Energy Drink Market

Global Energy Drink Market Size, Share & Trends Analysis Report by Product (Alcoholic and Non-Alcoholic), By Target Population (Adults and Teenagers), By Type (Organic and Non-Organic), and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global energy drink market is anticipated to grow at a CAGR of around 6% during the forecast period. Energy drink usually constitutes caffeine along with other mental and physical simulators that are used for providing instant energy to an individual. Nowadays, energy drinks are available in various flavors with vitamins or carnitine, in the market. Energy drinks also come in the no-calorie and sugar option which further enhance its adoption by fitness-conscious population and sports persons. This, in turn, will impact the growth of the energy drink market during the forecast period.

Additionally, the rapid adoption of energy drinks by the teenage population across the emerging as well as developed economies will drive the growth of the energy drink market. In addition to this, the increasing purchasing power of the middle-class population is also anticipated to surge the consumption of energy drink thereby contributing significantly to the market growth. However, the increasing health-associated threats due to the consumption of energy drinks will significantly challenge the market growth during the forecast period.

Segmental Outlook

The global energy drink market is segmented based on the product, target population, and type. Based on the product, the market is sub-segmented into alcoholic and non-alcoholic beverages. Based on the target population, the market is bifurcated into adults and teenagers. Further, based on the type, the market is divided into organic energy drink and non-organic energy drink.

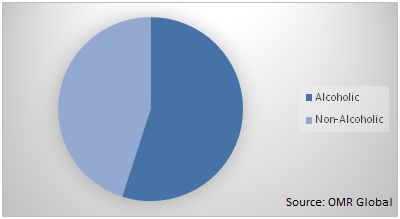

Global Energy Drink Market Share by Product, 2019 (%)

The Non-Alcoholic Segment will be the Fastest-Growing Segment by Product

The non-alcoholic segment is anticipated to grow with the fastest CAGR in the energy drink market owing to the increasing popularity of non-alcoholic energy drinks as an alternative to alcoholic drinks among the population. Additionally, the non-alcoholic energy drinks are also widely accepted by the recovering alcohol addicts as an alternative. This will also drive the non-alcohol segment in the energy drink market during the forecast period. Moreover, the wide range of options of non-alcoholic energy drink owing to the increasing focus of key market players is anticipated to drive the growth of the non-alcoholic energy drink market.

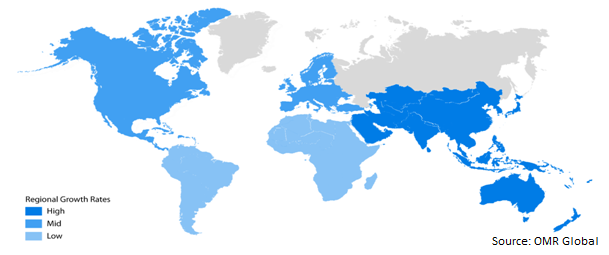

Regional Outlooks

The global energy drink market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is projected to hold the largest market share in the energy drink market during the forecast period. The growth of the market is attributed to the health concerned and aware population across the region. Additionally, the easy availability of energy drinks at affordable prices across the region will also fuel the market growth during the forecast period. Europe along with North America is also expected to be a considerably contributing region for the growth of the energy drink market owing to the increasing adoption of energy drinks by consumers.

Global Energy Drink Market Growth by Region, 2020-2026

Asia-Pacific to Augment with Considerable Rate in the Energy Drink Market

Asia-Pacific is anticipated to exhibit considerable growth rate in the energy drink market owing to the presence of young population across the region which is a major consumer of energy drink. Additionally, changing lifestyle choices will also impact the energy drink market growth. Moreover, the increasing number of energy drink manufacturing companies across the Asia-Pacific region will also drive the growth of the energy drink market during the forecast period. Additionally, the increasing sports activity in countries such as India and China will also provide new opportunities for the growth of the energy drink market across the region.

Market Players Outlook

Some of the key players of the energy drink market include PepsiCo, Inc., Red Bull GmbH, The Coca Cola Co., Monster Energy Co., and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, mergers and acquisitions, collaborations with government, and new product launches to stay competitive in the market. For instance, in March 2020, PepsiCo, Inc. announced the purchase of energy drink company Rockstar Energy Beverages for $3.85 billion. This will aid the company in becoming more consumer-centric and capitalize on rising demand. In addition to this, it will also support the presence of both the companies in the fast-expanding beverage market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Energy drink market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Business Functions and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Coco Cola Co

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. PepsiCo, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Red Bull GmbH

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Monster Energy Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Energy Drink Market by Product

5.1.1. Alcoholic

5.1.2. Non-Alcoholic

5.2. Global Energy Drink Market by Target Population

5.2.1. Adults

5.2.2. Teenagers

5.3. Global Energy Drink Market by Type

5.3.1. Organic

5.3.2. Non-Organic

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Nutrition (Abbott Laboratories Inc.

7.2. Amway Corp.

7.3. Atlanta Beverage Co.

7.4. CRUNK Energy

7.5. Keurig Dr Pepper, Inc

7.6. Lucozade Ribena Suntory Ltd.

7.7. Monster Energy Co.

7.8. Nestle S.A

7.9. PepsiCo, Inc.

7.10. Red Bull GmbH

7.11. Suntory Holdings Ltd.

7.12. Taisho Pharmaceutical Holdings Co., Ltd.

7.13. The Coca-Cola Co.

7.14. XL Energy Marketing s.p.zoo

7.15. XYIENCE Energy

1. GLOBAL ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL ALCOHOLIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL NON-ALCOHOLIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TARGET POPULATION, 2019-2026 ($ MILLION)

5. GLOBAL ENERGY DRINK FOR ADULTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ENERGY DRINK FOR TEENAGERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

8. GLOBAL ORGANIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL NON-ORGANIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TARGET POPULATION, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

17. EUROPEAN ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TARGET POPULATION, 2019-2026 ($ MILLION)

18. EUROPE ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TARGET POPULATION, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

24. REST OF THE WORLD ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TARGET POPULATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD ENERGY DRINK MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

1. GLOBAL ENERGY DRINK MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL ENERGY DRINK MARKET SHARE BY TARGET POPULATION, 2019 VS 2026 (%)

3. GLOBAL ENERGY DRINK MARKET SHARE BY TYPE, 2019 VS 2026 (%)

4. GLOBAL ENERGY DRINK MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

7. UK ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD ENERGY DRINK MARKET SIZE, 2019-2026 ($ MILLION)