Engineered Wood Adhesives Market

Engineered Wood Adhesives Market Size, Share & Trends Analysis Report by Resin (Melamine Formaldehyde, Phenol Resorcinol Formaldehyde, Polyurethane, and Others), by Product (Cross-laminated timber (CLT), Glulam, Plywood, Oriented Strand Board (OSB), Medium, Density Fiberboard (MDF) and Laminated Veneer Lumber (LVL)), and by Application (Flooring, Furniture, Doors & Windows and Housing Components), Forecast Period (2024-2031)

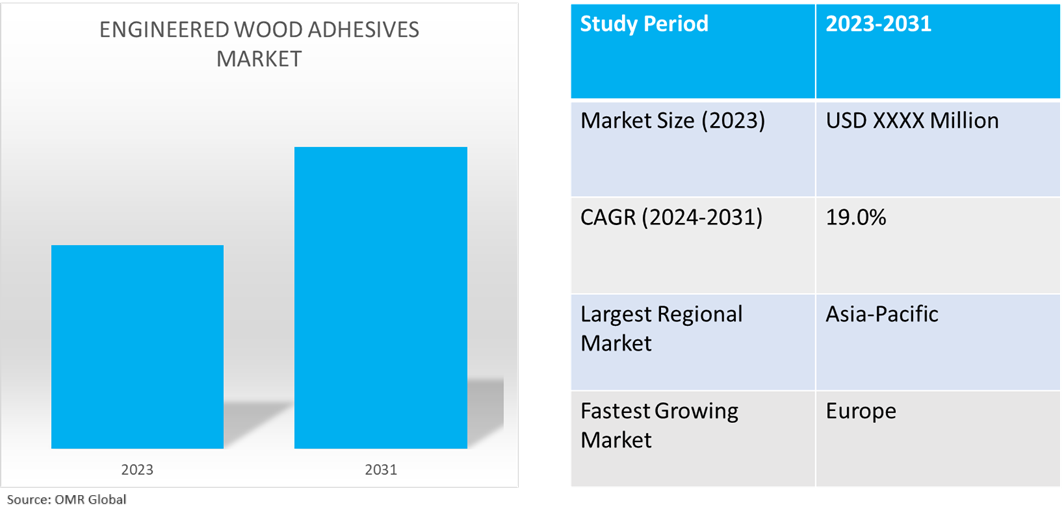

Engineered wood adhesives market is anticipated to grow at a significant CAGR of 19.0% during the forecast period (2024-2031). The market growth is attributed to the increasing manufacturing of engineered wood-based panels globally, the growing number of builds combined with growing refurbishment and renovation activities, adhesives in large quantities are used in the production of engineered wood panels, including oriented strand board, plywood, and particle board globally driving the growth of the market.

Market Dynamics

Growing Adoption of Wood-Based-Panel Adhesive

In the process of developing engineered wood-based panels such as plywood, particle board, oriented strand board, medium-density fiberboard, and high-density fiberboard, adhesives are the material of choice for binding wood strips, chips, fibers, strands, and veneers. The government's efforts to encourage residential building along with the growing population and fast urbanization are predicted to drive demand for wood-based panels that would in turn support the market's expansion. Wood-based panels could potentially be regarded as weak owing to their propensity to be light and low in density. While it is possible to strengthen lower-density panels like particle boards entirely, higher-density boards like MDF and plywood can also profit from local reinforcing using anchoring adhesive, which is frequently done to facilitate fastener applications.

Increasing Demand for Nanomaterial Adhesive

The use of nanocellulose in wood adhesives results in improvements to the adhesives' mechanical and performance attributes. The formation of chemical bonds in the adhesive system is essential to improving the characteristics further. The industry for wood-based products may potentially make use of a variety of easily accessible nanomaterials to improve the functionality of currently available products or to develop new, high-value forest products. The analysis focuses on current advancements in the industry's use of nanotechnology in wood-based products. There is an increasing demand to introduce sustainable and biodegradable nanomaterial adhesives to address growing environmental concerns.

Market Segmentation

- Based on the resin, the market is segmented into melamine formaldehyde, phenol resorcinol formaldehyde, polyurethane, and others (isocyanates, polyvinyl acetate (PVA)).

- Based on the product, the market is segmented into cross-laminated timber (CLT), glulam, plywood, oriented strand board (OSB), medium, density fiberboard (MDF), and laminated veneer lumber (LVL).

- Based on the application, the market is segmented into flooring, furniture, doors & windows, and housing components.

Melamine Formaldehyde Engineered Wood Adhesives are Projected to Hold the Largest Segment

The melamine formaldehyde-engineered wood adhesives segment is expected to hold the largest share of the market. The primary factors supporting the growth include melamine formaldehyde (MF) has remarkable performance in engineered wood products. Considering its superior resistance to bases, acids, and solvents, it is the material of choice in chemically demanding situations. Furthermore, its capacity to give bonded structures mechanical strength is essential for preserving their integrity and longevity under physical strain. Controlled application of heat and pressure is necessary for manufacturing procedures employing metal fiber (MF) to enable efficient curing, which is essential to attaining the best possible bond strength and stability. For instance, Akzo Nobel N.V. offers AkzoNobel Melamine-Formaldehyde and Melamine-urea-formaldehyde systems are used in load-bearing constructions and in other applications where there is demand for high-durability glue lines.

Furniture Segment to Hold a Considerable Market Share

The furniture segment is expected to hold a considerable share of the market. Engineered wood adhesives are used in the assembly of furniture and cabinets, the manufacture of engineered wood products, and the construction of residential and commercial structures. Adhesives transfer and distribute loads between components, thereby increasing the strength and stiffness of wood products. Adhesives are used extensively in the furniture industry to ensure product safety and appropriateness as well as streamline the production process. Adhesive systems for furniture are used to fuse wood, metal, foam, cloth, and plastic together.

Regional Outlook

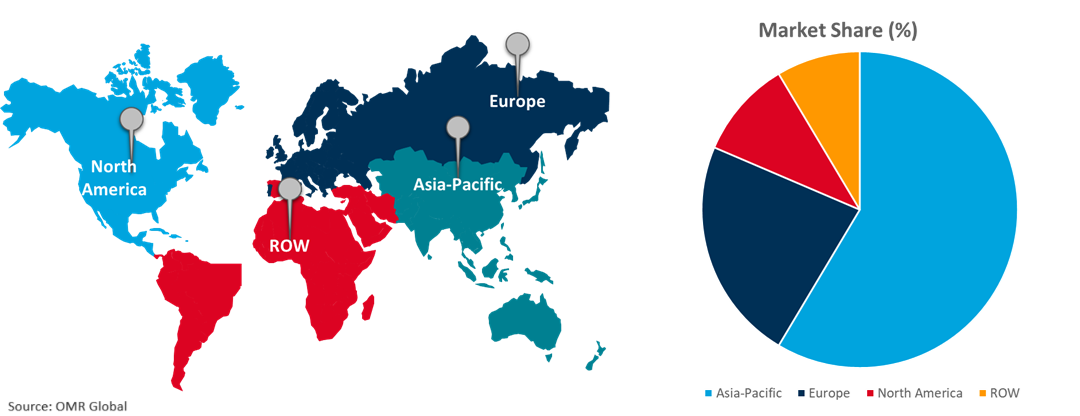

Global engineered wood adhesives market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand in Building and Furniture in Europe

- The regional growth is attributed to the increasing use of wood-based panels as they are more robust, well-finished, and lightweight than traditional wood. These panels can be utilized to make strong, long-lasting interior decorative pieces, unlike glass.

- Among the major producers of wood adhesives in Europe is Germany. With the building and furniture industries' strong demand, the wood adhesives market has grown rapidly in recent years. The furniture business has benefited greatly from robust economic development, which has also raised private consumption. According to the European Union (EU), in February 2024, the EU has been a net exporter of roundwood in the past four years, with exports to non-EU countries surpassing imports by 12.5 million m3 (cubic meters) in 2022. 25.0% of the EU’s roundwood production in 2022 was used as fuelwood; the rest was used for sawn wood and veneers, pulp, and paper production.

Global Engineered Wood Adhesives Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to numerous prominent engineered wood adhesives companies and providers such as Alteco Chemical Pte Ltd., and Beijing Comens New Materials Co., Ltd., DIC Corp., in the region. The growth is mainly attributed to the increasing significant demand for cost-effective housing, and government initiatives to provide basic necessities like food and shelter have fueled the growth of the building sector in the region. The increasing demand for Engineered Wood Adhesives in China, Japan, and South Korea drives the growth of the market in the region. According to the Japan Adhesive Industry Association (JAIA), Sales volume and value by adhesive reached 610,828 tons and 219.2 billion JPY. Market players introducing new adhesive centers, and manufacturing locations in Asia, and market players extending their presence in the Asia-Pacific market. It also strengthens another strategic cornerstone in its dynamic research and development landscape, reaffirming the enterprise’s position as an innovation in the industry. For instance, in March 2024, Jowat Opens the Modern Adhesive Center in China. Jowat inaugurates a new manufacturing location in China, underscoring its firm commitment to close customer contact around the globe and expanding its innovation capacities. The new facility of the adhesive manufacturer from Detmold is set to produce approximately 9,000 tons of tailor-made adhesives annually for the Asian market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the engineered wood adhesives market include H.B. Fuller Company, Henkel AG & Co. KGaA, Jowat SE, Sika AG, and The Dow Chemical Co., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In February 2023, Henkel and Covestro collaborated on the sustainability of engineered wood adhesives. Engineered wood adhesives from Henkel based on raw materials from Covestro used in building and construction applications. Covestro provides Henkel with polyurethane-based raw materials linked to bio-based feedstocks attributed via the mass balance approach.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the engineered wood adhesives market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. H.B. Fuller Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Henkel AG & Co. KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Jowat SE

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Sika AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Dow Chemical Co.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Engineered Wood Adhesives Market by Resin

4.1.1. Melamine Formaldehyde

4.1.2. Phenol Resorcinol Formaldehyde

4.1.3. Polyurethane

4.1.4. Others (Isocyanates, Polyvinyl Acetate (PVA))

4.2. Global Engineered Wood Adhesives Market by Product

4.2.1. Cross-laminated timber (CLT)

4.2.2. Glulam

4.2.3. Plywood

4.2.4. Oriented Strand Board (OSB)

4.2.5. Medium Density Fiberboard (MDF)

4.2.6. Laminated Veneer Lumber (LVL)

4.3. Global Engineered Wood Adhesives Market by Application

4.3.1. Flooring

4.3.2. Furniture

4.3.3. Doors & Windows

4.3.4. Housing Components

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East Africa

6. Company Profiles

6.1. 3M Company

6.2. Akzo Nobel N.V.

6.3. Ashland Inc.

6.4. Avery Dennison Corp.

6.5. Beardow Adams

6.6. Bostik Ltd.

6.7. Dymax Corporation

6.8. Franklin International

6.9. Hexion Inc.

6.10. Huntsman International LLC

6.11. Illinois Tool Works Inc.

6.12. M S International, Inc.

6.13. Momentive Performance Materials Inc.

6.14. Permabond Engineering Adhesives

6.15. Pidilite Industries Ltd.

6.16. Quin Global (UK) Ltd.

6.17. RPM International Inc.

6.18. Wacker Chemie AG

1. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN, 2023-2031 ($ MILLION)

2. GLOBAL ENGINEERED WOOD MELAMINE FORMALDEHYDE ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ENGINEERED WOOD PHENOL RESORCINOL FORMALDEHYDE ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ENGINEERED WOOD POLYURETHANE ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHER ENGINEERED WOOD RESIN ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

7. GLOBAL CROSS-LAMINATED TIMBER (CLT) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL GLULAM ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PLYWOOD ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ORIENTED STRAND BOARD (OSB) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL LAMINATED VENEER LUMBER (LVL) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. GLOBAL ENGINEERED WOOD ADHESIVES FOR FLOORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ENGINEERED WOOD ADHESIVES FOR FURNITURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ENGINEERED WOOD ADHESIVES FOR DOORS & WINDOWS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ENGINEERED WOOD ADHESIVES FOR HOUSING COMPONENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN, 2023-2031 ($ MILLION)

21. NORTH AMERICAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. NORTH AMERICAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. EUROPEAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN, 2023-2031 ($ MILLION)

25. EUROPEAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

26. EUROPEAN ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN, 2023-2031 ($ MILLION)

33. REST OF THE WORLD ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

34. REST OF THE WORLD ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN, 2023 VS 2031 (%)

2. GLOBAL ENGINEERED WOOD MELAMINE FORMALDEHYDE ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL ENGINEERED WOOD PHENOL RESORCINOL FORMALDEHYDE ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL ENGINEERED WOOD POLYURETHANE ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHER ENGINEERED WOOD RESIN ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

7. GLOBAL CROSS-LAMINATED TIMBER (CLT) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL GLULAM ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL PLYWOOD ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL ORIENTED STRAND BOARD (OSB) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL LAMINATED VENEER LUMBER (LVL) ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

14. GLOBAL ENGINEERED WOOD ADHESIVES FOR FLOORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL ENGINEERED WOOD ADHESIVES FOR FURNITURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL ENGINEERED WOOD ADHESIVES FOR DOORS & WINDOWS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. GLOBAL ENGINEERED WOOD ADHESIVES FOR HOUSING COMPONENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

18. GLOBAL ENGINEERED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

19. US ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

21. UK ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)

34. MIDDLE EAST AND AFRICA ENGINEERED WOOD ADHESIVES MARKET SIZE, 2023-2031 ($ MILLION)