Electric Bicycle Market

Electric Bicycle Market Size, Share & Trends Analysis Report by Propulsion Type (Pedal Assist, and Throttle), by Battery Type (Lead Acid, Lithium-ion, and Others), and by Application (City/Urban, Mountain/Trekking, and Cargo/Luggage) Forecast Period (2024-2031)

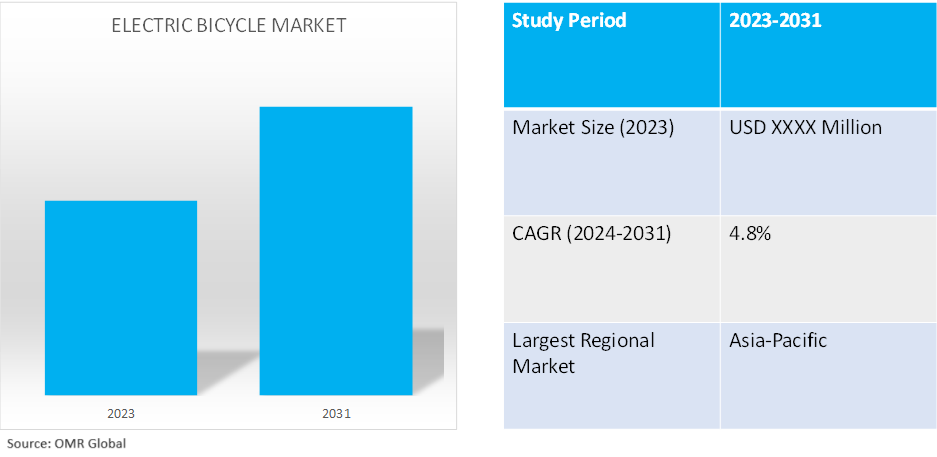

Electric bicycle market is anticipated to grow at a CAGR of 4.8% during the forecast period (2024-2031). A battery and electric motor driving system that generates power for locomotion are incorporated into an electric bicycle. Additionally, it has electronic displays and sensors that provide riders with the extra support they need for a comfortable ride. This aids the rider's pedal power.

Market Dynamics

Charging infrastructure development

The growing attempts of public and private companies to develop charging infrastructure is a key factor driving the adoption of the electric bicycles. For instance, in November 2023, Mercedes-Benz inaugurated its first European charging station in Mannheim, Germany, featuring six 300 kW charging points for electric vehicles. To optimize energy distribution, each charger has a single port, ensuring maximal efficiency. Additionally, with intelligent charging management, select EVs can achieve an 80.0% charge in less than 20 minutes.

Campaigns to promote electric bicycle market

The increasing campaigns to promote electric bicycles adoption are likely to drive the global market. For instance, in April 2024, ADO E-bike launched an Indiegogo crowdfunding campaign for a new lightweight folding model: the Air Carbon. The e-bike weighs 12.5 kg (~27.6 lbs) and offers a 100 km (~60 miles) assistance range. Plus, those who pledge to the campaign could receive the electric bicycle with a 40.0% discount.

Market Segmentation

- Based on propulsion type, the market is segmented into pedal assist, and throttle.

- Based on battery type, the market is segmented into lead acid, lithium ion, and other include nickel-metal-hydride.

- Based on application, the market is segmented into city/urban, mountain/trekking, and cargo/luggage.

Throttle is Projected to Emerge as the Largest Segment

The electric bicycle industry is dominated by the throttle assist segment. Electric bicycles with throttle assistance provide instantaneous power delivery, enabling riders to easily climb hills and accelerate rapidly from a stop. The immediate reaction improves the riding experience and gives the rider confidence and control, especially in city settings where there are many stops and starts. Due to its ease of use and accessibility, throttle assist electric bicycles can be purchased by a variety of customers, including those who are unfamiliar with conventional pedal assist systems. With just a twist or click of a button, riders can activate the electric motor to give extra propulsion, needing little effort to accelerate and maintain speed.

Regional Outlook

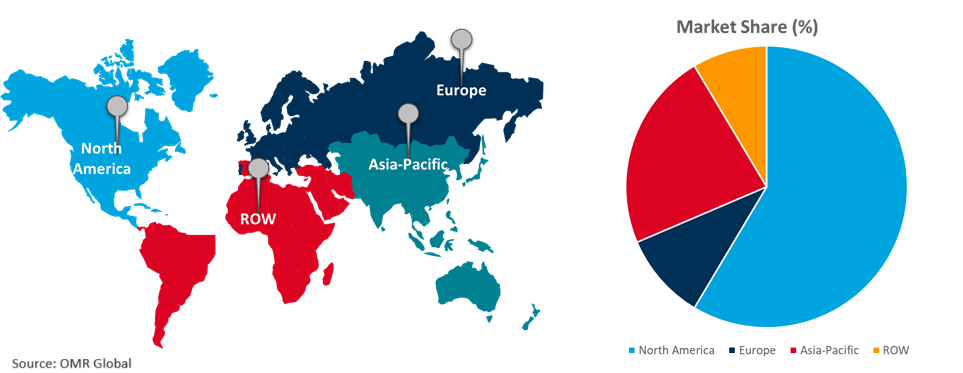

The global electric bicycle market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Fostering a Cycling Friendly Europe to Promote European Electric Bicycle Market

The European Declaration of Cycling outlines a comprehensive strategy to revolutionize urban mobility, emphasizing the need for enhanced city cycle networks, improved e-bike charging infrastructure, the development of cycling superhighways, and stronger integration with public transport systems. These measures aim to create a seamless and accessible cycling experience that encourages more people to choose sustainable and healthy modes of transportation. The presence of such strategies across Europe is likely to drive regional market growth.

Global Electric Bicycle Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a major share in the global electric bicycle market. The presence of major manufacturers across China, India, and South Korea that are highly focused on new product launches to meet consumer demand is driving the regional market. For instance, in February 2024, mXmotohas introduced the metal strong M16 electric bicycle with strength and durability for the Indian roads. The M16 electric bicycle by mXmoto comes with an 8-year warranty on the battery, 80,000 km of seamless riding and three-year warranty on motor and controller. Apart from this positive outlook of population towards electric bicycles is further aiding the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global electric bicycle market include Aima Technology Co. Ltd., Yadeo Group Holdings Ltd., Giant Manufacturing Co. Ltd., Hero Cycles Ltd., and Robert Bosch GmbH, among others.. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in January 2024, VinFast Auto officially announced the US rollout of the DrgnFly electric bike, at CES 2024. Underpinned by the message "Ride your style," the DrgnFly offers riders a unique and thrilling experience, contributing to catalyzing the future of accessible, electric mobility for everyone.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric bicycle market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Aima Technology Group Co. Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Giant Manufacturing Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Yadeo Group Holdings Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Bicycle Market by Propulsion Type

4.1.1. Pedal Assist

4.1.2. Throttle

4.2. Global Electric Bicycle Market by Battery Type

4.2.1. Lead Acid

4.2.2. Lithium-ion

4.2.3. Other (Nickel-Metal-Hydride)

4.3. Global Electric Bicycle Market by Application

4.3.1. City/Urban

4.3.2. Mountain/Trekking

4.3.3. Cargo/Luggage

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Alton Sports Co. Ltd.

6.2. Cannondale Bicycle Corp.

6.3. Canyon Bicycle

6.4. CSE EV GROUP Co. Ltd.

6.5. Focus & Kalkhoff Holding GmbH (Derby Cycle)

6.6. Hero Cycles Ltd.

6.7. Merida Industry Co Ltd.

6.8. Myvela Co. Ltd.

6.9. Pedego Electric Bikes

6.10. Robert Bosch GmBH

6.11. Royal Dutch Gazelle

6.12. Sunra EV

6.13. Tailing Electric Vehicle Co. Ltd.

6.14. The Cargo Bike Company

6.15. Trek Bicycle Corp.

6.16. Yadea Group Holdings Ltd

6.17. Yamaha Motor Co. Ltd.

1. GLOBAL ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

2. GLOBAL PEDAL ASSIST ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL THROTTLE ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

5. GLOBAL LEAD ACID ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LITHIUM-ION ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHER BATTERY BASED ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL ELECTRIC BICYCLE FOR CITY/URBAN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ELECTRIC BICYCLE FOR MOUNTAIN/TREKKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ELECTRIC BICYCLE FOR CARGO/LUGGAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD ELECTRIC BICYCLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ELECTRIC BICYCLE MARKET SHARE BY PROPULSION TYPE, 2023 VS 2031 (%)

2. GLOBAL PEDAL ASSIST ELECTRIC BICYCLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL THROTTLE ELECTRIC BICYCLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ELECTRIC BICYCLE MARKET SHARE BY BATTERY TYPE, 2023 VS 2031 (%)

5. GLOBAL LEAD ACID ELECTRIC BICYCLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL LITHIUM-ION ELECTRIC BICYCLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHER BATTERY BASED ELECTRIC BICYCLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ELECTRIC BICYCLE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL ELECTRIC BICYCLE FOR CITY/URBAN MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ELECTRIC BICYCLE FOR MOUNTAIN/TREKKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ELECTRIC BICYCLE FOR CARGO/LUGGAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ELECTRIC BICYCLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

15. UK ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA ELECTRIC BICYCLE MARKET SIZE, 2023-2031 ($ MILLION)