Employment Screening Services Market

Employment Screening Services Market Size, Share & Trends Analysis Report byType (Criminal Background Checks, Education & Employment Verification, Credit History Checks, Drug & Health Screening, and Others), by Organization Size(Small and medium enterprises, and Large enterprises) and by End-user(Healthcare Industry, IT and Telecom, Financial Services, Retail and Hospitality, Education Sector, Government Agencies, Transportation and Logistics, and Others) Forecast Period (2024-2031)

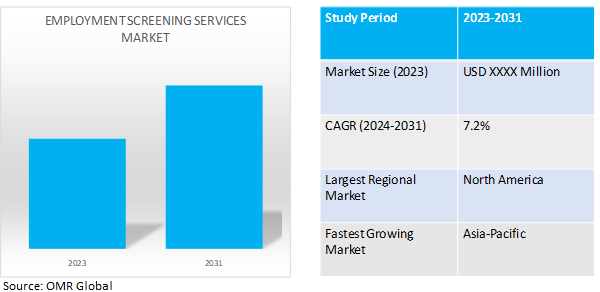

Employment screening services market is anticipated to grow at a considerable CAGR of 7.2% during the forecast period (2024-2031).Employment screening services are driven by regulatory compliance, risk mitigation, globalization, gig economy, technological advancements, security concerns, and digital transformation. Compliance with regulations such as, the Fair Credit Reporting Act and GDPR mandates background checks and verification processes. These services help businesses mitigate risks like fraud, theft, and workplace violence. Globalization has standardized screening processes across regions, leading to increased demand for international screening. The gig economy has created a need for flexible screening solutions for non-traditional employment arrangements. Advancements in technology, security measures, and digital transformation have further accelerated the adoption of screening solutions. These services contribute to higher-quality hires and improved organizational performance..

Market Dynamics

Increased demand for screening services

The demand for screening services rises in accordance with increasing immigration rates, offering organizations the ability to manage a larger candidate pool and guarantee regulatory compliance.. According to theCongressional Budget Office (CBO), in March 2024, recent immigration rates in the US have exceeded previous projections significantly. In 2019, it estimated that net immigration in 2023 across 1.0 million individuals. However, recent data suggests that net immigration in the previous year was approximately 3.3 million. These updated figures additionally indicate a faster population and labor force growth than what has been reported by the Bureau of Labor Statistics (BLS) using Census population estimates.

Technological innovation in employment screening services Technological innovation in employment screening services has increased scalability, accuracy, and accessibility through digital health platforms, mobile testing units, and contact tracing applications.. For instance, in August 2020, HireRight launched COVID-19 Screening. The company provides COVID-19 antigen testing services to assist employers in determining whether to terminate the employment of workers returning to work.

Market Segmentation

Our in-depth analysis of the global employment screening services market includes the following segments by type, organization size, and end-user:

- Based on type, the market is sub-segmented into criminal background checks, education & employment verification, credit history checks, drug & health screening, and others (compliance and regulatory screening, and social media screening).

- Based on organization size, the market is bifurcated into small and medium enterprises and large enterprises.

- Based on end-user, the market is augmented into the healthcare industry, IT and telecom, financial services, retail and hospitality, education sector, government agencies, transportation and logistics, and others (manufacturing).

Criminal background checks are Projected to Emerge as the Largest Segment

Based on the type, the global employment screening services market is sub-segmented into criminal background checks, education & employment verification, credit history checks, drug & health screening, and others. Among these, the criminal background checks sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includesemployers streamlining screening operations and minimizing administrative burdens by implementing a new analytics system that delivers advanced data visualization and reporting capabilities, increasing screening efficiency. For instance,in August 2023, HireRight Holdings Corp. launched a new background screening analytics solution.It offers advanced data visualization and reporting tools to provide valuable insights into a company's screening activity, enabling optimization of program performance and potential warning signs.

Small and Medium EnterprisesSub-segment to Hold a Considerable Market Share

The expansion is a result of Latin American organizations' growing dependence on local partners for background checks and job screening, that is driving up demand for compliance solutions.

For instance, in November 2023, HireRight Holdings Corp. launched its operational entity in Brazil, marking a significant milestone in its regional expansion strategy, aiming to enhance employment screening services for local small- and medium-sized businesses in Latin America.

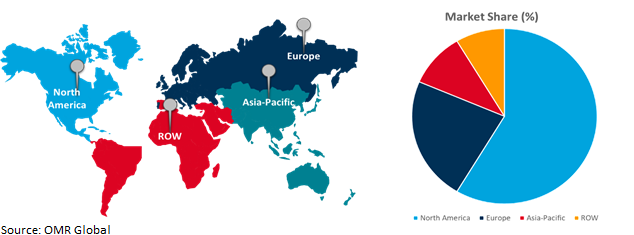

Regional Outlook

The global employment screening services market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Rapid Innovation and Economic Growth Drives Market Growth in Asia-Pacific

Urbanization boosts economic growth and innovation by concentrating resources, infrastructure, and human capital. Employment screening services support urban economies by hiring skilled workers and maintaining global competitiveness. According to the World Bank, in April 2023, approximately 4.4 billion individuals, or 56.0% of the world's population, lived in cities. By 2050, over 7 out of 10 individuals are expected to reside in cities as a result of this trend, with the urban population predicted to have more than doubled from its current level. Given that cities develop more than 80.0% of the globe's GDP, organized urbanization can promote sustainable growth by boosting creativity and efficiency.

Global Employment Screening Services Market Growth by Region 2024-2031

North America Holds Major Market Share

Legal immigration increases demand for pre-employment screening services, helping employers verify immigrant candidates' credentials, qualifications, and legal eligibility, and ensuring compliance with immigration laws and hiring standards. According to the Migration Policy Institute, in March 2024, in fiscal year (FY) 2023, a notable increase in legal immigration, both temporary and permanent. The State Department issued 10.4 million temporary visas for tourists, international students, and others, surpassing the 8.7 million visas issued in FY 2019. Additionally, in FY 2022, a total of 969,000 immigrants successfully obtained citizenship within the US.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global employment screening services market includeAccurate Background, LLC, HireRightLLC, First Advantage, and InfoMartamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. for instance, in February 2023,Konfir partnered with Secure Screening Services to use the Konfir API for verifying candidates' employment history, providing instant, accurate data for hiring decisions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global employment screening services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scop e of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. HireRight, LLC.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Insperity, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sterling

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Employment Screening Services Market by Type

4.1.1. Criminal Background Checks

4.1.2. Education & Employment Verification

4.1.3. Credit History Checks

4.1.4. Drug & Health Screening

4.1.5. Others (Compliance and Regulatory Screening, and Social Media Screening)

4.2. Global Employment Screening Services Market by Organization Size

4.2.1. Small and medium enterprises

4.2.2. Large enterprises

4.3. Global Employment Screening Services Market by End- user

4.3.1. Healthcare Industry

4.3.2. IT and Telecom

4.3.3. Financial Services

4.3.4. Retail and Hospitality

4.3.5. Education Sector

4.3.6. Government Agencies

4.3.7. Transportation and Logistics

4.3.8. Others (Manufacturing)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Accurate Background, LLC

6.2. Backgrounds Online (‘BGO’)

6.3. Capita Plc

6.4. CARCO Group, Inc.

6.5. CareerBuilder, LLC

6.6. ClearStar, Inc.

6.7. First Advantage

6.8. Inflection Risk Solutions, LLC

6.9. InfoMart

6.10. Intelius, LLC.

6.11. InterGuard(Awareness Technologies)

6.12. PEOPLETRAIL, LLC

6.13. TruDiligence

6.14. Universal Background Screening

6.15. Verified Credentials, LLC

6.16. ADP, Inc.

6.17. CARCO Group, Inc.

6.18. HireRight, LLC

1. GLOBAL EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CRIMINAL BACKGROUND CHECKS EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL EDUCATION & EMPLOYMENT VERIFICATION EMPLOYMENT SCREENING SERVICES IN POST-PARTUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CREDIT HISTORY CHECKS EMPLOYMENT SCREENING SERVICES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL DRUG & HEALTH SCREENING EMPLOYMENT SCREENING RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER TYPE EMPLOYMENT SCREENING SERVICES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2023-2031 ($ MILLION)

8. GLOBAL EMPLOYMENT SCREENING SERVICES BY SMALL AND MEDIUM ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL EMPLOYMENT SCREENING SERVICES BY LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY End-user, 2023-2031 ($ MILLION)

11. GLOBAL EMPLOYMENT SCREENING SERVICES FOR HEALTHCARE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL EMPLOYMENT SCREENING SERVICES FOR IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL EMPLOYMENT SCREENING SERVICES FOR FINANCIAL SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL EMPLOYMENT SCREENING SERVICES FOR RETAIL AND HOSPITALITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL EMPLOYMENT SCREENING SERVICES FOR EDUCATION SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL EMPLOYMENT SCREENING SERVICES FOR GOVERNMENT AGENCIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL EMPLOYMENT SCREENING SERVICES FOR TRANSPORTATION AND LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL EMPLOYMENT SCREENING SERVICES FOR OTHER END-USERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2023-2031 ($ MILLION)

23. NORTH AMERICAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. EUROPEAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2023-2031 ($ MILLION)

27. EUROPEAN EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFICEMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

32. REST OF THE WORLD EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2023-2031 ($ MILLION)

35. REST OF THE WORLD EMPLOYMENT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL EMPLOYMENT SCREENING SERVICES MARKETSHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL CRIMINAL BACKGROUND CHECKS EMPLOYMENT SCREENING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL EDUCATION & EMPLOYMENT VERIFICATION EMPLOYMENT SCREENING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CREDIT HISTORY CHECKS EMPLOYMENT SCREENING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DRUG & HEALTH SCREENING EMPLOYMENT SCREENING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER TYPE EMPLOYMENT SCREENING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL EMPLOYMENT SCREENING SERVICES MARKET SHARE BY ORGANIZATION SIZE, 2023 VS 2031 (%)

8. GLOBAL EMPLOYMENT SCREENING SERVICES BY SMALL AND MEDIUM ENTERPRISES MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL EMPLOYMENT SCREENING SERVICES BY LARGE ENTERPRISES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL EMPLOYMENT SCREENING SERVICES MARKET SHARE BY END-USER, 2023 VS 2031 (%)

11. GLOBAL EMPLOYMENT SCREENING SERVICES FOR HEALTHCARE INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL EMPLOYMENT SCREENING SERVICES FOR IT AND TELECOM MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL EMPLOYMENT SCREENING SERVICES FOR FINANCIAL SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL EMPLOYMENT SCREENING SERVICES FOR RETAIL AND HOSPITALITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL EMPLOYMENT SCREENING SERVICES FOR EDUCATION SECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL EMPLOYMENT SCREENING SERVICES FOR GOVERNMENT AGENCIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL EMPLOYMENT SCREENING SERVICES FOR TRANSPORTATION AND LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL EMPLOYMENT SCREENING SERVICES FOR OTHER END-USERMARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL EMPLOYMENT SCREENING SERVICES MARKETSHARE BY REGION, 2023 VS 2031 (%)

20. US EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

21. CANADA EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

22. UK EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

23. FRANCE EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

24. GERMANY EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

25. ITALY EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

26. SPAIN EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF EUROPE EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

28. INDIA EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

29. CHINA EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

30. JAPAN EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

31. SOUTH KOREA EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF ASIA-PACIFIC EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

34. MIDDLE EAST AND AFRICA EMPLOYMENT SCREENING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)