Electric Vehicle Supply Equipment Market

Electric Vehicle Supply Equipment Market by Charger Type (Level-1, Level-2, and Level-3), by Vehicle Type (Two-Wheelers, Passenger Cars, and Commercial Vehicles), by Station Type (Stationary Charging Station and Portable Charging Facilities) – Industry Size, Share, Global Trends, Competitive Analysis and Forecast, 2019 to 2025 Update Available - Forecast 2025-2035

The electric vehicle supply equipment market is driven by significant growth in the electric vehicle market globally. Huge market growth will be observed in the upcoming period in the electric vehicle supply equipment market. Most of the government are focusing to change their vehicle fleet from IC engine vehicles to electric vehicles. The major motive for countries and government organizations to shift from IC vehicles to an electric vehicle is rising environmental pollution due to the combustion of fossil fuel and rising prices of crude oil in the international market. However, at present, the major hurdle for this is high charging time of the vehicle and inadequate charging facilities on roads, especially at the remote location. Hence, as the number of electric vehicles will increase in a region, the electric vehicle supply equipment market will also rise in that region.

Some of the drivers of the electric vehicle supply equipment industry are large investment by the automakers in the electric vehicle and their infrastructure technology. Favorable government policies toward electric vehicles due to rising global warming is also expected to be a prominent factor for the adoption of electric vehicles. Under a campaign by International Energy Agency, Electric Vehicle Initiative (EVI) has launched EV30@30 in June 2017. The goal of the campaign is to reach 30% of sales for Electric vehicles by 2030. Lead countries in the initiative are China and Canada. Other member countries are Finland, France, India, Japan, Mexico, Netherland, Norway, and Sweden are also contributing to the market growth.

Some of the restraints to the market is the lack of standardization of charging infrastructure globally. Due to the lack of standardization vehicle manufacturers are using a different kind of charging connectors for their vehicles. The connectors include Port J1772, CHAdeMO, SAE Combo CCS, Tesla HPWC, Nema 515, Nema 520 Nema 1450 (RV plug), and Nema 6-50. The variety of connectors can be problematic and will cost a higher price during the development of a universal charging station for vehicles. The high initial cost of an electric vehicle is also restricting the consumer to prefer electric vehicle over a conventional IC engine however the operational cost is lower in the case of electric vehicles which creates enormous opportunities for the market.

Segmental Outlook

The global electric vehicle supply equipment market is segmented on the basis of charger type, vehicle type, and charging station type. By charger type, the market is segmented into level 1, 2 and 3. Level 1 and Level 2 charger are AC current chargers whereas Level 3 charger is three-phase AC or DC charger. As the charger level increase power output also increases and time to charge a vehicle decreases. Level 3 charger is costlier however, will observe significant growth during the forecast period. By vehicle type, the market is segmented into two-wheelers, passenger cars, and commercial vehicle charger.

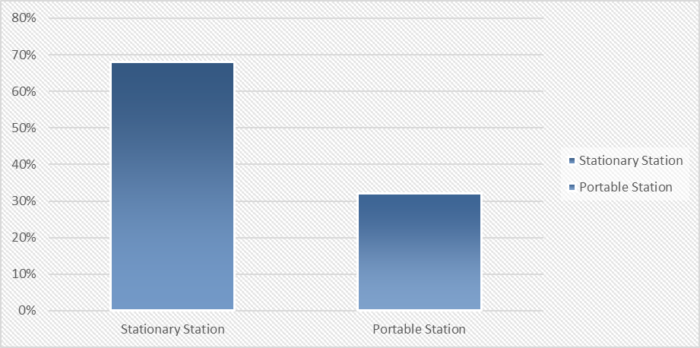

Global Electric Vehicle Supply Equipment Market Size by Station Type, 2018 ($ Million)

Stationary Charging Station is expected to have the largest market share in the market

By station type, the market is segmented into a stationary charging station and portable charging station. It is expected that the stationary charging station will have larger share during the forecast period. It is due to the huge government and auto-companies investment in developing the charging infrastructure across the globe. At the initial level, in order to appreciate electric vehicles, it is mandatory to first develop sufficient charging infrastructure in the region. Portable charging facilities will observe a significant market growth rate as the market is small at the present time.

Regional Outlook

The global electric vehicle supply equipment market is further classified based on geography including North America, Europe, Asia-Pacific and Rest of the World. A significant growth rate will be observed globally. As per the International Energy Agency, in 2018 the estimated total number of charging point globally was 5.2 million which was 44% high year-on-year basis. Most of them are private charging points and accounting for more than 90% of total charging points. In 2018, publicly accessible chargers were 539,000 a 24% high as compared to 2017 level. It is recommended by the European Union Alternative Fuels Infrastructure Directive that there should be at least 1 publicly accessible charger over 10 electric vehicles. As the vehicle number will increase, charger requirement and installation will also rise during the forecast period.

Growth in emerging economies boost the market in the Asia-Pacific region

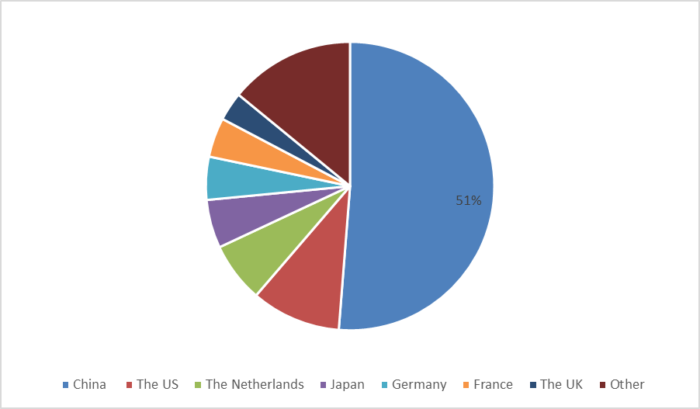

The Asia-Pacific region is expected to show the highest growth rate in electric vehicle supply equipment market attributed to the major contribution of emerging economies China and India. As per the International Energy Agency, in 2018 half of the global publicly charging infrastructure were installed in China. Out of total fast charger installed globally about 75% were in China only, followed by Japan in overall and fast charging both segments. The country is also promoting electric vehicles as they have prohibited investment in new ICE plant from January 2019. The country has a target of creating 500,000 chargers for 5 million electric vehicles by 2020. Along with China, India is also contributing to the Asia-Pacific market. In 2019, the government has planned to invest $1.4 billion for 3 years to support the domestic electric vehicle industry. Out of this, $140 million is for developing charging infrastructure. Japan is also targeting for 15-20% EV sales in passenger light-duty vehicles by 2020 and 20-30% by 2030. South Korea has a target of 430,000 battery electric vehicle and 10,000 fast chargers by 2022.

Publicly accessible chargers by country, 2018 (%)

European countries are also committed to reducing carbon emission by automobiles hence encouraging electric vehicles in the region. Some of the major countries in the market are France, Germany, the Netherlands, Norway, and Sweden. By 2020, the Netherlands has the plan to install 2,000 charging points by 2020 in order to support the electrification of its government fleet by 20% in 2020 and 100% by 2028. The US is also promoting electric vehicles. As an instance, California aims to have 5 million EVs on the road by 2030. It is estimated that the Califonia government will invest $900 million in electric charging infrastructure to install 250,000 charging points by 2025, out of which around 10,000 should be DC fast chargers.

Market Players Outlook

The major players that contribute to the growth of the global electric vehicle supply equipment market include ABB Inc., Tesla Inc., Bosch Automotive Service Solutions Inc., ChargePoint, Inc., EFACEC Group, Mitsubishi Electric Corp., POD Point Ltd., Schneider Electric SE, Shell Group, Siemens AG, Yazaki Corp. and so on. These market players are contributing to the market by adopting various market approaches which include merger and acquisition with other companies or with government, innovate techniques for infrastructure development in order to gain a strong position in the market.

Recent Activities

- In June 2019, Electrify America and ChargePoint have gone into a partnership which will now allow drivers to use public chargers operated by either network without costing any additional fees. Due to this partnership over 30,000 Level, 2 and DC fast chargers will be available for vehicles for both the companies.

- In May 2019, China has developed the world’s largest charging station in Shenzhen. In collaboration with BYD and Potevio, Chinese power company Southern Power Grid had 637 fast chargers. It is able to service 5,000 vehicles per day by using a total of 160 MWh of energy on average.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric vehicle supply equipment Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Tesla, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bosch Automotive Service Solutions, Inc

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. ABB, Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Siemens AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Shell Group

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Electric Vehicle Supply Equipment Market by Charger Type

5.1.1. Level-1 Charger

5.1.2. Level-2 Charger

5.1.3. Level-3 Charger

5.2. Global Electric Vehicle Supply Equipment Market by Vehicle Type

5.2.1. Two-Wheelers

5.2.2. Passenger Cars

5.2.3. Commercial Vehicles

5.3. Global Electric Vehicle Supply Equipment Market by Station type

5.3.1. Stationary Charging Station (Plug-In)

5.3.2. Portable Charging Facilities

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB, Ltd.

7.2. Alfen Beheer B.V.

7.3. Allego B.V.

7.4. Blink Charging Co.

7.5. Bosch Automotive Service Solutions, Inc.

7.6. ChargePoint, Inc.

7.7. EFACEC Group

7.8. EV Safe Charge, Inc.

7.9. EV-Box B.V.

7.10. EVgo Services, LLC

7.11. Heliox B.V.

7.12. IONITY GmbH

7.13. Leviton Manufacturing Co., Inc.

7.14. Mitsubishi Electric Corp.

7.15. OpConnect, LLC

7.16. POD Point, Ltd.

7.17. Schneider Electric SE

7.18. SemaConnect, Inc.

7.19. Shell Group

7.20. Siemens AG

7.21. Tesla, Inc.

7.22. Volta Industries, Inc.

7.23. Webasto Charging Systems, Inc.

7.24. Yazaki Corp.

1. GLOBAL ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CHARGER TYPE, 2018-2025 ($ MILLION)

2. GLOBAL LEVEL-1 CHARGER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL LEVEL-2 CHARGER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL LEVEL-3 CHARGER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

6. GLOBAL TWO-WHEELERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CHARGING STATION TYPE, 2018-2025 ($ MILLION)

10. GLOBAL STATIONARY CHARGING STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PORTABLE CHARGING FACILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. NORTH AMERICAN ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CHARGER TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

15. NORTH AMERICAN ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2018-2025 ($ MILLION)

16. EUROPE ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPE ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CHARGER TYPE, 2018-2025 ($ MILLION)

18. EUROPE ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

19. EUROPE ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CHARGER TYPE, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2018-2025 ($ MILLION)

24. REST OF WORLD ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CHARGER TYPE, 2018-2025 ($ MILLION)

25. REST OF WORLD ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

26. REST OF WORLD ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2018-2025 ($ MILLION)

1. GLOBAL ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SHARE BY CHARGER TYPE, 2018 VS 2025 (%)

2. GLOBAL ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SHARE BY VEHICLE TYPE, 2018 VS 2025 (%)

3. GLOBAL ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SHARE BY VEHICLE TYPE, 2018 VS 2025 (%)

4. GLOBAL ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. UK ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD ELECTRIC VEHICLE SUPPLY EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)