Drone Simulator Market

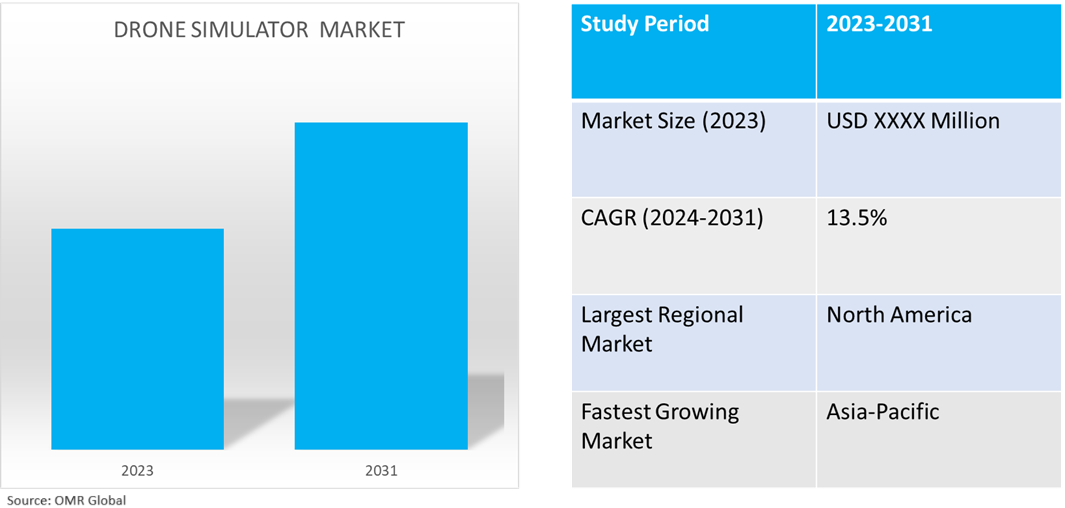

Drone Simulator Market Size, Share & Trends Analysis Report by Component (Software, and Hardware), by End-User (Commercial, and Military & Defense), and by Drone Type (Fixed Wing, and Rotary Wing) Forecast Period (2024-2031)

Drone simulator market is anticipated to grow at a CAGR of 13.5% during the forecast period (2024-2031). The market growth is driven by the rising demand for drones in the defense sector, increasing investment by governments in drone R&D, increasing applications for drones in the commercial sector, and the affordability of drone simulation and testing software. Further, the market trend is expected to move towards integration of augmented reality (AR) and virtual reality (VR) technology in drone simulation, demand for trained pilots, adoption of 3D simulation, and regulatory compliance for the drone market.

Market Dynamics

Increasing Demand for Drones

The growth in the drone simulator market is instigated by the increasing demand for drones, especially in the commercial sector for several purposes including surveillance, information collection, 3D modeling, and others. The increasing demand and innovation in drones have created scope for developing simulation technology that assists in training, testing, and development of novel drones. For instance, Garuda Aerospace, a drone manufacturer, revealed that it has secured its first contract with the Indian Space Research Organization (ISRO) to deliver cutting-edge quadcopter drones. These cutting-edge quadcopter drones, which are equipped with Machine Learning and Artificial Intelligence capabilities, are intended to transform ISRO operations, increasing efficiency across the famed Bengaluru-based space agency's diverse activities.

Rising Demand for Trained Pilots in the Drone Industry

The growing demand for qualified drone operators is one of the key reasons moving the drone simulator industry forward. As organizations use drones for functions such as aerial surveillance, mapping, and delivery services, there is an increasing demand for qualified individuals who can operate these advanced devices. Further, the demand has resulted in the creation of several training institutes and centers leveraging simulation technology. For instance, in February 2021, Indira Gandhi Rashtriya Uran Akademi, an autonomous body under the aegis of the Ministry of Civil Aviation and one of the largest flight training organizations in the country, began DGCA-certified training at India's first and exclusive Drone Flying Site in Gurugram, along with its Drone Training Partner, M/s Drone Destination Private Limited. Also as informed by the Ministry of Civil Aviation to Indian the Parliament in February 2023, the DGCA has approved 44 drone training schools across the country. These training schools have certified 2521 drone pilots.

Segmental Outlook

- Based on components, the market is segmented into software and hardware.

- Based on end-users, the market is segmented into commercial and military & defense.

- Based on drone type, the market is segmented into fixed-wing and rotary-wing.

Hardware is the Most Prominent Drone Component

The drone simulator hardware segment is leading the market owing to advancements in drone simulation such as integration of AR & VR technology, development of 3D simulation devices, and increasing number of training institutes. The advancement has resulted in the requirement of various sorts of hardware components including sensors, chips, radar, controllers, batteries, and others.

Commercial drones are Expected to Hold a Considerable Market Share

The commercial drone industry has recorded steady growth in recent years owing to increasing applications in industries such as agriculture, research, disaster management, construction, logistics, photography, and others. Most commercial industries are willing to utilize drone technology as an alternative to manpower for risky and repetitive tasks reducing cost and effort. In November 2022, DJI launched its Mavic 3 Classic camera drone, giving creators a new way to experience the unparalleled Hasselblad camera and unbeatable flight performance of the Mavic 3 Series. Mavic 3 Classic features the same 4/3 CMOS 20-megapixel camera, 46-minute maximum flight time, and O3+ transmission system as the original Mavic 3 drone, without an additional telephoto lens.

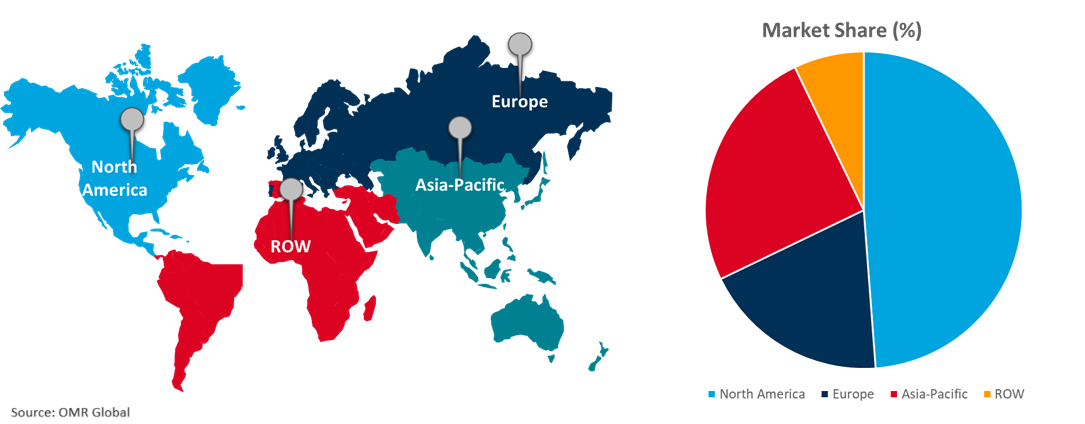

Regional Outlook

The global drone simulator market is further segmented based on geography including North America (the US, and Canada), Europe (the (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Drone Simulator Market Growth by Region 2024-2031

North America Holds Highest Share in Global Drone Simulator Market

North America holds the highest share of the global drone simulation market. The increasing investment in military simulation technology, rising demand for commercial drones, and increasing application of drones in defense in the region are key contributors to the regional market growth. For instance, in February 2024, Leonardo and FlightSafety International (FSI) announced the signing of a Memorandum of Understanding (MoU) at Heli-Expo 2024 to assess a variety of prospective training and simulation cooperation in the US. The MoU authorizes the partners to assess the possible design, production, sale, and operation of training equipment for use at FlightSafety, Leonardo's helicopter sites, or third-party facilities and the consideration of different helicopter types, allowing the partners to benefit from their unique simulation and training capabilities as well as the presence in the US and around the world. Furthermore, the partners would consider appointing FlightSafety's training companies or divisions as Leonardo Authorized Training Centers to provide training services using the training devices.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global drone simulator market include CAE Inc., Leonardo S.p.A., and General Atomics-Aeronautical Systems, Inc., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in November 2020, CAE announced its acquisition of all Flight Simulation Company B.V.'s (FSC) issued and existing shares for a cash consideration of approximately $75 million given to the sellers, based on an enterprise value of $108. The acquisition broadens CAE's capabilities to serve the training market for European customers, including airlines and freight carriers. It adds to CAE's customer base and establishes a recurrent training business that complements the company's existing network.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global drone simulator market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. CAE Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Atomics-Aeronautical Systems, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Leonardo S.p.A

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Drone Simulator Market by Component

4.1.1. Software

4.1.2. Hardware

4.2. Global Drone Simulator Market by End-User

4.2.1. Commercial

4.2.2. Military & Defense

4.3. Global Drone Simulator Market by Drone Type

4.3.1. Fixed-Wing

4.3.2. Rotary Wing

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. BLUEHALO

6.2. ComQuest Ventures LLC

6.3. Dronobotics Aviation Developers LLP

6.4. Havelsan A.S.

6.5. IG Drones

6.6. Israel Aerospace Industries Ltd.

6.7. Kratos Defense & Security Solutions, Inc.

6.8. L3 Link Training Simulation

6.9. MOSIMTEC, LLC

6.10. Simlat Ltd.

6.11. ST Engineering

6.12. Textron Systems Corp.

6.13. UAV Navigation S.L.

6.14. Quantum3D, Inc.

6.15. Zen Technologies Ltd.

1. GLOBAL DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL DRONE SIMULATOR SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DRONE SIMULATOR HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

5. GLOBAL DRONE SIMULATOR FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DRONE SIMULATOR FOR MILITARY & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY DRONE TYPE, 2023-2031 ($ MILLION)

8. GLOBAL FIXED-WING DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ROTARY WING DRONE SIMULATOR ANALYSIS MARKET RESEARCH AND BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

12. NORTH AMERICAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. NORTH AMERICAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY DRONE TYPE, 2023-2031 ($ MILLION)

14. EUROPEAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

16. EUROPEAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

17. EUROPEAN DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY DRONE TYPE, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY DRONE TYPE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

24. REST OF THE WORLD DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

25. REST OF THE WORLD DRONE SIMULATOR MARKET RESEARCH AND ANALYSIS BY DRONE TYPE, 2023-2031 ($ MILLION)

1. GLOBAL DRONE SIMULATOR MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL DRONE SIMULATOR SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DRONE SIMULATOR HARDWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DRONE SIMULATOR MARKET SHARE BY END-USER, 2023 VS 2031 (%)

5. GLOBAL DRONE SIMULATOR FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DRONE SIMULATOR FOR MILITARY & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DRONE SIMULATOR MARKET SHARE BY DRONE TYPE, 2023 VS 2031 (%)

8. GLOBAL FIXED-WING DRONE SIMULATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ROTARY WING DRONE SIMULATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DRONE SIMULATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

13. UK DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICA DRONE SIMULATOR MARKET SIZE, 2023-2031 ($ MILLION)