Electric Ships Market

Global Electric Ships Market Size, Share & Trends Analysis Report by Type (Fully Electric and Hybrid), by Mode of Operations (Manned and Autonomous), by Vessel Type (Commercial and Defense), by Range (<50 KM, 50 -100 KM, 101 – 1000 KM, > 1000 KM), and by End Use (Linefit and Retrofit) Forecast Period (2021-2027) Update Available - Forecast 2025-2031

The global electric ships market is anticipated to grow at a significant CAGR of around 11% during the forecast period. The market growth is attributed to the growing focus towards limiting the sulphur emission generated by the heavy powertrain system in ships vehicles due to use of fuel oils for powering the ship. The shipowners are focusing towards automation and integration of newbuild ships and retrofit the existing ships with hybrid and electric propulsion, which in turn accelerating the demand for for electric propulsion and battery storage systems. The standard government regulation for eliminating the sulphar emission by adopting mendatory measures has augumented the adoption of electric ships in shipping sectors. For inatnce, IMO 2020 rule limits the sulphur in the fuel oil used on board ships operating outside designated emission control areas to 0.50% m/m (mass by mass) a significant reduction from the previous limit of 3.5%. Furthermore, electric ships offer tremendiouse advantages such as low-costoperation, easy-to-maintain, high cargo capacity due to small powertrain system makes them best replacement for traditional fuel-based ships.

Besides, advanced battery technologies are driving the market growth as the batteries are being constantly upgraded and updated. The companies are more emphasizing towards the integration of electric power sources and development of energy storage devices. For instance, in October 2020, Kawasaki Heavy Industries received their first order for the supply of large capacity system of battery propulsion that is designed for coastal ships integration. The new battery propulsion system includes Lithium – ion marine batteries. Vessels operating completely through batteries reduces the emissions of NOx, CO2 and SOx during the operation. Apart from these factors, the limited range in sigle charge offered by the electric ships restrains their growth.

Impact of COVID-19 Pandemic on Global Electric Ships Market

The COVID-19 pandemic had disrupted the manufacturing operations of various industries across the globe, which had significantly affected the shipping industry as well. The industry relies heavily on the other industries such as spare part manufacturing and others, that was on halt during the the COVID-19 pandemic. Multiple challenges were faced by shipping industry, such as travel restrictions, limited research and development operations due to inadequate funds, global trade limitations and so on. Due to increased cost shipping owing to less demand and unavailability of vessels has further disrupted the shipping industry leading declination in revenue generation. As the COVID-19 situation normalizes, the electric ships market started overcoming the challenges as industrial operations commenced and various economies are now focusing on strenghtening and maintaining supply chain management.

Segmental Outlook

The global electric ships market is segmented based on the type, mode of operations, vessel type, range and end use. Based on the type, the market is sub-segmented into fully electric and hybrid. Based on the mode of operations, the market is sub-segmented into the manned and autonomous. Based on the vessel type, the market is sub-segmented into commercial and defense. Based on the range, the market is sub-segmented into < 50 km, 50-100 km, 101–1000 km and > 1000 km. Based on the end use, the market is sub-segmented into linefit and retrofit. The above mentioned segments can be customized as per the requirements.

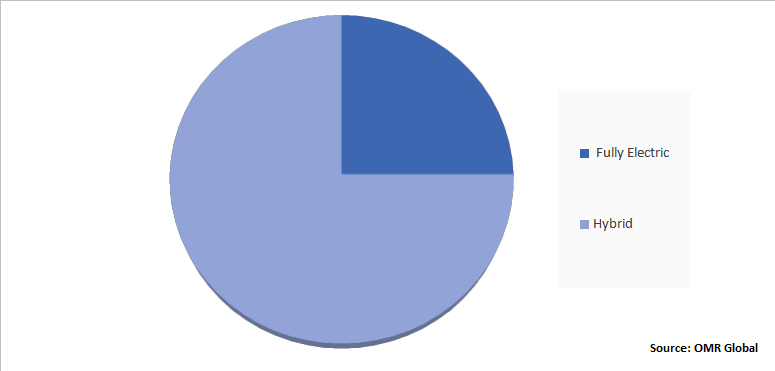

Global Electric Ships Market Share by Type, 2021 (%)

The Hybrid Segment Holds the Major Share in the Global Electric Ships Market

On the basis of type, hybrid segment is likely to hold the prominent market share in the global electric ships market. Hybrid electric ships can reduce CO2 emissions by 15% and fuel consumption by approximately 20%. Environment sustainability and reduced risk of operational failure will lead the growth of this segment in the market. Moreover, market players are focusing on developing hybrid electric ships and energy storage devices along with integrated electric power sources. For instance, in November 2019, Corvus Energy entered into an agreement with Norwegian Electric Systems (NES) to deliver for the largest marine battery package for installation of hybrid powered vessel. The system is adopted by using hydrogen fuel cells.

Regional Outlooks

The global electric ships market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

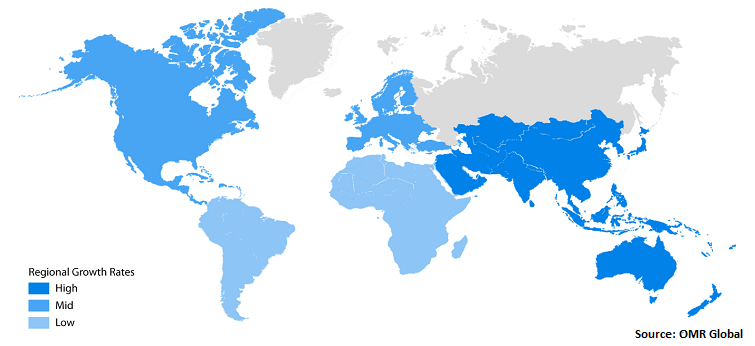

Global Electric Ships Market Growth, by Region 2021-2027

The Europe Region is Estimated to be the Fastest Growing in the Global Electric Ships Market

Based on the region, it is anticipated that the Europe region will be the fastest growingin the market. The rise in demand of fully electric vessels and significant developments in autonomous fully electric vehicles will propel the market growth in region. The trend towards the replacement of conventional passenger and cargo ship vehiicles with fully electric ship vehicles is contributing in the market growth in the region. The presence of major players and high demand for electric ships in commercial and defence marintime industry positively impacting the market. For instance, in November 2021, the first autonomous electric ship, named as Yara Bikerland has built by VARD that will come into operations from 2022. This electric ship has been developed in a collaboration, where KONGSBERE is leading the development and delivery. It will be operated from the operation center of a joint venture between Wilhelmsen and KONGSBERE at Hortan, Norway.

Market Players Outlook

The major companies serving the global electric ships market include Damen Shipyards Group, General Dynamics Electric Boat, MAN Energy Solutions Group, Echandia Marine AB, Eco Marine Power, Corvus Energy, VARD, Siemens, AKASOL AG, Norwegian Electric Systems, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In February 2021, Garden Reach Shipbuilders & Engineers Ltd. and GE Power Conversion has signed a MoU i.e. memorandum of understanding, to leverage ship bulding expertise of Garden Reach Shipbuilders & Engineers Ltd. and advanced technology expertise of GE Power Conversion that brings synergy to develop integrated hybrid and fully electric propulsion systems for upcoming projects.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global electric ships market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Electric Ships Market

• Recovery Scenario of Global Electric Ships Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. ABBLtd.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Damen Shipyards Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Dynamics Electric Boat

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Kongsberg Gruppen

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Norwegian Electric Systems

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Electric Ships Market by Type

4.1.1. Fully Electric

4.1.2. Hybrid

4.2. Global Electric Ships Market by Mode of Operation

4.2.1. Manned

4.2.2. Autonomous

4.3. Global Electric Ships Market by Vessel Type

4.3.1. Commercial

4.3.2. Defense

4.4. Global Electric Ships Market by Range

4.4.1. < 50 KM

4.4.2. 50-100 KM

4.4.3. 101-1000 KM

4.4.4. >1000 KM

4.5. Global Electric Ships Market by End-Use

4.5.1. Linefit

4.5.2. Retrofit

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AKASOL AG

6.2. Corvus Energy

6.3. Echandia Marine AB

6.4. Eco Marine Power

6.5. Fjellstrand AS

6.6. Hollands Shipyards

6.7. Leclanche SA

6.8. Man Energy Solutions Group

6.9. Siemens

6.10. SCHOTTEL Group

6.11. SSC Marine Ltd

6.12. Tuco Marine ApS

6.13. VARD

6.14. Wartsila Corp.

6.15. WELLINGTON ELECTRIC BOAT BUILDING CO.

1. GLOBAL ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL FULLY ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL HYBRID ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2020-2027 ($ MILLION)

5. GLOBAL MANNED ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL AUTONOMOUS ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2020-2027 ($ MILLION)

8. GLOBAL COMMERCIAL ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL DEFENSE ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY RANGE, 2020-2027 ($ MILLION)

11. GLOBAL < 50 KM RANGE ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL 50-100 KM RANGE ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL 101-1000 KM RANGE ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL > 1000 KM RANGE ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

16. GLOBAL LINEFIT ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL RETROFIT ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

19. NORTH AMERICAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. NORTH AMERICAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

21. NORTH AMERICAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2020-2027 ($ MILLION)

22. NORTH AMERICAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2020-2027 ($ MILLION)

23. NORTH AMERICAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY RANGE, 2020-2027 ($ MILLION)

24. NORTH AMERICAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

25. EUROPEAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. EUROPEAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

27. EUROPEAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2020-2027 ($ MILLION)

28. EUROPEAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2020-2027 ($ MILLION)

29. EUROPEAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY RANGE, 2020-2027 ($ MILLION)

30. EUROPEAN ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

32. ASIA-PACIFIC ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

33. ASIA-PACIFIC ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2020-2027 ($ MILLION)

34. ASIA-PACIFIC ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2020-2027 ($ MILLION)

35. ASIA-PACIFIC ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY RANGE, 2020-2027 ($ MILLION)

36. ASIA-PACIFIC ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

37. REST OF THE WORLD ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

38. REST OF THE WORLD ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

39. REST OF THE WORLD ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2020-2027 ($ MILLION)

40. REST OF THE WORLD ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2020-2027 ($ MILLION)

41. REST OF THE WORLD ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY RANGE, 2020-2027 ($ MILLION)

42. REST OF THE WORLD ELECTRIC SHIPS MARKET RESEARCH AND ANALYSIS BY END USE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ELECTRIC SHIPS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ELECTRIC SHIPS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL ELECTRIC SHIPS MARKET, 2021-2027 (%)

4. GLOBAL ELECTRIC SHIPS MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL ELECTRIC SHIPS MARKET SHARE BY MODE OF OPERATION, 2020 VS 2027 (%)

6. GLOBAL ELECTRIC SHIPS MARKET SHARE BY VESSEL TYPE, 2020 VS 2027 (%)

7. GLOBAL ELECTRIC SHIPS MARKET SHARE BY RANGE, 2020 VS 2027 (%)

8. GLOBAL ELECTRIC SHIPS MARKET SHARE BY END-USE, 2020 VS 2027 (%)

9. GLOBAL FULLY ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL HYBRID ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL MANNED ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL AUTONOMOUS ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL COMMERCIAL ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL DEFENSE ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL < 50 KM RANGE ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL 50 – 100 KM RANGE ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL 101 – 1000 KM RANGE ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL > 1000 KM RANGE ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL LINEFIT ELECTRIC SHIPS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

20. GLOBAL RETROFIT ELECTRIC SHIPS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

21. GLOBAL ELECTRIC SHIPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

22. US ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

23. CANADA ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

24. UK ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

25. FRANCE ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

26. GERMANY ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

27. ITALY ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

28. SPAIN ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF EUROPE ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

30. INDIA ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

31. CHINA ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

32. JAPAN ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

33. SOUTH KOREA ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

34. REST OF ASIA-PACIFIC ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)

35. REST OF THE WORLD ELECTRIC SHIPS MARKET SIZE, 2020-2027 ($ MILLION)