Drug Discovery Informatics Market

Global Drug Discovery Informatics Market Size, Share & Trends Analysis Report by Function (Docking, Molecular Modeling, Libraries &Database Preparation, Sequencing & Target Data Analysis, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global drug discovery informatics market is projected to have a considerable CAGR of around 10.1% during the forecast period. The market growth mainly backed by the increasing pharmaceutical R&D, increasing investment in the drug discovery and research, others. Recent advancements such as microarray-based expression profiling in genomics, proteomics, and drug discovery domains, create a large amount of biological data that further encourages the demand drug discovery informatics solutions. Drug discovery informatics solutions provide clinical decision systems that support R&D programs and other research studies to discover and develop safe and effective drugs for various chronic diseases including cancer, diabetes, and neurological diseases, among others. Research programs related to human genetics have been analysed in combination with health data and have become increasingly vital for understanding the most complex diseases. Government grants and funding is projected to boost the research programs for the prevention, diagnosis, treatment, intervention, and discovery of new drugs that further increases the demand of informatics tools in drug discovery applications.

Segmental Outlook

The global drug discovery informatics market is segmented on the function and End-User. Based on the function, the market is further classified into docking, molecular modeling, libraries & database preparation, sequencing & target data analysis, and others. The sequencing & target data analysis segment is projected to have considerable growth owing to the growing technological advancement in sequencing technology encourage the demand of sequencing in new drug entity and information handling. On the basis of end-user the market for drug discovery informatics further classified into pharmaceutical & biotechnology companies, contract research organizations, and others.

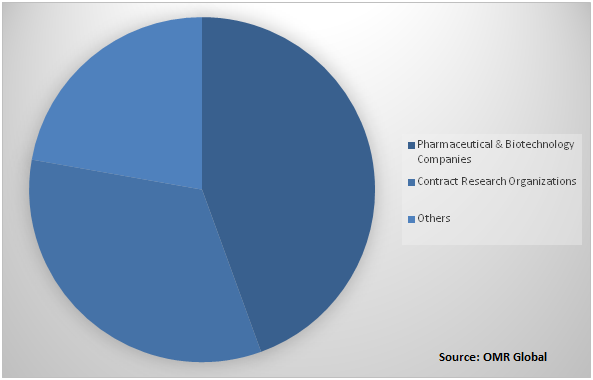

Global Drug Discovery Informatics Market Share by End-User, 2018(%)

Global Drug Discovery Informatics Market to be driven by Pharmaceutical & Biotechnology Companies End-User

The pharmaceutical & biotechnology companies segment held a considerable share in the market. The pharmaceutical industry is greatly benefited by the significant R&D activities performed at the clinical labs. The validation of the drug and designing of a more effective drug is the leading factor that is responsible for adopting the informatics tool in pharmaceutical and biotechnology companies. The drug discovery is very complex and time taking process that can be achieved by integrating metabolomics structural biology, proteomics, with bio informatics tools. The drug discovery is a step by step process which include identification and selection of target, the synthesis characterization, screening of molecule and assays for therapeutic efficacy. Here, informatics services play an eminent role in pharmaceutical manufacturing and drug discovery conducted by pharmaceutical and biotechnology companies.

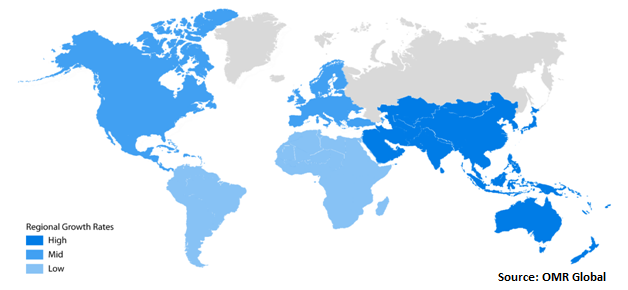

Regional Outlook

Geographically, the global drug discovery informatics market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market mainly driven due to due to the increasing R&D and investments by big pharmaceutical companies in drug discovery.The major economies which are contributing to the market include China, India, and Japan. Apart from that, South Korea, Australia, and Singapore are also contributing significantly to the market growth.

Global Drug Discovery Informatics Market Growth, by Region 2019-2025

North America to hold a considerable share in the global Drug Discovery Informatics market

Geographically, North America is projected to hold a significant market share in the global drug discovery informatics market. Along with the presence of the well-established healthcare system, the existence of major informatics tools and services provider companies such as IBM Corp. in the region that offers biomedical cloud for research institutions, pharma and biotech companies, and CROs is projected to spur the growth of the market in the region. The US IT infrastructure is undergoing extensive digital transformation. Life science organizations such as pharmaceutical and biotechnology companies are considered to be the major sector that highly requires the implementation of the informatics solutions to manage their operation. The pharmaceutical and biotechnology companies whether they are key market players or start-ups are basically recognized by their increased R&D efforts that generate large volumes of data. The data originates from several phases of drug development, including the preclinical trial phase, drug approval phase, and marketing and post-sales phase.

Market Players Outlook

The key players in the drug discovery informatics market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Charles River Laboratories, Inc., Cognizant Function Solutions Corp., Dassault Systèmes SE, Eurofins GSC Lux SARL, Evotec SE, Jubilant Life Sciences, Infosys Ltd., IBM Corp., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global drug discovery informatics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Drug Discovery Informatics Market by Function

5.1.1. Docking

5.1.2. Molecular Modeling

5.1.3. Libraries and Database Preparation

5.1.4. Sequencing and Target Data Analysis

5.1.5. Others

5.2. Global Drug Discovery Informatics Market by End-User

5.2.1. Pharmaceutical & Biotechnology Companies

5.2.2. Contract Research Organization(CRO)

5.2.3. Others( Research Institutes)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accenture PLC

7.2. Albany Molecular Research Inc.

7.3. Charles River Laboratories, Inc.

7.4. ChemBridge Corp.

7.5. Clarivate Analytics

7.6. Certara, L.P.

7.7. Cognizant Function Solutions Corp.

7.8. Collaborative Drug Discovery Inc.

7.9. Dassault Systèmes SE

7.10. Eurofins GSC Lux SARL

7.11. Evotec SE

7.12. GVK Biosciences Pvt Ltd.

7.13. Jubilant Life Sciences

7.14. Infosys Limited

7.15. IBM Corp.

7.16. Novo Informatics Pvt. Ltd.

7.17. OpenEye Scientific Software

7.18. PerkinElmer Inc.

7.19. Schrödinger, LLC

7.20. Selvita S.A.

1. GLOBAL DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

2. GLOBAL DOCKING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL MOLECULAR MODELING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL LIBRARIES & DATABASE PREPARATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL SEQUENCING AND TARGET DATA ANALYSIS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

8. GLOBAL DRUG DISCOVERY INFORMATICS IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL DRUG DISCOVERY INFORMATICS IN CONTRACT RESEARCH ORGANIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL DRUG DISCOVERY INFORMATICS IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

14. NORTH AMERICAN DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

15. EUROPEAN DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

17. EUROPEAN DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. REST OF THE WORLD DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

22. REST OF THE WORLD DRUG DISCOVERY INFORMATICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL DRUG DISCOVERY INFORMATICS MARKET SHARE BY FUNCTION, 2018 VS 2025 (%)

2. GLOBAL DRUG DISCOVERY INFORMATICS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL DRUG DISCOVERY INFORMATICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD DRUG DISCOVERY INFORMATICS MARKET SIZE, 2018-2025 ($ MILLION)