Embolic Protection Devices Market

Global Embolic Protection Devices Market Size, Share & Trends Analysis Report by Product (Filter Devices and Occlusion Devices), by Application (Cardiovascular & Peripheral and Neurovascular), and by End-user (Ambulatory Surgery Centers, Freestanding CATH Labs, Hospitals, and Specialty Cardiac Centers) Forecast Period (2021-2027) Update Available - Forecast 2025-2035

The embolic protection devices market is projected to propagate at a solid CAGR of 8.0% during the forecast period (2021-2027). Embolic protection devices (EPDs) are mainly used during percutaneous cardiac procedures to reduce the number of complications caused by debris being released into the bloodstream and lead to blockages in smaller vessels. EPDs are potentially designed to capture and remove debris that may be dislodged during procedures. Rapid deployment of EPDs and the execution of percutaneous cardiac procedures to treat various cardiovascular and neurovascular diseases by health care professionals (HCPs) is essential for improving patient outcomes during the procedures. Elderly patients are most likely to be at high risk of developing cardiovascular and neurovascular diseases. Therefore, the number of minimally invasive procedures to treat diseases, particularly in the rising elderly population across the globe, is influencing the higher uptake of EPDs for the prevention of stroke caused by procedural embolization.

Among all surgery techniques available for treating various heart related disorders, including CVDs, neurovascular diseases and heart valve replacements, MI (Minimally Invasive) surgical techniques are highly advanced compared to other open surgical techniques. Balloon angioplasty and stenting are the major MI treatment options for CVDs. Similarly, TAVR (Transcatheter Aortic Valve Replacement) is the most widely used MI procedure to replace a narrowed aortic valve, which fails to open properly, known as aortic stenosis. This further contributes to the growth of the global embolic protection devices market.

Segmental Outlook

The global embolic protection devices market is segmented based on product, application, and end-user. Based on product, the market is segmented into filter devices and occlusion devices. Based on application, the market is categorized into cardiovascular & peripheral and neurovascular. Based on end-user, the market is fragmented into ambulatory surgery centers, freestanding CATH labs, hospitals, and specialty cardiac centers. In 2019, the filter devices segment accounted for the largest share owing to its safe and effective clinical results for percutaneous and transcatheter surgical techniques for treating cardiovascular and neurovascular disorders. Due to its safety and efficacy, the segment is also expected to witness the highest CAGR. The majority of commercially available embolic protection devices are classified as filter devices. The primary benefit of utilizing the filter device technique over the occlusion devices is the maintenance of continuous antegrade blood flow while collecting larger debris during the procedure and avoiding myocardial ischemia (MI).

Emergence of Advanced EPDs

Despite the rapid use of embolic protection devices, the risk of stroke remains one of the biggest challenges in carotid artery stenting (CAS), mainly in the critical procedural stage of post-dilation. Latest generation devices, where an integrated embolic protection contains an angioplasty balloon and an integrated filter, coupled together to minimize the risk of strokes during embolic complications. This is expected to contribute to the growth of the global embolic protection devices market in the future.

Regional Outlook

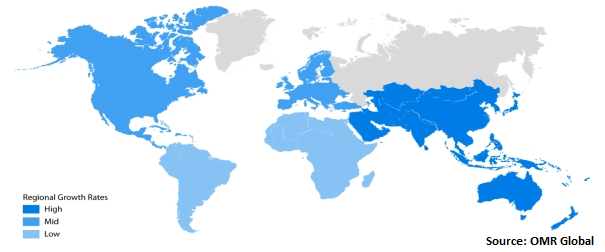

The global embolic protection devices market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America dominates the embolic protection devices market. The presence of a large proportion of the disease population, coupled with better access to treatment for embolic protection, is the primary factor for its high market share. The strong presence of key embolic protection devices vendors is also another reason for the high uptake of embolic protection devices in North America. The rise in the number of valvular heart disease and CVD patient pool, as well as the necessity to treat the disease with percutaneous and transcatheter procedures, are also expected to boost the market growth during the forecast period.

Global Embolic Protection Devices Market Growth, by Region 2021-2027

Market Players Outlook

The global embolic protection devices market is highly concentrated, with the presence of a few established players holding the majority of the market share. Vendors are offering several filter and occlusion embolic protection devices and are competing based on factors such as technology up-gradation, safety features, regulatory approvals, marketing strategies, and distribution channels. The key vendors in the market include Boston Scientific, Abbott, and Medtronic. These companies have a wide geographic footprint, diversified product portfolio, and a strong focus on product innovation, strategic mergers & acquisitions, as well as research activities.

Other prominent market players in the global embolic protection devices market include Cardinal Health, Contego Medical, InspireMD, among others. All these players are also competing in the market by offering technologically advanced EPDs. Though the market is dominated by major players, other players are also focusing on the continuous development of EPDs with advanced features such as devices with integrated protection, devices for advanced procedures such as TAVR. In addition, few investigational companies are also coming into existence with innovative products and technologies. For instance, Innovative Cardiovascular Solutions is developing the Emblok Embolic Protection System. Similarly, another emerging player, Transverse Medical, is developing a POINT-GUARD embolic protection device for cerebral protection.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global embolic protection devices market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Boston Scientific Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Cardinal Health, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Medtronic plc

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Embolic Protection Devices Industry Market by Product

5.1.1. Filter Devices

5.1.2. Occlusion Devices

5.2. Global Embolic Protection Devices Market by Application

5.2.1. Cardiovascular & Peripheral

5.2.2. Neurovascular

5.3. Global Embolic Protection Devices Market by Sales Channel

5.3.1. Ambulatory Surgery Centers

5.3.2. Freestanding CATH Labs

5.3.3. Hospitals

5.3.4. Specialty Cardiac Centers

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott

7.2. Boston Scientific Corp.

7.3. Cardinal Health, Inc.

7.4. Cardioptimus, LLC

7.5. Cardiovascular Systems, Inc.

7.6. Contego Medical, LLC

7.7. Filterlex

7.8. Innovative Cardiovascular Solutions, LLC

7.9. InspireMD Inc.

7.10. Medtronic plc

7.11. NIPRO

7.12. Protembis GmbH

7.13. Silk Road Medical

7.14. Terumo Corp.

7.15. Transverse Medical, Inc.

7.16. VENUS MEDTECH

1. GLOBAL EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

2. GLOBAL FILTER DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL OCCLUSION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

5. GLOBAL CARDIOVASCULAR & PERIPHERAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL NEUROVASCULAR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

8. GLOBAL AMBULATORY SURGERY CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL FREESTANDING CATH LABS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL SPECIALTY CARDIAC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. NORTH AMERICA EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICA EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

14. NORTH AMERICA EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

15. NORTH AMERICA EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

16. EUROPE EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. EUROPE EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

18. EUROPE EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

19. EUROPE EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

24. REST OF THE WORLD EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

25. REST OF THE WORLD EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

26. REST OF THE WORLD EMBOLIC PROTECTION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. GLOBAL EMBOLIC PROTECTION DEVICES MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

2. GLOBAL EMBOLIC PROTECTION DEVICES MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

3. GLOBAL EMBOLIC PROTECTION DEVICES MARKET SHARE BY END-USER, 2020 VS 2027 (%)

4. GLOBAL EMBOLIC PROTECTION DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. THE US EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

6. CANADA EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

7. UK EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

8. FRANCE EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

9. GERMANY EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

10. ITALY EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

11. SPAIN EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

12. ROE EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

13. CHINA EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

14. INDIA EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

15. JAPAN EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

16. SOUTH KOREA EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

17. REST OF ASIA-PACIFIC EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

18. REST OF THE WORLD EMBOLIC PROTECTION DEVICES MARKET SIZE, 2020-2027 ($ MILLION)