheon Technologies Corp.

6.10. Rheinmetall AG

6.11. Textron Systems Corp.

1. GLOBAL DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

2. GLOBAL HIGH ENERGY LASER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL HIGH POWER RADIO FREQUENCY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL ELECTROMAGNETIC WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL SONIC WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY LASER, 2022-2030 ($ MILLION)

7. GLOBAL CHEMICAL LASER DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL FIBER LASER-DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL FREE ELECTRON LASER-DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL SOLID STATE LASER DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

12. GLOBAL DIRECTED ENERGY WEAPONS FOR HOMELAND SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL DIRECTED ENERGY WEAPONS FOR MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL DIRECTED ENERGY WEAPONS FOR DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2030 ($ MILLION)

16. GLOBAL LAND DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL AIRBORNE DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. GLOBAL NAVAL DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

19. GLOBAL SPACE DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

20. GLOBAL DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

21. NORTH AMERICAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. NORTH AMERICAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

23. NORTH AMERICAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY LASER, 2022-2030 ($ MILLION)

24. NORTH AMERICAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

25. NORTH AMERICAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2030 ($ MILLION)

26. EUROPEAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. EUROPEAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

28. EUROPEAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY LASER, 2022-2030 ($ MILLION)

29. EUROPEAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

30. EUROPEAN DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2030 ($ MILLION)

31. ASIA-PACIFIC DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

32. ASIA-PACIFIC DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

33. ASIA-PACIFIC DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY LASER, 2022-2030 ($ MILLION)

34. ASIA-PACIFIC DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

35. ASIA-PACIFIC DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2030 ($ MILLION)

36. REST OF THE WORLD DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

37. REST OF THE WORLD DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

38. REST OF THE WORLD DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY LASER, 2022-2030 ($ MILLION)

39. REST OF THE WORLD DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

40. REST OF THE WORLD DIRECTED ENERGY WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2030 ($ MILLION)

1. GLOBAL DIRECTED ENERGY WEAPONS MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

2. GLOBAL HIGH ENERGY LASER MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL HIGH POWER RADIO FREQUENCY MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL ELECTROMAGNETIC WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL SONIC WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL DIRECTED ENERGY WEAPONS MARKET SHARE BY LASER, 2022 VS 2030 (%)

7. GLOBAL CHEMICAL LASER DIRECTED ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL FIBER LASER DIRECTED ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL FREE ELECTRON LASER DIRECTED ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL SOLID STATE LASER DIRECTED ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL DIRECTED ENERGY WEAPONS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

12. GLOBAL DIRECTED ENERGY WEAPONS FOR HOMELAND SECURITY MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL DIRECTED ENERGY WEAPONS FOR MILITARY MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL DIRECTED ENERGY WEAPONS FOR DEFENSE MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL DIRECTED ENERGY WEAPONS MARKET SHARE BY PLATFORM, 2022 VS 2030 (%)

16. GLOBAL DIRECTED LAND ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL DIRECTED AIRBORNE ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. GLOBAL DIRECTED NAVAL ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

19. GLOBAL DIRECTED SPACE ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

20. GLOBAL DIRECTED ENERGY WEAPONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

21. US DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

22. CANADA DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

23. UK DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

24. FRANCE DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

25. GERMANY DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

26. ITALY DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

27. SPAIN DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF EUROPE DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

29. INDIA DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

30. CHINA DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

31. JAPAN DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

32. SOUTH KOREA DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

33. REST OF ASIA-PACIFIC DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)

34. REST OF THE WORLD DIRECTED ENERGY WEAPONS MARKET SIZE, 2022-2030 ($ MILLION)