Egg Replacers Market

Global Egg Replacers Market Size, Share & Trends Analysis Report by Source (Plant and Animal), by application (Bakery and Confectionery, Dressings and Spreads, Savories and Sauces, and Others) and by Ingredient (Dairy Proteins, Starch, Algal Flour, Soy-based Products) Forecast (2022-2028) Update Available - Forecast 2025-2035

The global Egg Replacers market is anticipated to grow at a significant CAGR of 6.5% during the forecast period. Cost is a major driving factor for many food manufacturers to consider egg replacement options. In industrial baking, challenges are approaching bakers to look for solution to deal with volatile supply chain costs and serve the growing demand for products. Companies are always searching for options to reduce raw material costs and to cop raw material availability due to the fluctuations in egg prices. The fluctuations in prices of Liquid whole eggs, whites, yolks and powdered eggs significantly affect the cost of use in bakery products. For instance the Ukrainian Agribusiness Club (UCAB) business association forecasts that a record-breaking drop in egg production in Ukraine since the beginning of 2021 is likely to drive egg prices on the domestic market to new heights. From January to May of 2021, egg production in Ukraine dropped by as much as 25%, which caused temporary shortage in the domestic market. These sudden cost increases can have an enormous effect on businesses, causing bakers to seek out for reliable solutions to fulfill the functions eggs provide. Moreover in 2018, when egg prices were going through an extended period of volatility, Arla Foods Ingredients launched a online egg calculator to help out bakery companies in calculating how much they could save by using egg replacers in their cake recipes.

Impact of COVID-19 Pandemic on Global Egg Replacers Market

COVID-19 pandemic impacted mental and physical well-being of people globally which made consumers more concerned and aware about their health and well-being. Surge in consumer spending on food products is been seen during the pandemic. Moreover, egg replacers’ products witnessed an increase in demand as a result of shortage of eggs in retail stores due to movement restrictions.

Segmental Outlook

The global Egg Replacers market is segmented based on the source, application and ingredients. Based on the source, the market is segmented into plants and animal. Based on the application, the market is sub-segmented into the bakery and confectionery, dressings and spreads, savories and sauces, and others. Based on the ingredient the market is sub-segmented into dairy proteins, starch, algal flour, soy-based products. The above mentioned segments can be customized as per the requirements.

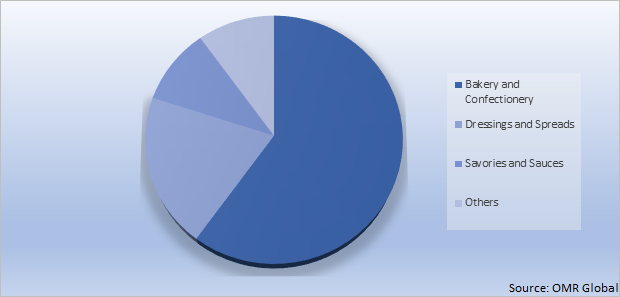

Global Egg Replacers Market Share by Application, 2020 (%)

The bakery and confectionery Segment is anticipated to hold a prominent Share in the Global Egg Replacers Market.

A major driving factor of the egg replacement market is the constant expansion of bakeries and cafes globally. In the food industry, egg replacements are most commonly being used in the baking and confectionary and many bakeries are on the seeking for vegan options also. People are increasingly adopting lifestyle, where they are trying to cut down milk and dairy products which presents plant-based product as an option for brands to attract consumers. Companies are constantly trying to grab on emerging egg replacements opportunities and attracting the quickly growing plant-based customers. For instance, in April 2021, Moolec Science expanded its portfolio to include animal-free protein solutions based on molecular farming. The agri-tech company is engineering ovum protein into wheat for an egg replacement specially designed for the bakery industry.

Regional Outlooks

The global Egg Replacers market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for particular region or country level as per the requirement.

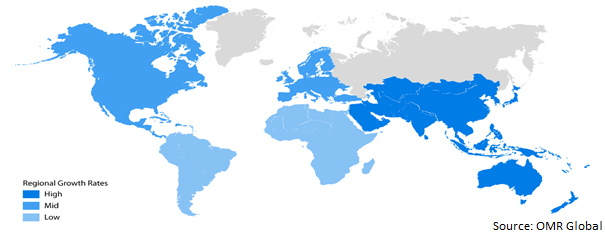

Global Egg Replacers Market Growth, by Region 2022-2028

The North America is anticipated to Holds the Prominent Share in The Global Egg Replacers Market.

The egg replacers market in North America is expected to grow at a significant speed due to growing vegan population across this region. For instance, the 2021 vegan statistics for the UK reveal that the number of vegans in the country increased from 150,000 in 2014, to 720,000 in 2020. The consumers are more aware about the nutritional content of the product in the developed countries. The demand for low-calorie and clean label ingredient is extensively driving the need for the egg replacer market in Europe. This rising demand and growing vegan population poses a great opportunity for food manufacturers to launch innovative ingredients. For instance, in 2019, UK ingredient supplier Ulrick & Short, launched egg replacer to take advantage of growing vegan trend. The company developed ovaprox V, which is a 100% clean label egg replacement solution that is suitable for a range of bakery applications like cakes, muffins and waffles.

Market Players Outlook

The major companies serving the global Egg Replacers market include Archer Daniels Midland Company, Cargill Inc., Danone S.A., DuPont de Nemours, Inc.,Fiberstar, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2022, Plant B has announced an upcoming launch of its lupin-based liquid egg product across Germany after 15 months of development. The company claims that its plant-based egg alternative behaves like regular eggs, while saves 50% of the calories. The product is market as ready-to-cook fresh item suitable for use in baking and cooking.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global egg replacers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.