Edible Films and coatings Market

Edible Films and coatings Market Size, Share & Trends Analysis Report by Type (Barrier Films, Antimicrobial Films, Anti-browning Films, Texture Enhancing Films, and Others), by Material (Proteins, Lipids, Polysaccharides, and Composites), and by Industry (Bakery and Confectionery, Fruits and Vegetables, Meat, Poultry, and Seafood, Dairy Products, Pharmaceuticals, and Others), Forecast Period (2024-2031)

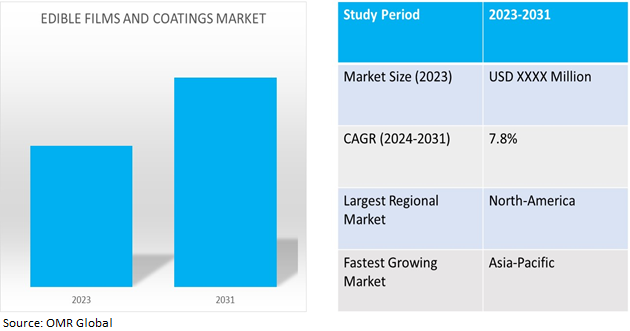

Edible films and coatings market is anticipated to grow at a CAGR of 7.8% during the forecast period (2024-2031). The market growth is attributed to rising consumer consciousness about eco-friendly and sustainable products, and the implication of stringent policies, and regulations by the government on organic products, and packaging for environmental stewardship. Also, constant efforts by organizations to make business processes more sustainable in every aspect are creating demand for the product. Further, the market is expected to be influenced by advancements in films and coatings, the incorporation of additives, the increasing adoption of plant-based sources for film and coating production, and the use of nanomaterials.

Market Dynamics

Government Policies and Regulations May Benefit the Industry.

Globally, efforts are being made by governments to preserve the environment by imposing laws, policies, and partnerships on global platforms. Governments are setting deadlines and milestones for tackling issues such as waste disposal, biodiversity, plastic pollution, and others. The changing dynamics in the packaging and coatings industry are expected to influence the adoption of edible films and coatings across end-user industries. For instance, in November 2023, the European Parliament adopted revamped rules to reduce, reuse, and recycle packaging. Members of the European Parliament (MEPs) approved the report mandated to reduce packaging, restrict certain types, and ban the use of forever chemicals (highly toxic fluorinated chemicals). Also, targets were proposed in the regulation (5% by 2030, 10% by 2035, and 15% by 2040) to ban the sale of very lightweight plastic carrier bags (below 15 microns) unless required for hygiene reasons or provided as primary packaging for loose food to help prevent food waste.

Rise in Consumption of Organic Products

Edible films and coatings offer a high potential for promoting sustainable food production by minimizing packaging waste, extending product shelf life, and actively interacting to preserve food quality. Furthermore, the ability to interact with circular economy techniques makes edible films and coatings adaptable and capable of lowering the environmental effect of food systems, such features are widely adopted by organic food manufacturers to make processes and offerings more lucrative for green consumers, as they prefer products with complete sustainability.

Segmental Outlook

Our in-depth analysis of the global edible films and coatings market includes segment analysis by type, material, and application.

- Based on function type, the market is sub-segmented into barrier films, antimicrobial films, anti-browning films, texture-enhancing films, and other films.

- Based on material, the market is sub-segmented into proteins, lipids, polysaccharides, and composites.

- Based on application, the market is sub-segmented into bakery and confectionery, fruits and vegetables, meat, poultry, seafood, dairy products, pharmaceuticals, and others.

Anti-microbial and anti-browning films are projected to emerge as a bigger segment.

The growth of antimicrobial and anti-browning films is attributed to their high demand in the food and beverage industry, as anti-microbial and anti-browning films are highly favored owing to their resistance to staleness, microorganisms, and other damage, providing the best edible solution to the industry. Also, it is extremely effective at inhibiting or killing pathogenic and spoilage bacteria that cause food contamination and can decrease the unpleasant flavors that may result from the direct inclusion of active substances into foods.

Bakery & Confectionary and food and beverages are the biggest end-users.

Bakery and confectionary items, along with food and vegetables, dominate the end-user segment of edible films and coatings owing to their shorter shelf lives compared to other end-user industries' products. They also require coatings to protect their inherent qualities. Furthermore, due to the industry's size in terms of consumption, it is bound by significant government restrictions to make its packaging environmentally friendly.

Regional Outlook

The global edible films and coatings market is further segmented based on geography, including North America (the US and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East, Africa, and Latin America).

North America Holds the Highest Share in Global Edible Film and Coatings Market.

North America holds the highest share of the global edible film and coatings market. The key factors contributing to the growth of the market include the rising consciousness of consumers towards sustainable alternatives for packaging and processes and government policies. For instance, Extended Producer Responsibility (EPR) laws impose liability on producers for the lifecycle of their products. EPR laws are found globally, particularly in Europe and Canada, and are becoming more prevalent at the state level in the US. Such laws are putting strain on companies for waste management and making it more feasible to shift to an edible packaging alternative.

Global Edible Films and Coatings Market Growth by Region 2024-2031

Asia-Pacific is the fastest-growing Edible films and coatings market.

- Asia (specifically India and China) is a huge exporter of organic products to Western countries, creating a big market for sustainable and edible packaging in the region.

- The region is also adopting stringent regulatory policies to regulate the packaging industry, promote eco-friendly materials, and reduce environmentally harmful practices across industries.

Market Player Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global edible films and coatings market include Glanbia plc, Ingredion, Inc., and Tate & Lyle PLC, among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global edible films and coatings market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tool

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Edible Films and Coatings Market by Type

4.1.1. Barrier Films and Coatings

4.1.2. Antimicrobial Films and Coatings

4.1.3. Anti-browning Films

4.1.4. Texture Enhancing Films

4.1.5. Others

4.2. Global Edible Films and Coatings Market by Material

4.2.1. Proteins

4.2.2. Lipids

4.2.3. Polysaccharides

4.2.4. Composites

4.3. Global Edible Films and Coatings Market by Application

4.3.1. Bakery and Confectionery

4.3.2. Fruits and Vegetables

4.3.3. Meat, Poultry, and Seafood

4.3.4. Dairy Products

4.3.5. Pharmaceuticals

4.3.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.2.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Akorn Technology, Inc.

6.2. Dohler GmbH.

6.3. Flo Chemical Corp.

6.4. Glanbia plc

6.5. Ingredion, Inc.

6.6. Nabaco, Inc.

6.7. Nagase America LLC

6.8. Pace International, LLC

6.9. PolyNatural Holding Spa.

6.10. Sufresca Ltd.

6.11. Takikawa Oblate Corp. Ltd.

6.12. Tate & Lyle PLC.

1. GLOBAL EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL EDIBLE BARRIER FILMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL EDIBLE ANTIMICROBIAL FILMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL EDIBLE ANTI-BROWNING FILMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL EDIBLE TEXTURE ENHANCING FILMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER EDIBLE FILMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

8. GLOBAL POLYSACCHARIDES-BASED EDIBLE FILMS AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LIPIDS-BASED EDIBLE FILMS AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PROTEINS-BASED EDIBLE FILMS AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL COMPOSITE-BASED EDIBLE FILMS AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL EDIBLE FILMS AND COATINGS FOR BAKERY AND CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL EDIBLE FILMS AND COATINGS FOR FRUITS AND VEGETABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL EDIBLE FILMS AND COATINGS FOR MEAT, POULTRY, AND SEAFOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL EDIBLE FILMS AND COATINGS FOR DAIRY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL EDIBLE FILMS AND COATINGS FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL EDIBLE FILMS AND COATINGS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

23. NORTH AMERICAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. EUROPEAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

27. EUROPEAN EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

35. REST OF THE WORLD EDIBLE FILMS AND COATINGS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL EDIBLE FILMS AND COATINGS MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL EDIBLE BARRIER FILMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL EDIBLE ANTIMICROBIAL FILMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL EDIBLE ANTI-BROWNING FILMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL EDIBLE TEXTURE ENHANCING FILMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER EDIBLE FILMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL EDIBLE FILMS AND COATINGS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL POLYSACCHARIDES-BASED EDIBLE FILMS AND COATINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL LIPIDS-BASED EDIBLE FILMS AND COATINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PROTEINS-BASED EDIBLE FILMS AND COATINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL COMPOSITE-BASED EDIBLE FILMS AND COATINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL EDIBLE FILMS AND COATINGS FOR EDIBLE FILMS AND COATINGS SHARE BY APPLICATION, 2023 VS 2031 (%)

13. GLOBAL EDIBLE FILMS AND COATINGS FOR BAKERY AND CONFECTIONERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL EDIBLE FILMS AND COATINGS FOR FRUITS AND VEGETABLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL EDIBLE FILMS AND COATINGS FOR MEAT, POULTRY, AND SEAFOOD MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL EDIBLE FILMS AND COATINGS FOR DAIRY PRODUCTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL EDIBLE FILMS AND COATINGS FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL EDIBLE FILMS AND COATINGS FOR EDIBLE FILMS AND COATINGS SHARE BY REGION, 2023 VS 2031 (%)

19. US EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

20. CANADA EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

21. UK EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

22. FRANCE EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

23. GERMANY EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

24. ITALY EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

25. SPAIN EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

27. INDIA EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

28. CHINA EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

29. JAPAN EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA EDIBLE FILMS AND COATINGS SIZE, 2023-2031 ($ MILLION)