Electric Food Steamers Market

Electric Food Steamers Market Size, Share & Trends Analysis Report by Product (Pressure Electric Food Steamer and Pressure Less Electric Food Steamer), and by Application (Household and Commercial), Forecast Period (2024-2031)

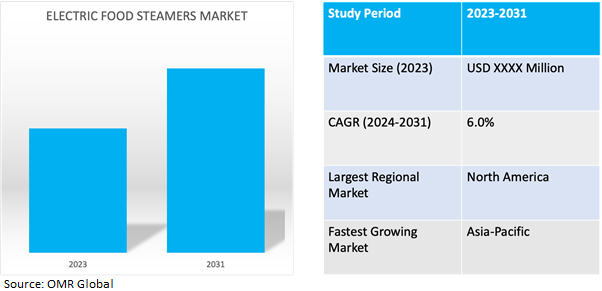

Electric food steamers market is anticipated to grow at a CAGR of 6.0% during the forecast period (2024-2031). Electric food steamers are kitchen appliances designed to cook food by using steam generated from boiling water. These steamers typically consist of multiple stackable trays or compartments where food can be placed for cooking. The appliance is equipped with a heating element that heats the water to produce steam, which then circulates through the compartments to cook the food evenly. A major factor supporting the market growth is the increasing consumer demand for healthier cooking methods and the rising awareness of the benefits of steaming food.

Market Dynamics

Efficiency and Convenience: The Appeal of Electric Food Steamers

Modern lifestyles often leave consumers strapped for time, driving a significant demand for convenient cooking solutions. Electric food steamers address this need by offering hassle-free meal preparation with minimal supervision required. These appliances simplify the cooking process, allowing users to place ingredients in the steamer, set the timer, and attend to other tasks while their food cooks. The convenience offered by electric food steamers resonates with busy individuals seeking efficient ways to prepare healthy and delicious meals without sacrificing precious time.

Transforming Electric Food Steamers for Modern Consumers

Continual advancements in technology have revolutionized the design and functionality of electric food steamers, further fueling their market growth. Manufacturers are incorporating innovative features such as programmable settings, multi-cooking capabilities, and smart connectivity options to enhance user experience and versatility. These technological enhancements not only improve the performance and efficiency of electric food steamers but also cater to the evolving needs and preferences of consumers. As a result, modern electric food steamers offer an array of convenient features that elevate the cooking experience and meet the demands of today's tech-savvy consumers.

Market Segmentation

Our in-depth analysis of the global electric food steamers market includes the following segments by product and application:

- Based on the product, the market is segmented into pressure electric food steamer and pressure less electric food steamer.

- Based on application, the market is segmented into household and commercial.

Pressure Electric Food Steamer is Projected to Emerge as the Largest Segment

The pressure electric food steamer segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing consumer preference for healthier cooking methods. Electric food steamers offer a convenient and efficient way to cook a variety of foods while retaining their nutritional value, flavor, and texture. As awareness of the health benefits of steaming food grows, coupled with a rising trend towards healthier eating habits, the demand for electric food steamers is expected to surge.

Household Segment to Hold a Considerable Market Share

The household segment is expected to hold a significant market share in the global electric food steamers market due to increasing trends toward home cooking and healthier lifestyles. Electric food steamers offer versatility in cooking various foods while retaining their nutritional value, making them appealing to health-conscious consumers. Technological advancements have enhanced the usability of electric food steamers, with features like programmable settings and digital displays, further driving adoption in households. Additionally, the affordability and accessibility of electric food steamers make them a popular choice among consumers of varying income levels.

Regional Outlook

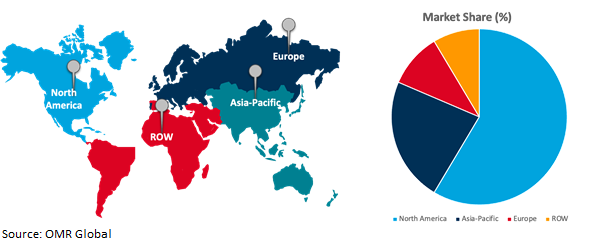

The global electric food steamers market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Leading the Charge in Electric Food Steamers Market Growth

Asia-Pacific leads as the fastest-growing market in the global electric food steamers market due to several key factors. Rapid urbanization and rising disposable incomes in the region drive increased consumer spending on kitchen appliances, including electric food steamers, to meet the needs of busy urban lifestyles. Moreover, Asia-Pacific's diverse culinary traditions and growing emphasis on health and wellness contribute to the demand for versatile and nutritious cooking solutions like electric food steamers. Technological advancements tailored to meet the specific preferences of Asian consumers, coupled with government initiatives promoting energy efficiency and sustainability, further accelerate the adoption of electric food steamers in the region. For instance, in July 2021, Xiaomi expanded its product offering in the Philippines by introducing the Mi Smart Steam Oven. Initially launched in China in 2020 under the name MIJIA Smart Oven, this electric steam oven boasts a capacity of 30 liters and operates at a power output of 1,200 watts. Equipped with advanced features, the oven offers users a diverse array of cooking solutions tailored to their culinary needs.

Global Electric Food Steamers Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its large consumer base and high disposable income, fostering greater adoption of kitchen appliances like electric food steamers. A strong culture of home cooking and health-consciousness in the region further drives demand for appliances that support nutritious meal preparation methods such as steaming. Additionally, North America often leads in technological advancements and product innovations in the electric food steamer market, attracting consumers with cutting-edge offerings. Well-established retail channels and e-commerce platforms facilitate easy access to a wide range of electric food steamers, contributing to market growth. For instance, in March 2023, Nutribullet® Baby unveiled its latest innovation in the form of the nutribullet® Baby Steam + Blend, a cutting-edge baby food maker engineered to streamline the preparation of fresh, homemade baby food. This innovative product amalgamates the functionalities of a cooking pot, steaming basket, and blender into a singular, compact system. By seamlessly integrating the capabilities to steam, blend, cook, purée, and defrost ingredients, this device offers users a comprehensive solution for crafting nutritious meals for their infants.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global electric food steamers market include G.S. BLODGETT, ITW Food Equipment Group LLC, Unified Brands, Rational AG, and The Middleby Corporation, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in May 2020, Xiaomi introduced the OCooker Multipurpose Electric Cooker to the Chinese market, offering consumers a versatile cooking solution. This innovative electric cooker is designed to accommodate various cooking tasks with its 400ml capacity and inner cooking surface crafted from durable 304 stainless steel. The use of high-quality materials ensures both durability and safety in food preparation.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric food steamers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. G.S. BLODGETT

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ITW Food Equipment Group LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Unified Brands Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Food Steamers Market by Product

4.1.1. Pressure Electric Food Steamer

4.1.2. Pressureless Electric Food Steamer

4.2. Global Electric Food Steamers Market by Application

4.2.1. Household

4.2.2. Commercial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AccuTemp Products, Inc.

6.2. A. J. Antunes and Co.

6.3. Chigo

6.4. Cleveland Range

6.5. Crown Verity

6.6. EmberGlo

6.7. Falcon Foodservice Equipment

6.8. Giorik SpA

6.9. Global Kitchen Equipment Company

6.10. Hackman

6.11. HOBART GmbH

6.12. Nemco Food Equipment

6.13. Rational AG

6.14. SALVIS AG

6.15. Southbend

6.16. The Middleby Corporation

6.17. Vulcan

1. GLOBAL ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL PRESSURE ELECTRIC FOOD STEAMER ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PRESSURELESS ELECTRIC FOOD STEAMER ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL ELECTRIC FOOD STEAMERS FOR HOUSEHOLD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ELECTRIC FOOD STEAMERS FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. NORTH AMERICAN ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

9. NORTH AMERICAN ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

10. NORTH AMERICAN ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. EUROPEAN ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. EUROPEAN ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

13. EUROPEAN ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. ASIA-PACIFIC ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. REST OF THE WORLD ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. REST OF THE WORLD ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. REST OF THE WORLD ELECTRIC FOOD STEAMERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ELECTRIC FOOD STEAMERS MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL PRESSURE ELECTRIC FOOD STEAMER ELECTRIC FOOD STEAMERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PRESSURELESS ELECTRIC FOOD STEAMER ELECTRIC FOOD STEAMERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ELECTRIC FOOD STEAMERS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL ELECTRIC FOOD STEAMERS FOR HOUSEHOLD MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ELECTRIC FOOD STEAMERS FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ELECTRIC FOOD STEAMERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. US ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

9. CANADA ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

10. UK ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

11. FRANCE ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

12. GERMANY ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

13. ITALY ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

14. SPAIN ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

15. REST OF EUROPE ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

16. INDIA ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

17. CHINA ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

18. JAPAN ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

19. SOUTH KOREA ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF ASIA-PACIFIC ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

21. LATIN AMERICA ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)

22. MIDDLE EAST AND AFRICA ELECTRIC FOOD STEAMERS MARKET SIZE, 2023-2031 ($ MILLION)