Dual Carbon Battery Market

Dual Carbon Battery Market Size, Share & Trends Analysis Report by Type (Primary and Secondary), and by End-User Industry (Electronics and Semiconductor, Automotive, Energy, Healthcare, and Others), Forecast Period (2024-2031) Update Available - Forecast 2025-2031

Dual carbon battery market is anticipated to grow at a CAGR of 7.0% during the forecast period (2024-2031). Pivotal factors driving the overall market growth include the increasing demand for sustainable energy solutions, rapid adoption of electric vehicles (EVs), and the growing electronics and electrical market. Additionally, with the growing demand and a competitive landscape, market players are increasingly investing in increasing manufacturing capabilities, and R&D to stay competitive.

Segmental Outlook

The global dual carbon battery market is segmented by type and end-user industry. Based on the type, the market is sub-segmented into primary and secondary dual carbon batteries. Based on the end-user industry, the market is sub-segmented into electronics and electrical, automotive, energy, healthcare, and other end users such as aerospace and defense, and industrial automation. Among the end-user industry, the energy sub-segment is expected to hold a considerable share of the market owing to the rising demand for dual carbon batteries in the energy sector. The growth is owing to significant growth in sustainable energy generation, investments in smart grid infrastructure, importance of energy security primarily due to rising geopolitical tensions among others. According to the International Environmental Agency (IEA), in 2022, China added grid-scale battery storage by installing nearly 5 GW annually, followed by the US, commissioning 4 GW throughout the year. In addition, the Inflation Reduction Act passed in August 2022, incorporates an investment tax credit specifically for stand-alone storage, indicating a potential for increased deployments in the coming years.

Electronics and Semiconductors Contribute the Highest to the Global Dual Carbon Battery Industry

Among the end-users, the demand for dual-carbon batteries is growing within the electronics and electrical sector owing to multiple pivotal factors. One significant factor is the advantage of dual carbon batteries for offering greater safety features and a prolonged cycle life, making them and preferable choice over conventional lithium-ion batteries. Additionally, the growing focus on sustainability and environmental awareness in the electronics industry has boosted the adoption of dual-carbon batteries. Additionally, growing technological advancements in the electronics and electrical industry and battery technology, and growing consumer demand, are also contributing to the overall market growth.

Regional Outlook

The global dual carbon battery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among regions, the European dual carbon battery market is expected to grow significantly during the forecasting period primarily due to the growing focus on sustainable solutions by regional economies. Growing investments in sustainable energy production in the region are also driving demand for strong energy storage infrastructure. As per the data from the European Association for Storage of Energy, to achieve a target of approximately 200 GW by 2030, the deployment of storage must increase to a minimum of 14 GW per year. Looking ahead to 2050, the energy system will require a storage capacity of at least 600 GW, with more than two-thirds of this demand being fulfilled by energy-shifting technologies, specifically power-to-X-to-power applications. Additionally, the growth of the regional EV market and, the importance of energy security mainly after Russia-Ukraine is further contributing to overall market growth.

Global Dual Carbon Battery Market Growth, by Region 2024-2031

Asia-Pacific is the Fastest Growing Dual Carbon Battery Market

Among the regions, the Asia-Pacific region is growing at the highest CAGR in the forecasting period owing to several pivotal factors. One of the key factors is growing electrification, demand for efficient power storage, and growing investments in the development of regional energy infrastructure from both private and public organizations. As per the data from the Asian Development Bank, from 2016 to 2021, approximately 380 million individuals in Asia-Pacific obtained electricity access. Despite a population growth of 180 million during this timeframe, the electrification rate surged from 94.0% to 98.6%. By 2021, urban areas achieved nearly universal access at 99.8%, and rural regions are steadily narrowing the gap, reaching 97.7%. Additionally, the region has a significant share in global EV sales and production. As per the same source, in 2022, China was the largest EV market globally, accounting for 60.0% of global EV sales. Outside major markets, EV sales have generally been low, but there was significant growth in 2022 in India, Thailand, and Indonesia. Combined, the sales of electric cars in these countries more than triple compared to 2021, reaching a total of 80,000 units. In Thailand, electric cars constituted slightly over 3.0% of total sales in 2022, while both India and Indonesia maintained an average of around 1.5% throughout the year. India is experiencing growth in EV and component manufacturing, driven by the government's $3.2 billion incentive program, which has attracted investments totaling $8.3 billion. Apart from this, growing government support to promote domestic battery ecosystems, increasing investments primarily due to low labor costs, and growing R&D activities are further contributing to the overall market growth. For instance, in April 2021, Scientists at the Electrochemical Energy Storage (EES) Lab, IIT Hyderabad, engineered a 5V dual carbon battery employing self-supporting carbon fiber mats serving as both cathode and anode.

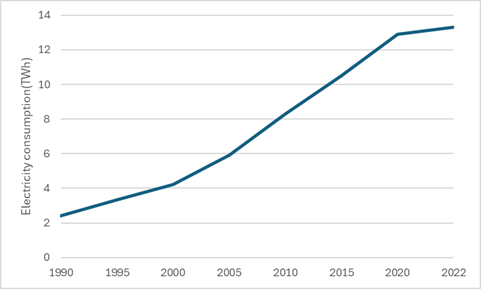

Asia Pacific energy consumption, in TWh

/p>

/p>

Source: International Energy Agency (IEA)

Market Players Outlook

The major companies serving the global dual carbon battery market are Wanxiang A123 Systems Corp., Ambri Inc., Amperex Technologies Ltd., and Amprius Inc. among others. With significant growth in demand, market players are increasingly focusing on R&D and increasing production capacity through collaboration, and acquisitions among others. For instance, in May 2023, Stellantis, in collaboration with TotalEnergies and Mercedes-Benz inaugurated Automotive Cells Company's (ACC) battery gigafactory in Billy-Berclau Douvrin, France. According to the company, the facility's initial production line has a capacity of 13 gigawatt-hours (GWh), expected to increase to 40GWh by 2030. The plant will produce high-performance lithium-ion batteries with a low CO2 footprint, and the first production unit is set to be operational by the end of 2023. This gigafactory is a part of Stellantis' strategy to achieve 250 GWh of battery manufacturing capacity in Europe by 2030, supporting its goal to offer diverse battery technologies across its brand portfolio. The company aims to secure approximately 400 GWh of capacity by 2030 through five gigafactories in Europe and North America, along with additional supply contracts.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the dual carbon battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 24M Technologies, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BYD Company Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Duracell Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. LG Chem Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tesla Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Dual Carbon Battery Market by Type

4.1.1. Primary

4.1.2. Secondary

4.2. Global Dual Carbon Battery Market by End-User Industry

4.2.1. Electronics and Electrical

4.2.2. Automotive

4.2.3. Energy

4.2.4. Healthcare

4.2.5. Others (Aerospace and Defense, Industrial Automation)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ambri Inc.

6.2. Amperex Technologies Ltd.

6.3. Amprius Inc.

6.4. Aquion Energy Inc.

6.5. Boulder Lonics

6.6. Cadenza Innovation, Inc.

6.7. EnerDel Inc.

6.8. Enevate CorporationCorp.

6.9. Enovix CorporationCorp.

6.10. GS Yuasa CorporationCorp.

6.11. Hitachi Ltd.

6.12. Ilika plc

6.13. Johnson Controls

6.14. JSR Corp.

6.15. Nohms Technologies Inc.

6.16. Panasonic CorporationCorp.

6.17. PolyPlus

6.18. QuantumScape CorporationCorp.

6.19. Toshiba CorporationCorp.

6.20. Wanxiang A123 Systems Corp.

1. GLOBAL DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL PRIMARY DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SECONDARY CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

5. GLOBAL DUAL CARBON BATTERY IN ELECTRONICS AND ELECTRICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DUAL CARBON BATTERY IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DUAL CARBON BATTERY IN ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL DUAL CARBON BATTERY IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DUAL CARBON BATTERY IN OTHER END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

14. EUROPEAN DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. EUROPEAN DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

20. REST OF THE WORLD DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD DUAL CARBON BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL DUAL CARBON BATTERY MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL PRIMARY DUAL CARBON BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SECONDARY CARBON BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DUAL CARBON BATTERY MARKET SHARE BY END-USER INDUSTRY, 2023 VS 2031 (%)

5. GLOBAL DUAL CARBON BATTERY IN ELECTRONICS AND ELECTRICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DUAL CARBON BATTERY IN AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DUAL CARBON BATTERY IN ENERGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL DUAL CARBON BATTERY IN HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL DUAL CARBON BATTERY IN OTHER END-USER INDUSTRIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DUAL CARBON BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

13. UK DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD DUAL CARBON BATTERY MARKET SIZE, 2023-2031 ($ MILLION)