Electrophysiology Devices Market

Global Electrophysiology Devices Market Size, Share & Trends Analysis Report by Product (Monitoring Devices, Laboratory Devices, Treatment Device, Catheter), By End-users (Hospitals & Clinics, and Ambulatory Surgical Centres) Forecast Period 2021-2027 Update Available - Forecast 2025-2031

The global electrophysiology devices market is anticipated to grow at a CAGR of 8.3% during the forecast period. Electrophysiology is considered a branch of science, related to electric activity in the human body. The electrophysiological devices are capable of detecting an abnormality in electrical impulses by tissues or cells in the human body. The advancement in electrophysiology technologies eases the diagnosis and treatment of conditions such as atrial fibrillation and cardiac arrhythmias.

The factors contributing to the growth of the electrophysiology devices market include increasing demand for catheter ablation procedures, growing incidences of arrhythmia, and high adoption of cardiovascular surgeries in emerging countries. A large portion of young adults suffers from arrhythmias due to an underlying congenital heart defect or surgical treatment. The patients with arrhythmias can be managed through device therapy, pharmacological treatment, and catheter ablation. The advancement in new technologies such as 3D mapping systems into clinical practice enables treating patients with abnormal cardiac anatomy and physiology. The device therapies enable to maintain chronotropic competence and AV conduction, improvise hemodynamics by cardiac resynchronization, and prevent unexpected sudden fatalities.

However, the lack of skilled electrophysiologists is considered as the major restraint for the growth of the market. Additionally, the high cost of electrophysiology devices and inadequate reimbursement may also restrain the growth of the market. Though emerging markets in cardiac mapping systems due to rising awareness about cardiovascular diseases, raising the number of patients, and improvement in healthcare infrastructure bring upon an opportunity for growth in the market.

Segmental Outlook

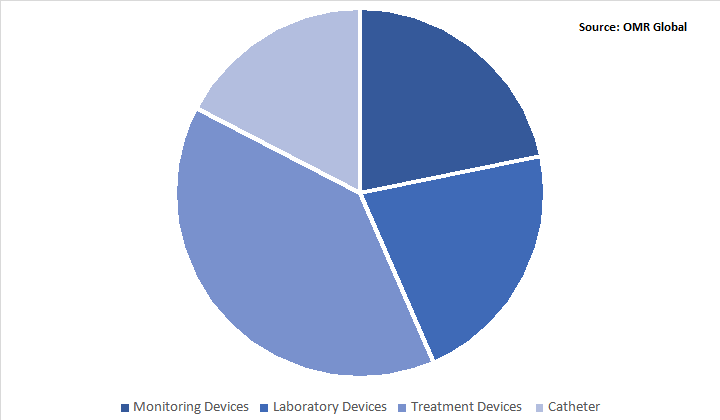

The global electrophysiology devices market is segmented based on product and end-user. Based on the product the market is segmented into monitoring devices, laboratory devices, treatment devices, and catheters. Each segment is detailed further segmented such as monitoring devices is sub-segmented into electrocardiography, electrocorticography, electrooculography, and electrophysiology. The laboratory devices segment is sub-segmented into recording generator, x-ray system, 3D mapping system. Electrophysiology catheter is further divided into ablation catheters, diagnostic catheter, ultrasound catheter, and advanced mapping catheter. Based on the end-users, the market is segmented into hospitals and clinics, and ambulatory surgical centers.

Global Electrophysiology Devices Market Share by Product, 2020 (%)

Catheters segment is anticipated to grow due to increasing treatment of atrial fibrillation

Catheters are estimated to show significant growth in the global market during the forecast period. The factors being increase use of the ablation process in the treatment of atrial fibrillation. Ablation catheters are the process that uses energy which makes small scars in human heart tissue that prevents abnormal electrical signals to move through the heart. It aids in treating various types of arrhythmias, irregular heartbeats which are not possible to control with medicines, sudden cardiac arrest, atrial fibrillation, and others. According to Harvard Health Publishing, the success rate of ablation catheters is nearly 75%, where sometimes patients go for a second procedure that increases the growth rate up to 90%.

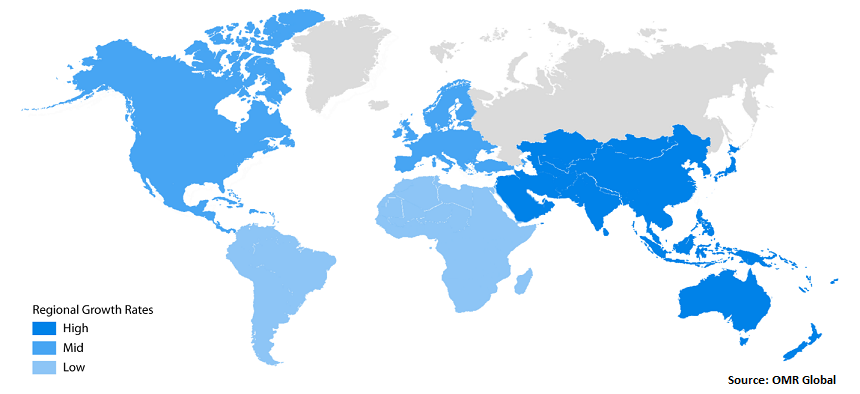

Regional Outlooks

The global electrophysiology devices market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold a major market in the electrophysiology devices market. It is attributed to well-developed advanced healthcare facilities and an increasing number of arrhythmia and heart failure cases in the region. For instance, in 2018 almost 379,800 heart failure was the reason for mortality in the US. The availability of favorable reimbursement policies and developed healthcare facilities also drives the market growth.

Global Electrophysiology Devices Market Growth, by Region 2021-2027

Asia-Pacific will have considerable shares in the global Electrophysiology Devices Market

Asia-Pacific is considered as the growing market during the forecast period. The growing cardiovascular disease even in the young population and need for the effective treatment are driving the region's growth. Moreover, improvising healthcare infrastructure enables the expansion of the market in Asia-Pacific. Further improving healthcare infrastructure, rising healthcare expenditure, and rising disposable income in emerging economies such as China, India, and ASEAN countries to propel the growth of the market in the region.

Market Players Outlook

The key players of the electrophysiology devices market GE Healthcare, Abbott Laboratories, Biosense Webster, Inc., Boston Scientific Corp., Johnson & Johnson Services, Inc., and Medtronic PLC, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers, and acquisitions, collaborations, and new product launches, to stay competitive in the market.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Electrophysiology Devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Boston Scientific Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Koninklijke Philips N.V.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Siemens Healthineers AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Medtronic PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Electrophysiology Devices market by Products

5.1.1. Electrophysiology Monitoring Devices

5.1.1.1. Electrocardiography

5.1.1.2. Electrocorticography

5.1.1.3. Electrooculography

5.1.2. Electrophysiology Laboratory Devices

5.1.2.1. Recording Generator

5.1.2.2. X-Ray System

5.1.2.3. 3d Mapping System

5.1.3. Electrophysiology Treatment Devices

5.1.3.1. Implantable Cardioverter Defibrillators

5.1.3.2. Cardiac Resynchronization Therapy Devices

5.1.3.3. Pacemaker

5.1.4. Electrophysiology Catheter

5.1.4.1. Ablation Catheters

5.1.4.2. Diagnostic Catheter

5.1.4.3. Ultrasound Catheter

5.1.4.4. Advanced Mapping Catheters

5.2. Global Electrophysiology Devices market by End users

5.2.1. Hospitals and Clinics

5.2.2. Ambulatory Surgical Centres

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Biomerics LLC

7.2. Biosense Webster Inc.

7.3. Biotronik Inc.

7.4. Catheter Precision Inc.

7.5. CathVisionApS

7.6. EPIMED International, Inc.

7.7. General Healthcare Resources, Inc.

7.8. Integer Holdings Corp.

7.9. Japan Lifeline Co., Ltd.

7.10. Johnson & Johnson Service, Inc.

7.11. Microport Scientific Corp.

7.12. Millar, Inc.

7.13. Molecular Devices, LLC

7.14. Nihon Kohden Corp.

7.15. Rhythmlink International, LLC

7.16. Stryker’s Corp.

7.17. Transonic Systems, Inc.

7.18. TZ Medical Inc.

1. GLOBAL ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

2. GLOBAL ELECTROPHYSIOLOGY MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL ELECTROPHYSIOLOGY MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

4. GLOBAL ELECTROPHYSIOLOGY LABORATORY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL ELECTROPHYSIOLOGY LABORATORY DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

6. GLOBAL ELECTROPHYSIOLOGY TREATMENT DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL ELECTROPHYSIOLOGY TREATMENT DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

8. GLOBAL ELECTROPHYSIOLOGY CATHETER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL ELECTROPHYSIOLOGY CATHETER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

10. GLOBAL ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END USERS, 2020-2027 ($ MILLION)

11. GLOBAL HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL AMBULATORY SURGICAL CENTRES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. NORTH AMERICAN ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

15. NORTH AMERICAN ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

16. EUROPEAN ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. EUROPEAN ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

18. EUROPEAN ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. ASIA PACIFIC ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

21. ASIA PACIFIC ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

22. REST OF THE WORLD ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. REST OF THE WORLD ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

24. REST OF THE WORLD ELECTROPHYSIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

1. GLOBAL ELECTROPHYSIOLOGY DEVICES MARKET SHARE BY PRODUCTS, 2020 VS 2027 (%)

2. GLOBAL ELECTROPHYSIOLOGY DEVICES MARKET SHARE BY END USERS, 2020 VS 2027 (%)

3. GLOBAL ELECTROPHYSIOLOGY DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

4. GLOBAL ELECTROPHYSIOLOGY MONITORING DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. GLOBAL ELECTROPHYSIOLOGY LABORATORY DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL ELECTROPHYSIOLOGY TREATMENT DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL ELECTROPHYSIOLOGY CATHETER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL ELECTROCARDIOGRAPHY MARKET SIZE, 2020-2027($ MILLION)

9. GLOBAL ELECTROCORTICOGRAPHY MARKET SIZE, 2020-2027($ MILLION)

10. GLOBAL ELECTROOCULOGRAPHY MARKET SIZE, 2020-2027($ MILLION)

11. GLOBAL RECORDING GENERATOR MARKET SIZE, 2020-2027($ MILLION)

12. GLOBAL X-RAY SYSTEM MARKET SIZE, 2020-2027($ MILLION)

13. GLOBAL 3D MAPPING SYSTEM MARKET SIZE, 2020-2027($ MILLION)

14. GLOBAL IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET SIZE, 2020-2027($ MILLION)

15. GLOBAL CARDIAC RESYNCHRONIZATION THERAPY DEVICES MARKET SIZE, 2020-2027($ MILLION)

16. GLOBAL PACEMAKER MARKET SIZE, 2020-2027($ MILLION)

17. GLOBAL ABLATION CATHETERS MARKET SIZE, 2020-2027($ MILLION)

18. GLOBAL DIAGNOSTIC CATHETER MARKET SIZE, 2020-2027($ MILLION)

19. GLOBAL ULTRASOUND CATHETER MARKET SIZE, 2020-2027($ MILLION)

20. GLOBAL ADVANCED MAPPING CATHETERS MARKET SIZE, 2020-2027($ MILLION)

21. GLOBAL HOSPITALS AND CLINICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

22. GLOBAL AMBULATORY SURGICAL CENTRES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

23. US ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

24. CANADA ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

25. UK ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

26. FRANCE ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

27. GERMANY ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

28. ITALY ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

29. SPAIN ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

30. RUSSIA ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

31. REST OF EUROPE ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

32. INDIA ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

33. CHINA ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

34. JAPAN ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

35. SOUTH KOREA ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

36. REST OF ASIA-PACIFIC ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

37. LATIN AMERICA ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

38. MIDDLE EAST AND AFRICA ELECTROPHYSIOLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)