Electric Scooters Market

Electric Scooters Market Size, Share & Trends Analysis Report by Battery (Lithium-ion Battery and Lead-acid Battery), by Drive Type (Belt Drive, Chain Drive and Hub Motors), by Product (Standard, Folding, Self-Balancing, Maxi and Three wheeled), and by End-Use (Personal and Commercial) Forecast Period (2024-2031) Update Available - Forecast 2025-2031

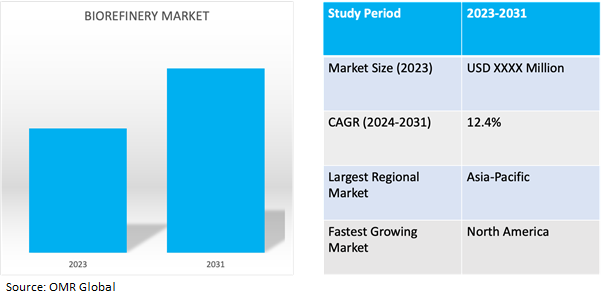

Electric Scooters market is anticipated to grow at a CAGR of 12.4% during the forecast period (2024-2031). The electric scooters market comprises the production and distribution of electrically powered scooters for personal transportation. These scooters, equipped with electric motors and batteries, offer a sustainable alternative to traditional gasoline-powered models. Rising environmental awareness, government incentives, and battery technology advancements drive market growth, catering to diverse commuting and urban mobility needs.

Market Dynamics

Navigating the dynamics of rising fuel prices and rising demand for electric scooter adoption

A combination of global supply and demand dynamics, economic factors, taxes and duties, environmental policies, energy market trends, and geopolitical events drives rising fuel prices. Fluctuations in oil production, economic growth, taxation policies, and environmental regulations all contribute to the increasing cost of traditional fossil fuels like gasoline and diesel. These rising prices affect consumers, businesses, and economies by impacting transportation costs, inflation, and household budgets. As fuel becomes more expensive, consumers may turn to alternative transportation options such as electric scooters, which offer lower operating costs and reduced environmental impact, potentially fueling the growth of the electric scooter market.

Navigating the shift: understanding changing consumer preferences towards electric scooters

Shifting consumer preferences towards electric scooters reflects a growing concern for environmental sustainability, driven by rising urbanization and congestion. With escalating fuel costs, individuals seek cost-effective transportation options, finding appeal in electric scooters' lower operating expenses and maintenance requirements. Technological advancements, including improved battery efficiency and connectivity features, enhance user experience and convenience. Social influences and regulatory support further bolster this trend, as electric scooters become synonymous with urban mobility and modern lifestyles. Brands emphasizing sustainability and innovation attract consumers seeking alignment with their values. Understanding these evolving preferences is crucial for manufacturers, guiding product development and marketing strategies to meet the demands of environmentally conscious, tech-savvy consumers.

Market Segmentation

Our in-depth analysis of the global Electric Scooters market includes the following segments by battery, by drive type, by product, and by end-use:

- Based on battery, the market is sub-segmented into lithium-ion battery and lead-acid battery.

- Based on drive type, the market is sub-segmented into belt drive, chain drive and hub motors.

- Based on product, the market is sub-segmented into standard, folding, self-balancing, maxi and three wheeled.

- Based on end-use, the market is sub-segmented into personal use and commercial use.

Hub Motors Sub-segment is Projected to Emerge as the Largest Segment

Based on drive, the global electric scooters market is sub-segmented into belt drive, chain drive and hub motors. Among these, the Hub Motors sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include efficient power transmission, quitter operations and low repair & maintenance over the other counterparts in the market.

Personal Use Sub-segment to Hold a Considerable Market Share

Electric scooters are classified into personal and commercial use segments according to their intended purposes, with the personal use segment holding the majority of the market share. They are gaining popularity due to being eco-friendly, affordable, lightweight, low maintenance, and easily manoeuvrable, particularly among millennials and low to middle-income groups. Manufacturers are increasingly incorporating connected vehicle technology to enhance the riding experience. Moreover, efforts to develop private charging stations or designated charging spots are anticipated to further drive the adoption of electric scooters among consumers.

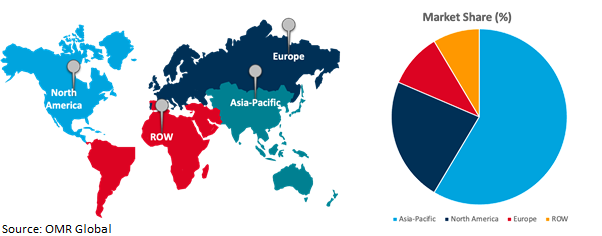

Regional Outlook

The global Electric Scooters market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in electric scooters market

- The US is the key investor and user in electric scooters based products around the globe.

- Canada is gradually transitioning from oil-powered scooters to electric scooters due to environmental concerns, government incentives, technological advancements, and urban mobility initiatives.

Global Electric Scooters Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of rising demand for electric scooters. Asia Pacific dominates the electric scooter market due to several factors such as the region has large population, particularly in densely populated urban areas, where electric scooters offer a convenient and eco-friendly mode of transportation. The rapid urbanization and growing middle-class population in countries like China and India have increased the demand for affordable and efficient personal mobility solutions. Additionally, government initiatives promoting clean energy and sustainable transportation further drive the adoption of electric scooters. Furthermore, the presence of key manufacturers and technological advancements in electric scooter production in Asia Pacific contribute to its significant market share in the global electric scooter market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Electric Scooters market include BMW Motorrad International, Suzuki Motor Co., Yamaha Motor Co. Ltd., Honda Motor Co. Ltd., Okinawa Autotech Internationall Pvt. Ltd., Piaggio Group and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2024, Yamaha Motor Co., Ltd. invests in Indian startup River, known for its electric scooter production, aiming to expand in India's growing EV market, aligning with the company's goal of reducing emissions by 90% by 2050 as per its Environmental Plan 2050.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Electric Scooters market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BMW Motorrad International

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Suzuki Motor Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Yamaha Motor Co. Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electric Scooters Market by Battery

4.1.1. Lithium-ion

4.1.2. Lead-acid

4.2. Global Electric Scooters Market by Drive Type

4.2.1. Belt Drive

4.2.2. Chain Drive

4.2.3. Hub Motors

4.3. Global Electric Scooters Market by Product

4.3.1. Standard

4.3.2. Folding

4.3.3. Self-Balancing

4.3.4. Maxi

4.3.5. Three wheeled

4.4. Global Electric Scooters Market by End-Use

4.4.1. Personal

4.4.2. Commercial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AllCell Technologies LLC

6.2. Amper Vehicles

6.3. BOXX Corp.

6.4. Brammo, Inc.,

6.5. eccity motorcycles

6.6. GenZe by Mahindra

6.7. Gogoro Inc.

6.8. Govecs Group

6.9. Green Energy Motors Corp.

6.10. Greenwit Technologies Inc.

6.11. Hero Electric

6.12. Honda Motor Co. Ltd

6.13. Jiangsu Xinri E-Vehicle Co. Ltd.,

6.14. KTM AG

6.15. Peugeot Motocycles

6.16. Lime

6.17. GenZe

6.18. Ninebot Ltd.

6.19. Niu Technologies

6.20. Okinawa Autotech Internationall Pvt. Ltd.

6.21. Piaggio Group

6.22. Silence Urban Ecomobility

6.23. Spin

6.24. Terra Motors Co.

6.25. TVS Motor Company

6.26. Vmoto Ltd.

6.27. Xiaomi

6.28. Yadea Technology Group Co. Ltd

6.29. Zhejiang Luyuan Electric Vehicle Co Ltd

1. GLOBAL ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY BATTERY, 2023-2031 ($ MILLION)

2. GLOBAL LITHIUM-ION BATTERY ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LEAD-ACID BATTERY ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2023-2031 ($ MILLION)

5. GLOBAL BELT DRIVE ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CHAIN DRIVE ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HUB MOTORS ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

9. GLOBAL STANDARD ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FOLDING ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SELF-BALANCING ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MAXI ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL THREE WHEELED ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

15. GLOBAL ELECTRIC SCOOTERS FOR PERSONAL USE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ELECTRIC SCOOTERS FOR COMMERCIAL USE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY BATTERY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. NORTH AMERICAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

23. EUROPEAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY BATTERY, 2023-2031 ($ MILLION)

25. EUROPEAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

27. EUROPEAN ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY BATTERY, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY BATTERY, 2023-2031 ($ MILLION)

35. REST OF THE WORLD ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2023-2031 ($ MILLION)

36. REST OF THE WORLD ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

37. REST OF THE WORLD ELECTRIC SCOOTERS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL ELECTRIC SCOOTERS MARKET SHARE BY BATTERY, 2023 VS 2031 (%)

2. GLOBAL LITHIUM-ION BATTERY ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LEAD-ACID BATTERY ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ELECTRIC SCOOTERS MARKET SHARE BY DRIVE TYPE, 2023 VS 2031 (%)

5. GLOBAL BELT DRIVE ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CHAIN DRIVE ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL HUB MOTORS ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ELECTRIC SCOOTERS MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

9. GLOBAL STANDARD ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FOLDING ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SELF-BALANCING ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MAXI ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL THREE WHEELED ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ELECTRIC SCOOTERS MARKET SHARE BY END-USE, 2023 VS 2031 (%)

15. GLOBAL ELECTRIC SCOOTERS FOR PERSONAL USE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ELECTRIC SCOOTERS FOR COMMERCIAL USE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL ELECTRIC SCOOTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

20. UK ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA ELECTRIC SCOOTERS MARKET SIZE, 2023-2031 ($ MILLION)