Electrophysiology Catheters Market

Global Electrophysiology Catheters Market Size, Share & Trends Analysis Report by Product Type (Diagnostic Catheters and Ablation Catheters), By End-user (Hospitals & Clinics and Ambulatory Surgical Centers) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for electrophysiology catheters is projected to have considerable CAGR of around 6.1% during the forecast period. The market is mainly driven due to growing prevalence of CVD related diseases such as cardiac arrhythmias and growing trend for minimally invasive surgical methods. Atrial fibrillation (AFib) is the most common cause of heart arrhythmia. Under the condition, the heart beats very slowly, very fast or in an irregular way. According to the Institute for Health Metrics and Evaluation, the value for the prevalence of AF in the year 2013 was 33.6 million peoples, which increased up to 37.5 million in 2017. With the significant rise in geriatric population across the globe, this number is expected to increase. The two major strategies used for the management of AFib include rhythm control and rate control. Electrophysiology devices, ablation catheters and diagnostic catheters have a significant application to diagnose abnormal heart rhythms and treatment of the condition that further contribute in the market. Additionally, significant advances in electrophysiology technology coupled with new ablation tools to advance treatment of AFib, new implantable rhythm management devices and small diagnostic monitoring systems are propelling the demand of electrophysiology catheters.

Segmental Outlook

The global electrophysiology catheters market is segmented based on product type and end-user. Based on the product type, the market is further classified into diagnostic catheters and ablations catheters. The diagnostic catheters market is projected to grow at a significant CAGR during the forecast period. Diagnostic electrophysiology catheters are primarily used for temporary intra-cardiac sensing, recording, stimulation, and mapping. Diagnostic catheters are majorly used along with cardiac ablation procedure; however, they can also be used during procedures that are not involving ablation such as pacemaker or CRT device implantation. The growth of the segment is attributed the rising number of ablation procedures performed across the globe. Angiography catheters are one such type of diagnostic catheter which are used in electrophysiology procedures. On the basis of end-user the market is further segregated into hospitals & clinics and ambulatory surgical centers.

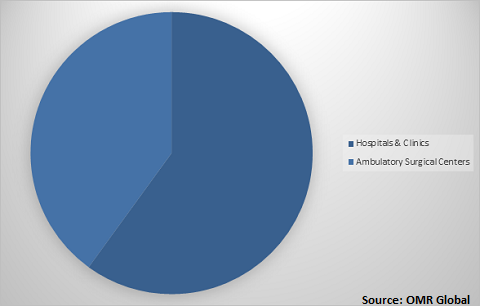

Global Electrophysiology Catheters Market Share by End-User, 2019(%)

Global electrophysiology catheters market to be driven by hospitals & clinics

Among end-user, the hospitals & clinics segment held a considerable share in the market. The segmental growth is attributed to the increasing prevalence of heart failure and sudden cardiac arrest cases that has resulted into an increasing number of hospitalizations. In addition, interventional cardiologists at the hospital has adopted technologically advanced electrophysiology devices that has further augmented the segmental growth of the market. However, ambulatory surgical centers has considerable market growth in the electrophysiology catheters market. With the continuously growing patient care transition to the outpatient setting the Ambulatory surgical centers have become popular has high quality and cost-effective alternative to the hospitals. The type and number of services provided in the ambulatory surgical centers setting have prominently expanded. The scope of the procedure has a diverse range of services through several specialties such as cardiology.

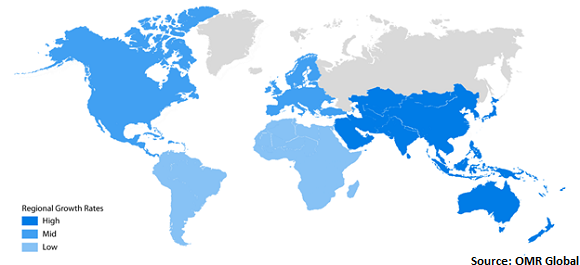

Regional Outlook

Geographically, the global electrophysiology catheters market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market growth is attributed to the significant adoption of minimal invasive surgical technology in economies such as China, Japan, India, South Korea, Thailand, and Australia.The penetration of atrial fibrillation ablation is moderate in the region and expected to grow substantially over the forecast period. With advancing success rate enabled by new technologies, electrophysiology catheters market is projected to record significant growth rate in these countries.

Global electrophysiology catheters Market Growth, by Region 2020-2026

North America to hold a considerable share in the global electrophysiology catheters market

Geographically, North America is projected to hold a significant market share in the global electrophysiology catheters market. Major economies which are anticipated to contribute to the North America electrophysiology catheters market are the US and Canada. Presence of major market players such as Boston Scientific Corporation and Medtronic plc, among more involved in electrophysiology, increasing prevalence of cardiac arrhythmias, and favorable mediclaim reimbursement scenarios are some of the major factors contributing to growth of the market in the region. Favorable initiatives by government and private organizations have also caused a surge in the increasing implementation of electrophysiology devices in hospitals, clinical, and research centers, among more. Numerous summits including Cardiometabolic Health and Diabetes Summit and more have also been held over the years in the US with a focus on helping people manage heart disease and arrhythmia by controlling diabetes, pre-diabetes and metabolic syndrome.

Market Players Outlook

The key players in the electrophysiology catheters market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Abbott Laboratories, Boston Scientific Corp., Johnson & Johnson Services, Inc., Medtronic PLC, Stryker Corp., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electrophysiology catheters market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Boston Scientific Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Johnson & Johnson Services, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Medtronic PLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Stryker Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Electrophysiology Catheters Market by Product Type

5.1.1. Diagnostic Catheters

5.1.2. Ablation Catheters

5.2. Global Electrophysiology Catheters Market by End-User

5.2.1. Hospitals & Clinics

5.2.2. Ambulatory Surgical Centers

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. ADInstruments Pty Ltd.

7.3. Biomerics, LLC

7.4. Biotronik, Inc.

7.5. Boston Scientific Corp.

7.6. CathRx Ltd.

7.7. EPIMED International, Inc.

7.8. Integer holdings corp.

7.9. Johnson & Johnson Services, Inc.

7.10. Japan Lifeline Co., Ltd.

7.11. Medtronic plc

7.12. MicroPort Scientific Corp.

7.13. Millar, Inc.

7.14. Nihon Kohden Corp.

7.15. Stryker Corp.

7.16. Smiths Interconnect Group Ltd.

7.17. Transonic Systems, Inc.

7.18. TZ Medical Inc.

7.19. The Standard

7.20. Teleflex Inc.

1. GLOBAL ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL DIAGNOSTIC CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ABLATION CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

5. GLOBAL ELECTROPHYSIOLOGY CATHETERS IN HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ELECTROPHYSIOLOGY CATHETERS IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

10. NORTH AMERICAN ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

11. EUROPEAN ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

13. EUROPEAN ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

17. REST OF THE WORLD ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD ELECTROPHYSIOLOGY CATHETERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL ELECTROPHYSIOLOGY CATHETERS MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL ELECTROPHYSIOLOGY CATHETERS MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL ELECTROPHYSIOLOGY CATHETERS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ELECTROPHYSIOLOGY CATHETERS MARKET SIZE, 2019-2026 ($ MILLION)