Distribution Transformer Market

Distribution Transformer Market Size, Share & Trends Analysis Report by Type (Oil-Filled and Dry Type), by Capacity (Below 500 kVA, 500 kVA - 2500 kVA and Above 2500 kVA), by Phase (Single-Phase and Three-Phase), and by End User (Commercial, Industrial, Utilities, Renewable Energy and Residentials) Forecast Period (2024-2031)

Distribution transformer market is anticipated to grow at a CAGR of 10.7% during the forecast period (2024-2031). The rising use of renewable energy sources, the need for advanced transformers for wind, solar, and hydropower technologies, policies that encourage rural electrification and the integration of renewable energy sources, and the expansion of power transmission and distribution networks is driving the market's growth. According to the International Energy Agency (IEA), 2024, energy consumption grew by 2.2% in 2024 globally, slower than the 2.4% growth observed in 2022. In 2023, China, India, and many countries in Southeast Asia experienced a sharp increase in demand for power.

Market Dynamics

Technological Advancements in Transformer Design

The market for distribution transformers is expanding dramatically owing to technological advancements in transformer design. Innovations such as smart transformers with monitoring and diagnostic capabilities are increasing efficiency and reliability. The demand for energy-efficient solutions has been met by improved core materials with reduced energy losses, such as amorphous metals. Transformer shapes that are small and modular have grown to overcome space limitations in metro and industrial surroundings. The increasing real-time performance monitoring is made possible by the combination of IoT and advanced analytics.

Accelerated Electrification and Infrastructure Projects in Emerging Regions

Governments in emerging countries are prioritizing rural electrification and metro grid upgrades to address the global expanding energy demands. The market for distribution transformers is growing in rising economies owing to accelerating electrification approaches and framework development action. By accelerating energy productiveness and lowering transmission losses, technological advancements in transformer design encourage their wide acceptance. Programs that endorse renewable energy sources also contribute to the sector's growth. Large-scale structure investments, such as the incorporation of renewable energy and added energy-effective distribution transformers.

Market Segmentation

- Based on the type, the market is segmented into oil-filled and dry types.

- Based on the capacity, the market is segmented into below 500 kVA, 500 kVA - 2500 kVA, and above 2500 kVA.

- Based on the phase, the market is segmented into single-phase and three-phase.

- Based on the end-user, the market is segmented into commercial, industrial, utilities, renewable energy, and residential.

Oil-Filled Segment is Projected to Hold the Largest Market Share

The primary factors supporting the growth are being driven by the increasing demand for oil-filled transformers owing to their higher efficiency and cooling capacity. For grid integration to thrive, reliable oil-filled transformers are needed owing to the rising use of renewable energy sources corresponding to wind and solar. Transformer technology advancements have increased the oil-filled models' functioning life and efficacy, which has accelerated their uptake indeed more. Another factor driving market growth is regulatory demands that support an energy-effective structure. Oil-filled distribution transformers are also in demand owing to the growing demand for electricity in both metro and rural areas.

Industrial to Hold a Considerable Market Share

The factors supporting segment growth include the growing industrial development which has a major impact on the market expansion for distribution transformers. Advanced transformer usage has been fueled by the need for dependable and effective power distribution systems owing to the growing demand for electricity in industrial sectors. The demand for high-capacity transformers has increased owing to the growth of the mining, industrial, and heavy sectors. The technological innovation that satisfies the evolving demands of industrial automation and energy management is the smart transformer. New growth opportunities are being created by infrastructural improvements. The key players are improved by governments' emphasis on energy efficiency measures. For instance, in July 2023, Maddox Industrial Transformer constructed a new 45,000-square-foot production plant in Batavia, Ohio, which is their fourth significant production location in the US. The production plant accommodates up to 1,200 transformers. This reserve parts storage allows Maddox to recondition and repair customers' transformers faster, cutting down on lead times and minimizing the impact of future supply chain issues.

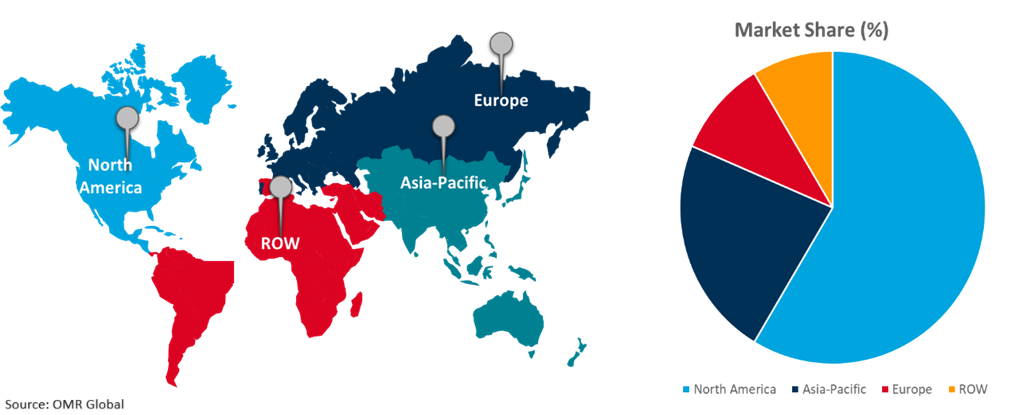

Regional Outlook

The global distribution transformer market is further segmented based on region including North America (the US, and Canada), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (Latin America and the Middle East & Africa).

Growing Demand for Grid Upgrade and Energy Efficiency in North America

The rising rapidly owing to the increasing demand for dependable power distribution systems brought on by industrialization and urbanization. Programs from the government that promote energy efficiency and grid upgrades drive the growth of the North American distribution transformer market. To integrate renewable energy sources into the system efficiently, advanced transformers are required. Initiatives to expand infrastructure continue to support the region's demand for distribution transformers. According to the US Department of Energy (DOE), in April 2024, congressionally mandated energy efficiency standards for distribution transformers to bolster and increase the resilience and efficiency of America’s power grid and accelerate the nation’s rollout of affordable, reliable, and clean electricity. The demand for grain-oriented electrical steel (GOES) and other essential components would rise as a result of this new standard, it has a five-year compliance period and is expected to save $824 million annually in electricity costs for commercial and industrial businesses as well as American utilities.

Global Distribution Transformer Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of distribution transformer offering companies such as Toshiba Corp., Mitsubishi Electric Corp., CG Power and Industrial Solutions Ltd., Bharat Heavy Electricals Ltd. (BHEL), Hyosung Heavy Industries and Hyundai Electric & Energy Systems and others. The rapid industrialization and urbanization of countries such as China, India, and Southeast Asia have increased the need for reliable energy distribution. According to the Indian Electrical and Electronic Manufacturer Association (IEEMA), in 2023, the production of distribution transformers reached 7.0%, whereas production of power transformers increased by only 2.0%. Encouraging regulations and energy infrastructure investments are crucial for propelling industry expansion. For instance, in April 2024, Hitachi Energy announced investments totaling more than $1.5 billion to increase its global transformer manufacturing capacity. The investments, which come in addition to the $3 billion already announced to advance the electrification of the energy system led by the energy transition, progressively increase the company's global transformer capacity by 2027.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the distribution transformer market include ABB Ltd., GE Vernova Group, Hitachi Energy Ltd., Schneider Electric SE, and Siemens AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In October 2023, Prolec and Ubicquia collaborated to construct integrated smart transformers for the industry. The UbiGrid DTM+ platform is the first distribution transformer monitoring platform providing real-time electrical and physical transformer health data along with advanced grid analytics deployed at scale.

- In December 2022, Fuji Electric Co., Ltd. announced the launch of the FR3®Fluid-applied transformer, a transformer that uses natural ester oil as electrical insulating oil. Fuji Electric contributes to reducing environmental impact by proposing this product to industrial plants in Japan and overseas as well as to data centers and water treatment plants, for which markets continue to grow.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global distribution transformer market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.1.1. Expansion of Power Transmission and Distribution Networks

2.2.1.2. Enhancements in Grid Reliability and Energy Efficiency.

2.2.1.3. Government Initiatives and Energy Policies

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GE Vernova Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hitachi Energy Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Schneider Electric SE

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Distribution Transformer Market by Type

4.1.1. Oil-filled

4.1.2. Dry Type

4.2. Global Distribution Transformer Market by Capacity

4.2.1. Below 500 kVA

4.2.2. 500 kVA - 2500 kVA

4.2.3. Above 2500 kVA

4.3. Global Distribution Transformer Market by Phase

4.3.1. Single-phase

4.3.2. Three-phase

4.4. Global Distribution Transformer Market by End-User

4.4.1. Commercial

4.4.2. Industrial

4.4.3. Utilities

4.4.4. Renewable Energy

4.4.5. Residential

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Bharat Heavy Electricals Ltd. (BHEL)

6.2. CAHORS Group

6.3. CG Power and Industrial Solutions Ltd.

6.4. Eaton Corp.

6.5. Efacec Power Solutions

6.6. Fuji Electric Co., Ltd.

6.7. Hammond Power Solutions (HPS)

6.8. Hyosung Heavy Industries

6.9. Hyundai Electric Co., Ltd.

6.10. IEO Transformers

6.11. Kirloskar Electric Co.

6.12. Meidensha Corp.

6.13. Mitsubishi Electric Corp.

6.14. Ormazabal (Velatia Group)

6.15. Sécheron SA

6.16. SGB SMIT Group

6.17. TBEA Co., Ltd.

6.18. Toshiba Corp.

6.19. Virginia Transformer Corp.

6.20. Wilson Power Solutions Pvt. Ltd.

1. Global Distribution Transformer Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Oil-Filled Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Dry Type Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Distribution Transformer Market Research And Analysis By Capacity, 2023-2031 ($ Million)

5. Global Below 500 kVA Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global 500 kVA - 2500 kVA Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Above 2500 kVA Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Distribution Transformer Market Research And Analysis By Phase, 2023-2031 ($ Million)

9. Global Single-Phase Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Three-Phase Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Distribution Transformer Market Research And Analysis By End-Users, 2023-2031 ($ Million)

12. Global Distribution Transformer For Commercial Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Distribution Transformer For Industrial Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Distribution Transformer For Utilities Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Distribution Transformer For Renewable Energy Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Distribution Transformer For Residential Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

18. North American Distribution Transformer Market Research And Analysis By Country, 2023-2031 ($ Million)

19. North American Distribution Transformer Market Research And Analysis By Type, 2023-2031 ($ Million)

20. North American Distribution Transformer Market Research And Analysis By Capacity, 2023-2031 ($ Million)

21. North American Distribution Transformer Market Research And Analysis By Phase, 2023-2031 ($ Million)

22. North American Distribution Transformer Market Research And Analysis By End-User, 2023-2031 ($ Million)

23. European Distribution Transformer Market Research And Analysis By Country, 2023-2031 ($ Million)

24. European Distribution Transformer Market Research And Analysis By Type, 2023-2031 ($ Million)

25. European Distribution Transformer Market Research And Analysis By Capacity, 2023-2031 ($ Million)

26. European Distribution Transformer Market Research And Analysis By Phase, 2023-2031 ($ Million)

27. European Distribution Transformer Market Research And Analysis By End-User, 2023-2031 ($ Million)

28. Asia-Pacific Distribution Transformer Market Research And Analysis By Country, 2023-2031 ($ Million)

29. Asia-Pacific Distribution Transformer Market Research And Analysis By Type, 2023-2031 ($ Million)

30. Asia-Pacific Distribution Transformer Market Research And Analysis By Capacity, 2023-2031 ($ Million)

31. Asia-Pacific Distribution Transformer Market Research And Analysis By Phase, 2023-2031 ($ Million)

32. Asia-Pacific Distribution Transformer Market Research And Analysis By End-User, 2023-2031 ($ Million)

33. Rest Of The World Distribution Transformer Market Research And Analysis By Region, 2023-2031 ($ Million)

34. Rest Of The World Distribution Transformer Market Research And Analysis By Type, 2023-2031 ($ Million)

35. Rest Of The World Distribution Transformer Market Research And Analysis By Capacity, 2023-2031 ($ Million)

36. Rest Of The World Distribution Transformer Market Research And Analysis By Phase, 2023-2031 ($ Million)

37. Rest Of The World Distribution Transformer Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Distribution Transformer Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Oil-Filled Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

3. Global Dry Type Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

4. Global Distribution Transformer Market Research And Analysis By Capacity, 2023 Vs 2031 (%)

5. Global Below 500 kVA Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

6. Global 500 kVA - 2500 kVA Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

7. Global Above 2500 kVA Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

8. Global Distribution Transformer Market Research And Analysis By Phase, 2023 Vs 2031 (%)

9. Global Single-Phase Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

10. Global Three-Phase Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

11. Global Distribution Transformer Market Research And Analysis By End-User, 2023 Vs 2031 (%)

12. Global Distribution Transformer For Commercial Market Share By Region, 2023 Vs 2031 (%)

13. Global Distribution Transformer For Industrial Market Share By Region, 2023 Vs 2031 (%)

14. Global Distribution Transformer For Utilities Market Share By Region, 2023 Vs 2031 (%)

15. Global Distribution Transformer For Renewable Energy Market Share By Region, 2023 Vs 2031 (%)

16. Global Distribution Transformer For Residential Market Share By Region, 2023 Vs 2031 (%)

17. Global Distribution Transformer Market Share By Region, 2023 Vs 2031 (%)

18. US Distribution Transformer Market Size, 2023-2031 ($ Million)

19. Canada Distribution Transformer Market Size, 2023-2031 ($ Million)

20. UK Distribution Transformer Market Size, 2023-2031 ($ Million)

21. France Distribution Transformer Market Size, 2023-2031 ($ Million)

22. Germany Distribution Transformer Market Size, 2023-2031 ($ Million)

23. Italy Distribution Transformer Market Size, 2023-2031 ($ Million)

24. Spain Distribution Transformer Market Size, 2023-2031 ($ Million)

25. Rest Of Europe Distribution Transformer Market Size, 2023-2031 ($ Million)

26. India Distribution Transformer Market Size, 2023-2031 ($ Million)

27. China Distribution Transformer Market Size, 2023-2031 ($ Million)

28. Japan Distribution Transformer Market Size, 2023-2031 ($ Million)

29. South Korea Distribution Transformer Market Size, 2023-2031 ($ Million)

30. Rest Of Asia-Pacific Distribution Transformer Market Size, 2023-2031 ($ Million)

31. Latin America Distribution Transformer Market Size, 2023-2031 ($ Million)

32. Middle East And Africa Distribution Transformer Market Size, 2023-2031 ($ Million)