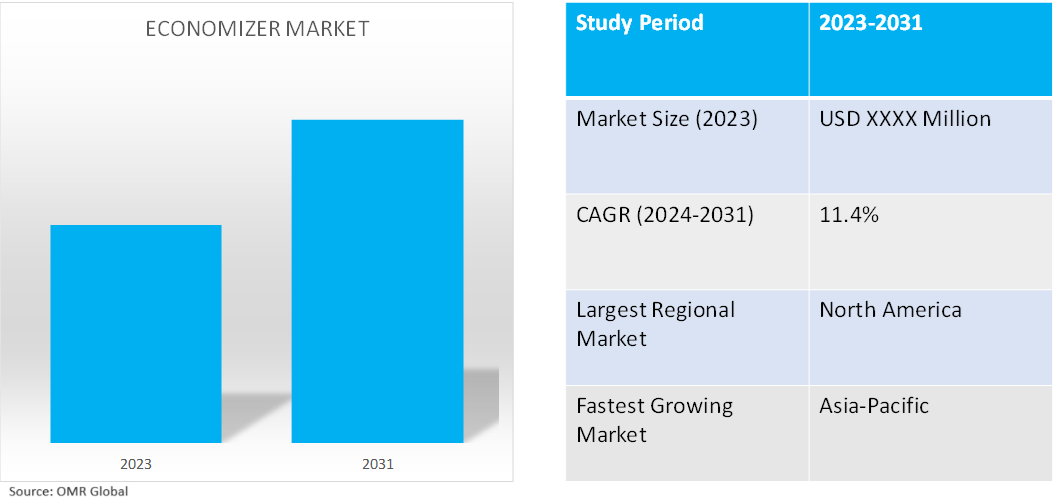

Economizer Market

Economizer Market Size, Share & Trends Analysis Report, by Type (Fluid Economizer and Air Side Economizer), by Application (Power Plants, HVAC, Boilers, Refrigeration, and Others), and by End-Use Industry (Industrial and Commercial) Forecast Period (2024-2031)

Economizer market is anticipated to grow at a significant CAGR of 11.4% during the forecast period (2024-2031). The market growth is attributed to the economizers are increasingly being utilized in a variety of applications, including power plants, data centers, boilers, heating, ventilation, and air conditioning (HVAC), and others driving the growth of the market. According to the US International Trade Commission, in May 2021, there were nearly 8,000 data centers globally. Among these countries, six houses a majority of data centers, the US (33.0%), the UK (5.7%), Germany (5.5 %), China (5.2 %), Canada (3.3 %), and the Netherlands (3.4%).

Market Dynamics

Growing Adoption in HVAC Systems

The use of economizers in HVAC systems has increased as concerns over energy efficiency have grown. When the outside air is colder than the inside air, economizers use the outside air to cool the interior space, therefore lowering the energy consumption of HVAC systems. Economizers are components of HVAC systems that increase equipment efficiency and result in energy savings. When the weather is mild, the economizer draws in outside air and uses it to pre-cool interior air before it enters the cooling system. As a result, there is less of a cooling burden and less energy required to maintain comfortable temperatures. Economizers can save up to 25–30.0% on energy bills by using an economizer. Economizers not only save energy but also contribute to improved indoor air quality by removing dust and impurities.

Increasing Integration with Smart Building Systems

Economizers are being connected to IoT platforms and building management systems (BMS) as smart building technologies gain traction. Further energy savings are possible due to the more accurate control and optimization of HVAC systems made possible by this connection. The effectiveness of rooftop units (RTUs) retrofitted with advanced controllers equipped with multi-speed fan, economizer, and demand ventilation controls. The performance and efficiency of modern economizers are improved by the advanced control technologies they are outfitted with, such as automation systems and sensors. These technologies ensure optimal operation by enabling real-time monitoring and modifications.

Market Segmentation

- Based on the type, the market is segmented into fluid economizers and air-side economizers.

- Based on the applications, the market is segmented into power plants, HVAC, boilers, refrigeration, and others (data centers).

- Based on the end-user industry, the market is segmented into industrial and commercial.

Fluid Economizer is Projected to Hold the Largest Segment

The primary factors supporting the growth include fluid-side economizers frequently use water, glycol mixes, and refrigerants as their fluids. This kind of economizer is frequently referred to as a "water-side economizer" as it minimizes the utilization of water. Data centers with air-cooled or water-cooled chilled water plants usually utilize fluid-side economizers. Most fluid economizers require two separate pieces of equipment, a chiller and a dry cooler, along with a layer of controls for coordination. By adding an on-board economizer to the Pathfinder, both tuned at the factory to optimize control and performance, the Daikin technology decreases installation and commissioning times, and related expenses. For instance, Daikin Industries, Ltd., introduced an integrated water-side economizer (WSE) for its Pathfinder Air-cooled Screw Chiller. The WSE, providing what is commonly known as “free cooling,” uses outdoor air to naturally cool water and other process fluids, reducing compressor work and increasing chiller efficiency.

Power Plants to Hold a Considerable Market Share

The factors supporting segment growth include increasing power plant economizers employed as heat exchangers to retain the leftover heat produced by boilers. New fossil fuel-based thermal power plants have been installed internationally driven by the increased energy demand. This is expected to increase the demand for economizers globally. The total power plant fuel consumption of all ships in a fleet, gathering information from all onboard fuel and power-related systems, including main and auxiliary engines, gas turbines, boilers, and inert gas generators, whether the ship is in action. For instance, in October 2023, Auramarine Ltd., the fuel supply systems for the marine, process, and power industries launched its new Auramarine Fuel Economiser (AFE) solution. The AFE enables ship owners and operators to proactively analyze and identify where fuel consumption and emissions can be reduced, delivering savings of between 5.0% and 20.0%.

Regional Outlook

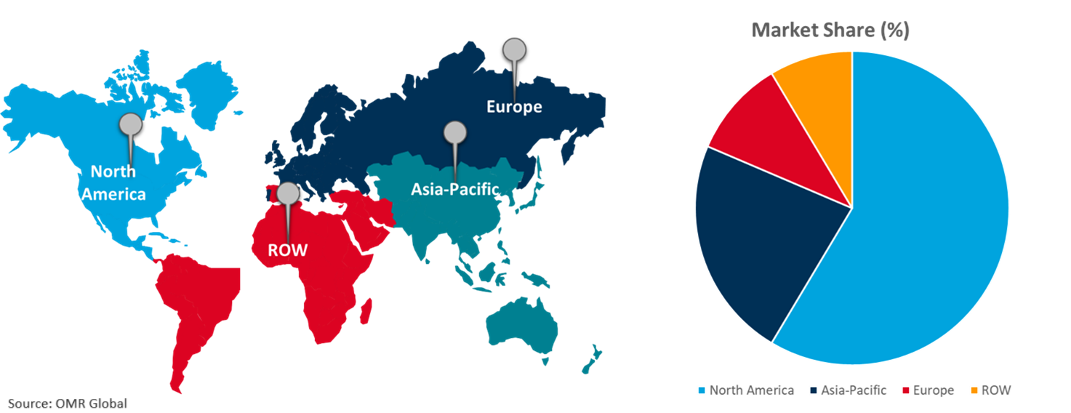

The global economizer market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Economizers in Asia-Pacific

The regional growth is attributed to the economizers in power plants rising owing to the increasing demand to cut energy consumption. Additionally, economizers are being used in power plants as heat exchangers, which is contributing to their expansion. According to the International Energy Agency, Industrial heat demand is projected to expand 16.0% (+17.6 EJ) globally during 2023-2028, with China and India together accounting for more than half of the growth. Significant increases in energy consumption and electricity demand in the region have also led to a corresponding increase in power plant size, consequently, rising power plant demand is driving the expansion of the economizer industry.

Global Economizer Market Growth by Region 2024-2031

North America Holds Major Market Share

The regional market growth is attributed to the growing demand for economizers in the commercial sector as well as the increasing need for economizers from thermal power plants. The rising demand for renewable energy and increasing concern for the environment in the construction industry. The economizer market is expanding owing to the increasing usage of economizers in data centers. According to the US International Trade Commission, in May 2021, In the US, there are over 2,600 data centers spread across the country. The lighter economizer produces pressure-build speeds that are up to two times faster than competitive models. Combining the pressure-building and economizer functions into one unit saves space and simplifies installation in tight plumbing situations. For instance, in September 2023, RegO Products, part of OPW Clean Energy Solutions and Dover introduced its new CBE504 Series Half-Inch Pressure Builder-Economizer Regulator, which enables cryogenic vessels to achieve and maintain proper pressures with minimal risk of product loss. Economizer seal design tied strictly to the PB Outlet function mitigates against pressure runaways, further reducing the potential for product loss.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global economizer market include Alfa Laval Corporate AB, Carrier Global Corp., Daikin Industries, Ltd., Honeywell International Inc., and Johnson Controls International PLC among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In May 2024, Carrier Transicold introduced the Vector HE 17 offering a significant reduction in fuel consumption and noise. The Vector HE 17 also builds upon the proven strengths of the Vector HE 19 unit: a hermetically sealed compressor and an economizer, increasing the machine's efficiency. This system offers greater efficiency, reduces the risk of refrigerant leaks, and significantly lowers fuel consumption.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global economizer market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Alfa Laval Corporate AB

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Carrier Global Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Daikin Industries Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Honeywell International Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Johnson Controls International PLC

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Economizer Market by Type

4.1.1. Fluid Economizer

4.1.2. Air Side Economizer

4.2. Global Economizer Market by Application

4.2.1. Power Plants

4.2.2. HVAC

4.2.3. Boilers

4.2.4. Refrigeration

4.2.5. Others (Data Centers)

4.3. Global Economizer Market by End-User Industry

4.3.1. Industrial

4.3.2. Commercial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. American Standard Heating & Air Conditioning

6.2. Baltimore Aircoil Company, Inc.

6.3. Building Automation Products, Inc.

6.4. Cambridgeport

6.5. Cannon Boiler Works, Inc.

6.6. Cleaver-Brooks Company, Inc.

6.7. Ecolab

6.8. Greenheck Fan Corp.

6.9. Ingersoll Rand

6.10. Lennox International Inc.

6.11. Mitsubishi Electric Corp.

6.12. Nortek Air Solutions, LLC

6.13. Rheem Manufacturing Co.

6.14. Robert Bosch GmbH

6.15. SAACKE GmbH

6.16. Sauter Controls (Fr. Sauter AG)

6.17. Schneider Electric SE

6.18. SEMCO, LLC (FläktGroup)

6.19. Thermo King

6.20. Trane Technologies

1. Global Economizer Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Fluid Economizer Market Share By Region, 2023 Vs 2031 (%)

3. Global Airside Economizer Market Share By Region, 2023 Vs 2031 (%)

4. Global Economizer Market Research And Analysis By Application, 2023 Vs 2031 (%)

5. Global Economizer For Power Plants Market Share By Region, 2023 Vs 2031 (%)

6. Global Economizer For HVAC Market Share By Region, 2023 Vs 2031 (%)

7. Global Economizer For Boilers Market Share By Region, 2023 Vs 2031 (%)

8. Global Economizer For Refrigeration Market Share By Region, 2023 Vs 2031 (%)

9. Global Economizer For Others Application Market Share By Region, 2023 Vs 2031 (%)

10. Global Economizer Market Research And Analysis By End-User Industry, 2023 Vs 2031 (%)

11. Global Industrial Economizer Market Share By Region, 2023 Vs 2031 (%)

12. Global Commercial Economizer Market Share By Region, 2023 Vs 2031 (%)

13. Global Economizer Market Share By Region, 2023 Vs 2031 (%)

14. US Economizer Market Size, 2023-2031 ($ Million)

15. Canada Economizer Market Size, 2023-2031 ($ Million)

16. UK Economizer Market Size, 2023-2031 ($ Million)

17. France Economizer Market Size, 2023-2031 ($ Million)

18. Germany Economizer Market Size, 2023-2031 ($ Million)

19. Italy Economizer Market Size, 2023-2031 ($ Million)

20. Spain Economizer Market Size, 2023-2031 ($ Million)

21. Rest Of Europe Economizer Market Size, 2023-2031 ($ Million)

22. India Economizer Market Size, 2023-2031 ($ Million)

23. China Economizer Market Size, 2023-2031 ($ Million)

24. Japan Economizer Market Size, 2023-2031 ($ Million)

25. South Korea Economizer Market Size, 2023-2031 ($ Million)

26. Rest Of Asia-Pacific Economizer Market Size, 2023-2031 ($ Million)

27. Rest Of The World Economizer Market Size, 2023-2031 ($ Million)

28. Latin America Economizer Market Size, 2023-2031 ($ Million)

29. Middle East And Africa Economizer Market Size, 2023-2031 ($ Million)