Drone Communication Market

Drone Communication Market Size, Share & Trends Analysis Report by Method (Radio Frequency, Single or multi-sim, LTE/4G, Satellite, and 5G), and by Application (Agriculture, Construction and Mining, Inspection, Oil and Gas, and Others) Forecast Period (2024-2031)

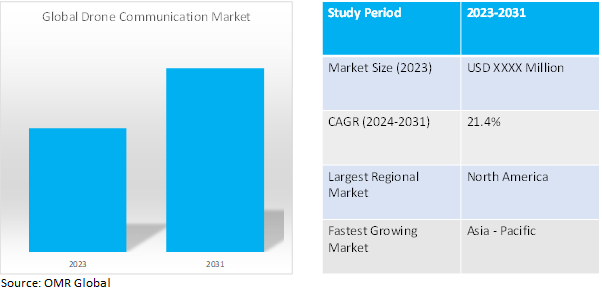

Drone communication market is anticipated to grow at a significant CAGR of 21.4% during the forecast period (2024-2031).Drone communication refers to the methods by which drones transmit and receive data, enabling control, telemetry exchange, and potential drone-to-drone coordination. The rising demand for drone swarms and autonomous drone operations further fuels the need for robust communication infrastructure. These trends, coupled with the expanding applications of drones in surveillance, disaster management, and delivery services, are propelling the growth of the global drone communication market.

Market Dynamics

Taking Control: Reliable Communication Drives the Drone Revolution

The expansion of drone technology in various industries is a key driver for the global drone communication market. Sectors such as agriculture, construction, security, and disaster response increasingly utilize drones for tasks once considered risky or costly. In March 2024, according to plans announced by the chancellor in the spring budget on Wednesday, drones are set to play a more prominent role as 'first responders' when the public reports incidents to emergency services. Jeremy Hunt Chancellor of the Exchequer informed MPs that£230.0 million ($248.9million) would be allocated for police to invest in 'time- and money-saving technology,' including unmanned flying vehicles (Drones) and video technology. These applications often require Beyond Visual Line of Sight (BVLOS) operation, where drones fly beyond direct pilot sight. With the rise of data-intensive sensors for tasks like crop monitoring, reliable communication becomes crucial. Effective drone communication ensures uninterrupted control, real-time data transmission, and secure information exchange. This fosters the safe and efficient execution of drone-powered applications, spurring demand for advanced communication solutions in the drone market.

Next-Gen Communication: Fueling the Power and Reach of Drones

The growing consumer electronics market stands as a significant driver for the growth of drone communication. With ongoing advancements in communication technologies, the global drone communication market is propelled forward. The integration of cutting-edge solutions such as satellite communication (SATCOM) and next-generation cellular networks (5G) is revolutionizing drone capabilities. For instance, Viasat, a satellite communications company, and Gotonomi, a UAV connectivity platform provider, showcased the capabilities of their VelarisTM connectivity solution in improving power line inspections. This demonstration was a collaborative effort that involved deploying ARA Robotics’ ARA-405 UAVs, equipped with state-of-the-art sensors and capable of beyond-line-of-sight (BVLOS) operations. SATCOM offers unmatched reach, facilitating Beyond Visual Line of Sight (BVLOS) operations crucial for tasks like pipeline inspections or extensive surveys by ensuring reliable connectivity even in remote areas. Meanwhile, the advent of 5G networks delivers vastly accelerated data transfer speeds compared to predecessors, enabling real-time data analysis and high-definition video transmission. These advancements empower more sophisticated and impactful drone operations, underscoring the growing reliance on robust communication infrastructure.

Market Segmentation

Our in-depth analysis of the global drone communication market includes the following segments by method and application:

- Based on the method, the market is segmented into radio frequency, single or multi-sim, LTE/4G, satellite, and 5G.

- Based on the application, the market is segmented into agriculture, construction and mining, inspection, oil and gas, and others (delivery services, search and rescue, public safety and law enforcement, environmental monitoring, mapping, and surveying, media, and entertainment).

5G: Supercharging the Future of Drone Communication

Among the segments in the drone communication market, the fastest-growing segment is 5G. With its unparalleled speed, low latency, and high capacity, 5G technology revolutionizes data transmission for drone operations. For instance, Nokia's Nokia Drone Networks, an industrial LTE and 5G drone solution received FCC certification, marking it as the first "native 4G/5G drone-in-a-box solution" to achieve this. Leveraging Rohde & Schwarz's network measurement capabilities, the solution supports BVLOS operations. Collaboration with partners like Kyndryl, AT&T, Verizon, DXC Technology, and Rohde & Schwarz was pivotal. Thomas Eder of Nokia stressed collaboration's importance, while Olaf Heisch of Rohde & Schwarz hailed their tester's transformative role in 5G and drone tech. It enables real-time data exchange, high-definition video streaming, and enhanced connectivity, crucial for various applications like surveillance, delivery services, and beyond-visual-line-of-sight (BVLOS) flights. As 5G networks continue to expand globally and infrastructure deployment progresses, the demand for drone communication solutions leveraging 5G technology is poised to skyrocket.

Taking Root: Agriculture Takes Flight as the Fastest-Growing Drone Communication Segment

The agriculture segment emerges as the fastest-growing sector within the drone communication market, propelled by a union of factors. With technological advancements reshaping traditional agricultural practices, drones have become integral tools for precision farming. For instance, in April 2024 DJI announces the global launch of Agras T50 and Agras T25 drones, expanding their precision agriculture solutions. The T50 is designed for larger-scale operations, boasting efficiency and versatility, while the T25 offers portability for smaller fields. Both drones are compatible with the SmartFarm app, providing comprehensive aerial application management. DJI aims to enhance crop protection, improve yields, and minimize environmental impact with these advanced solutions. Farmers increasingly rely on drones for tasks ranging from crop monitoring and yield estimation to soil analysis and pest management. The efficiency gains and cost-effectiveness offered by drone technology in agriculture are substantial, driving widespread adoption across diverse agricultural landscapes globally. Moreover, the ability of drones to provide real-time data insights enables farmers to make informed decisions swiftly, resulting in enhanced crop yields and resource optimization. As agriculture continues to embrace innovation for sustainable and efficient practices, the demand for drone communication solutions in this sector is poised for continued rapid expansion.

Regional Outlook

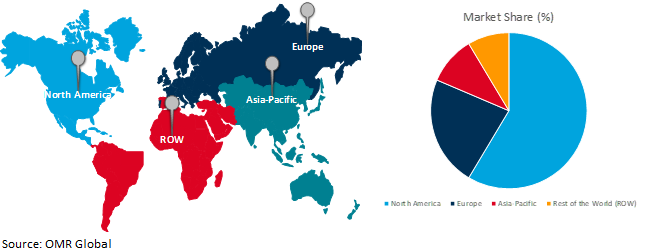

The global drone communication market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Soars High: A Leader in Drone Communication

North America's dominance in the drone communication market is driven by several key factors. The robust economies of the United States and Canada foster significant investment in drone technology and communication infrastructure, cultivating a thriving drone ecosystem. Moreover, a well-defined regulatory framework provides stability and predictability for businesses venturing into drone integration. North America's technological landscape boasts cutting-edge innovations, with leading company’s continuously advancing drone technology and communication systems. For instance-Mobile US and Valmont Industries collaborated on a groundbreaking drone flight enabled by 5G, covering nearly 80 miles. The trial demonstrated the potential for enhanced inspection programs, agriculture, and disaster relief efforts. Leveraging 5G capabilities, the drone recorded high-resolution video and conducted real-time analysis, offering significant efficiency gains over traditional methods. This milestone signifies a significant advancement in the drone industry. Additionally, the diverse applications of drones across sectors like construction, infrastructure, and entertainment create a consistent demand for reliable communication solutions. This convergence of economic strength, regulatory clarity, technological innovation, and diverse applications solidifies North America's position as the global leader in drone communication.

Global Drone Communication Growth by Region 2024-2031

Asia Pacific: Emerging Leader in Drone Communication Market Growth

While North America currently dominates the drone communication market, Asia Pacific is poised for remarkable growth fueled by several factors. The region's tech-savvy population eagerly embraces new technologies like drones, with countries like China and India witnessing a surge in drone use across sectors from agriculture to construction. Supportive government regulations and funding initiatives create fertile ground for drone communication technology. For instance, the government has approved the Production-Linked Incentive (PLI) scheme, allocating $14.5millionover three financial years for drones and drone components. The FY 2022-23 budget introduced the Drone Shakti scheme to support start-ups in Drone-As-A-Service (DrAAS) and announced skilling courses in select ITIs nationwide. The Ministry of Civil Aviation anticipates significant industry growth, with projected investments exceeding $605.5million and annual sales turnover increasing from$7.2millionin 2020-21 to over $108.9million in FY 2023-24, resulting in the creation of over 10,000 direct jobs. Asia Pacific's vast and diverse landscape offers varied drone applications, from rural farmlands to urban centers. This convergence of factors positions Asia Pacific as the leader in drone communication market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global drone communication market include AeroVironment, Inc., Elsight Ltd., Parrot Drone SAS, Skydio, Inc., and SKY-DRONES TECHNOLOGIES LTD, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2024, Elsight Ltd unveils a global version of its Halo drone communications system, enabling seamless operation worldwide without equipment changes. CEO Yoav Amitai highlights its cost-saving benefits and improved efficiency. The innovation supports universal SIM cards and is expected to aid Australian drone companies in international operations. Increased Halo orders, including from DroneUp, underscore growing demand for Elsight's connectivity solutions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global drone communication market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Current Industry Analysis and Growth Potential Outlook

1.2. Research Methods and Tools

1.3. Market Breakdown

1.3.1. By Segments

1.3.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AeroVironment, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Elsight Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Parrot Drone SAS

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Skydio, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. SKY-DRONES TECHNOLOGIES LTD

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Drone Communication Marketby Method

4.1.1. Radio Frequency

4.1.2. Single or multi-sim

4.1.3. LTE/4G

4.1.4. Satellite

4.1.5. 5G

4.2. GlobalDrone Communication Market by Application

4.2.1. Agriculture

4.2.2. Construction and Mining

4.2.3. Inspection

4.2.4. Oil and Gas

4.2.5. Others (Delivery Services, Search and Rescue, Public Safety and Law Enforcement, Environmental Monitoring, Mapping and Surveying, Media, and Entertainment)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AgEagle Aerial Systems Inc.

6.2. Botlink

6.3. DJI

6.4. Draganfly Innovations Inc.

6.5. Freefly Systems

6.6. FrSky Electronic Co.

6.7. Iridium Communications Inc.

6.8. MICRODRONES

6.9. Radiolink Electronics

6.10. Shenzhen Flysky Technology Co.,Ltd.

6.11. Teal Drones

6.12. Triad RF Systems

6.13. Yuneec Europe GmbH

1. GLOBAL DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BYMETHOD, 2023-2031 ($ MILLION)

2. GLOBAL RADIO FREQUENCYDRONE COMMUNICATION MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SINGLE OR MULTI-SIMDRONE COMMUNICATION MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL LTE/4GDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBALSATELLITEDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL 5GDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL DRONE COMMUNICATION MARKETFOR AGRICULTURERESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DRONE COMMUNICATION MARKET FOR CONSTRUCTION AND MININGRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DRONE COMMUNICATION MARKET FOR INSPECTION RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBALDRONE COMMUNICATION MARKET FOR OIL AND GASRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL DRONE COMMUNICATION MARKET FOR OTHERS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBALDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BYMETHOD 2023-2031 ($ MILLION)

16. NORTH AMERICAN DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BYMETHOD2023-2031 ($ MILLION)

19. EUROPEAN DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BYMETHOD, 2023-2031 ($ MILLION)

22. ASIA- PACIFIC DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. REST OF THE WORLD DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BYMETHOD, 2023-2031 ($ MILLION)

25. REST OF THE WORLD DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY METHOD, 2023 VS 2031 (%)

2. GLOBALRADIO FREQUENCYDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL SINGLE OR MULTI-SIMDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL LTE/4GDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL SATELLITEDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL 5GDRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

8. GLOBALDRONE COMMUNICATION MARKETFOR AGRICULTURERESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBALDRONE COMMUNICATION MARKETFOR CONSTRUCTION AND MININGRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL DRONE COMMUNICATION MARKET FORINSPECTIONRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL DRONE COMMUNICATION MARKET FOR OIL AND GAS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL DRONE COMMUNICATION MARKET FOR OTHERS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL DRONE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. US DRONE COMMUNICATION MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

16. UK DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

17. FRANCE DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

18. GERMANY DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

19. ITALY DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

20. SPAIN DRONE COMMUNICATION MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

22. INDIA DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

23. CHINA DRONE COMMUNICATION MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN DRONE COMMUNICATION MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC DRONE COMMUNICATION MARKETSIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA DRONE COMMUNICATION MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST & AFRICA DRONE COMMUNICATION MARKET SIZE, 2023-2031 ($ MILLION)