Endoscope Reprocessing Market

Global Endoscope Reprocessing Market Size, Share & Trends Analysis Report, By Product (Detergents and Wipes, High-Level Disinfectant and Test Strips, Endoscope Tracking Solutions, Automated Endoscope Reprocessors, and Others), and By End-User (Hospitals and Clinics, and Ambulatory Surgical Centers) Forecast Period, 2021-2027 Update Available - Forecast 2025-2035

The global endoscope reprocessing market is estimated to grow at a CAGR of nearly 7.5% during the forecast period (2021-2027). Emerging economies in the Asia-Pacific region such as India, China, Brazil, and Russia among others offer lucrative investment prospects for international infection control companies who are looking to relocate their operations across these countries. Public pressure to enhance hospital care quality, the rising burden of hospital-acquired infections (HAIs), the advent of multidrug-resistant bacteria, government focus on reprocessing of medical devices, and expansion of facilities by players are some key factors driving the market growth in these countries. For instance, in September 2018, Ecolab established the Greater China Healthcare Innovation and Customer Experience Center in Shanghai. Furthermore, the company established new headquarters in Singapore in October 2017, expanding its footprint across the APAC region.

Healthcare facilities are focusing on a reliable, high-quality system for reprocessing endoscopes which reduces infection risks. The rising number of endoscopy procedures, as well as clinicians' growing concerns about patient safety, the development of novel automated endoscope reprocessors, and the rising ageing population, are further contributing to the growth of the market. Moreover, rising demand for procedures that result in a quick recovery, fewer post-surgery infections, less discomfort, minimal scarring, better bleeding control, and higher precision is expected to drive the demand for endoscopic instruments. To grow their product range, major industry participants are focusing on launching their new product range. For instance, in April 2019, Advanced Sterilization Products' ASP AEROFLEX automatic endoscope reprocessor was approved by the US FDA. The increasing availability of endoscopic reprocessing devices is expected to offer an opportunity for market growth.

Impact of COVID-19 Pandemic on Global Endoscope Reprocessing Market

Elective endoscopic operations and non-essential gastrointestinal procedures were postponed due to the rapid spread of COVID-19. Due to the COVID outbreak, the possibility of infection from inadequate endoscope reprocessing was reported as a widespread concern among pulmonologists and otolaryngologists. The lipid envelope structure of the SARS-CoV-2 virus makes it more resistant to enzymatic detergent cleansing. After pre-cleaning with detergent, endoscopes must be disinfected according to the manufacturer. The virus's resistance to pre-cleaning reduces the safety margin for achieving acceptable high-level disinfection (HLD). Furthermore, there is a substantial risk of COVID-19 virus transmission during endoscopic surgery. Several countries have issued rules to halt all non-emergent procedures. COVID caused a large decline in the volume of GI endoscopy facilities, and the majority of procedures done were urgent. This, in turn, has adversely affected the growth of the market.

Segmental Outlook

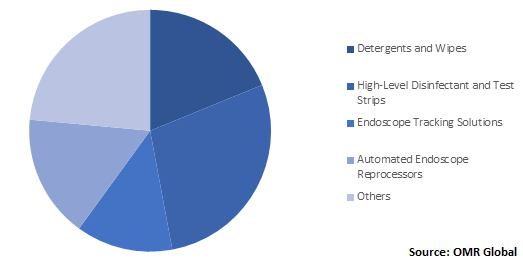

The global endoscope reprocessing market is segmented based on product and end-user. Based on the product, the market is segmented into detergents and wipes, high-level disinfectant and test strips, endoscope tracking solutions, automated endoscope reprocessors (AER), and others. AER is further classified based on the type and portability. AER by type includes single-basin AER and double-basin AER. The portability AER comprises standalone and portable. Based on end-user, the market is segmented into hospitals and clinics, and ambulatory surgical centers. Among the end-user segment, the hospitals' segment is projected to witness considerable growth during the forecast period, owing to the rising number of endoscopic procedures in hospitals and the increasing number of multispecialty hospitals.

Global Endoscope Reprocessing Market By Product, 2020 (%)

Automated Endoscope Reprocessor (AER) is Expected to Witness Significant Growth During the Forecast Period

Among the product segment, AER is anticipated to witness rapid growth during the forecast period, due to the increase in the demand for the sterilization process post-COVID-19 outbreak. These reprocessors have become an important part of the endoscopic surgery preparation process. The extreme benefits such as process standardization, staff safety, and cost-efficiency are some factors associated with automated endoscope reprocessors. As a result, AER experienced significant acceptance in hospitals and clinics. Moreover, the launch of the new AER has been witnessed. For instance, in April 2018, Cantel Medical announced that its innovative AER has achieved 510(k) certification from the US FDA. As a result, the market is estimated to increase significantly during the forecast period.

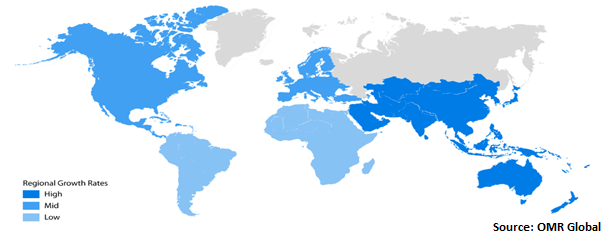

Regional Outlook

The global endoscope reprocessing market is segmented into North America (the US and Canada), Europe (Germany, Spain, Italy, France, the UK, and the Rest of Europe), Asia-Pacific (India, China, Japan South Korea, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). Owing to improved reimbursement systems and technological improvements in the endoscopic reprocessing solutions are expected to witness emerging demand in North America and Europe.

Global Endoscope reprocessing Market Growth, by Region 2021-2027

North America is Anticipated to Hold Major Share in the Global Endoscope Reprocessing Market

For the safety of patients and staff, community-based ambulatory endoscopy clinics across the North American region are striving to reopen and safely resume outpatient endoscopic procedures. Due to the rising prevalence of gastrointestinal disorders that require endoscopic operations and the presence of superior healthcare infrastructure, the US is the largest user of endoscope reprocessing products. According to a study taken by the National Center for Health Statistics in the United States, roughly 3.5 million laparoscopic procedures were performed in the US in 2017. The market for reprocessing products is likely to rise as endoscopic procedures become more common in the region.

Market Players Outlook

The prominent players functioning in the global endoscope reprocessing market include ASP Global Manufacturing GmbH, Ecolab, Getinge AB, Olympus Corp., and Steris plc. These key manufacturers are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others to thrive in a competitive environment. For instance, in June 2020, Getinge declared the acquisition of Quadralene, a manufacturer of decontamination products such as detergents and disinfectants for the health care and dental sector. The acquisition of Quadralene will strengthen the position of Getinge in disinfectants and detergents.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global endoscope reprocessing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Endoscope Reprocessing Industry

• Recovery Scenario of Global Endoscope Reprocessing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Porter's Five Force Analysis

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. ASP Global Manufacturing GmbH

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Ecolab

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Getinge AB

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Olympus Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Steris plc

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Endoscope Reprocessing Market by Product

5.1.1. Detergents and Wipes

5.1.2. High-Level Disinfectant and Test Strips

5.1.3. Endoscope Tracking Solutions

5.1.4. Automated Endoscope Reprocessors

5.1.4.1. By Type

5.1.4.1.1. Single-Basin

5.1.4.1.2. Double-Basin

5.1.4.2. By Portability

5.1.4.2.1. Standalone

5.1.4.2.2. Portable

5.1.5. Others (Endoscope Drying, Storage, and Transport Systems)

5.2. Global Endoscope Reprocessing Market by End-User

5.2.1.1. Hospitals and Clinics

5.2.1.2. Ambulatory Surgical Centers

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ARC Group of Companies Inc.

7.2. ASP Global Manufacturing GmbH

7.3. Belimed, Inc.

7.4. BES Rehab Ltd.

7.5. Borer Chemie AG

7.6. Cantel Medical Corp.

7.7. CONMED Corp.

7.8. Custom Ultrasonics, Inc.

7.9. Ecolab

7.10. ENDO-TECHNIK W. Griesat GmbH

7.11. Getinge AB

7.12. Micro-Scientific, LLC

7.13. MEDALKAN

7.14. Olympus Corp.

7.15. Richard Wolf GmbH

7.16. Steelco S.p.A.

7.17. Steris plc

7.18. Summit Imaging, Inc.

7.19. Tuttnauer Europe b.v.

7.20. Wassenburg Medical

1. GLOBAL ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

2. GLOBAL DETERGENTS AND WIPES FOR ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL HIGH-LEVEL DISINFECTANT AND STRIPS FOR ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL ENDOSCOPE TRACKING SOLUTIONS FOR ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL AUTOMATED ENDOSCOPE REPROCESSORS FOR ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OTHER ENDOSCOPE REPROCESSING PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

7. GLOBAL ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

8. GLOBAL ENDOSCOPE REPROCESSING IN HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL ENDOSCOPE REPROCESSING IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

13. NORTH AMERICAN ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

14. EUROPEAN ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. EUROPEAN ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

16. EUROPEAN ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

20. REST OF THE WORLD ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

21. REST OF THE WORLD ENDOSCOPE REPROCESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ENDOSCOPE REPROCESSING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ENDOSCOPE REPROCESSING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL ENDOSCOPE REPROCESSING MARKET, 2021-2027 (%)

4. GLOBAL ENDOSCOPE REPROCESSING MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. GLOBAL ENDOSCOPE REPROCESSING MARKET SHARE BY END-USER, 2020 VS 2027 (%)

6. GLOBAL ENDOSCOPE REPROCESSING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL DETERGENTS AND WIPES FOR ENDOSCOPE REPROCESSING MARKET SHARE BY REGION, 2020 VS 2027(%)

8. GLOBAL HIGH-LEVEL DISINFECTANT AND TEST STRIPS FOR ENDOSCOPE REPROCESSING MARKET SHARE BY REGION, 2020 VS 2027(%)

9. GLOBAL ENDOSCOPE TRACKING SOLUTIONS FOR ENDOSCOPE REPROCESSING MARKET SHARE BY REGION, 2020 VS 2027(%)

10. GLOBAL AUTOMATED ENDOSCOPE REPROCESSOR FOR ENDOSCOPE REPROCESSING MARKET SHARE BY TYPE, 2020 VS 2027(%)

11. GLOBAL ENDOSCOPE REPROCESSING IN HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2020 VS 2027(%)

12. GLOBAL ENDOSCOPE REPROCESSING IN AMBULATORY SURGICAL CENTERS MARKET SHARE BY REGION, 2020 VS 2027(%)

13. US ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

14. CANADA ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

15. UK ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

16. FRANCE ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

17. GERMANY ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

18. ITALY ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

19. SPAIN ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

20. ROE ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

21. INDIA ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

22. CHINA ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

23. JAPAN ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

24. SOUTH KOREA ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF ASIA-PACIFIC ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD ENDOSCOPE REPROCESSING MARKET SIZE, 2020-2027 ($ MILLION)