Electrolyzer Market

Electrolyzer Market Size, Share & Trends Analysis Report by Type (Traditional Alkaline Electrolyzer and Polymer Electrolyte Membrane (PEM) Electrolyzer), and by Application (Power Generation, Transportation, Industry Energy, Industry Feedstock, Building Heat & Power, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Electrolyzer market is anticipated to grow at a significant CAGR of 22.7% during the forecast period. The growing utilization of hydrogen as a green fuel is accelerating the growth of the global electrolyzer market during the forecast period. Green hydrogen is hydrogen produced by splitting water into hydrogen and oxygen using renewable electricity, it emits a negligible amount of carbon. Hence, supports reducing the carbon footprint in different sectors such as transportation, electricity, chemical manufacturing, and others. Hydrogen fuel can be produced through several methods, the most common methods today are natural gas reforming (a thermal process), and electrolysis. Strict government norms & policies support a sustainable environment with a positive outlook for a clean environment, which in turn is propelling the demand for the electrolyzer by key manufacturing and processing companies. For instance, in June 2021, Tata Motors Ltd. bagged an order of 15 hydrogen-based fuel cell buses from Indian Oil Corporation Ltd. These coaches would be used by Indian Oil to evaluate the potential of developing hydrogen-based PEM fuel-cell technology in India. IndianOil through cutting-edge R&D is committed to strengthening the production and supply chain of hydrogen energy across the country. Additionally, the company also announced to establish around 1 ton/ day hydrogen production pilot plants based on 4 innovative pathways besides collaborating with Tata Motors for fuel cell research.

Segmental Outlook

The global electrolyzer market is segmented based on type and application. Based on type, the market is segmented into traditional alkaline electrolyzers and PEM electrolyzers. Based on application, the market is sub-segmented into power generation, transportation, industry energy, industry feedstock, building heat & power, and others. The above-mentioned segments can be customized as per the requirements. Among the type, the traditional alkaline electrolyzer is anticipated to grow at a remarkable rate during the forecast period. The factors boosting the segmental growth include low operation & installation costs, high efficiency & durability, long-term stability, and matured technology are a few attributes positively impacting the product demand. Traditional alkaline electrolyzer uses less expensive catalysts for the hydrogen evolution reaction (HER). Nickel is used as electrode material in alkaline media due to its high stability under cathodic and anodic conditions it also shows high electrocatalytic activity compared to many other transition metals.

The power generation segment is anticipated to hold a considerable share in the global electrolyzer market during the forecast period. The growing desire to reduce carbon emissions from traditional power generation assets is driving an increase in power production from renewables such as hydrogen fuels. Gas turbines can be used for this problem, as these gas turbines can operate on hydrogen (H2), which does not provide any carbon emissions when combusted. Hydrogen production and storage are combined with power generation equipment, including fuel cells, reciprocating engines, combustion turbines, and steam turbines, resulting in a storage device to time-shift delivery of electricity for electric grid applications. According to the International Energy Agency (IEA), in 2021, the demand for electricity witnessed a 6% rise across the globe, which is considered as the the largest in percentage terms till now. As of 2021, it has reached over 1,500 TWH. Additionally, emissions from electricity required to decline by 55% by 2030 to meet Net Zero Emissions by 2050, which is another factor contributing to the increased use of hydrogen in electricity production.

Regional Outlooks

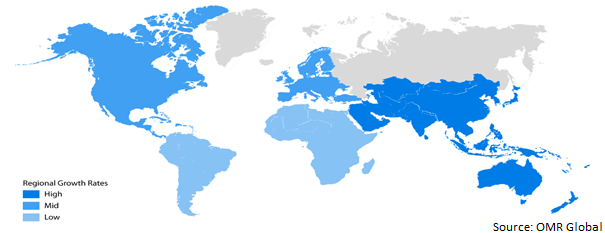

The global electrolyzer market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Europe market is anticipated to grow at a fastest CAGR during the forecast period owing to the increasing investments and introduction of supporting regulatory structure by governments. These investments are inclined towards expanding the grid infrastructure networks to support the installation of renewable energy, which in turn propelling the market growth. According to the European Commission, the publication of the REPowerEU plan in May 2022, the European Commission completed the implementation of the European hydrogen strategy. The REPowerEU plan’s ambition is to produce 10 million tonnes and import 10 million tonnes of renewable hydrogen into the EU by 2030. Through this, the region aims to accelerate the uptake of renewable hydrogen, ammonia, and other in sectors including transport, and energy-intensive industrial processes.

Global Electrolyzer Market Growth, by Region 2022-2028

North America is Expected to Hold the Considerable Share in the Global Electrolyzer Market

North America is anticipated to hold a considerable share in the global electrolyzer market during the forecast period. Owing to the increasing use of hydrogen in various applications in the industries such as manufacturing, power generation & storage, and others. The region has established several manufacturing infrastructures for several global brands, which directly raised the demand and interest in the energy storage. For instance, in June 2021, Plug Power announced to build a green hydrogen production plant in Camden Country, the US catering to serv customers of the South Eastern US. Further, Hydrogen is used to turn unsaturated fats into saturated oils and fats, including hydrogenated vegetable oils such as margarine and butter spreads.

Market Players Outlook

The major companies serving the global electrolyzer market include Nel ASA, Asahi Kasei Corp., Shandong Saikesaisi Hydrogen Energy Co., Ltd., Teledyne Energy Systems, Inc., Siemens AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2020 Asahi Kasei Corp. and it’s subsidiary Asahi Kasei Engineering Corp. started operating hydrogen supply in the alkaline water electrolysis system. The companies established a production scale of 10 MW in Namie, Futaba, Fukushima, and Japan.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electrolyzer market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Nel ASA

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Asahi Kasei Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Shandong Saikesaisi Hydrogen Energy Co., Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Teledyne Energy Systems, Inc.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Siemens AG

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electrolyzer Market by Type

4.1.1. Traditional Alkaline Electrolyzer

4.1.2. polymer electrolyte membrane (PEM) electrolyzer

4.2. Global Electrolyzer Market by Application

4.2.1. Power Generation

4.2.2. Transportation

4.2.3. Industry Energy

4.2.4. Industry Feedstock

4.2.5. Building Heat & Power

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Air Liquide S.A.

6.2. Ballard Power Systems Inc.

6.3. Beijing CEI Technology Co., Ltd.

6.4. Bloom Energy Corp.

6.5. CUMMINS, INC.

6.6. ErreDue spa

6.7. ENAPTER s.r.l.

6.8. Giner Inc.

6.9. H-TEC SYSTEMS GmbH

6.10. iGas Energy GmbH

6.11. ITM Power plc

6.12. Idroenergy

6.13. Kobelco Eco-Solutions Co., Ltd.

6.14. McPhy Energy SA

6.15. Next Hydrogen (Canada)

6.16. Plug Power Inc.

6.17. Toshiba Corp.

1. GLOBAL ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL TRADITIONAL ALKALINE ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PEM ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL ELECTROLYZER FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL ELECTROLYZER FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ELECTROLYZER FOR INDUSTRY ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ELECTROLYZER FOR INDUSTRY FEEDSTOCKMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ELECTROLYZER FOR BUILDING HEAT & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ELECTROLYZER FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. NORTH AMERICAN ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

15. EUROPEAN ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. REST OF THE WORLD ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. REST OF THE WORLD ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD ELECTROLYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL ELECTROLYZER MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL TRADITIONAL ALKALINE ELECTROLYZER FOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL PEM ELECTROLYZER MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL ELECTROLYZER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

5. GLOBAL ELECTROLYZER FOR POWER GENERATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL ELECTROLYZER FOR TRANSPORTATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL ELECTROLYZER FOR INDUSTRY ENERGY MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL ELECTROLYZER FOR INDUSTRY FEEDSTOCK MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL ELECTROLYZER FOR BUILDING HEAT & POWER MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL ELECTROLYZER FOR OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL ELECTROLYZER MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. US ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

14. UK ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD ELECTROLYZER MARKET SIZE, 2021-2028 ($ MILLION)