Electromagnetic Flowmeters Market

Electromagnetic Flowmeters Market Size, Share &Trends Analysis Report by Product (In-line Magnetic Flowmeters, Low Flow Magnetic Flowmeters, and Insertion Magnetic Flowmeters), and by Application (Water and Wastewater, Chemicals and Petrochemicals, Power Generation, Metals and Mining, Oil and Gas, Food and Beverages, and Others), Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Electromagnetic flowmeters market is anticipated to grow at a considerable CAGR of 5.7% during the forecast period (2024-2031). The market’s growth is attributed to the technological advances in connectivity across the globe. The integration of advanced communication options such as Modbus RTU and HART corresponds to the market's trend toward enhanced connectivity. The flowmeter's ability to provide several communication interfaces increases its attractiveness to companies seeking smart and integrated systems. For instance, in April 2023,VorTek Instruments released the Pro-M Electromagnetic Flowmeter. These meters provide precise, dependable volumetric flow metering for a variety of conductive liquids, with measurement stability and a maintenance-free full-bore design that eliminates pressure loss and moving components. Furthermore, pro-M meters offer a variety of communication and power options, including classic analog output signals in addition to sophisticated options such as Modbus RTU and HART.

Segmental Outlook

The global electromagnetic flowmeters market is segmented on the product type, and application. Based on the product, the market is sub-segmented into in-line magnetic flowmeters, low flow magnetic flowmeters, and insertion magnetic flowmeters. Furthermore, on the basis of application, the market is sub-segmented into water and wastewater, chemicals and petrochemicals, power generation, metals and mining, oil and gas, food and beverages, and others. The water and wastewater subcategory is expected to capture a significant portion of the market share within the application segment. The growth can be attributed to growing urbanization, and business growth that leads to a huge wastewater generation.

The Oil and Gas Sub-Segment is Anticipated to Exhibit Considerable CAGR in the global Electromagnetic Flowmeters Market

Among the application, the food and beverages sub-segment is anticipated to exhibit considerable share in the global electromagnetic flowmeters market. The segmental growth is attributed to the demand for portable flow measurement solutions. The portable flow meters are essential in industries such as oil and gas, where field measurements are prevalent. The TransPort PT900's portability satisfies the industry's need for on-site, non-invasive flow measuring capabilities without compromising with operations. In March 2017, Baker Hughes business introduced the GE Oil a new product TransPortPT900 Portable Ultrasonic Flow Meter, a clamp-on meter for measuring liquid flow. Significant customer research and input influenced the design of the TransPort, thatled to in an entirely new transmitter and clamping fixture, in addition to an app-driven user interface on an Android tablet.

Regional Outlook

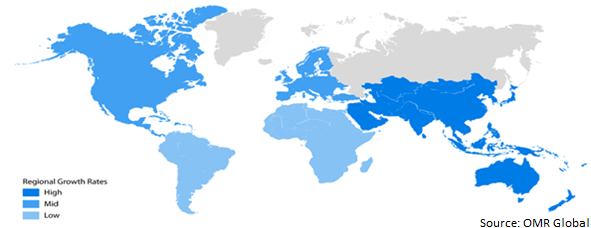

The global electromagnetic flowmeters market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, North Americais anticipated to hold a prominent share of the market across the globe, owing to the growing region's significant adoption of technologies in the power generation segment.

The Global Electromagnetic Flowmeters Market Growth by Region 2024-2031

Asia-Pacific is Expected to Grow at a Significant CAGR in the global Electromagnetic Flowmeters Market

Among all regions, the Asia- Pacific regions is anticipated to grow at a significant CAGR over the forecast period. Regional growth is attributed to the growing demand for government initiatives and regulations across the region. Government-led initiatives and regulations aimed at providing reliable water for consumption promote the usage of innovative technologies such as electromagnetic flowmeters even further. Compliance with these rules involves accurate measurement and management of water flow that increases demand for flow measurement technologies. According to India Brand Equity Foundation (IBEF), in December 2021, India has established an attainable objective of providing safe drinking water to all 192 million houses in 600,000 villages by 2024. Over 2.5 million miles of pipe have been installed as part of the project, that requires hundreds of thousands of contractors and laborers. The government has allotted a $50 billion budget for this program that is managed by around 18,000 government engineers.

Market Players Outlook

The major companies serving the electromagnetic flowmeters market includes Georg Fischer Ltd., Hitachi, Ltd., Honeywell International Inc., OMEGA Engineering, Inc., Siemens Ltd. and others.The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2020, Hitachi Capital Corp., Yokogawa Electric Corp., and amnimo Inc. collaborated to develop new services by integrating Industrial IoT ("IIoT") with individual companies' technologies know-how, and leasing equipment.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electromagnetic flowmeters market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Azbil Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Emerson Electric Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electromagnetic Flowmeters Market by Product

4.1.1. In-line Magnetic Flowmeters

4.1.2. Low Flow Magnetic Flowmeters

4.1.3. Insertion Magnetic Flowmeters

4.2. Global Electromagnetic Flowmeters Market by Application

4.2.1. Water and Wastewater

4.2.2. Chemicals and Petrochemicals

4.2.3. Power Generation

4.2.4. Metals and Mining

4.2.5. Oil and Gas

4.2.6. Food and Beverages

4.2.7. Others(Pulp and Paper, Pharmaceuticals)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. BRONKHORST HIGH-TECH B.V.

6.2. Endress+Hauser Corporate

6.3. Georg Fischer Ltd.

6.4. Hitachi, Ltd.

6.5. Honeywell International Inc.

6.6. Ingersoll Rand Inc.

6.7. Kobold Messring GmbH

6.8. KROHNE Messtechnik GmbH

6.9. OMEGA Engineering, Inc.

6.10. SEATTLE METRICS, INC.

6.11. Sensirion AG

6.12. Siemens Ltd.

6.13. Sierra Instruments, Inc.

6.14. TechnipFMC plc

6.15. Toshiba Corp.

6.16. Yokogawa Group

1. GLOBAL ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL IN-LINE ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

3. GLOBAL LOW FLOW ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

4. GLOBAL INSERTION ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

5. GLOBAL ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL ELECTROMAGNETIC FLOWMETERS IN WATER AND WASTEWATER MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

7. GLOBAL ELECTROMAGNETIC FLOWMETERS IN CHEMICALS AND PETROCHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

8. GLOBAL ELECTROMAGNETIC FLOWMETERS IN POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

9. GLOBAL ELECTROMAGNETIC FLOWMETERS IN METALS AND MINING MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

10. GLOBAL ELECTROMAGNETIC FLOWMETERS IN OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

11. GLOBAL ELECTROMAGNETIC FLOWMETERS IN FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

12. GLOBAL ELECTROMAGNETIC FLOWMETERS IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION,2023-2031 ($ MILLION)

13. GLOBAL ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. EUROPEAN ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

25. REST OF THE WORLD ELECTROMAGNETIC FLOWMETERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ELECTROMAGNETIC FLOWMETERS MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL IN-LINE ELECTROMAGNETIC FLOWMETERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LOW FLOW ELECTROMAGNETIC FLOWMETERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL INSERTION ELECTROMAGNETIC FLOWMETERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ELECTROMAGNETIC FLOWMETERS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL ELECTROMAGNETIC FLOWMETERS IN WATER AND WASTEWATER MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ELECTROMAGNETIC FLOWMETERS IN CHEMICALS AND PETROCHEMICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ELECTROMAGNETIC FLOWMETERS IN POWER GENERATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ELECTROMAGNETIC FLOWMETERS IN METALS AND MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ELECTROMAGNETIC FLOWMETERS IN OIL AND GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ELECTROMAGNETIC FLOWMETERS IN FOOD AND BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ELECTROMAGNETIC FLOWMETERS IN OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ELECTROMAGNETIC FLOWMETERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

16. UK ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD ELECTROMAGNETIC FLOWMETERS MARKET SIZE, 2023-2031 ($ MILLION)