Electronic Beam Welding Machine Market

Global Electronic Beam Welding Machine Market Research By End-User (Automotive, Aerospace, Marine, Energy, Medical, Construction, Industrial Fabrication), By Component (Electron Gun, Working Chamber, Workpiece Manipulator, Power Supply & Control Equipment), By Application (Welding, Drilling, Surface Treatment) and Forecast 2021-2027 Update Available - Forecast 2025-2035

The global electron beam welding machine market is growing at a considerable CAGR of around 3.3% during the forecast period (2021-2027). Electron beam welding (EBW) is used in automotive, aerospace, marine, medical, construction, and industrial fabrication, among others. The EBW machine is adopted by this industry due to several advantages such as the EBW is generally used for the joining of two or more different materials, the EBW welds large quantities of material with accuracy, high welding speed, and quality control. Another reason the EBW is used to owning no gas pollution due to electron beam welding is performed in a vacuum. The electron beam welding technique is a very precise technique with minimal reduction. Hence, The aerospace and automotive production manufacturing industries boost the demand for EBW machines. The global production of the vehicle was 70 million in 2018 with 77 million units sold across the globe. The welding technique is currently getting a wider application in automotive manufacturing.

According to the government of India, Department of Atomic Energy, Electron Beam Welding (EBW) can produce deep diffusion welds through very low mechanical distortion. This decreases the post-weld machining cost. The electron beam machine is beneficial in welding thick sections in a single pass. EBW machine welding from a distance as small as 0.0001 inches to 300 mm. the welding process is performed under vacuum due to this the electron beam is used for the welding of aerospace, and nuclear components.

Impact of COVID-19 on the Electron Beam Welding Machine Market

The global electron beam welding machine market is hardly hit by the COVID-19 pandemic since December 2019. Key industry applications of electron beam welding machines include automobiles, aerospace, among others. These industries rely on top economies such as China, the US, and Europe. these major economies have disrupted the manufacturing and supply of raw materials across the globe. The Covid19 pandemic has changed the market landscape. The market ecosystem has taken a reversing shift in the way the supply-side of the market is affected. China is one of the largest electronics, and automobile manufacturers, hence the outbreak of COVID-19 in China disrupt the global supply chain, hence impacted the electron beam welding machine market negatively. The market will witness “W” shape recovery in near future owing to the restart of key industries in major economies. A major portion of recovery in the electron beam welding Machine industry is attributed to the Chinese automotive industry.

Segmental Outlook

The market is segmented based on end-user, component, and application. Based on end-user, the market is segmented into Automotive, aerospace, marine, energy, medical, construction, industrial fabrication. By component, the market is segmented into electron gun, working chamber, workpiece manipulator, Power Supply & Control Equipment. By Application, the market is segmented into Welding, Drilling, Surface Treatment

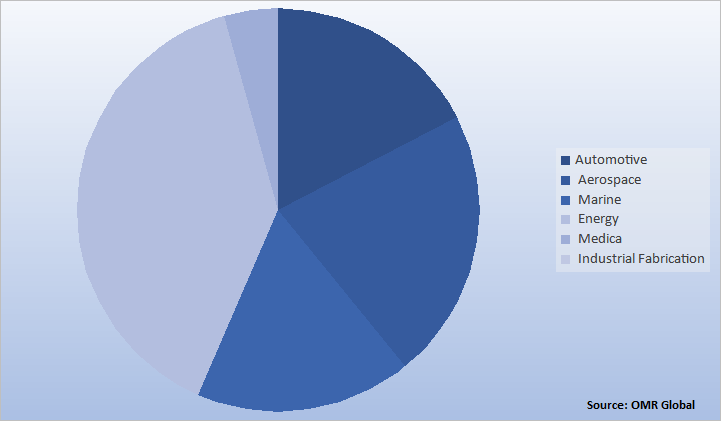

Global Electron Beam Welding Machine Market Share by End-User, 2020 (%)

Based on the end-user industry, the automotive segment is primary driven by the growth of the market. With the growing production of automobiles across the globe, and the benefits provided by the EBW machine for automotive industries such as smaller heat-affected zone, and less thermal distortion, and the EBW machine leading to enhanced vehicles structural performance. Additionally, the EBW machine is used for welding all types of automobile components such as turbochargers, gear parts, and shafts these are some factors that are estimated to further increase the growth of the automotive industry in the global electron beam machining market.

Regional Outlooks

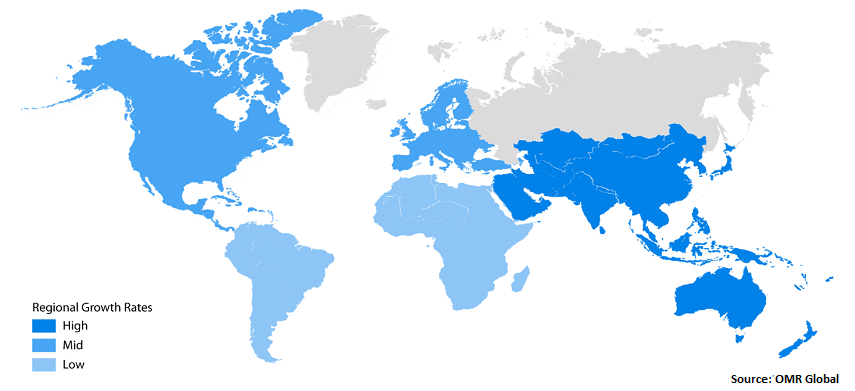

The global electron beam welding machine market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America held a considerable share in 2020 in the global electron beam welding machine market. Some factors that are boosting the market growth in this region include government and private companies are making ventures into infrastructure improvement, and a large number of electron beam welding machine key companies are based in the US and Canada. Moreover, The EBW machine manufacturing market is mainly dominated by the US, Germany, Japan, and China.

Global Electron Beam Welding Machine, by Region 2021-2027

Asia-Pacific will Have Considerable Growth in the Global Electron Beam Welding Machine Market

Asia-Pacific region is expected to witness significant growth opportunities for the market. As the manufacturing capital of the globe, China is emerging as a leading EBW market across the globe. China is one of the largest manufacturers of electronic equipment, and automotive. China is the key end-user of EBW machinery is expected to drive the growth of the regional market.

Market Player Outlook

Key players of the global electron beam welding machine market are Global Beam Technologies, Mitsubishi Electric, pro-beam. Cambridge Vacuum Engineering, Sciaky, Inc., Bodycote, Beijing Zhong Ke Electric Co.Ltd., TETA, Evobeam, and AVIC, among others. To survive in the market, these players adopt different marketing strategies such as product launches. For instance, In January 2020, GULLCO International Limited announced a distribution partnership with Translas. In this partnership, GULLCO will serve as the global distributor of Translas’ newest fume extraction solution such as the Translas 7XE Semi-Automatic Fume Extraction welding gun. The gun was engineered to be attached to any of the Translas ClearO2 hi-vac mobile fume extraction units.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electron beam welding machine market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Electron Beam Welding Industry

• Recovery Scenario of Global Electron Beam Welding Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of Covid-19on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Electronic Beam Welding Market, by End User

5.1.1. Automotive

5.1.2. Aerospace& Defense

5.1.3. Marine

5.1.4. Construction

5.1.5. Industrial Fabrication

5.1.6. Other (Energy, Medical)

5.2. Electronic Beam Welding Market, by Component

5.2.1. Electron Gun

5.2.2. Working Chamber

5.2.3. Workpiece Manipulator

5.2.4. Other (Power Supply and control systems)

5.3. Electronic Beam Welding Market, by Technology

5.3.1. Conveyor

5.3.2. Clock System

5.3.3. Local Vacuum Machine

5.3.4. Micro & Fine Welding Machine

5.3.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ags-Tech Inc.

7.2. Arcam Ab

7.3. Aviation Industry Corporation of China, Ltd.

7.4. Cambridge Vacuum Engineering

7.5. Electron Beam Engineering, Inc.

7.6. Elektroweld Automations India Pvt Ltd

7.7. Energy Sciences Inc.

7.8. Global Beam Technologies AG

7.9. Gullco International, Inc.

7.10. Hanwha Aerospace Co., Ltd.

7.11. Mitsubishi Electric Corp.

7.12. Ptr-Precision Technologies, Inc.

7.13. Sciaky, Inc.

7.14. Ulvac Technologies, Inc

7.15. Wasik Associates Inc

1. GLOBAL ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL ELECTRON BEAM WELDING MARKET BY END-USER, 2020-2027 ($ MILLION)

3. GLOBAL AUTOMOTIVE MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL AEROSPACE MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL MARINE MARKET BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL ENERGY MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL MEDICAL MARKET BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL CONSTRUCTION MARKET BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL INDUSTRIAL FABRICATION MARKET BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL ELECTRON BEAM WELDING MARKET BY COMPONENT, 2020-2027 ($ MILLION)

11. GLOBAL ELECTRON GUN MARKET BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL WORKING CHAMBER MARKET BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL WORKPIECE MANIPULATOR MARKET BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL POWER SUPPLY & CONTROL EQUIPMENT MARKET BY REGION, 2020-2027 ($ MILLION)

15. OTHER COMPONENTS MARKET BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL ELECTRON BEAM WELDING MARKET BY APPLICATION, 2020-2027 ($ MILLION)

17. GLOBAL WELDING MARKET BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL DRILLING MARKET BY REGION, 2020-2027 ($ MILLION)

19. GLOBAL SURFACE TREATMENT MARKET BY REGION, 2020-2027 ($ MILLION)

20. NORTH AMERICAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

21. NORTH AMERICAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

22. NORTH AMERICAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

23. NORTH AMERICAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. EUROPEAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

25. EUROPEAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

26. EUROPEAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

27. EUROPEAN ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

30. ASIA-PACIFICELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC ELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

32. REST OF THE WORLDELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

33. REST OF THE WORLDELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

34. REST OF THE WORLDELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

35. REST OF THE WORLDELECTRON BEAM WELDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ELECTRON BEAM WELDING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ELECTRON BEAM WELDING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL ELECTRON BEAM WELDING MARKET, 2021-2027 (%)

4. GLOBAL ELECTRON BEAM WELDING MARKET SHARE BY END-USER, 2020 VS 2027 (%)

5. GLOBAL ELECTRON BEAM WELDING MARKET SHARE BY COMPONENT, 2020 VS 2027 (%)

6. GLOBAL ELECTRON BEAM WELDING MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

7. GLOBAL ELECTRON BEAM WELDING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL AUTOMOTIVE MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL AEROSPACE MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL MARINE MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL ENERGY MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL MEDICAL MARKET BY REGION, 2020 VS 2027 (%)

13. GLOBAL CONSTRUCTION MARKET BY REGION, 2020 VS 2027 (%)

14. GLOBAL INDUSTRIAL FABRICATION MARKET BY REGION, 2020 VS 2027 (%)

15. GLOBAL ELECTRON GUN MARKET BY REGION, 2020 VS 2027 (%)

16. GLOBAL WORKING CHAMBER MARKET BY REGION, 2020 VS 2027 (%)

17. GLOBAL WORKPIECE MANIPULATOR MARKET BY REGION, 2020 VS 2027 (%)

18. GLOBAL POWER SUPPLY & CONTROL EQUIPMENT MARKET BY REGION, 2020 VS 2027 (%)

19. GLOBAL OTHER COMPONENTS MARKET BY REGION, 2020 VS 2027 (%)

20. GLOBAL WELDING MARKET BY REGION, 2020 VS 2027 (%)

21. GLOBAL DRILLING MARKET BY REGION, 2020 VS 2027 (%)

22. GLOBAL SURFACE TREATMENT MARKET BY REGION, 2020 VS 2027 (%)

23. US ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

24. CANADA MARKET ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

25. UK ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

26. GERMANY ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

27. SPAIN ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

28. FRANCE ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

29. ITALY ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF EUROPEELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

31. INDIA ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

32. CHINA ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

33. JAPAN ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

34. SOUTH KOREA ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

35. REST OF ASIA-PACIFICELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)

36. REST OF WORLD ELECTRON BEAM WELDING MARKET SIZE, 2020-2027 ($ MILLION)