Energy Contract Manufacturing Market

Global Energy Contract Manufacturing Market Size, Share & Trends Analysis Report By End-User (Commercial and Government), By Services (Manufacturing, Design & Engineering, Assembly, Testing & Inspection, and Maintenance), By Source Type (Renewable Energy Sources and Non-Renewable Energy Sources) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global energy contract manufacturing market is growing at a considerable CAGR of 6.8% during the forecast period (2021-2027). The factors that augment the growth of the market include a rise in consumption of renewable energy, an increase in oil & gas production across the globe, high use in automobile industries, and testing and inception of new technologies. The government of several countries works to meet their targeted energy installations and provide new energy projects which increases the manufacturing of several components which adds value to the market growth. For instance, by 2030, Italian’s National Energy Strategy aims to boost the share of wind and solar power in total final energy consumption. As per the National, Energy and Climate Plan presented to the European Commission in August 2019, solar capacity is expected to expand from 21 gigawatts (GW) to 50.9 GW by 2030, and wind capacity is expected to grow at a similar rate from 11 GW to 18.4 GW.

Moreover, with the help of contract manufacturing, the companies can save costs, increase flexibility within the firm, reduce operational and production cost costs, reduce fixed capital investments, and engages in increasing technical insights. However, government regulations regarding sustainable development, high initial investments, and lack of space requirements for heavy projects are some of the constraints that challenge the growth of the market in the forecast period. Conversely, rising demand for energy-efficient technologies and innovation in new technologies to meet consumer needs are the opportunities estimated for the market players. Moreover, targets set by the government to meet the pollution-free environment leading to more efficient energy equipment are also an opportunity estimated for the market players.

Impact of COVID-19 on the Global Energy contract manufacturing Market

The global energy contract manufacturing market is hardly hit by the COVID-19 pandemic since December 2019. The outbreak of COVID-19 in the major economies has disrupted the manufacturing and supply of energy manufacturing products across the globe which resulted in the decrease of market share. This was mainly due to the lockdowns imposed by the governments of several countries due to which many industries were not being operated and hence the pandemic created technical challenges for the industries. Moreover, the lack of workforce availability and logistics also hindered the growth of the market. In addition to this, according to the reports of the International Energy Agency (IEA), the pandemic resulted in a decrease in demand for weekly electricity by 10-35% across affected regions.

Segmental Outlook

The global energy contract manufacturing market is segmented based on end-user, services, and source types. Based on the end-user segment, the market is segmented into commercial and government. Based on the services segment, the market is segmented into manufacturing, design & engineering, assembly, testing & inspection, and maintenance. Based on the source type segment, the market is segmented into renewable energy sources and non-renewable energy sources. Further, based on the renewable energy sources segment, the market is segmented into solar, geothermal, wind, hydropower, and bio-energy. Further, based on the non-renewable energy sources segment, the market is bifurcated into coal, natural gas, nuclear energy, and petroleum.

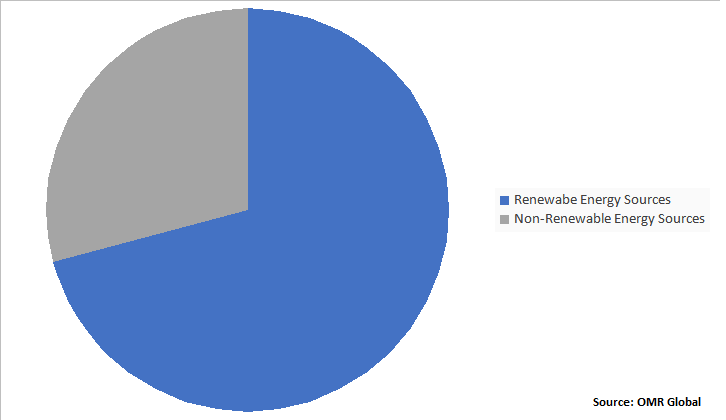

Global Energy Contract Manufacturing Market Share by Sources Type, 2020 (%)

Renewable Energy Sources Segment to Hold a Lucrative Share in the Global Energy Contract Manufacturing market

Amongst the source type segment of the global energy contract manufacturing market, the renewable energy sources segment is projected to grow at a substantial rate over the forecast period. Among these, solar energy accounted for one of the largest shares in the renewable energy sources segment in 2020. The major factor that augments the growth of solar energy includes, government initiatives to store high solar energy through solar panels by huge installations. Moreover, the increase in use by the commercial sector also fuels the growth of the solar energy market as many companies are engaged in adopting solar panels instead of wind turbines due to space requirements, low cost of solar panels, and high energy.

Regional Outlooks

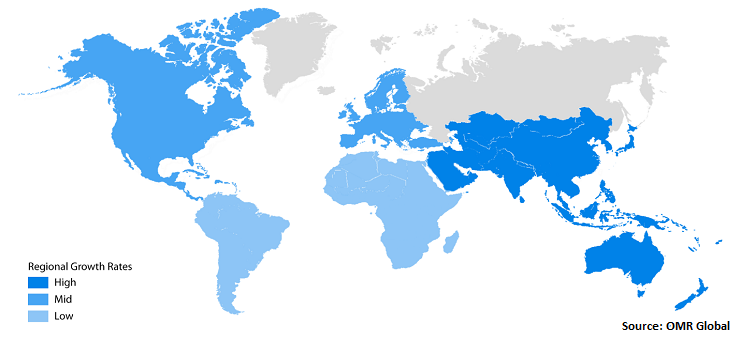

The energy contract manufacturing market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America (the US and Canada), Europe (Germany, Spain, Italy, France, the UK, and the Rest of Europe), Asia-Pacific (India, China, Japan South Korea, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). Europe and North America are estimated to have a significant share in the market owing availability of a highly-skilled workforce for the development of new technologies, and the presence of major market players in the region.

Energy contract manufacturing Market, by Region 2021-2027

Asia-Pacific is projected to highest Contributor to the growth of the Global Energy Contract Manufacturing market

Asia-Pacific is anticipated to be the fastest-growing region in the global energy contract manufacturing market. In the region, China, South Korea, Japan, Singapore, and India are showing rapid progress. Asia-Pacific region is estimated to have one of the largest shares in this market. An increase in electricity demand in emerging economies like India and China due to industrialization and government initiatives to focus on renewable energy sources are some of the factors that drive the growth of the energy contract manufacturing market in the Asia-Pacific region. For instance, China’s target is of producing 110 GW of solar energy by 2022, and India’s target is of producing 100 GW of solar energy.

Market Player Outlook

The key players of the global energy contract manufacturing market are Hyundai Heavy Industries Co., Ltd., General Electric Co., Eni S.p.A., Marubeni Corp., ABB Ltd., Engie SA, and Mitsubishi Heavy Industries, Ltd, among others. These key manufacturers are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others in order to thrive in a competitive environment. For instance, in January 2021, Eni gas e luce a wholly-owned company of Eni SpA announced the acquisition of Aldro Energía. The company aims to expand its business in the Iberian energy market. Aldro Energía operated in the market for the sale of electricity, gas, and energy services to residential customers, small and medium-sized businesses, and big companies.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global energy contract manufacturing market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Energy Contract Manufacturing Industry

• Recovery Scenario of Global Energy Contract Manufacturing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Energy Contract Manufacturing Market by End-User

5.1.1. Commercial

5.1.2. Government

5.2. Global Energy Contract Manufacturing Market by Services

5.2.1. Manufacturing

5.2.2. Design & Engineering

5.2.3. Assembly

5.2.4. Testing & Inspection

5.2.5. Maintenance

5.3. Global Energy Contract Manufacturing Market by Source Type

5.3.1. Renewable Energy Sources

5.3.2. Non-Renewable Energy Sources

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. B&W Energy Services.

7.3. Black & Veatch Holding Co.

7.4. Bladt Industries A/S

7.5. Bruce Power Limited Ltd.Partnership

7.6. Edison S.p.A.

7.7. Engie SA

7.8. Eni S.p.A.

7.9. First Solar, Inc.

7.10. Flexenergy, Inc.

7.11. General Electric Co.

7.12. Hyundai Heavy Industries Co., Ltd.

7.13. Jabil, Inc.

7.14. Marubeni Corp.

7.15. Mitsubishi Heavy Industries, Ltd.

7.16. Ontario Power Generation, Inc.

7.17. PJSC (Public Joint Stock Co.)Gazprom

7.18. Sinopec Group

7.19. SoEnergy, Inc.

7.20. SunPower Corp.

1. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020 VS 2027 ($ MILLION)

2. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

3. GLOBAL ENERGY CONTRACT MANUFACTURING IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL ENERGY CONTRACT MANUFACTURING IN GOVERNMENT SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

6. GLOBAL MANUFACTURING IN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL DESIGN & ENGINEERING IN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL ASSEMBLY IN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL TESTING & INSPECTION IN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL MAINTENANCE IN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SOURCE TYPE, 2020-2027 ($ MILLION)

12. GLOBAL RENEWABLE ENERGY SOURCES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL NON-RENEWABLE ENERGY SOURCES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

17. NORTH AMERICAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2020-2027 ($ MILLION)

18. NORTH AMERICAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SOURCE TYPE, 2020-2027 ($ MILLION)

19. EUROPEAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. EUROPEAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

21. EUROPEAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2020-2027 ($ MILLION)

22. EUROPEAN ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SOURCE TYPE, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SOURCE TYPE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

28. REST OF THE WORLD ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD ENERGY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SOURCE TYPE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ENERGY CONTRACT MANUFACTURING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ENERGY CONTRACT MANUFACTURING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL ENERGY CONTRACT MANUFACTURING MARKET, 2021-2027 (%)

4. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET SHARE BY END-USER, 2020 VS 2027 (%)

5. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET SHARE BY SERVICE, 2020 VS 2027 (%)

6. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET SHARE BY SOURCE TYPE, 2020 VS 2027 (%)

7. GLOBAL ENERGY CONTRACT MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL ENERGY CONTRACT MANUFACTURING IN COMMERCIAL MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL ENERGY CONTRACT MANUFACTURING IN GOVERNMENT SECTOR MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL MANUFACTURING IN ENERGY CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL DESIGN & ENGINEERING IN ENERGY CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL ASSEMBLY IN ENERGY CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL TESTING & INSPECTION IN ENERGY CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL MAINTENANCE IN ENERGY CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL RENEWABLE ENERGY SOURCES MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL NON-RENEWABLE ENERGY SOURCES MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. US ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

18. CANADA ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

19. UK ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

20. GERMANY ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

21. ITALY ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

22. SPAIN ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

23. FRANCE ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

24. ROE ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

25. CHINA ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

26. JAPAN ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

27. INDIA ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

28. SOUTH KOREA ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF ASIA-PACIFIC ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF THE WORLD ENERGY CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)