Endpoint Security Market

Global Endpoint Security Market Size, Share & Trends Analysis Report, by Solution (Anti-Virus, Anti-Spyware, Firewall, and Others), by Mode of Deployment (On-Premises and Cloud), by Industry Vertical (Banking, Financial Services and Insurance (BFSI), Government and Defense, IT & Telecom, Retail, Healthcare, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global endpoint security market is estimated to grow at a significant rate of 10.1% during the forecast period. The market growth is attributed to various factors such as increasing adoption of cloud-based services, increasing adoption of endpoint security in various industry verticals, shifting trends towards bring your own device (BYOD) and increasing concern regarding data security and privacy.

The major benefit offered by the endpoint security solutions includes reducing threats associated with devices connected to an organization network. Therefore, endpoint security solutions are considered a secure platform with cost-saving potential and capability to enhance the performance and security of a network. Due to these benefits, endpoint security solutions are being significantly preferred in several application areas, such as banking, financial services and insurance (BFSI), government and defense, retail, healthcare among others.

Segmental Outlook

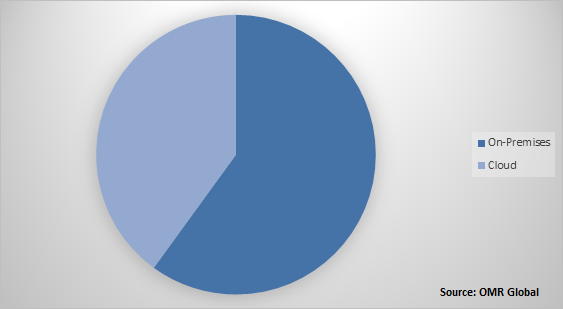

The global endpoint security market is segmented on the basis of solution, mode of deployment, industry vertical, and region. On the basis of the solution, the market is classified into anti-virus, anti-spyware, firewall, and others. Based on the mode of deployment, the market is bifurcated into on-premises and cloud endpoint security. On the basis of industry vertical, the market is sub-segmented into BFSI, government and defense, IT & telecom, retail, healthcare, and others.

Global Endpoint Security Market Share by Mode of Deployment, 2018 (%)

- In February 2019, Symantec Corp. announced the acquisition of Luminate for the expansion of its hybrid-based security product portfolio. Through this, the company aimed to extend the power of integrated cyber defense in the cloud generation with full access to protection, monitoring, and continuous visibility.

- In January 2019, Sophos Ltd. acquired DarkBytes for Managed Detection and Response (MDR) services. This would allow Sophos to present worldwide managed security services that may eventually span endpoints, firewall, and mobile devices.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global endpoint security market. Based on the availability of data, information related to products and services, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. IBM Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Intel Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Microsoft Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Cisco Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Kaspersky Lab Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Endpoint Security Market by Solution

5.1.1. Anti-Virus

5.1.2. Anti-Spyware

5.1.3. Firewall

5.1.4. Others (Endpoint Device Control)

5.2. Global Endpoint Security Market by Mode of Deployment

5.2.1. On-Premises

5.2.2. Cloud

5.3. Global Endpoint Security Market by Industry Vertical

5.3.1. Banking, Financial Services and Insurance (BFSI)

5.3.2. Government and Defense

5.3.3. IT & Telecom

5.3.4. Retail

5.3.5. Healthcare

5.3.6. Others (Manufacturing)

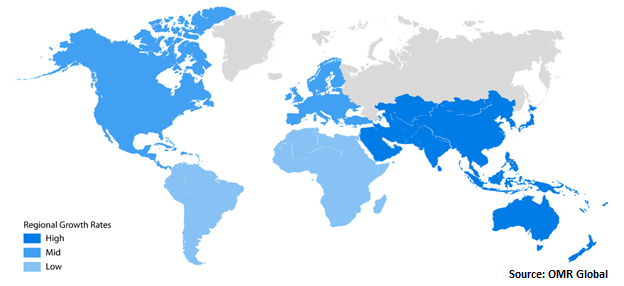

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AhnLab, Inc.

7.2. Avast Software s.r.o.

7.3. Bitdefender S.R.L.

7.4. Blackberry Ltd.

7.5. Carbon Black Inc.

7.6. Cisco Inc.

7.7. Comodo Security Solutions, Inc.

7.8. CrowdStrike, Inc.

7.9. ESET, spol. s r.o.

7.10. F-Secure Corp.

7.11. IBM Corp.

7.12. Intel Corp.

7.13. Kaspersky Lab Inc.

7.14. Microsoft Corp.

7.15. Panda Security S.L.

7.16. Sophos Ltd.

7.17. Symantec Corp.

7.18. ThreatTrack Security, Inc.

7.19. Trend Micro Inc.

7.20. Webroot Inc.

1. GLOBAL ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

2. GLOBAL ANTI-VIRUS SOLUTION IN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ANTI-SPYWARE SOLUTION IN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL FIREWALL SOLUTION IN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHER SOLUTIONS IN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

7. GLOBAL ON-PREMISES ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL CLOUD ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

10. GLOBAL ENDPOINT SECURITY IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL ENDPOINT SECURITY IN GOVERNMENT AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ENDPOINT SECURITY IN IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL ENDPOINT SECURITY IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL ENDPOINT SECURITY IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL ENDPOINT SECURITY IN OTHER INDUSTRY VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

19. NORTH AMERICAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

20. NORTH AMERICAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

21. EUROPEAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

23. EUROPEAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

24. EUROPEAN ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

29. REST OF THE WORLD ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

30. REST OF THE WORLD ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

31. REST OF THE WORLD ENDPOINT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

1. GLOBAL ENDPOINT SECURITY MARKET SHARE BY SOLUTION, 2018 VS 2025 (%)

2. GLOBAL ENDPOINT SECURITY MARKET SHARE BY MODE OF DEPLOYMENT, 2018 VS 2025 (%)

3. GLOBAL ENDPOINT SECURITY MARKET SHARE BY INDUSTRY VERTICAL, 2018 VS 2025 (%)

4. GLOBAL ENDPOINT SECURITY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

7. UK ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

15. INDIA ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD ENDPOINT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)