Electrophoresis Market

Electrophoresis Market Size, Share & Trends Analysis Report by Product (Electrophoresis Reagents and Electrophoresis Systems), by Application (Diagnostic Applications and Research Applications), and by End-Use (Academic Institutions, Hospitals & Diagnostic Centres, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global electrophoresis market is anticipated to grow at a significant CAGR of 6.0% during the forecast period. The rising incidence of cancer, infectious diseases, and genetic disorders, as well as increased funding for genomic, proteomic, and electrophoresis research, the increasing number of industry-academic research collaborations, the growing use of capillary electrophoresis with mass spectroscopy, the increasing use of next-generation sequencing, and the increase in the number of clinical, forensic, and research laboratories, are all factors driving the electrophoresis market. For instance, according to the Globocan 2020 report, the US recorded an estimated 2,281,658 new cancer cases in 2020, with almost 612,390 mortalities. Breast cancer (253,465), lung cancer (227,875), prostate cancer (209,512), and colon cancer (101,809) were the most frequent malignancies in the US in 2020. Furthermore, the International Agency for Research on Cancer (IARC) predicts that by 2040, the global burden of cancer would have increased to 27.5 million new cancer cases and 16.3 million mortalities.

Impact of COVID-19 Pandemic on Global Electrophoresis Market

The outbreak of one of the worst diseases in history, coronavirus has taken place – affecting 219 countries and territories, over 96 million people, and more than 2 million mortalities till January 2021. The COVID-19 pandemic is expected to affect negatively the global economy over a few future years. However, the US along with China are among the world’s largest economies with a significant number of COVID-19 infected cases. The impact of COVID-19 on the largest economies has stalled the world’s economic growth. Since, the first case of COVID-19, most economies across the globe have enforced the lockdown. The pandemic has positively affected the global electrophoresis market. Electrophoresis is a technique for physically separating macromolecules such as RNA, nucleic acid fragments, and proteins based on their molecular size and electric charge. For efficient analytical separation of macromolecules, researchers choose gel electrophoresis and capillary electrophoresis techniques. In the development of DNA analysis methods, capillary electrophoresis is crucial. It's the ideal option for DNA analysis procedures such as sequencing, scaling, and aptamer discovery, as well as affinity investigations.

Segmental Outlook

The global electrophoresis market has been segmented based on product, application, and end-user. The global electrophoresis market by product includes electrophoresis reagents and electrophoresis systems. Based on electrophoresis systems, the market is further segmented into gel electrophoresis systems and capillary electrophoresis. Electrophoresis technology has varied products due to the successful outcome of R&D and the huge demand created by proteomics and genomics. The global electrophoresis market by application includes diagnostic, and research applications. The pivotal factors for the modest growth of the global electrophoresis market include the significant development and progress in R&D in DNA and RNA analysis techniques. Development in proteomics and genomics has boosted the electrophoresis market and created considerable scope for the new entrant and existing players in the electrophoresis market. Based on end-use, the market is segmented into academic institutions, hospitals & diagnostic centers, among others.

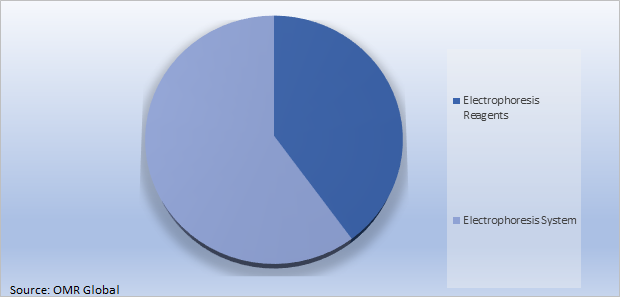

Global Electrophoresis Market Share by Product, 2021 (%)

The Electrophoresis Reagents Segment is Expected to Hold a Prominent Share in the Global Electrophoresis Market

The electrophoresis reagents segment is expected to hold a prominent share in the global electrophoresis market. This can be attributed to the increased usage of consumables in the disciplines of proteomics, genomics, drug discovery, antibody generation, and personalized medicine, among others, due to the rise in electrophoresis. In addition, rising demand for 2D electrophoresis for protein separation in a variety of applications such as drug development, protein mapping, and chronic disease diagnostics, as well as expanding application areas for capillary electrophoresis, are driving the market growth.

Regional Outlooks

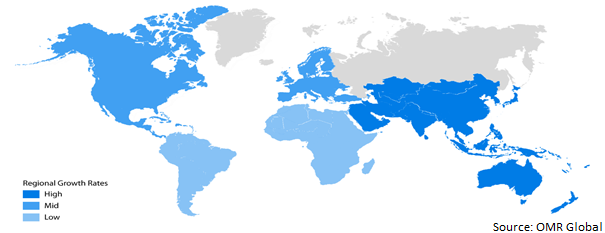

The global electrophoresis market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North American region is anticipated to be the fastest-growing region in the electrophoresis market owing to due to the increasing adoption of electrophoresis products, applications, and end-user segments.

Global Electrophoresis Market Growth, by Region 2022-2028

The Asia-Pacific Region is Anticipated to hold the Prominent Share in the Global Electrophoresis Market

The Asia-Pacific region is anticipated to hold a prominent share of the electrophoresis market owing to the growing proteomics and genomics research, increased investments by pharmaceutical and biotechnology companies, increased awareness about personalized therapeutics, and increased research activities in the field of mAbs-based therapeutics. Further, the presence of market players and strategic activities performed by them in the region is contributing to the growth of the market. For instance, in September 2020, Hitachi High-Tech Corp. stated that local agencies will sell the Hitachi DS3000 compact capillary electrophoresis (CE) sequencer in Japan, China, South Korea, and Taiwan. Hitachi High-Tech Corporation and Hitachi High-Tech Corp. collaborated on the development of the Hitachi DS3000.

Market Players Outlook

The major companies serving the global electrophoresis market include Thermofisher Scientific, Agilent Technologies, PerkinElmer Inc., Danaher Corp., GE healthcare, and CBS Scientific Co. Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2020, miniPCR bio, a manufacturer of scientific equipment for educators and researchers, announced the launch of the GELATO, an integrated DNA analysis device. GELATO combines gel electrophoresis and transillumination technologies in a single, compact apparatus, enabling simultaneous nucleic acid separation and visualization.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electrophoresis market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Electrophoresis Market

• Recovery Scenario of Global Electrophoresis Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Electrophoresis Market by Product

4.1.1. Electrophoresis Reagents

4.1.2. Electrophoresis Systems

4.1.2.1. Gel Electrophoresis Systems

4.1.2.2. Capillary Electrophoresis

4.2. Global Electrophoresis Market by Application

4.2.1. Diagnostic Applications

4.2.2. Research Applications

4.3. Global Electrophoresis Market by End-Use

4.3.1. Academic Institutions

4.3.2. Hospitals & Diagnostic Centres

4.3.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Thermo Fisher Scientific, Inc.

6.2. Agilent Technologies, Inc.

6.3. COLE PARMER

6.4. Cleaver Scientific

6.5. CBS Scientific Co., Inc.

6.6. BIO-RAD Laboratories, Inc.

6.7. GE Healthcare

6.8. Danaher Corp.

6.9. Harvard Bioscience, Inc.

6.10. Helena Laboratories

6.11. Perkinelmer, Inc.

6.12. QIAGEN N.V.

6.13. SIGMA-ALDRICH Corp.

6.14. Shimadzu Corp.

1. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL ELECTROPHORESIS REAGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ELECTROPHORESIS SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL GEL ELECTROPHORESIS SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL CAPILLARY ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL ELECTROPHORESIS FOR DIAGNOSTIC APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ELECTROPHORESIS FOR RESEARCH APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

10. GLOBAL ELECTROPHORESIS IN ACADEMIC INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL ELECTROPHORESIS IN HOSPITALS & DIAGNOSTIC CENTRES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL ELECTROPHORESIS IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

16. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

17. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

18. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

20. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

28. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

29. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ELECTROPHORESIS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ELECTROPHORESIS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL ELECTROPHORESIS MARKET, 2022-2028 (%)

4. GLOBAL ELECTROPHORESIS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

5. GLOBAL ELECTROPHORESIS REAGENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL ELECTROPHORESIS SYSTEMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL GEL ELECTROPHORESIS SYSTEMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL CAPILLARY ELECTROPHORESIS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL ELECTROPHORESIS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL ELECTROPHORESIS FOR DIAGNOSTIC APPLICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL ELECTROPHORESIS FOR RESEARCH APPLICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL ELECTROPHORESIS MARKET SHARE BY END-USE, 2021 VS 2028 (%)

13. GLOBAL ELECTROPHORESIS IN ACADEMIC INSTITUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL ELECTROPHORESIS IN HOSPITALS AND DIAGNOSTIC CENTERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL ELECTROPHORESIS IN OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL ELECTROPHORESIS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

19. UK ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)