Electric Scooter Lift and Carrier Market

Electric Scooter Lift and Carrier Market Size, Share & Trends Analysis Report by Type (Interior Lift and Exterior Lift), and by Application (Personal Mobility, Healthcare Institutions, Old Age Homes, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Electric scooter lift and carrier market is anticipated to grow at a considerable CAGR of 4.1% during the forecast period. The increasing demand for mobility electric scooters coupled with available innovative options that allow for the ease of carrying these vehicles over long distances are primary factors that are expected to significantly impact the revenue growth of the global electric scooter lift and carrier market in the years to come. The development of various innovations, technological advancements, and expansion by key industry players which include, Superpedestrian, EZ Carrier, and Ford Smart Mobility, to improve the functionality of these devices, are factors that are positively impacting the future revenue growth of this global market. For instance, in February 2022, Superpedestrian announced a major expansion, as it brought in $125 million of new investment in San Diego and Chicago, and unveiled an improved safety system such as GPS with onboard sensors measuring variables such as speed and direction, AI software that combined data to calculate a scooter’s precise position, down to inches, so it can prevent riders from driving on a sidewalk or going the wrong way on a one-way street, to prevent riders from misbehaving.

Segmental Outlook

The global electric scooter lift and carrier market is segmented based on type, and application. Based on type the market is subdivided into the interior lift, and exterior lift. Based on application, the market is sub-segmented into personal mobility, healthcare institutions, old age homes, and others. The interior lift segment is expected to grow at a favourable rate during the forecast period. The growth is mainly attributed owing to features offered by interior lift electric scooters such as power boom rotation and power telescoping boom and easy folds for storage to various end-user industries such as healthcare, automotive, and individual use.

Based on application, the healthcare segment is expected to register a significant CAGR during the forecast period. The growth is mainly attributed owing to the increasing number of physically impaired people, that required carrying scooters to move from one place to other, and rising government and regulatory bodies' initiative, funding, and program designed to make electric scooters affordable to patients, and healthcare staff is expected to drive the segment growth. For instance, in April 2020, NIU along with its sharing partners which include Revel, Ewe-Go, GoVolt, and others unveiled the MoveSafely program to provide healthcare workers NIU’s electric mopeds with its safe access to their places of work. As part of the program, healthcare workers get free rentals of NIU’s electric mopeds, which can reach speeds of up to 30 mph (51 km/h), and are particularly useful for navigating urban areas.

Regional Outlooks

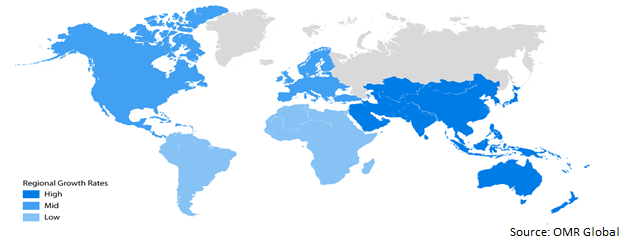

The global electric scooter lift and carrier market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement.Among these, the North American regional market is expected to grow with the significant growth rate during forecast period, owing to presence of prominent manufacturers that are producing products according to the government regulations. Whereas, Asia-Pacific is expected to grow at a higher rate, due to growing demand for electric two-wheelers in the region complemented by government subsidies.

Global Electric Scooter Lift and Carrier Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold a Prominent Share of the Global Electric Scooter Lift and Carrier Market

Among all regions, the regional growth is majorly attributed owing to an increasing awareness regarding the convenience offered by electric scooters, wheelchairs, and mobility scooters coupled with the government’s initiative to manufacture electric scooters affordable. Thus, such factors are anticipated to increase the adoption of e-scooters, which in turn will bolster the market growth. For instance, in June 2021, in India, Hero reduced prices of its electric scooters in the range of 12% to 33%, owing to the increased incentive by the government through the Faster Adoption and Manufacturing of Hybrid and Electric (FAME) vehicle scheme.

Market Players Outlook

The major companies serving the global electric scooter lift and carrier market include Ford Motor Co., Golite, Harmar, Hibor, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2022, Trenton in partnership with Bird launched e-scooters as a new eco-friendly mode of public transportation. With this partnership, both companies designed e-scooters to be used for various daily trips. The company mainly focuses on reducing car trips, traffic, and carbon emissions.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric scooter lift and carrier market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Development

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Scooter Lift and Carrier Market by Types

4.1.1. Interior Lift

4.1.1.1. Platform Lift

4.1.1.2. Crane Style Lift

4.1.2. Exterior Lift

4.1.2.1. Outside & Hitch Mount Lift

4.1.2.2. Wheeled Lift

4.2. Global Electric Scooter Lift and Carrier Market by Application

4.2.1. Personal Mobility

4.2.2. Healthcare Institutions

4.2.3. Old Age Homes

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. All Terrain Medical & Mobility

6.2. Bruno Independent Living Aids, Inc.

6.3. Ez Carrier Usa.

6.4. Ford Motor Co.

6.5. Golite

6.6. Harmar

6.7. Hiboy

6.8. Magneta Trailers

6.9. Pride Mobility Products Corp.

6.10. The Creative Mobility Group, Inc.

6.11. Travel Buggy

6.12. Wheelchair Carrier.

1. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL INTERIOR LIFT ELECTRIC SCOOTER CARRIER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL EXTERIOR LIFT ELECTRIC SCOOTER CARRIER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR PERSONAL MOBILITY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR HEALTHCARE INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR OLD AGE HOMES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. NORTH AMERICAN ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. EUROPEAN ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. EUROPEAN ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD ELECTRIC SCOOTER LIFT AND CARRIER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL INTERIOR LIFT ELECTRIC SCOOTER MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL EXTERIOR LIFT ELECTRIC SCOOTER MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

5. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR PERSONAL MOBILITY MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR HEALTHCARE INSTITUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR OLD AGE HOMES MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER FOR OTHERS APPLICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL ELECTRIC SCOOTER LIFT AND CARRIER MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. US ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

12. UK ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD ELECTRIC SCOOTER LIFT AND CARRIER MARKET SIZE, 2021-2028 ($ MILLION)