E-Bikes Market

Global E-Bikes Market Size, Share & Trends Analysis Report by Propulsion Type (Pedal Assisted And Throttle Assisted), by Power (Less Than and Equal To 250W and Above 250W), and by Battery Type (Li-Ion Battery And Lead Acid Battery) Forecast Period (2021-2027) Update Available - Forecast 2025-2031

The global e-bikes market is anticipated to grow at a significant CAGR of around 14.5% during the forecast period. The rising government regulations to encourage the use of electric bikes to to reduce carbon emission levels, consumer inclination towards e-bikes adoption for commute, recreational and adventure activities, and features provided by e-bikes such as compact size, flexible, and eco-friendly are the key factors boosting the market growth. The use of pedel assisted bikes helps to maintain fitness also. Therefore consumers opt e-bikes in fitness activites. A study conducted by CU Boulder quantified the health benefits of replacing commuting via cars from Class-1 e-bike they found that in one month, in comparison to driving a car, traveling via an e-bike helped contributors improve blood sugar control, increased essential cardiovascular endurance. Additionally, the popularity of cycling as recreational activity due to several cycling benefits such as physical and mental health muscle fitness, flexibility with the reduced risk of stress and depression are the major factors driving the e-bikes market. High costs of e-bikes are due to the cost of battery and technology used in e-bikes are high as compared to traditional bikes these factors are hampering the market growth. The growing demand for e-bikes, the connected-bikes is one such advancement, in the SIM module that enables the e-bike to send and receive data to and from the cloud without a connected smartphone are opportunities for the market growth.

Impact of COVID-19 Pandemic on Global E-Bikes Market

The impact of COVID-19 was seen positively on the global e-bike market, that is attributed to commuters are mostly avoiding public transportation, e-ikes are considered as a safe, convenient, and affordable alternative to public transportation. According to e-bikes manufacturers such as VanMoof, Lectric e-bike, and Rad Poer Bike, e-bikes are considered as ideal transportation. Commuters are adopting the bike as a mode of day-to-day transportation. In March 2021, According to the report published by World Economic Forum(WEF), sales of electric bikes in the US grew by 145% in 2020 as compared to 2019. In August 2020, According to New Product Development (NPD group), electric moped sales with an average selling price of over $1,000 grew by 190% in June 2020 from June 2019 as a result the COVID-19 has sped the demand for e-bikes.

Segmental Outlook

The global e-bikes market is segmented based on propulsion type, power, and battery type. Based on the propulsion type, the market is segmented into pedal-assisted and throttle-assisted. Based on the power, the market is sub-segmented into less than and equal to 250W and above 250W. Based on the battery type, the market is sub-segmented into the Li-ion battery and lead-acid battery. Among the battery type segment lithium-ion battery segment is dominating, lithium-ion batteries are mostly preferred in-bikes currently due to the small in size, long-lasting and they have more power to weight ratio than other batteries.

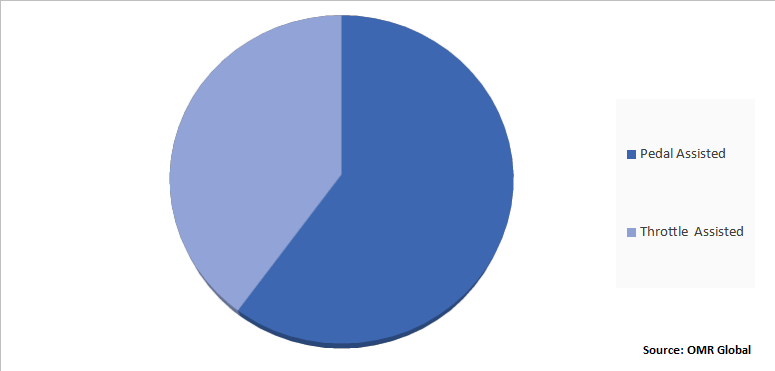

Global E-Bikes Market Share by Propulsion Type, 2020 (%)

The Pedal Assisted Segment is Expected to Dominate in the Global E-Bikes Market

Pedal-assisted e-bikes to dominate over the forecast period is attributed to their better battery life, lower servicing needs, and the ability for users to switch to five pedal assist modes that are dependent upon the model. For instance, In September 2020, Sparta launched,k Sparta d-Brust d(distance) series via live stream. By focusing on the newly commuters cycling between home to the workplace it is available in both as e-bike and pedelec with a total capacity of more than 1125Wh. It is available in two models with the features such as anti-theft protection with track and trace, maintenance-friendly carbon belt drive, and others. Companies are focusing on the pedal-assist e-bike due to health benefits such as calorie burn and maintaining various body diseases.

Regional Outlooks

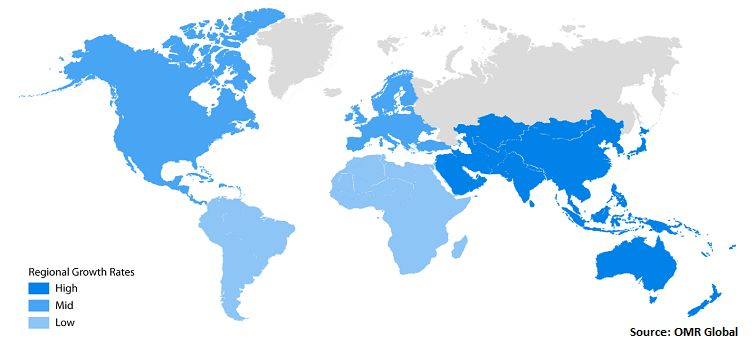

The global E-Bikes market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia Pacific is dominating due to key manufacturers of the e-bike in this region including Accell Group, AIMA Technology Group Co. Ltd., Yadea Group Holdings Ltd, among others. Class-1 e-bikes are the largest used electric bikes in the Asia Pacific as government regulation permit only Class-1 e-bike, in India Class-2 e-bikes market exist due to no strict regulation by the government.

Global E-Bikes Market Growth, by Region 2021-2027

The Europe Region is Fastest Growing in the Global E-Bikes Market

Europe is anticipated to fastest-growing over the forecast period. In July 2021, Heinrich-Boll-Stiftung European Union published the second edition of the European Mobility Atlas, in the report, e-bikes manufacturers and parts industry are active in 23 out of the 27 EU member countries. Moreover, over 900 small and medium enterprises employ approx 120,000 people directly or indirectly and invest more than one billion euro in R&D. Additionally according to the report, 60% of electric bikes sold in the EU are produced by Europe only. Apart from this country such as Germany, France, Italy among others are also in high demand of e-bikes, it is attributed to the adoption of e-bikes for health benefits, environmental benefits, reduction in expenditure, the main factor in Europe is an increase in demand of e-bikes for sports equipment among the young generation for tracking.

Market Players Outlook

The major companies serving the global e-bikes market include Accell Group, Ancheer, Giant Bicycles, MERIDA & CENTURION, Pon Holdings B.V, Robert Bosch GmbH, Shimano Inc., Trek Bicycle Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In March 2021, Cannondale launched, Adventure Neo range of commuter e-bikes in this new model uses a Bosch performance lin drive system that is paired with Bosch Purion Controller and 625Wh battery.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global e-bikes market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global E-Bikes Market

• Recovery Scenario of Global E-Bikes Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Accell Group N.V.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Ancheer

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Giant Bicycles

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. MERIDA & CENTURION GERMANY GMBH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Energica Motor Company

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global E-Bikes Market by Propulsion Type

4.1.1. Pedal Assisted

4.1.2. Throttle Assisted

4.2. Global E-Bikes Market by Power

4.2.1. Less Than And Equal To 250W

4.2.2. Above 250W

4.3. Global E-Bikes Market by Battery Type

4.3.1. Li-Ion Battery

4.3.2. Lead Acid Battery

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ATALA S.p.A

6.2. Benelli Q.J.

6.3. Cycling Sports Group, LLC

6.4. Damon Motors Inc.

6.5. Derby Cycle

6.6. Electric Bike & Skate

6.7. Energica Motor Co. SpA

6.8. ENGWE

6.9. Fuji-ta Bicycle Co.,Ltd.

6.10. Harley-Davidson

6.11. Mahindra & Mahindra.

6.12. PEDEGO INC

6.13. Rad Power Bikes Inc.

6.14. Riese& Müller GmbH

6.15. Robert Bosch GmbH

6.16. Shimano Inc.

6.17. Trek Bicycle Corp.

6.18. VanMoof B.V.

6.19. Yamaha Motor Co., Ltd.

6.20. Zero Motorcycles

1. GLOBAL E-BIKES MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

2. GLOBAL PEDAL ASSISTED E-BIKES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL THROTTLE ASSISTED E-BIKES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL E-BIKES MARKET RESEARCH AND ANALYSIS BY POWER, 2020-2027 ($ MILLION)

5. GLOBAL LESS THAN AND EQUAL TO 250 WE-BIKES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL ABOVE 250 WE-BIKES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL E-BIKES MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

8. GLOBAL LI-ION BATTERY FOR E-BIKES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL LEAD ACID BATTERY FOR E-BIKES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL E-BIKES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN E-BIKES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN E-BIKES MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

13. NORTH AMERICAN E-BIKES MARKET RESEARCH AND ANALYSIS BY POWER, 2020-2027 ($ MILLION)

14. NORTH AMERICAN E-BIKES MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

15. EUROPEAN E-BIKES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN E-BIKES MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

17. EUROPEAN E-BIKES MARKET RESEARCH AND ANALYSIS BY POWER, 2020-2027 ($ MILLION)

18. EUROPEAN E-BIKES MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC E-BIKES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC E-BIKES MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC E-BIKES MARKET RESEARCH AND ANALYSIS BY POWER, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC E-BIKES MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD E-BIKES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. REST OF THE WORLD E-BIKES MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

25. REST OF THE WORLD E-BIKES MARKET RESEARCH AND ANALYSIS BY POWER, 2020-2027 ($ MILLION)

26. REST OF THE WORLD E-BIKES MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL E-BIKES MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL E-BIKES MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL E-BIKES MARKET, 2021-2027 (%)

4. GLOBAL E-BIKES MARKET SHARE BY PROPULSION TYPE, 2020 VS 2027 (%)

5. GLOBAL PEDAL ASSISTED E-BIKES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL THROTTLE ASSISTED E-BIKES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL E-BIKES MARKET SHARE BY POWER, 2020 VS 2027 (%)

8. GLOBAL LESS THAN AND EQUAL TO 250 WE-BIKES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL ABOVE 250 WE-BIKES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL E-BIKES MARKET SHARE BY BATTERY TYPE, 2020 VS 2027 (%)

11. GLOBAL LI-ION BATTERY FOR E-BIKES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL LEAD ACID BATTERY FOR E-BIKES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. US E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

14. CANADA E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

15. UK E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

16. FRANCE E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

17. GERMANY E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

18. ITALY E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

19. SPAIN E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

20. REST OF EUROPE E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

21. INDIA E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

22. CHINA E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

23. JAPAN E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

24. SOUTH KOREA E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF ASIA-PACIFIC E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD E-BIKES MARKET SIZE, 2020-2027 ($ MILLION)