Electronic Sensors Market

Global Electronic Sensors Market Size, Share & Trends Analysis Report by Type (Image Sensor, Temperature Sensor, Pressure Sensor, Motion Sensor, Biometric Sensor, and Others), By Application (Consumer Electronics, Automotive, Industrial, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global market for electronic sensors is projected to have considerable CAGR of around 12.8% during the forecast period. The major factors that propels the electronic sensors market include growing penetration of smartphone coupled with growing technological advancement in the smartphone sensor technology. A huge number of smartphone companies in the market and the wide range of products offered by them have increased the number of users. According to the communications regulator in the UK, Ofcom in 2015, two-thirds of the people in the UK own a smartphone, spending nearly about two hours every day on their phones. As per the Ofcom, for 33% of the internet users, the smartphone is the most important device for their on-going life in contrast to the 30% who use laptops. Smartphone manufacturers nowadays use three image sensors in a single smartphone. One sensor in front of the mobile and 2 at the back of the smartphone. This helps to improve the quality of the picture. The market players are continuously investing in the development of advanced technologies that further provide significant opportunity to the market.

Segmental Outlook

The global electronic sensors market is segmented based on type and application. Based on the type, the market is further classified into image sensor, temperature sensor, pressure sensor, motion sensor, biometric sensor, and others. The image sensor segment is projected to grow at a significant CAGR during the forecast period. The growing demand of various types of image sensors in consumer electronics such as smartphone, laptops, and others. Moreover, proliferation of image sensing technologies in automotive sector further propels the demand of image sensors. On the basis of application the market is further segregated into consumer electronics, automotive, industrial, and others.

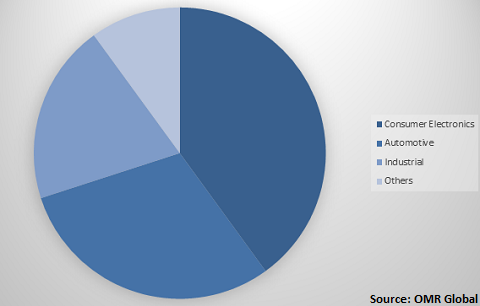

Global Electronic Sensors Market Share by application, 2019(%)

Global electronic sensors market to be driven by consumer electronics

Among application, the consumer electronics held a considerable share in the market owing to the significant rise in the application of various types of sensors in consumer electronics products such as smartphone, laptops, wearable devices and other consumer electronics products. Along with smartphone, the electronic sensors such as image sensors find their significant application in HD camcorders. Media and journalism can be considered as a major sector that offers growth to the HD camcorders industry. Moreover, in the recent past, the trend of video recording in festivals, weddings, birthday celebration have increased. This is backed by the increasing trend of sharing videos and pictures on social media. Collectively, these factors have increased the market of HD camcorders in the recent few years, which in turn, have augmented the demand for image sensors. The various electronic sensors such as image sensors are particularly used in camcorders to record better HD resolution and fast-moving activity, and thus these sensors are found in the majority of IP security cameras.

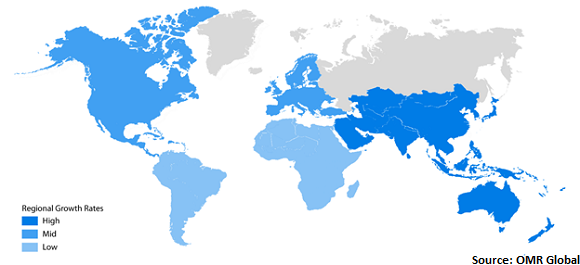

Regional Outlook

Geographically, the global Electronic Sensors market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. North America is projected to hold significant growth in the global electronic sensors market. The market is mainly driven due to growing smartphone penetration and significant adoption of sensors in automotive and industrial applications. According to our world in data, in the US smartphone penetration was about 68% in 2015. The smartphone penetration in 2019 increased to 81% in 2015 that further provides ample opportunity to the market. The automotive sector is another industry that has been deploying sensor technology in autonomous vehicles.

Global Electronic Sensors Market Growth, by Region 2020-2026

Asia-Pacific to hold a considerable share in the global electronic sensors market

Geographically, Asia-Pacific is projected to hold a significant market share in the global Electronic Sensors market. The market is mainly driven by the increasing consumer electronics industry in the region, increasing smartphone sales, increasing trend of the electric vehicle, increasing industrial sensor products. The major countries which will have a significant market share during the forecast period are India, China, and Japan. China is the largest consumer electronics industry in terms of the user followed by India. Apart from those nations, South Korea, Australia, Thailand, and Indonesia will play a major contributor to the market. According to the International Trade Union Federation (ITUF), China is the largest producer of the world’s electronic and electronic components across the globe. Furthermore, along with the high customer base in China, the country is exporting a larger number of smartphone across the globe. China has a significant market share in almost all major economies such as India, UK and so on. Due to this, several companies and research institutes are investing a significant portion of resources in the R&D program in advance electronic technology.

Market Players Outlook

The key players in the Electronic Sensors market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Sony Corp., Samsung Electronics Co., Ltd., STMicroelectronics International N.V., NXP Semiconductors N.V., Infineon Technologies AG and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Electronic Sensors market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Sony Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Samsung Electronics Co., Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. STMicroelectronics International N.V.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. NXP Semiconductors N.V.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Infineon Technologies AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Electronic Sensors Market by Type

5.1.1. Image Sensor

5.1.2. Temperature Sensor

5.1.3. Pressure Sensor

5.1.4. Motion Sensor

5.1.5. Biometric Sensor

5.1.6. Others(Proximity Sensors)

5.2. Global Electronic Sensors Market by Application

5.2.1. Consumer Electronics

5.2.2. Automotive

5.2.3. Industrial

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Airy3D Inc.

7.2. AMS AG

7.3. Canon, Inc.

7.4. CMOS Sensor, Inc.

7.5. Infineon Technologies AG

7.6. Hamamatsu Photonics K.K

7.7. Himax Technologies, Inc.

7.8. Murata Manufacturing Co., Ltd.

7.9. NXP Semiconductors N.V.

7.10. OmniVision Technologies, Inc.

7.11. OMRON Corp.

7.12. Panasonic Corp.

7.13. Robert Bosch GmbH

7.14. Sony Corp.

7.15. Samsung Electronics Co., Ltd.

7.16. STMicroelectronics International N.V.

7.17. Synaptics Inc.

7.18. Semiconductor Components Industries, LLC

7.19. TE Connectivity Ltd.

7.20. Teledyne Judson Technologies

1. GLOBAL ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL IMAGE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL MOTION SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL BIOMETRIC SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER ELECTRONIC SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

9. GLOBAL ELECTRONIC SENSORS IN CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ELECTRONIC SENSORS IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL ELECTRONIC SENSORS IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL ELECTRONIC SENSORS IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. NORTH AMERICAN ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. EUROPEAN ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. EUROPEAN ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

23. REST OF THE WORLD ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

24. REST OF THE WORLD ELECTRONIC SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL ELECTRONIC SENSORS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL ELECTRONIC SENSORS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL ELECTRONIC SENSORS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ELECTRONIC SENSORS MARKET SIZE, 2019-2026 ($ MILLION)