Emergency Shutdown Systems Market

Global Emergency Shutdown Systems Market Size, Share & Trends Analysis Report by Component (Safety Switches, Safety Sensors, Safety Valves, Actuators, Emergency Stop Devices, Safety Controllers, and Programmable Safety Systems) by Application (Oil & Gas, Pharmaceutical, Power Generation, Chemical, Food & Beverages, Metal & Mining, and Others), Forecast Period 2019-2025 Update Available - Forecast 2025-2035

The emergency shutdown systems market is anticipated to grow at 7.2% CAGR during the forecast period. The emergency shutdown system is largely deployed in the oil & gas industry, power generating sector, manufacturing industry, and various other industries. The emergency shutdown system market consists of standardized software and hardware systems. The software-based technologies have extensive safety functions that are important for personnel and machinery safety. Software-based technologies offer high flexibility for the modification and maintenance of systems. The growing demand for safety and shutdown systems in the oil & gas industry is a major factor propels the growth of the emerging shutdown systems market. This system supports in reducing the consequences of emergency conditions that include uncontrolled flooding, escape of hydrocarbons and outbreak of fire in hydrocarbon areas.

Moreover, the growing demand for devices to decrease catastrophic accidents at workstations is also expected to boost the market growth. The risk of machinery failure at the stage of production is hazardous for labors that are controlled through these systems. The increasing need for human safety in the manufacturing department of industries is fueling the use of emergency shutdown systems. The implementation of stringent government regulations related to industrial machine safety is projecting to the higher adoption of these systems for a better work environment and human safety measures.

However, less reliability of these systems limits the growth of the emergency shutdown systems market. At the time of harsh environmental conditions, these systems are not capable of securing natural gas plants. This can be overcome through developing efficient EMC-based emergency shutdown systems which enable in decreasing the source interference and improving the immunity of instruments. Wireless systems face connectivity that hampers the performance of these systems. The issue can be overcome by efficient broadband infrastructure in industries. These systems consist of input and output devices that acquire a large space in production plants, hence mat restraint adoption of emergency shutdown systems.

Segmental Outlook

The global emergency shutdown systems market is segmented on the basis of component and application. Based on component, the market is segmented into safety switches, safety sensors, safety valves, actuators, emergency stop devices, safety controllers and programmable safety systems. The programmable safety system is expected to grow at a considerable growth rate during the forecast period. It is the backbone of an entire safety system and reliable logic solvers offer fail-safe and fault-tolerant operations. They are flexible to design, highly efficient, highly reliable, highly secure and easy to install. These benefits of programmable safety systems have boosted the growth of programmable safety systems in the emergency shutdown system market.

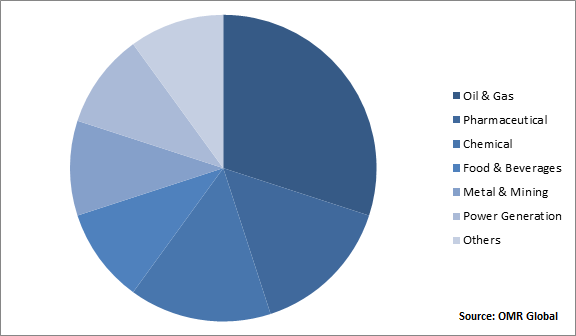

Oil & Gas will be the largest segment by Application

Based on the application, the market is segmented into oil & gas, pharmaceutical, power generation, chemical, food & beverages, metal & mining, and others. Oil & gas is anticipated to have the largest segment in the emergency shutdown systems market. The controlled emergency process enables in crude line safety, leak location detection, and leak identification. They are deployed in oil & gas refineries to shut down part systems in hazardous situations. The increasing exploration of oil & gas fields and growing investments in refineries and pipelines in various countries such as the US, Saudi, and UAE drive the growth of the emergency shutdown systems market.

Global Emergency Shutdown Systems Market Share by Application, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global emergency shutdown systems market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Schneider Electric SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. ABB, Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Honeywell International, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Siemens AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. General Electric Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Emergency Shutdown Systems Market by Component

5.1.1. Safety Switches

5.1.2. Safety Sensors

5.1.3. Safety Valves

5.1.4. Actuators

5.1.5. Emergency Stop Devices

5.1.6. Safety Controllers

5.1.7. Programmable Safety Systems

5.2. Global Emergency Shutdown Systems Market by Application

5.2.1. Oil & Gas

5.2.2. Pharmaceutical

5.2.3. Power Generation

5.2.4. Chemical

5.2.5. Food & Beverages

5.2.6. Metal & Mining

5.2.7. Others

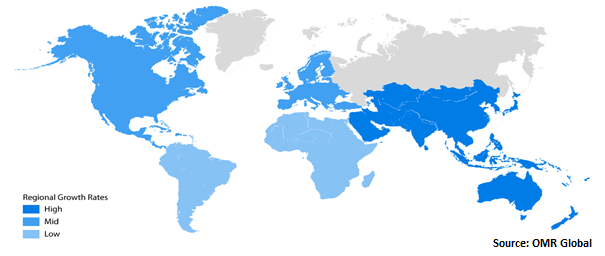

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB, Ltd.

7.2. Emerson Electric Co.

7.3. Esoteric Automation & Control Technologies

7.4. General Electric Co.

7.5. HIMA Paul Hildebrandt GmbH

7.6. Honeywell International, Inc.

7.7. IMI Norgren, Ltd.

7.8. Johnson Controls, Inc.

7.9. Kongsberg Gruppen ASA

7.10. Nidec Corp.

7.11. Proserv UK, Ltd.

7.12. Rockwell Automation

7.13. Schneider Electric SE

7.14. SELLA CONTROLS

7.15. Siemens AG

7.16. Yokogawa Electric Corp.

1. GLOBAL EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENTS, 2018-2025 ($ MILLION)

2. GLOBAL SAFETY SWITCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL SAFETY SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SAFETY VALVES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ACTUATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL EMERGENCY STOP DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL PROGRAMMABLE SAFETY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL SAFETY CONTROLLERS MARKET RESEARCH AND ANALYSIS BY PROCEDURE, 2018-2025 ($ MILLION)

9. GLOBAL EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

10. GLOBAL OIL & GAS SPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL METAL & MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. NORTH AMERICA EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

19. NORTH AMERICAN EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. EUROPE EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPE EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

22. EUROPE EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

26. REST OF THE WORLD EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

27. REST OF THE WORLD EMERGENCY SHUTDOWN SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL EMERGENCY SHUTDOWN SYSTEMS MARKET SHARE BY COMPONENT, 2018 VS 2025 (%)

2. GLOBAL EMERGENCY SHUTDOWN SYSTEMS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL EMERGENCY SHUTDOWN SYSTEMS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD EMERGENCY SHUTDOWN SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)