Electric Commercial Truck Market

Electric Commercial Truck Market Size, Share & Trends Analysis Report by Propulsion Technology (Plug-In Hybrid, Fuel Cell Electric and Battery Electric), by Battery Type (Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA) and Others) and by Application (Logistics, Municipal, Construction, Mining and Others) Forecast Period (2024-2031)

Electric commercial truck market is anticipated to grow at a significant CAGR of 22.3% during the forecast period (2024-2031). The market growth is attributed to the enhancements in battery technology, energy density, and charging capacity for improved performance in electric truck vehicles. Government initiatives that encourage environmentally friendly transportation, like regulations and subsidies, are driving the adoption of electric trucks globally driving the growth of the market. According to the International Energy Agency, in 2024, 60,000 medium- and heavy-duty trucks were sold globally in 2022 representing about 1.2% of truck sales globally. An estimated 52,000 electric medium- and heavy-duty trucks were sold in China. Sales of electric trucks increased 35.0% in 2023 compared to 2022.

Market Dynamics

Increasing Adoption of Advanced Technology in Electric Commercial Truck

The adoption of advanced technology such as telematics and connectivity, autonomous driving technology, and battery technology in electric commercial trucks. Higher energy density and longer ranges for electric trucks on a single charge are made possible by advances in lithium-ion battery technology. Advancement in electric vehicle trucks by research and development initiatives that are concentrated on improving battery longevity, charging effectiveness, and shortening charging times is increasing. The development of electric drivetrains and powertrain systems tailored for heavy-duty applications is another area of innovation. Electric vehicle trucks are outfitted with powerful electric motors that can transport bulky objects over extended distances. Regenerative braking systems also aid in energy recovery during deceleration, that raises the efficiency of electric trucks even more.

Integration of Autonomous Driving

There is a growing global demand for electric trucks owing to various factors such as reducing greenhouse gas emissions and the increased emphasis on sustainability becoming a priority. Stringent emission regulations are being implemented by governments and regulatory agencies, which are encouraging the use of electric trucks and other zero-emission vehicles. Furthermore, companies and customers are choosing environmentally friendly transportation options as a result of growing awareness of their carbon footprint. For instance, in April 2023, the US government announced the goal of having 50.0 of all new vehicle sales be electric by 2030. We Realize Inc. is committing to add over 200,000 electric semi-truck Level 2 and DC Fast charging stations to its nationwide network by 2030.

Market Segmentation

Our in-depth analysis of the global electric commercial truck market includes the following segments propulsion technology, battery type and application.

- Based on the propulsion technology, the market is segmented into plug-in hybrid, fuel cell electric and battery electric.

- Based on the battery type, the market is segmented into lithium iron phosphate (LFP), nickel manganese cobalt (NMC), lithium nickel cobalt aluminum oxide (NCA) and others (solid-state batteries).

- Based on the application, the market is segmented into logistics, municipal, construction, mining and others (field services).

Battery Electric Commercial Truck is Projected to Hold the Largest Segment

The battery-electric commercial truck segment is expected to hold the largest share of the market. The primary factors supporting the growth include advancements in battery technology have led to better user economics, longer range, faster charging times, and increased safety. Batteries are an effective power source for electric vehicles and offer several benefits over traditional methods. These batteries are used to power electric commercial trucks, which, especially in places where a significant amount of energy is derived from renewable sources, contribute to the reduction of emissions and air pollution. Market players assist their clients in moving their heavy-duty truck and last-mile van fleets to zero-emission modes of transportation. Without incurring any upfront expenditures, market players integrate energy supply with fleet management software, installation, operations, and charging infrastructure. For instance, in November 2022, Prologis, Inc., in logistics real estate, introduced two significant electric truck-charging installations as part of its Prologis Mobility platform. The two charging sites enable Performance Team, a national logistics company, to simultaneously charge up to 38 of its Volvo VNR electric class 8 battery-electric trucks.

Logistics Segment to Hold a Considerable Market Share

The logistics segment is expected to hold a considerable share of the market. In terms of urban logistics, one of the biggest innovations is the electric truck. One or more electric motors power these freight trucks, reducing their carbon footprint. Electric trucks are more common in the transportation sector as a way to increase delivery efficiency. The development of batteries and the introduction of new motor technology may promote the use of electric vehicles in urban logistics for the delivery of orders to residential addresses or physical points of sale. For instance, in March 2023, Volvo Trucks received an order for 100 electric trucks from logistics company DFDS. With this latest order, DFDS has almost doubled its Volvo electric truck fleet to 225 trucks in total – the largest company fleet of heavy electric trucks in Europe.

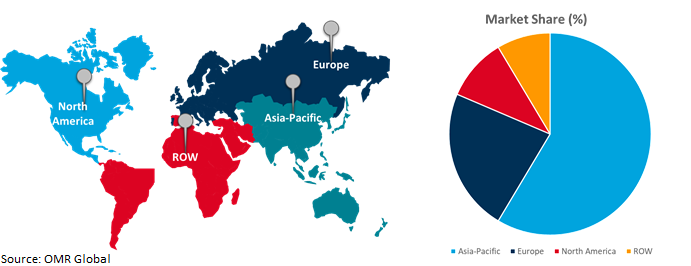

Regional Outlook

Global electric commercial truck market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of Sustainable Transportation in Europe

- The regional growth is attributed to raising public awareness of truck emissions, decreasing operating and maintenance expenses, and intensifying government initiatives to encourage the adoption of electric vehicles. According to the International Council on Clean Transportation, in August 2023, about 260,000 heavy trucks were sold in 2022. Of those, just over 700 were electric. This is a substantial growth compared to 2021 when less than 300 e-trucks were registered in the EU. Germany, Sweden, and the Netherlands were responsible for the lion’s share of the e-truck sales in 2022, collectively accounting for about 65.0%.

- According to the International Energy Agency, in 2023, cumulative electric medium- and heavy-duty truck (“truck”) sales to date number in the hundreds in most countries (under 2,000 electric trucks were sold across the entire European Union in 2022). Sales shares generally remain well under 1.0% in medium- and heavy-duty segments, with major shipping logistics companies running demonstrations of electric trucks in regional and long-haul electric operations.

Global Electric Commercial Truck Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to numerous prominent electric commercial truck companies and providers such as BYD Co., Ltd., GAC Group, SAIC Motor Corp., Ltd. and Tata Motor Ltd., Wuling Motors, and Zhejiang Geely Holding Group Co., Ltd. in the region. The growth is mainly attributed to the increasing growth in various industries such as e-commerce, construction, and logistics along with the adoption of electric mobility increasing technological advancements, particularly in areas such as battery technology that improves charging times, efficiency, and range driving the growth of the market in the region. According to the International Energy Agency, in April 2023, China continued to dominate production and sales of electric (and fuel cell) trucks. In 2022, an estimated 52,000 electric medium- and heavy-duty trucks were sold in China. The majority of electric trucks sold in China are box trucks, and 90.0% of electric truck sales were under 4.5 tonnes in gross vehicle weight (GVW), with the majority of these being between 3.5 and 4.5 tonnes.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the electric commercial truck market include AB Volvo, BYD Co., Ltd., Daimler AG, Tata Motors Ltd. and Tesla Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In March 2023, Ford announced construction at BlueOval City mega-campus and is poised to usher in a new era of American innovation and manufacturing. The electric vehicle and battery manufacturing campus in West Tennessee begins production in 2025, and will be home to Ford’s second-generation electric truck, code-named Project T3, and will be capable of producing 500,000 EV trucks a year at full production.

- In March 2022, Maersk to deploy 300 electric trucks in partnership with Einride. The trucks will be delivered between 2023 - 2025 for use by Maersk’s North American warehousing, distribution and transportation business called Performance Team – A Maersk Company. The trucks will be operated using Einride’s digital road freight operating system and charging solutions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the electric commercial truck market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AB Volvo

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BYD Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Daimler AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Tata Motors Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tesla, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Commercial Truck Market by Propulsion Technology

4.1.1. Plug-In Hybrid

4.1.2. Fuel Cell Electric

4.1.3. Battery Electric

4.2. Global Electric Commercial Truck Market by Battery Type

4.2.1. Lithium Iron Phosphate (LFP)

4.2.2. Nickel Manganese Cobalt (NMC)

4.2.3. Lithium Nickel Cobalt Aluminum Oxide (NCA)

4.2.4. Others (Solid-State Batteries)

4.3. Global Electric Commercial Truck Market by Application

4.3.1. Logistics

4.3.2. Municipal

4.3.3. Construction

4.3.4. Mining

4.3.5. Others (Field Services)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. CityFreighter Inc.

6.2. Dongfeng Motor Corp.

6.3. Einride AB

6.4. E-Trucks Europe b.v.b.a.

6.5. Hitachi Ltd.

6.6. Hyliion Inc.

6.7. Lion Electric Co.

6.8. MAN Truck & Bus SE

6.9. Nikola Corp.

6.10. PACCAR Inc.

6.11. Rivian Automotive, LLC

6.12. Sandvik AB

6.13. Scania CV AB

6.14. Tevva Motors Ltd.

6.15. VIA Motors Inc.

6.16. Volkswagen AG

6.17. Volta Commercial Vehicles

6.18. Workhorse Group, Inc.

6.19. ZF Friedrichshafen AG

6.20. Motiv Power Systems, Inc.

6.21. Orange EV

6.22. Bollinger Motors Inc.

6.23. Lightning eMotors

1. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

2. GLOBAL PLUG-IN HYBRID ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FUEL CELL ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BATTERY ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

6. GLOBAL LITHIUM IRON PHOSPHATE (LFP) ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL NICKEL MANGANESE COBALT (NMC) ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OTHER ELECTRIC COMMERCIAL TRUCK BATTERY TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR MUNICIPAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL LI-ION ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL OTHER ELECTRIC COMMERCIAL TRUCK BATTERY TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. EUROPEAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

25. EUROPEAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2023-2031 ($ MILLION)

33. REST OF THE WORLD ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD ELECTRIC COMMERCIAL TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY PROPULSION TECHNOLOGY, 2023 VS 2031 (%)

2. GLOBAL PLUG-IN HYBRID ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FUEL CELL ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BATTERY ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY BATTERY TYPE, 2023 VS 2031 (%)

6. GLOBAL LITHIUM IRON PHOSPHATE (LFP) ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL NICKEL MANGANESE COBALT (NMC) ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL OTHER COMMERCIAL TRUCK BATTERY TYPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR MUNICIPAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL ELECTRIC COMMERCIAL TRUCK FOR OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ELECTRIC COMMERCIAL TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

19. UK ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-20

26. 31 ($ MILLION)

27. CHINA ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA ELECTRIC COMMERCIAL TRUCK MARKET SIZE, 2023-2031 ($ MILLION)