Drug Testing Market

Drug Testing Market Size, Share & Trends Analysis Report by Product Type (Consumables, Instruments, and Rapid Testing Devices), by Sample Type (Urine Samples, Oral Fluid Samples, Hair Samples, and Other Samples), by Drug Type (Alcohol, Cannabis/Marijuana, Cocaine, Opioids, and Others), and by End-Users (Drug Testing Laboratories, Workplaces, Hospitals, Healthcare, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Drug testing market is anticipated to grow at a CAGR of 16.1% during the forecast period. The increasing prevalence of drug addiction and illicit drug consumption is expected to drive the growth of the drug testing market during the forecast period. Additionally, the key players are continuously contributing to the growth of the market by adopting various strategies including new devices and drug launches, along with various strategic initiatives to stay competitive in the market. For instance, in February 2021, Thermo Fisher Scientific Inc. partnered with Mindray Medical International Ltd. Through this partnership, Thermo Fisher Scientific aims to address the requirements of customers in commercial labs, hospitals, and the criminal justice field. Moreover, to provide access to drug testing both companies entered into an agreement to offer the FDA-cleared and Health Canada–approved BS-480 (400 tests/hour) and BA-800M (800 tests/hour) analyzers’ to toxicology labs.

Segmental Outlook

The global drug testing market is segmented based on product type, sample type, drug type, and end-users. Based on the product type, the market is sub-segmented into consumables, instruments, and rapid testing devices. Based on the sample type, the market is sub-segmented into urine samples, oral fluid samples, hair samples, and other samples. Based on the drug type, the market is further sub-segmented into alcohol, cannabis/marijuana, cocaine, opioids, and others. Based on the end-users, the market is augmented into drug testing laboratories, workplaces, hospitals, healthcare, and others. Among these, the urine samples sub-segment is expected to hold a considerable share of the market due to the ease of collection, and concentrations of drugs and metabolites tend to be high in the urine.

Among the product type, the consumables sub-segment is expected to hold a prominent share of the drug testing market over the forecast period. The increase in the launch of advanced consumables by key players to provide improved solutions to make testing easy, accurate, and fast is expected to accelerate the market growth during the forecast period. For instance, in August 2019, MedTest Dx, Inc. introduced an improved line of Clinitox calibrators and controls for confirmation testing at the 2019 American Association for Clinical Chemistry (AACC) Annual Scientific Meeting. The new product line provides laboratories performing confirmation testing with a comprehensive, reliable, easy-to-use, and customizable calibration along with controlled solution designed for accuracy and efficiency.

Regional Outlooks

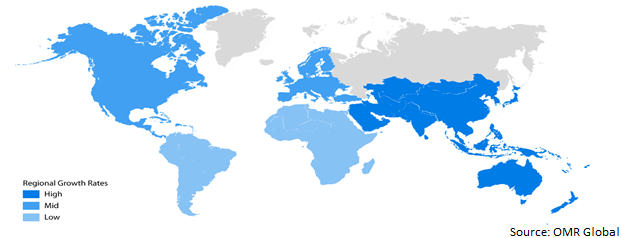

The global drug testing market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the Asia-Pacific region is expected to hold a considerable share of the drug testing market during the forecast period, owing to the increase in drug abuse and drug consumption in the region.

Global Drug Testing Market Growth, by Region 2022-2028

North America is Expected to Hold a Significant Share of the Global Drug Testing Market

Among all regions, North America is expected to hold a significant market share during the forecast period. The presence of drug testing market players such as LabCorp., Abbott, Quest Diagnostics Inc., and others are accelerating the growth of the drug testing market. These key players are implementing extensive expansion and acquisition strategies to stay competitive in the market. For instance, in November 2021, LabCorp. acquired Toxikon, a contract research organization (CRO) that delivers non-clinical testing services. This acquisition extends LabCorp’s portfolio of full-service drug development and medical device solutions. Additionally, Toxikon’s strategic location allows LabCorp. to further engage with large pharmaceutical companies and biotech firms operating in the region. Moreover, Toxikon will also complement LabCorp’s existing non-clinical medical device efficacy and safety testing.

Market Players Outlook

The major companies serving the global drug testing market include Abbott Laboratories, Agilent Technologies, Inc., Alfa Scientific Designs, Inc., Bio-Rad Laboratories, Inc., Clinical Reference Laboratory (CRL), Inc., Drägerwerk AG & CO. KGaA., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2019, Thermo Fisher Scientific Inc. launched CEDIA Mitragynine (Kratom) Assay, a drug of abuse test. The drug supports calibrators and controls. The drug is able to run on commonly used clinical chemistry analyzers, allowing a broad spectrum of laboratorians to test for the presence of Kratom. Additionally, the test is for criminal justice and forensic use only.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global drug testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Drug Testing Market by Product Type

4.1.1. Consumables

4.1.2. Instruments

4.1.3. Rapid Testing Devices

4.2. Global Drug Testing Market by Sample Type

4.2.1. Urine Samples

4.2.2. Oral Fluid Samples

4.2.3. Hair Samples

4.2.4. Other Samples

4.3. Global Drug Testing Market by Drug Type

4.3.1. Alcohol

4.3.2. Cannabis/Marijuana

4.3.3. Cocaine

4.3.4. Opioids

4.3.5. Others (Amphetamine & Methamphetamine, lysergic acid diethylamide)

4.4. Global Drug Testing Market by End-User

4.4.1. Drug Testing Laboratories

4.4.2. Workplaces

4.4.3. Hospitals

4.4.4. Healthcare

4.4.5. Others (Drug treatment centers, Individual user)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott Laboratories

6.2. Agilent Technologies, Inc.

6.3. Alfa Scientific Designs, Inc.

6.4. Bio-Rad Laboratories, Inc.

6.5. Clinical Reference Laboratory (CRL), Inc.

6.6. Drägerwerk AG & CO. KGaA

6.7. F. Hoffmann-La Roche AG

6.8. LabCorp.

6.9. Legacy Medical Services, LLC

6.10. Lifeloc Technologies, Inc.

6.11. MPD Inc.

6.12. Omega laboratories, Inc.

6.13. OraSure Technologies, Inc.

6.14. Premier Biotech, Inc

6.15. Psychemedics Corp.

6.16. Quest Diagnostics Inc.

6.17. Quidel Corp.

6.18. Shimadzu Corp

6.19. Siemens Healthineers AG

6.20. Sterling Healthcare Opco, LLC

6.21. Thermo Fisher Scientific Inc.

1. GLOBAL DRUG TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL CONSUMABLES IN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL INSTRUMENTS IN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL RAPID DRUG TESTING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL DRUG TESTING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2021-2028 ($ MILLION)

6. GLOBAL URINE SAMPLES FOR DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ORAL FLUID SAMPLES FOR DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL HAIR SAMPLES FOR DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL OTHER SAMPLES FOR DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL DRUG TESTING MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021-2028 ($ MILLION)

11. GLOBAL ALCOHOL DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL CANNABIS/MARIJUANA DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION

13. GLOBAL COCAINE DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL OPIOIDS DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION

15. GLOBAL OTHER DRUGS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION

16. GLOBAL DRUG TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17. GLOBAL DRUG TESTING IN LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL DRUG TESTING IN WORKPLACES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL DRUG TESTING IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL DRUG TESTING IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. GLOBAL DRUG TESTING IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

22. GLOBAL DRUG TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

23. NORTH AMERICAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. NORTH AMERICAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE , 2021-2028 ($ MILLION)

25. NORTH AMERICAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2021-2028 ($ MILLION)

26. NORTH AMERICAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021-2028 ($ MILLION)

27. NORTH AMERICAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

28. EUROPEAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. EUROPEAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

30. EUROPEAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2021-2028 ($ MILLION)

31. EUROPEAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021-2028 ($ MILLION)

32. EUROPEAN DRUG TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

33. ASIA-PACIFIC DRUG TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. ASIA-PACIFIC DRUG TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

35. ASIA-PACIFIC DRUG TESTING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2021-2028 ($ MILLION)

36. ASIA-PACIFIC DRUG TESTING MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021-2028 ($ MILLION)

37. ASIA-PACIFIC DRUG TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

38. REST OF THE WORLD DRUG TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

39. REST OF THE WORLD DRUG TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE , 2021-2028 ($ MILLION)

40. REST OF THE WORLD DRUG TESTING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2021-2028 ($ MILLION)

41. REST OF THE WORLD DRUG TESTING MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021-2028 ($ MILLION)

42. REST OF THE WORLD DRUG TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL DRUG TESTING MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

2. GLOBAL CONSUMABLES IN DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL INSTRUMENTS IN DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL RAPID DRUG TESTING DEVICES MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL DRUG TESTING MARKET SHARE BY SAMPLE TYPE, 2021 VS 2028 (%)

6. GLOBAL URINE SAMPLES FOR DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL ORAL FLUID SAMPLES FOR DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL HAIR SAMPLES FOR DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL OTHER SAMPLES FOR DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL DRUG TESTING MARKET SHARE BY DRUG TYPE, 2021 VS 2028 (%)

11. GLOBAL ALCOHOL DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL CANNABIS/MARIJUANA DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL COCAINE DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL OPIOIDS DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL OTHER DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL DRUG TESTING MARKET SHARE BY END-USER, 2021 VS 2028 (%)

17. GLOBAL DRUG TESTING IN TESTING LABORATORIES MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. GLOBAL DRUG TESTING IN WORKPLACES MARKET SHARE BY REGION, 2021 VS 2028 (%)

19. GLOBAL DRUG TESTING IN HOSPITALS MARKET SHARE BY REGION, 2021 VS 2028 (%)

20. GLOBAL DRUG TESTING IN HEALTHCARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

21. GLOBAL DRUG TESTING IN OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

22. GLOBAL DRUG TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

23. US DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

24. CANADA DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

25. UK DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

26. FRANCE DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

27. GERMANY DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

28. ITALY DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

29. SPAIN DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF EUROPE DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

31. INDIA DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

32. CHINA DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

33. JAPAN DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

34. SOUTH KOREA DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF ASIA-PACIFIC DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)

36. REST OF THE WORLD DRUG TESTING MARKET SIZE, 2021-2028 ($ MILLION)