Electric Car Market

Electric Car Market Size, Share & Trends Analysis Report by Vehicle Type (Hatchback, Sedan and SUV), by Propulsion Technology (Battery Electric Car, Plug-in Hybrid Electric Car and Fuel Cell Electric Car) and by End-Users (NiMH, Li-ion and Other) Forecast Period (2024-2031)

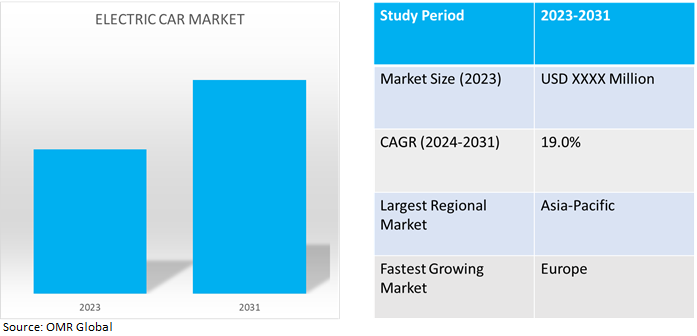

Electric car market is anticipated to grow at a significant CAGR of 19.0% during the forecast period (2024-2031). The market growth is attributed to the improvements in energy density, charging capabilities, and battery technology for better electric vehicle performance. The adoption of electric vehicles is fueled by supportive government policies, such as laws and subsidies that support environmentally friendly transportation, which increases demand for EV batteries globally driving the growth of the market. According to the International Energy Agency (IEA), in April 2024, Almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35.0% year-on-year increase. Electric cars accounted for around 18.0% of all cars sold in 2023, up from 14.0% in 2022.

Market Dynamics

Longer Range and Faster Charging for Electric Car

The adoption of electric vehicles with improvements in battery technology resulting in advancements in the infrastructure for fast charging makes recharging just as convenient as refuelling traditional vehicles. The availability of ultra-fast charging stations, which enable EVs to gain hundreds of miles of range in a matter of minutes, may increase. Solid-state batteries, which have a higher energy density and more safety, may become more widely used, resulting in EVs that are lighter and more efficient. For instance, in January 2024, the US Government announced $623 million in grants to help build out an electric vehicle (EV) charging network across the US. EV sales have more than quadrupled, the number of publicly available charging ports has grown by nearly 70.0%, and more than 4 million EVs are now on the road.

Integration of Autonomous Driving

The integration of electric and autonomous car technologies with sophisticated sensors and computer capacity, offers an ideal platform for autonomous systems. The idea of personal transportation has changed with the emergence of robot taxis and autonomous ride-sharing services, which are driven by electric and self-driving technology. Electric autonomous vehicles can navigate highways, avoid obstacles, and respond to dynamic traffic situations as artificial intelligence (AI) algorithms can handle large volumes of data in real time by integrating sensors, cameras, and powerful computing systems.

Market Segmentation

Our in-depth analysis of the global electric car market includes the following segments vehicle type, propulsion technology and battery type.

- Based on the vehicle type, the market is segmented into hatchback, sedan and SUV.

- Based on the propulsion technology, the market is segmented into battery electric cars, plug-in hybrid electric cars and fuel cell electric car.

- Based on the battery type, the market is segmented into NiMH, Li-ion and other (lead-acid batteries).

Battery Electric Car is Projected to Hold the Largest Segment

The battery electric car segment is expected to hold the largest share of the market. The primary factors supporting the growth include improvements in battery technology have resulted in increased safety, faster charging times, longer range, and improved economics for users. Electric vehicles are efficiently powered by batteries, which have various advantages over conventional options. These batteries power electric cars that help reduce emissions and air pollution, particularly in areas where a large portion of energy comes from renewable sources. According to the US Energy Information Administration, in January 2024, combined sales of hybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles (BEV) in the US increased to 16.3% of total new light-duty vehicle (LDV) sales in 2023. In 2022, hybrid, plug-in hybrid, and BEV sales were 12.9% of total sales. Manufacturers added 20 new BEV models during 2023 (mostly in the second half) for 70 BEV models at year-end out of 459 unique LDV models.

Li-ion Segment to Hold a Considerable Market Share

The Li-ion segment is expected to hold a considerable share of the market. Lithium-ion batteries have a higher energy density per unit mass and volume than other electrical energy storage devices, they are currently found in the majority of electric cars. Enhanced energy density, resistance to discharge, extended cycle life, and little memory effect are among the primary benefits that make lithium-ion batteries a preferred choice for electric vehicle applications. According to the International Energy Agency (IEA), Automotive lithium-ion (Li-ion) battery demand increased by about 65.0% to 550 GWh in 2022, from about 330 GWh in 2021, primarily as a result of growth in electric passenger car sales, with new registrations increasing by 55.0% in 2022 relative to 2021.

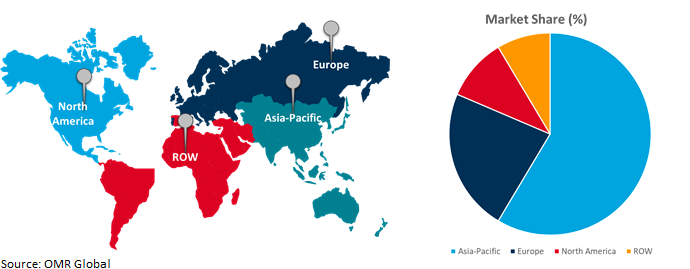

Regional Outlook

Global electric car market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of Sustainable Transportation in Europe

- The regional growth is attributed to increasing government activities to promote the use of electric vehicles, lowering operating and maintenance costs, and more public awareness of car emissions. According to the Association of European Automobile Manufacturers, in January 2024, the EU car market concluded with a solid 13.9% expansion compared to 2022, reaching a full-year volume of 10.5 million units in 2023. Battery-electric cars established themselves as the third most popular choice for buyers in 2023. In December, market share surged to 18.5%, contributing to a 14.6% share for the full year. The new EU registrations of hybrid-electric cars surged by 26.0%, driven by impressive gains in three of the four largest markets Germany (+38%), France (+32.6%), and Spain (+24.3%).

- According to the European Environment Agency (EEA), in October 2023, Electric cars, which include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), are gradually penetrating the EU market. There has been a steady increase in the number of new electric car registrations from 600 in 2010, to about 1,74 million in 2021, accounting for 18.0% of new registrations. These figures continued to grow in 2022 when almost 22.0% of newly registered passenger cars were electric. BEVs accounted for 12.2% of total new car registrations in 2022, while PHEVs represented 9.4%.

Global Electric Car Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

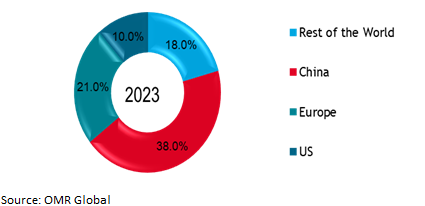

Asia-Pacific holds a significant share owing to numerous prominent electric car companies and providers such as Honda Motor Co., Ltd., Hyundai Motor Co., SAIC Motor Corp. Ltd., Tata Motors Ltd. Wuling Motors, and Zhejiang Geely Holding Group Co., Ltd. in the region. The growth is mainly attributed to the increasing technological advancements, particularly in the areas such as battery technology that improves charging times, efficiency, and range driving the growth of the market in the region. According to the International Energy Agency, in April 2024, 60.0% of new electric car registrations were in China and more than one in three new car registrations in China was electric in 2023. In China, the number of new electric car registrations reached 8.1 million in 2023, increasing by 35.0% relative to 2022. Increasing electric car sales was the main reason for growth in the overall car market. In addition, China exported over 4 million cars in 2023, making it the largest auto exporter globally, among which 1.2 million were EVs. Market players in the region introducing advanced electric vehicles with the integration of smart software and AI. For instance, in December 2023, Xiaomi EV Technology introduced, Xiaomi EV's five core technologies - E-Motor, Battery, Xiaomi hyper die-casting, Xiaomi pilot autonomous driving, and smart cabin.

Electric Car Sales Share in China, US, Europe and Rest of the World 2023 (Million Units)

Source: International Energy Agency

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the electric car market include AB Volvo, Audi AG, Honda Motor Co., Ltd., Hyundai Motor Co., and Tesla, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In February 2023, Stellantis announced investment of total $155 million in three Kokomo, Indiana, plants to produce new electric drive modules (EDM) that help power future electric vehicles assembled in North America and support the goal of 50.0% battery electric sales in the US by 2030.

- In April 2022, General Motors and Honda collaborated on affordable electric vehicles based on a new global architecture using next-generation Ultium battery technology. GM and Honda also will discuss future EV battery technology collaboration opportunities, to further drive down the cost of electrification, improve performance and drive sustainability for future vehicles.

- In July 2021, Nissan launched Nissan EV36Zero, a £1 billion ($1 billion) flagship electric vehicle (EV) hub creating a EV manufacturing ecosystem. The plant plant in Sunderland, UK, Nissan EV36Zero will supercharge the company's drive to carbon neutrality and establish a new 360-degree solution for zero-emission motoring.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the electric car market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AB Volvo

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Audi AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honda Motor Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Hyundai Motor Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tesla, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Car Market by Vehicle Type

4.1.1. Hatchback

4.1.2. Sedan

4.1.3. SUV

4.2. Global Electric Car Market by Propulsion Technology

4.2.1. Battery Electric Car

4.2.2. Plug-in Hybrid Electric Car

4.2.3. Fuel Cell Electric Car

4.3. Global Electric Car Market by Battery Type

4.3.1. NiMH

4.3.2. Li-ion

4.3.3. Other (Lead-Acid Batteries)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. BMW AG

6.2. BYD Co., Ltd.

6.3. CHERY Automobile Co., Ltd.

6.4. Dr. Ing. h.c. F. Porsche AG

6.5. Ford Motor Co.

6.6. General Motors Co.

6.7. Great Wall Motor Co. Ltd.

6.8. Jaguar Land Rover Ltd.

6.9. Kia Motors Corp.

6.10. Lucid Group, Inc.

6.11. Mercedes-Benz AG

6.12. Mitsubishi Motors Corp.

6.13. Nissan Motor Co. Ltd.

6.14. Polestar Performance AB

6.15. Rivian Automotive, LLC

6.16. SAIC Motor Corp. Ltd.

6.17. Tesla, Inc.

6.18. Volkswagen Group

6.19. Wuling Motor Holdings., Ltd

6.20. Zhejiang Geely Holding Group Co., Ltd.

1. GLOBAL ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL HATCHBACK ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SEDAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SUV ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

6. GLOBAL BATTERY ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PLUG-IN HYBRID ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FUEL CELL ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

10. GLOBAL NIMH ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LI-ION ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OTHER ELECTRIC CAR BATTERY TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

21. EUROPEAN ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

29. REST OF THE WORLD ELECTRIC CAR MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

1. GLOBAL ELECTRIC CAR MARKET SHARE BY VEHICLE TYPE, 2023 VS 2031 (%)

2. GLOBAL HATCHBACK ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SEDAN ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SUV ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ELECTRIC CAR MARKET SHARE BY PROPULSION TECHNOLOGY, 2023 VS 2031 (%)

6. GLOBAL BATTERY ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PLUG-IN HYBRID ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FUEL CELL ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ELECTRIC CAR MARKET SHARE BY BATTERY TYPE, 2023 VS 2031 (%)

10. GLOBAL NIMH ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LI-ION ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL OTHER ELECTRIC CAR BATTERY TYPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ELECTRIC CAR FOR PRIVATE GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL ELECTRIC CAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

17. UK ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA ELECTRIC CAR MARKET SIZE, 2023-20

24. 31 ($ MILLION)

25. CHINA ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA ELECTRIC CAR MARKET SIZE, 2023-2031 ($ MILLION)