Electronic Warfare Market

Global Electronic Warfare Market Size, Share & Trends Analysis Report by Capability (Electronic Attack, Electronic Protection, and Electronic Support), and by Platform (Air, Sea, Land, and Space) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global electronic warfare market is anticipated to grow at a considerable CAGR of 4.9% during the forecast period. One of the key factors that are fueling market growth includes the growing defense budgets of developed and developing countries. Nations such as the US, India, China, the UK, and others across the globe have been raising their national defense budget as tensions rise on borders between multiple countries such as China, India, the US, Russia, and others. For instance, in February 2022, Russia invaded Ukraine which caused more than 7.7 million Ukrainians escaping the nation, and a third of the population of the country displaced. Such incidences have influenced the defense budget of multiple nations which has contributed to the growth of the electronic warfare market. For instance, in March 2022, China increased its annual defense budget by 7.1% to reach $230 billion.

Segmental Outlook

The global electronic warfare market is segmented based on capability and platform. Based on the capability, the market is segmented into electronic attack, electronic protection, and electronic support. Based on the platform, the market is sub-segmented into air, sea, land, and space. The above-mentioned segments can be customized as per the requirements. Based on capability, the electronic support segment is anticipated to grow significantly in the market owing to the rising necessity for cutting-edge information gathering and communication systems while based on platform, the air segment is anticipated to grow significantly during the forecast period owing to the rising investments in on-air military equipment across the globe.

The Electronic Support Segment is Anticipated to Grow Considerably Over the Forecast Period

Based on capability, the electronic support segment is anticipated to grow significantly in the market during the forecast period owing to the rising necessity for gathering and communicating cutting-edge information systems on the frontline. These systems include intelligence, surveillance, target acquisition, and reconnaissance (ISTAR), intelligence, surveillance, and reconnaissance (ISR), signals intelligence (SIGINT) systems, and others that recognize and target threats are anticipated to record the significant demand. These systems can assist in attack or protect from countering the enemy’s attack. Moreover, the use of military robots such as unmanned sea vehicles and unmanned aerial vehicles (UAVs), with the SIGINT and ISTAR systems, has increased in the past few years. As a result of which, there is a significant increase in collaborations between nations and market players to fulfilling the demands. For instance, in June 2021, Patria signed an agreement for the delivery of Patria’s ARIS-E Electronic Support Measures (ESM) system to a European customer. Patria ARIS-E is an ESM system applicable for identifying, intercepting, and geolocating radioemitters without being detected.

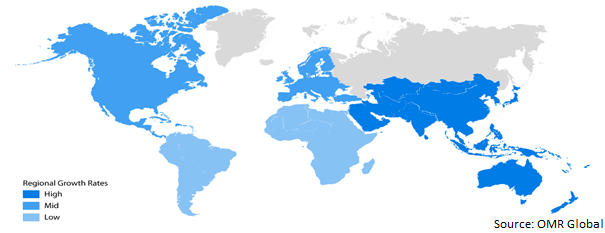

Regional Outlooks

The global electronic warfare market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Asia-Pacific region is anticipated to grow at the fastest rate in the market owing to the high tension between the countries in the region while North America is anticipated to grow significantly during the forecast period owing to enlarged investments in electronic warfare technologies by countries such as the US in the region.

Global Electronic Warfare Market Growth, by Region 2022-2028

The Asia-Pacific Region Anticipated to Grow Fastest in the Global Electronic Warfare Market

Based on region, the Asia-Pacific region is anticipated to grow at the fastest rate in the market during the forecast period owing to the high tension between the countries in the region over border distribution between countries such as China, India, Pakistan, and others. These countries have been battling over the borderline for years. For instance, in May 2020, Chinese and Indian troops battled over the boundary of disputed areas. Such instance has been a rising military budget in multiple countries of the region, which has also contributed to the demand for electronic warfare systems significantly over the past few years and is anticipating future potential growth. As per SIPRI, India, and China were among the top three military payors in 2021, together with other countries accounting for 62% of global military expenditure. Moreover, in 2021, only China’s military budget reached $293 billion, which is anticipated for driving the procurement and development of electronic warfare systems. Many other countries in the region are also focusing on the enhancement of their EW capabilities. For instance, in March 2021, the Australian Department of Defense (DoD) shaped a strategic partnership with internal universities for establishing a Center of Expertise for electronic warfare systems. In the upcoming 5 years, the DoD and Flinders University planned together for investing a total of $3.8 million into the development of the systems.

Market Players Outlook

The major companies serving the global electronic warfare market include BAE Systems, Inc., L3Harris Technologies, Inc., Lockheed Martin Corp., Northrop Grumman, Raytheon Technologies Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2022, The UK, the US, and Australia signed a contract for cooperating on electronic warfare and hypersonic weapons capabilities. The agreement set up followed the AUKUS defense alliance in September 2021, which planned at improving cooperation in military capabilities among these countries.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electronic warfare market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. BAE Systems, Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. L3Harris Technologies, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Lockheed Martin Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Northrop Grumman Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Raytheon Technologies Corp.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Electronic Warfare Market by Capability

4.1.1. Electronic Attack

4.1.2. Electronic Protection

4.1.3. Electronic Support

4.2. Global Electronic Warfare Market by Platform

4.2.1. Air

4.2.2. Sea

4.2.3. Land

4.2.4. Space

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ASELSAN A.?.

6.2. Elbit Systems Ltd.

6.3. General Dynamics Mission Systems

6.4. HENSOLDT AG

6.5. Israel Aerospace Industries Ltd.

6.6. Leonardo S.p.A.

6.7. Saab Group

6.8. Thales Group

1. GLOBAL ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY CAPABILITY, 2021-2028 ($ MILLION)

2. GLOBAL ELECTRONIC ATTACK WARFARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ELECTRONIC PROTECTION WARFARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ELECTRONIC SUPPORT WARFARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

6. GLOBAL AIR ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SEA ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LAND ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SPACE ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY CAPABILITY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

14. EUROPEAN ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY CAPABILITY, 2021-2028 ($ MILLION)

16. EUROPEAN ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY CAPABILITY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

20. REST OF THE WORLD ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY CAPABILITY, 2021-2028 ($ MILLION)

22. REST OF THE WORLD ELECTRONIC WARFARE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

1. GLOBAL ELECTRONIC WARFARE MARKET SHARE BY CAPABILITY, 2021 VS 2028 (%)

2. GLOBAL ELECTRONIC ATTACK WARFARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ELECTRONIC PROTECTION WARFARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL ELECTRONIC SUPPORT WARFARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL ELECTRONIC WARFARE MARKET SHARE BY PLATFORM, 2021 VS 2028 (%)

6. GLOBAL AIR ELECTRONIC WARFARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL SEA ELECTRONIC WARFARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL LAND ELECTRONIC WARFARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL SPACE ELECTRONIC WARFARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL ELECTRONIC WARFARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. US ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

13. UK ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD ELECTRONIC WARFARE MARKET SIZE, 2021-2028 ($ MILLION)