Electric Water Heater Market

Global Electric Water Heater Market Size, Share & Trends Analysis Report by Product Type (Tankless Water Heater and Storage Water Heater), By Application (Residential, Commercial, and Industrial) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for electric water heater is projected to have considerable CAGR of around 5.4% during the forecast period. The major factor driving the market of electric water heater is that the electric heater do not having the danger of exploding as compare to gas water heater. In addition to this, electric water heaters allow hassle free installation leading to the increase in market growth for electric water heaters. Electric water heaters consume less space as compared to conventional gas water heaters boosting the demand of electric water heater market. Furthermore, electric water heaters can be equipped with AI such as auto-timer. Moreover, Electric immersion water heaters are being significantly utilized for industrial applications due to robust and efficient heating. In addition, it has its own electricity supply and is not dependent on boilers to work. The rising application of electric water heater in commercial and industrial sector further provides significant opportunity to the market.

Segmental Outlook

The global electric water heater market is segmented based on product type and application. Based on the product type, the market is further classified into tankless water heater and storage water heater. The storage water heater segment is further projected to have significant share in the global electric water heater market. The storage water heaters are the standard water heaters used in most indoor spaces. The storage water heaters comprise an enclosed tank that heats water and is stored in the same tank for later use. Storage heaters are widely used in various sectors in operation, as it conserves energy and reduces heat loss during standby times. On the basis of application the market is further segregated into residential, commercial and industrial.

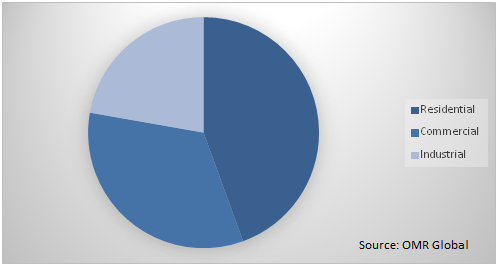

Global electric water heater Market Share by Application, 2019(%)

Global electric water heater market to be driven by residential application

Among application, the residential segment held a considerable share in the market owing to growing requirement of hot water for residential applications such as cleaning, bathing, and others have augmented the demand for water heater. There has been increased importance of water heaters among residential users. For instance, the shipment of residential electric storage water heaters increased 2% in October 2018 to 341,572 units, which is increased from 334,901 units shipped in October 2017 (according to Air Conditioning, Heating & Refrigeration Institute (AHRI). The demand for residential electric storage water heaters is growing significantly as they are usually cost-effective to operate than other water heaters. Moreover, the government is working towards encouraging consumers to use energy-efficient water heaters that can support to save energy, thus contribute in the growth of the market.

Regional Outlook

Geographically, the global electric water heater market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. North America have significant growth in the global electric water heater market. The advancement of electric water heater for various application in North America such as the US and Canada coupled with integration of smart technology such as AI in water heater systems are further making a considerable contribution towards the market in the region

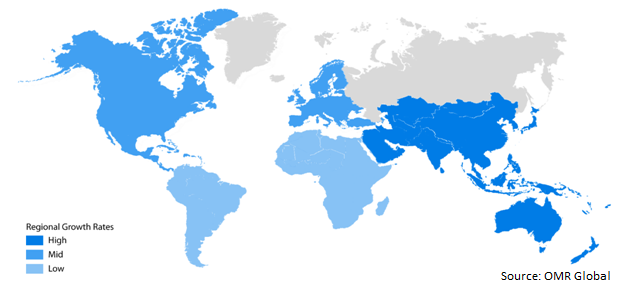

Global electric water heater Market Growth, by Region 2020-2026

Asia-Pacific to hold a considerable share in the global electric water heater market

Geographically, Asia-Pacific is projected to hold a significant market share in the global electric water heater market during the forecast period. Major economies which are anticipated to contribute to Asia-Pacific electric water heater market include China, India Japan and others. The major factors contributing to the growth of the market in the region include the rising demand of electric water heater in residential and commercial sector coupled with rising disposable income in emerging economies. Asia-Pacific homes nearly two-third of global population which have led to the significant demand of water heaters across the region. Moreover, rapid urbanization and government support to install water heaters are also fueling the Asia-Pacific water heater market over the forecast period. The Indian Government offers subsidy of nearly 30% to 60% to water heater consumers on the basis of category of users and states.

Market Players Outlook

The key players in the electric water heater market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include A.O. Smith Corp., Bajaj Electricals Ltd., Haier electronics group Co., Ltd., Havells India Ltd., General Electric Co., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric water heater market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. A.O. Smith Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bajaj Electricals Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Haier electronics group Co., Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Havells India Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. General Electric Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Electric Water Heater Market by Product Type

5.1.1. Tankless Water Heater

5.1.2. Storage Water Heater

5.2. Global Electric Water Heater Market by Application

5.2.1. Residential

5.2.2. Commercial

5.2.3. Industrial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. A.O. Smith Corp.

7.2. Ariston Thermo SpA

7.3. ATC Electrical and Mechanical, Ltd.

7.4. Bajaj Electricals Ltd.

7.5. Bandini Scaldabagni SpA

7.6. Bradford White Corp.

7.7. Crompton Greaves Consumer Electricals Ltd.

7.8. General Electric Co.

7.9. Haier electronics group Co., Ltd.

7.10. HTP Comfort Solutions LLC

7.11. Havells India Ltd.

7.12. Hangzhou Kangquan Water Heater Co., Ltd.

7.13. Hubbell Electric Heater Co.

7.14. Marey Heater Corp

7.15. Robert Bosch GmbH

7.16. Rheem Manufacturing Company, Inc.

7.17. Racold Thermo Pvt. Ltd.

7.18. Stiebel Eltron, Inc.

7.19. Transform Holdco LLC (Kenmore)

7.20. Venus Home Appliances (P) Ltd.

1. GLOBAL ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL STORAGE WATER HEATER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL ELECTRIC WATER HEATER IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ELECTRIC WATER HEATER IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ELECTRIC WATER HEATER IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

11. NORTH AMERICAN ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

12. EUROPEAN ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. EUROPEAN ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

14. EUROPEAN ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. REST OF THE WORLD ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

19. REST OF THE WORLD ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL ELECTRIC WATER HEATER MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL ELECTRIC WATER HEATER MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL ELECTRIC WATER HEATER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ELECTRIC WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)