Electric Motor Market

Electric Motor Market Size, Share & Trends Analysis Report by Type (Alternate Current (AC) and Direct Current (DC)), by Rotor Type (Inner Rotor and Outer Rotor), by Power Output (Fractional Horsepower (Up to 1HP) and Integral Horsepower (Above 1HP)), and by End-Users (Industrial, Commercial, Residential, Transportation, and Agriculture) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Electric motor market is anticipated to grow at a CAGR of 6.5% during the forecast period. The rising environmental regulations and automobile CO2 emission regulations increase the demand for electric automotive motors and related products to control CO2 emissions across the globe. Furthermore, the key players are establishing new factories to expand the production of electric motors to cater to the demand. For instance, in November 2022, Nidec Corp. announced their plans to invest around $715 million in establishing an electric motor plant in Mexico. Moreover, earlier in April 2021, Nidec Corp. also held an event to announce their decision to open new factories in the city of Novi Sad in the Republic of Serbia. The company established a new business office in Novi Sad to start preparations to start up the factories on a full scale.

Additionally, back in April 2019, Nidec Corp. invested around $500 million in developing a new factory in China. The factory primarily manufactures electric-vehicle (EV) motors, which in turn is anticipated to bolster the growth of the market across the globe.

Segmental Outlook

The global electric motor market is segmented based on the type, rotor type, power output, and end-users. Based on the type, the market is bifurcated into AC and DC. Based on the rotor type, the market is divided into the inner rotor and outer rotor. Based on the power output, the market is further sub-segmented into fractional horsepower (up to 1HP), and integral horsepower (above 1HP). Based on the end-users, the market is augmented into industrial, commercial, residential, transportation, and agriculture. Among these, the AC sub-segment is expected to hold a considerable share of the market due to the increasing adoption of AC motors for several industrial applications such as irrigation pumps, and others.

Among end-users, the transportation sub-segment is expected to hold a prominent share in the electric motor market over the forecast period. The growing awareness regarding the use of EVs has increased the demand for electric motors from the automotive industry and transportation sector. Thus, the key market players are also inclined towards launching electric motors for the automotive industry to fulfill the demand of the industry. For instance, in October 2021, Nidec Corp. launched Ni200Ex, a 200kW, E-Axle traction motor system for an EV. This new EV was newly released by Chinese auto giant Geely Automobile Group, under its premium brand, “Zeek.” Nidec’s E-Axle is installed in ZEEKR 001. Ni200Ex is a compact unit that adopts a light, thin, short, and small motor structure that is based on the magnetic circuit design.

Regional Outlooks

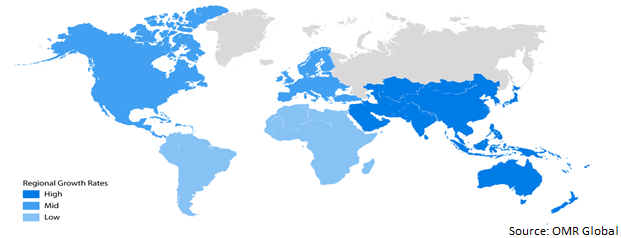

The global electric motor market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Europe is expected to hold a considerable share of the electric motor market during the forecast period, owing to the increasing adoption and demand for EVs in the region.

Global Electric Motor Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold a Significant Share in the Global Electric Motor Market

Among all regions, the Asia-Pacific region is expected to hold a significant market share during the forecast period owing to rapid industrialization in countries such as China, India, and Japan among other countries. The presence of electric motor market players such as Wolong, Nidec Corp., and others is further accelerating the growth of the electric motor market. These market players of the region are continuously adopting an acquisition strategy to strengthen their position and stay competitive in the market. For instance, in December 2019, Nidec Corp. acquired Roboteq Inc., a US-based designer of ultra-low voltage (ULV) drives. Through this acquisition, the company aims to strengthen its presence in some key future growth drivers, including robotization, and to expand its ability to provide package solutions.

Market Players Outlook

The major companies serving the global electric motor market include ABB Group, ARC Systems, Inc., Asmo Co., Ltd., DENSO Corp., Emerson Electric Co., GE Group, Hitachi, Ltd., Johnson Electric Holdings Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2022, Nidec Corp. launched E-Axle Gen.2, a second-generation E-Axle electric motor for EVs. The motor is 19% lighter and embedded with smaller magnetic circuits and inverters which provides 20% better power density. The motor also has magnet cooling for heat resistance.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric motor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Motor Market by Current Type

4.1.1. Alternate Current (AC)

4.1.2. Direct Current (DC)

4.2. Global Electric Motor Market by Rotor Type

4.2.1. Inner Rotor

4.2.2. Outer Rotor

4.3. Global Electric Motor Market by Power Output

4.3.1. Fractional Horsepower (Up to 1HP)

4.3.2. Integral Horsepower (Above 1HP)

4.4. Global Electric Motor Market by End-User

4.4.1. Industrial

4.4.2. Commercial

4.4.3. Residential

4.4.4. Transportation

4.4.5. Agriculture

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABB Group

6.2. ARC Systems, Inc.

6.3. Asmo Co., Ltd.

6.4. DENSO Corp.

6.5. Emerson Electric Co.

6.6. GE Group

6.7. Hitachi, Ltd.

6.8. Johnson Electric Holdings Ltd.

6.9. Maxon Group

6.10. Nidec Motor Corp.

6.11. Regal Rexnord Corp.

6.12. Robert Bosch GmbH

6.13. Rockwell Automation, Inc.

6.14. Siemens AG

6.15. TECO-Westinghouse

6.16. Toshiba Corp.

6.17. WEG Group

6.18. Wolong Electric Group

1. GLOBAL ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY CURRENT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ELECTRIC AC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ELECTRIC DC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY ROTOR TYPE, 2021-2028 ($ MILLION)

5. GLOBAL INNER ROTOR ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL OUTER ROTOR ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2021-2028 ($ MILLION)

8. GLOBAL FRACTIONAL HORSEPOWER (UP TO 1HP) ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL INTEGRAL HORSEPOWER (ABOVE 1HP) ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION

10. GLOBAL ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

11. GLOBAL ELECTRIC MOTOR FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL ELECTRIC MOTOR FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL ELECTRIC MOTOR FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL ELECTRIC MOTOR FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL ELECTRIC MOTOR FOR AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. NORTH AMERICAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY CURRENT TYPE, 2021-2028 ($ MILLION)

19. NORTH AMERICAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY ROTOR TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2021-2028 ($ MILLION)

21. NORTH AMERICAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

22. EUROPEAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. EUROPEAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY CURRENT TYPE, 2021-2028 ($ MILLION)

24. EUROPEAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY ROTOR TYPE, 2021-2028 ($ MILLION)

25. EUROPEAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2021-2028 ($ MILLION)

26. EUROPEAN ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY CURRENT TYPE, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY ROTOR TYPE, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

32. REST OF THE WORLD ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

33. REST OF THE WORLD ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY CURRENT TYPE, 2021-2028 ($ MILLION)

34. REST OF THE WORLD ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY ROTOR TYPE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2021-2028 ($ MILLION)

36. REST OF THE WORLD ELECTRIC MOTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL ELECTRIC MOTOR MARKET SHARE BY CURRENT TYPE, 2021 VS 2028 (%)

2. GLOBAL ELECTRIC AC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ELECTRIC DC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL ELECTRIC MOTOR MARKET SHARE BY ROTOR TYPE, 2021 VS 2028 (%)

5. GLOBAL INNER ROTOR ELECTRIC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL OUTER ROTOR ELECTRIC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL ELECTRIC MOTOR MARKET SHARE BY POWER OUTPUT, 2021 VS 2028 (%)

8. GLOBAL FRACTIONAL HORSEPOWER (UP TO 1HP) ELECTRIC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL INTEGRAL HORSEPOWER (ABOVE 1HP) ELECTRIC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL ELECTRIC MOTOR MARKET SHARE BY END-USER, 2021 VS 2028 (%)

11. GLOBAL ELECTRIC MOTOR FOR INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL ELECTRIC MOTOR FOR COMMERCIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL ELECTRIC MOTOR FOR RESIDENTIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL ELECTRIC MOTOR FOR TRANSPORTATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL AGRICULTURE ELECTRIC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL ELECTRIC MOTOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. US ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

19. UK ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD ELECTRIC MOTOR MARKET SIZE, 2021-2028 ($ MILLION)