Electric Bus Market

Electric Bus Market Size, Share & Trends Analysis Report by Vehicle Type (Fuel Cell Electric Vehicles, Battery Electric Vehicles and Plug-in Hybrid Electric Vehicle), by Battery Type (Nickel Manganese Cobalt (NMC), Lithium Iron Phosphate (LFP) and Lithium Nickel Cobalt Aluminum Oxide (NCA) and by End-Users (Public and Private) Forecast Period (2024-2031)

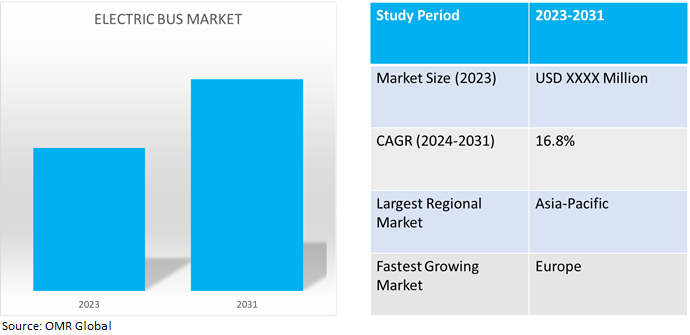

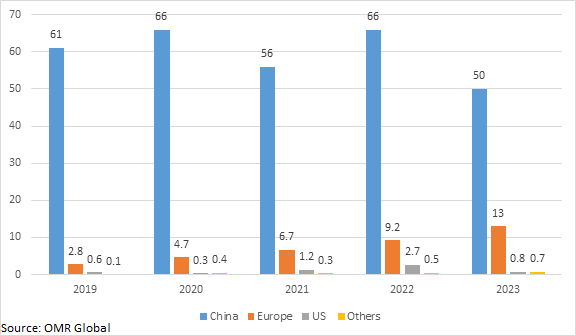

Electric bus market is anticipated to grow at a significant CAGR of 16.8% during the forecast period (2024-2031). The market growth is attributed to the increasing development of hydrogen fuel cell-powered electric bus, battery based electric buses with advancements in features including increased range, decreased charging time globally driving the growth of market. According to the International Energy Agency (IEA), in 2023, nearly 66,000 electric buses and 60,000 medium- and heavy-duty trucks were sold globally in 2022, representing about 4.5% of all bus sales and 1.2% of truck sales globally. China continues to dominate production and sales of electric (and fuel cell) trucks and buses. In 2022, 54,000 new electric buses and an estimated 52,000 electric medium- and heavy-duty trucks were sold in China, representing 18.0% and 4.0% of total sales in China and about 80.0% and 85.0% of global sales, respectively.

Market Dynamics

Development of Charging Infrastructure for Electric Bus

The development of charging infrastructure to save the depot cost on electricity. It accomplishes this by carefully planning the length and time of the charging of the electric vehicle. Consequently, less electricity is used during peak hours. According to the International Council on Clean Transportation, in September 2022, the cost of setting up a depot for 100 electric buses can be as high as ?5 crores ($50 million), and up to 50.0% of this cost could go into the security deposit to the power distribution company. Effective energy management techniques can reduce costs and accelerate the adoption of electric buses by maximizing energy utilization, putting in place intelligent charging infrastructure, and utilizing innovative technologies.

Governments Offering Incentives and Subsidies

The usage of electric buses is also being prompted by government initiatives to meet zero emissions targets, stringent restrictions, and growing environmental concerns. Since buses serve the public, promoting electric buses is vital as a key strategy for decarbonizing the transportation sector. The adoption of electric vehicles (EVs) is necessary to achieve the objective of net zero emissions. For instance, in December 2023, India-US payment security mechanism incentive e-bus operations, establish a manufacturing hub in India. The India-US payment security mechanism (PSM) for e-buses serve as an incentive for both Indian and international OEMs/Bus operators to participate in e-bus operations and potentially establish a manufacturing hub in India.

Market Segmentation

Our in-depth analysis of the global electric bus market includes the following segments vehicle type, battery type and end-users.

- Based on the vehicle type, the market is segmented into fuel cell electric vehicles, battery electric vehicles and plug-in hybrid electric vehicles.

- Based on the battery type, the market is segmented into nickel manganese cobalt (NMC), lithium iron phosphate (LFP) and lithium nickel cobalt aluminum oxide (NCA).

- Based on the end-users, the market is segmented into public and private.

Battery Electric Vehicle is Projected to Hold the Largest Segment

The battery-electric vehicle segment is expected to hold the largest share of the market. The primary factors supporting the growth include battery electric buses provide several benefits such as they operate quietly and have no tailpipe emissions, they help to lessen air and noise pollution in metropolitan areas. In addition, their running expenses are lower than those of traditional buses because electricity is typically less expensive than fuel or gasoline. Regenerative braking is another advantage for battery electric buses it enables them to store and recover energy during deceleration, improving their overall efficiency. For instance, in October 2023, Scania launched new battery-electric bus platform at Busworld. With the introduction of low-entry 4x2 buses, the sustainably sourced and built batteries offer a vast energy storage capacity of up to 520 kWh and have been developed specifically for heavy commercial vehicles, enabling a range in optimal conditions of over 500 km.

Public Segment to Hold a Considerable Market Share

The public segment is expected to hold a considerable share of the market. Governments impose various GHG emissions to curb air and noise pollution and lessen reliance on fossil fuels, as well as rising transportation demand. In the future, there will be significant savings as the cost of power needed to charge electric buses is significantly lower than the cost of diesel fuel. The government promotes the usage of electric buses by providing a range of subsidies and incentives. For instance, in January 2024, the US government announced investment in clean school buses across the nation. EPA’s Clean School Bus Program has awarded nearly $2 billion and funded approximately 5,000 electric and low-emission school buses nationwide.

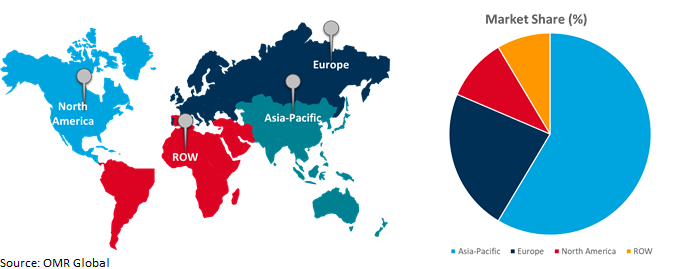

Regional Outlook

Global electric bus market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of Sustainable Transportation in Europe

- The regional growth is attributed to the growing demand for effective and ecologically sustainable public transit solutions as European countries expanded. One approach to meet this need was to deploy electric buses. According to the International Council on Clean Transportation, in May 2023, electric city bus sales overtake diesel in Europe. This marks the first time that zero-emission technology has dominated the road transport sector in Europe. City buses make up about 60.0% of all heavy-duty passenger vehicle sales (the rest are coaches and interurban buses).

- According to the UITP (Union Internationale des Transports Publics), in April 2024, Battery buses count will increase from 1,621 in 2022 to nearly 11,000 vehicles in 2030, which would make them more than 50.0% of the entire fleet. This change takes place most notably in Western Europe, as well as in Central and Eastern Europe, which will be home to around 65% of Europe’s trolleybuses.

Global Electric Bus Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to numerous prominent electric bus companies and providers such as YUTONG Bus Co., Ltd., Xiamen King Long International Trading Co., Ltd., Higer Bus Company, CRRC Zhuzhou Electric Co., Ltd. in the region. According to the Chinabuse, in September 2023, according to the latest statistics, China sold 3,096 units of medium- and large-sized new energy buses (6-meter and above in length). The growth is mainly attributed to the increasing technological advancements, particularly in the areas of energy storage, electric drivetrains, and battery technology. Advances in battery technology improve charging times, efficiency, and range. The advent of vehicle-to-grid (V2G) technology in the electric bus, drives the growth of the market in the region. For instance, in April 2022, Wuhan Quanqiutong Commuting Service Co., Ltd. placed an order for 220 units XML6118JEV electric buses on Golden Dragon. Wuhan launched new regulations on buses involved in commuting service. According to Wuhan Quanqiutong, 98.0% of its vehicles have to be replaced to meet more stringent regulations on the road.

Electric Bus Sales Share by Region, 2019-2023

Source: International Energy Agency

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the electric bus market include AB Volvo, BYD Motors, Inc., Daimler AG, Tata Motors, Ltd., and Yutong Bus Co., Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In November 2023, Hitachi ZeroCarbon Ltd. collaborated with FirstGroup plc to lead the UK's shift to electric buses. The collaboration, which is part of FirstGroup's bus fleet and infrastructure decarburization programme, provides batteries for First Bus's expanding electric bus fleet, helping to make a positive impact on air quality, tackle congestion and improve customer experience.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the electric bus market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AB Volvo

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BYD Motors, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Daimler AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Tata Motors, Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Yutong Bus Co., Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Bus Market by Vehicle Type

4.1.1. Fuel Cell Electric Vehicle

4.1.2. Battery Electric Vehicle

4.1.3. Plug-in Hybrid Electric Vehicle

4.2. Global Electric Bus Market by Battery Type

4.2.1. Nickel Manganese Cobalt (NMC)

4.2.2. Lithium Iron Phosphate (LFP)

4.2.3. Lithium Nickel Cobalt Aluminum Oxide (NCA)

4.3. Global Electric Bus Market by End-Users

4.3.1. Public

4.3.2. Private

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Allison Transmission, Inc.

6.2. Anhui Ankai Automobiles Co. Ltd

6.3. BlueBird Corp.

6.4. Chariot Motors

6.5. Deutsche Bahn AG

6.6. Ebusco Holding N.V.

6.7. GILLIG LLC

6.8. GreenPower Motor Company

6.9. Hinduja Group (Ashok Leyland)

6.10. Hunan CSR Times Electric Vehicle Co., Ltd.

6.11. Iveco S.p.A

6.12. Mellor Bus Ltd.

6.13. NFI Group, Inc.

6.14. Proterra, Inc.

6.15. Scania CV AB

6.16. Solaris Bus & Coach sp. z o.o.

6.17. Tecnobus Industries srl

6.18. VDL Bus & Coaches B.V.

6.19. Xiamen King Long International Trading Co., Ltd.

6.20. Yinlong Energy International Pte Ltd.

1. GLOBAL ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL FUEL CELL BASED ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BATTERY BASED ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PLUG-IN HYBRID BASED ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

6. GLOBAL NICKEL MANGANESE COBALT (NMC) ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LITHIUM IRON PHOSPHATE (LFP) ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

10. GLOBAL ELECTRIC BUS FOR PUBLIC MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ELECTRIC BUS FOR PRIVATE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

17. EUROPEAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

25. REST OF THE WORLD ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD ELECTRIC BUS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL ELECTRIC BUS MARKET SHARE BY VEHICLE TYPE, 2023 VS 2031 (%)

2. GLOBAL FUEL CELL BASED ELECTRIC BUS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BATTERY BASED ELECTRIC BUS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PLUG-IN HYBRID BASED ELECTRIC BUS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ELECTRIC BUS MARKET SHARE BY BATTERY TYPE, 2023 VS 2031 (%)

6. GLOBAL NICKEL MANGANESE COBALT (NMC) ELECTRIC BUS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL LITHIUM IRON PHOSPHATE (LFP) ELECTRIC BUS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) ELECTRIC BUS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ELECTRIC BUS MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

10. GLOBAL ELECTRIC BUS FOR PUBLIC MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ELECTRIC BUS FOR PRIVATE GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL ELECTRIC BUS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

15. UK ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA ELECTRIC BUS MARKET SIZE, 2023-2031 ($ MILLION)