Drilling Waste Management Market

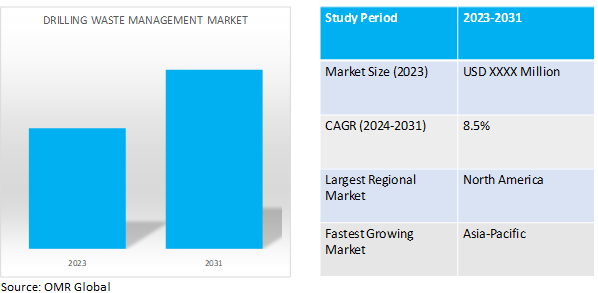

Drilling Waste Management Market Size, Share & Trends Analysis Report by Service (Solid Control, Containment & Handling and Treatment & Disposal), and by Application (Onshore and Offshore) Forecast Period (2024-2031) Update Available - Forecast 2025-2031

Drilling waste management market is anticipated to grow at a considerable CAGR of 8.5% during the forecast period (2024-2031). Drilling waste management is a process of handling, treating, and disposing of waste generated during drilling operations in the oil and gas industry. This waste typically includes drilling fluids, cuttings, muds, sludges, and other by-products produced during drilling activities.

Market Dynamics

Growing demand for drilling waste management

The global drilling waste management market is rising by exploration and production activities in the oil and gas sector, along with stringent environmental regulations. Technological advancements drive the adoption of innovative waste treatment solutions, ensuring compliance and operational efficiency while reducing environmental impact. Cost reduction and sustainability are key drivers, with companies increasingly focused on optimizing resource utilization and minimizing their environmental footprint. Market consolidation and strategic partnerships further enhance service offerings to meet evolving customer needs, particularly in offshore drilling operations where specialized waste management solutions are in high demand.

A rising number of permits for the partial use of global waste management

The increasing issuance of permits for the partial use of drilling waste management solutions reflects a growing recognition of the importance of sustainable waste practices in the industry. Regulatory bodies are acknowledging the effectiveness of certain waste management methods, allowing their partial implementation to address environmental concerns while maintaining operational efficiency. This trend signifies a shift towards more flexible and adaptive regulatory frameworks, facilitating innovation and encouraging the adoption of environmentally friendly practices within the drilling waste management market.

Market Segmentation

Our in-depth analysis of the global drilling waste management market includes the following segments by service and application:

- Based on service, the market is sub-segmented into solid control, containment &handling and treatment &disposal.

- Based on application, the market is sub-segmented into onshore and offshore.

Treatment & Disposal is Projected to Emerge as the Largest Segment

Based on the service, the global drilling waste management market is sub-segmented into solid control, containment & handling, and treatment & disposal. Among these, the treatment & disposal sub-segment is expected to hold the largest share in the market. The primary factor supporting the segment's growth includes the increasing focus on environmental regulations and sustainability. As governments worldwide impose stricter regulations on the disposal of drilling waste to minimize environmental impact, companies are compelled to invest in advanced treatment technologies and environmentally responsible disposal methods.

Solid Control Sub-segment to Hold a Considerable Market Share

Solid control equipment is indispensable for separating drilling fluids from cuttings, ensuring fluid reuse and waste minimization. As global drilling activities surge, demand for such equipment remains strong, bolstering the drilling waste management market. For example, in November 2021, the oil and gas sector grappled with significant waste generation, prompting innovative solutions like the Thermomechanical cutting cleaning process, coupled with solid control equipment. This approach repurposes treated cuttings for construction or cement production, aligning with circular economy principles. These insights are crucial for stakeholders aiming for safe, sustainable waste management solutions in offshore operations and beyond.

Regional Outlook

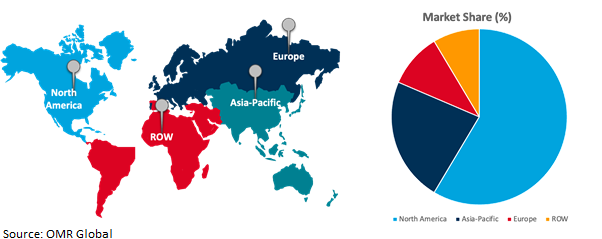

The global drilling waste management market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Investment in Global Drilling Waste Management

- Asia-Pacific countries are investing in the global drilling waste management market due to rising energy demand, environmental concerns, technological advancements, market opportunities, and international partnerships. With rapid economic growth driving increased exploration and production activities, efficient waste management is crucial for sustainable development and regulatory compliance. These investments aim to optimize waste treatment processes, improve operational efficiency, and capture opportunities in the growing global market, while fostering environmental sustainability through advanced technologies and international collaboration.

Global Drilling waste management Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds the major market share in the drilling waste management industry due to the presence of significant oil and gas reserves, leading to extensive drilling activities. The well-established regulatory frameworks that necessitate proper waste management practices further aiding to the regional market growth. Additionally, the region's advanced technological capabilities enable the development and adoption of innovative waste treatment technologies, further consolidating its market dominance and increasing environmental awareness among stakeholders and stringent enforcement of environmental regulations contribute to the region's leadership in the drilling waste management market. In December 2023, dry natural gas production in the Lower 48 states of the US recorded a monthly high of 105.5 billion cubic feet per day (Bcf/d) and also there was an increase in Lower 48 dry natural gas production, registering a growth of 3.7% (equivalent to 3.6 Bcf/d) compared to the levels observed in 2022. A rise in oil & gas production to fulfil the burgeoning energy need in the country will further boost the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global drilling waste managementmarket include Baker Hughes Co., CLEAN HARBORS, INC., Weatherford, General Electric, Derrick Corp., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, TWMAsigned a 10-year contract with Equinor that enabled TWMA to provide global waste management services for Equinor's operations. The contract includes various services such as bulk transfer, slop treatment, and the utilization of TWMA's RotoMill technology. TWMA's CEO, Halle Aslaksen, emphasized the company's commitment to environmental practices and highlighted the importance of efficient waste management for offshore drilling operations.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global drilling waste managementmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. CLEAN HARBORS, INC.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Weatherford International Plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Drilling Waste Management Market by Service

4.1.1. Solid Control

4.1.2. Containment & Handling

4.1.3. Treatment & Disposal

4.2. Global Drilling Waste Management Market by Application

4.2.1. Onshore

4.2.2. Offshore

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Bowron Environmental Group Ltd.

6.2. Derrick Corp.

6.3. Eco-Logic Environmental Engineering Inc.

6.4. General Electric

6.5. Halliburton Energy Services, Inc.

6.6. Imdex Ltd.

6.7. KOSUN Machinery Co., Ltd.

6.8. Newpark Resources Inc.

6.9. NOV Inc.

6.10. Nuverra Environmental Solutions

6.11. Ridgeline Canada Inc.

6.12. Schlumberger ltd. (SLB)

6.13. Secure Energy Services Inc.

6.14. SELECT WATER SOLUTIONS.

6.15. Services Ltd.

6.16. Soiltech AS

6.17. Soli-Bond, Inc.

6.18. Specialty Drilling Fluids Ltd.

6.19. STEP Oiltools

6.20. Tervita Corp.

6.21. TWMA

6.22. Veolia Environnement S.A.

6.23. Xi'an Brightway Energy Machinery Equipment Co., Ltd.

6.24. Xian Kosun Machinery Co., Ltd.

1. GLOBAL DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

2. GLOBAL SOLID CONTROL IN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CONTAINMENT & HANDLING IN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TREATMENT & DISPOSAL IN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL ONSHORE DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OFFSHORE DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

11. NORTH AMERICAN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. EUROPEAN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

14. EUROPEAN DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. ASIA-PACIFICDRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

17. ASIA-PACIFICDRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. REST OF THE WORLD DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

20. REST OF THE WORLD DRILLING WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL DRILLING WASTE MANAGEMENT MARKETSHARE BY SERVICE, 2023 VS 2031 (%)

2. GLOBAL SOLID CONTROL IN DRILLING WASTE MANAGEMENT MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CONTAINMENT & HANDLING IN DRILLING WASTE MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL TREATMENT & DISPOSAL IN DRILLING WASTE MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DRILLING WASTE MANAGEMENT MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL ONSHORE DRILLING WASTE MANAGEMENTMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OFFSHORE DRILLING WASTE MANAGEMENTMARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL DRILLING WASTE MANAGEMENT MARKETSHARE BY REGION, 2023 VS 2031 (%)

9. US DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

11. UK DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. MIDDLE EAST AND AFRICA DRILLING WASTE MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)