Electronic Logging Device Market

Global Electronic Logging Device (ELD) Market Size, Share & Trends Analysis Report by Form Factor (Embedded and Integrated) and by Vehicle Type (Bus, Truck, and LCV) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

Global electronic logging device (ELD) market is projected to witness a growth by exhibiting a significant CAGR of around 5%, during the forecast period. ELD is an electronic solution that records the driving time and hours of service of commercial motor carriers and professional truck drivers. Vehicle identification, motor carrier identification, time, date, geographical location, miles traveled, yards move, engine power up and shutdown, and engine diagnostic and malfunctioning are some of the key features offered by the ELD. The US Federal Motor Carrier Safety Administration (FMCSA) is liable for the encouragement of the safe driving practices in the overall truck industry, which also includes the oversight of vehicle safety and track record of the driver’s duty status, ensuring a smooth ELD implementation. Furthermore, the growing need for vehicle tracking, monitoring, measuring driver’s performance and details are the primary factors driving the demand for ELD across every vehicle. The rising trend for connected vehicles, improved route and efficiency management for commercial vehicles are creating lucrative opportunities for market growth. Whereas, the lack of skilled operators will still be a major challenge to market growth during the forecast period. Moreover, the ELD market is segmented on the basis of form factor and vehicle type. The form factor segment of the ELD market includes embedded and integrated type; whereas the vehicle type segment of the ELD market consists of bus, truck, and LCV.

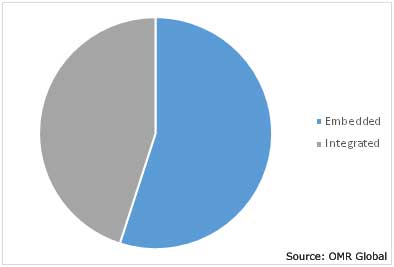

Embedded ELD to hold a considerable share in the market over the forecast period

Among the form factors, the embedded segment registers a considerable share in the market, owing to the increasing adoption of the ELD’s in developed as well as emerging economies. Moreover, the embedded ELD’s are considered as more reliable, secure and useful device compared to an integrated ELD. Embedded ELD systems consist of the display implemented in the device itself for providing information and other operations, such as vehicle motoring and managing. Omnitracs, LLC, a global pioneer of trucking solutions, provides the embedded ELD’s.

Trucks segment to register significant growth in the market over the forecast period

Among vehicle type, the truck segment contributes a significant share in the market, owing to the higher number of trucks equipped with the ELD devices and high requirements of the transportation of the goods across the globe. Moreover, the lack of skilled operators (truck drivers) is at present a challenge faced by the industry; however, the continuous deployment of advanced technologies will propel the segmental growth in the market during the forecast period. On the flip side, LCV is gaining traction in the global ELD market, owing to the technological advancements and growth in the middle-class population across the globe.

Global Electronic Logging Device Market, by Form Factor 2018 (%)

Regional Outlook

On the basis of geographical viewpoint, the global ELD market is segmented into North America, Europe, Asia-Pacific, and Rest of the World. Asia-pacific is projected to exhibit considerable growth in the global ELD market during the forecast period. This is owing to the large transformation of automotive industry over the last decade in Asia-Pacific. The key growth drivers of the market in these regions are the fast-growing GDP and the highly aspirational Asian consumers in emerging countries such as India and China. Some of the challenges faced by the market include responding to the market demands, delivering brand consistently and managing the business in an environmentally friendly manner.

Global Electronic Logging Device Market Growth, by Region 2019-2025

Market Player Outlook

The prominent players functioning in the global ELD are AT&T Inc., Garmin Ltd., KeepTruckin, Inc., Spireon, Inc., Omnitracs, LLC, and many others. These market players are continuously contributing in the market by adopting various market techniques and approaches, which includes product launch and approvals, merger and acquisition, partnerships and collaborations, and others for gaining a strong position in the ELD market.

Recent Developments

- In February 2018, Omnitracs, LLC has innovated its ELD series, in which the ELD will do various services along with recording the hours of the service of the driver.

- In April 2018, Omnitracs LLC has developed its services by using ELD data to improve performance and reduce the number of accidents and will be building an accident severity model and ELD retention model that will further aid in mitigating accidents and risks.

- In April 2017, Teletrac Navman US Ltd., GPS tracking and fleet management company, announced the new DIRECTOR ELD solution to cater to the needs of the Federal Motor Carrier Safety Administration (FMCSA) ELD mandate.

The Report Covers

- Annualized market revenues ($ Million) for each market segment.

- Market value data analysis of 2018 and forecast to 2025.

- Company profiles of key players operating in the global electronic logging device market. Based on the availability of data for the category and country, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Understand the key distribution channels and identifying the most preferred mode of product distribution.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Omnitracs, LLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Spireon, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. KeepTruckin, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Garmin Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. AT&T Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global ELD Market by Form Factor

5.1.1. Embedded

5.1.2. Integrated

5.2. Global ELD Market by Vehicle Type

5.2.1. Bus

5.2.2. Truck

5.2.3. LCV

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AT&T Inc.

7.2. Big Road Inc.

7.3. Blue Ink Technology, Inc.

7.4. CarrierWeb Group of Companies

7.5. EROAD Ltd.

7.6. Garmin Ltd.

7.7. Geotab Inc.

7.8. Gorilla Safety Fleet Management

7.9. KeepTruckin, Inc.

7.10. Linxup, a company of Agilis Systems, LLC

7.11. Omnitracs, LLC

7.12. Pedigree technologies

7.13. Rand McNally, a company of RM Acquisition LLC

7.14. Samsara Networks Inc., a company of Delaware Corp.

7.15. Spireon, Inc.

7.16. Stoneridge, Inc.

7.17. Teletrac Navman US Ltd.

7.18. Transflo a Pegasus TransTech Company

7.19. Trimble Inc.

7.20. VDO, a company of Continental Automotive GmbH

7.21. Verizon Connect

1. GLOBAL ELD MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2018-2025 ($ MILLION)

2. GLOBAL EMBEDDED ELD MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL INTEGRATED ELD MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ELD MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

5. GLOBAL ELD IN BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ELD IN TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ELD IN LCV MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ELD MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN ELD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN ELD MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2018-2025 ($ MILLION)

11. NORTH AMERICAN ELD MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

12. EUROPEAN ELD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. EUROPEAN ELD MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2018-2025 ($ MILLION)

14. EUROPEAN ELD MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC ELD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC ELD MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC ELD MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

18. REST OF THE WORLD ELD MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2018-2025 ($ MILLION)

19. REST OF THE WORLD ELD MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

1. GLOBAL ELD MARKET SHARE BY FORM FACTOR, 2018 VS 2025 (%)

2. GLOBAL ELD MARKET SHARE BY VEHICLE TYPE, 2018 VS 2025 (%)

3. GLOBAL ELD MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ELD MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ELD MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ELD MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ELD MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ELD MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ELD MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ELD MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ELD MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ELD MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ELD MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ELD MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ELD MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ELD MARKET SIZE, 2018-2025 ($ MILLION)