ENT Devices Market

Global ENT Devices Market Research By Product (Diagnostic Devices, Surgical Devices, Hearing Aids, Hearing Implants, Co2 Lasers, and Image-Guided Surgery Systems) and By End-User (Hospitals, ENT Centres and Ambulatory Surgery Centres) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global ENT devices market is growing at a considerable CAGR of 6.5% during the forecast period. The increasing geriatric population, rising affordability associated with ENT treatment is considered as the prime factors affecting and driving the market. The increasing product awareness along with accessibility and rapid advancements in technology are also estimated to be the key factors that are contributing significantly towards the growth of the market. However, the inadequacy of skilled ENT surgeons and high costs related to ENT devices are hindering the growth of the global ENT devices market across the globe.

Moreover, increasing demand for cosmetic ENT procedures is one of the key factors that are creating opportunities in the market. New product launches in the market are likely to drive the growth of the global ENT devices market. For instance, in December 2020, Olympus Corp. had done the acquisition of one of the providers of advanced medical devices specializing in interventional pulmonology, named Veran Medical Technologies, Inc. for around $340 million in order to strengthen its portfolio.

Impact of COVID-19 Pandemic on the Global ENT Devices Market

The global ENT devices market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic in the major economies had brought a lot of disruption. Due to the COVID-19 pandemic, the availability of hospital resources had also been significantly impacted. Moreover, various manufacturing activities were shut down that delayed in making of new devices due to the COVID-19 pandemic that had adversely impacted the market.

Segmental Outlook

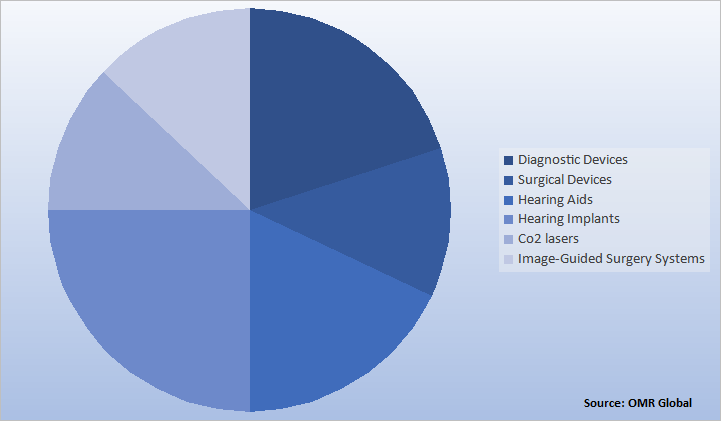

The global ENT devices market is segmented based on product and end-user. Based on product, the market is segmented into diagnostic devices, surgical devices, hearing aids, hearing implants, co2 lasers, and image-guided surgery systems. Further, based on end-user the market is segmented into hospitals, ENT centres, and ambulatory surgery centres.

Global ENT Devices Market Share by Product 2020 (%)

Based on the product segment, hearing aids hold a significant share in the market. This is owing to the growing pervasiveness of hearing loss and disability which in turn are increasing the demand for hearing aids. Additionally, advanced technological devices, which are also user-friendly, are effectively contributing to the growth of the segment in the market.

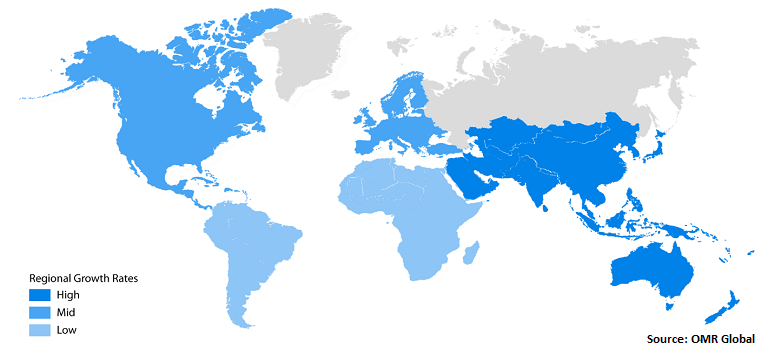

Regional Outlooks

The global ENT devices market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America held a considerable share in 2020 in the global ENT devices market. As per the information of the Centers for Disease Control and Prevention (CDC), in the US around 12.1% of the adult population covers around 29.4 million people, which are suffering from chronic sinusitis. So, some factors that are boosting the market growth in North America are increasing pervasiveness of chronic sinusitis among adults, increasing government initiatives related to the ENT along with the presence of a large number of players in the region. Additionally, the growing geriatric population and well-established healthcare infrastructure are some other factors that are impacting the growth of the market. Moreover, in Europe, growing Rhinosinusitis in the aging population is considered a prime factor that is impacting the market in the region. EU had also imposed certain initiatives that support and permit an optimum decrease in the cost associated with surgery and due to the growing surging need for ENT treatment tools startup companies are also looking to operate in the region.

Global ENT Devices Market, by Region 2021-2027

Asia-Pacific will have Considerable Growth in the Global ENT Devices Market

Asia-Pacific region is expected to witness significant growth opportunities for the market. Increasing disposable income across the region is likely to drive the growth of the regional market. Additionally, key market companies expanding their reach along with rising health care expenditure in this region, especially in South Korea, China, and India are also impacting the market. Moreover, increasing awareness about ENT disorders is another factor that is also affecting the growth of the market.

Market Player Outlook

Key players of the global ENT devices market are Olympus America, Medtronic, Stryker, Smith & Nephew, and Cochlear Ltd. To survive in the market, these players adopt different marketing strategies such as product launches and mergers and acquisitions. For instance, in December 2019, one of the implantable hearing solution providers named Cochlear Ltd., set forth that it had received the U.S. Food and Drug Administration (FDA) clearance for the new Cochlear Osia 2 System. The new system is considered an active osseointegrated steady-state implant (OSI) that utilizes digital piezoelectric stimulation to bypass damaged areas of the natural hearing system in order to send sound vibrations directly to the inner ear (cochlea). Whereas on the outside, the new Osia 2 Sound Processor is present that captures sounds and sends both the sound signal and power to the internal implant. The Osia 2 System is regarded as an effective system for chronic otitis media (COM), otosclerosis, and atresia/microtia.

In February 2018, Stryker had completed the acquisition of Entellus Medical that is considered a medical technology company. Through this acquisition, the company enhances its portfolio by focusing on providing products that are made for the minimally invasive treatment of various ear, nose, and throat (ENT) in disease states.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global ENT devices market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global ENT Devices Industry

• Recovery Scenario of Global ENT Devices Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global ENT Devices Market by Product

5.1.1. Diagnostic Devices

5.1.2. Surgical Devices

5.1.3. Hearing Aids

5.1.4. Hearing Implants

5.1.5. Co2 Lasers

5.1.6. Image-Guided Surgery Systems

5.2. Global ENT Devices Market by End-User

5.2.1. Hospitals

5.2.2. ENT Centres

5.2.3. Ambulatory Surgery Centres

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. American Hearing + Audiology

7.2. Audina Hearing Instruments, Inc.

7.3. Cochlear Ltd.

7.4. Demant A/S

7.5. GN Hearing A/S

7.6. Horentek Hearing Diagnostics

7.7. KARL STORZ

7.8. Medtronic

7.9. Meril Life Sciences Pvt. Ltd.

7.10. Narang Medical Ltd.

7.11. Olympus America

7.12. Rion Co. Ltd.

7.13. Sonova

7.14. Starkey

7.15. Stryker

7.16. Zounds Hearing

1. GLOBAL ENT DEVICES MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL ENT DEVICES MARKET BY PRODUCT, 2020-2027 ($ MILLION)

3. GLOBAL DIAGNOSTIC DEVICES MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SURGICAL DEVICES MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL HEARING AIDS MARKET BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL HEARING IMPLANTS MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL CO2 LASERS MARKET BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL IMAGE-GUIDED SURGERY SYSTEMS MARKET BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL ENT DEVICES MARKET BY END-USER, 2020-2027 ($ MILLION)

10. GLOBAL HOSPITALS MARKET BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL ENT CENTRES MARKET BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL AMBULATORY SURGERY CENTRES MARKET BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL ENT DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN ENT DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN ENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

16. NORTH AMERICAN ENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

17. EUROPEAN ENT DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. EUROPEAN ENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

19. EUROPEAN ENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC ENT DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC ENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC ENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

23. REST OF THE WORLD ENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

24. REST OF THE WORLD ENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ENT DEVICES MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ENT DEVICES MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL ENT DEVICES MARKET, 2021-2027 (%)

4. GLOBAL ENT DEVICES MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. GLOBAL ENT DEVICES MARKET SHARE BY END-USER, 2020 VS 2027 (%)

6. GLOBAL ENT DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL DIAGNOSTIC DEVICES MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL SURGICAL DEVICES MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL HEARING AIDS MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL HEARING IMPLANTS MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL CO2 LASERS MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL IMAGE-GUIDED SURGERY SYSTEMS MARKET BY REGION, 2020 VS 2027 (%)

13. GLOBAL HOSPITALS MARKET BY REGION, 2020 VS 2027 (%)

14. GLOBAL ENT CENTRES MARKET BY REGION, 2020 VS 2027 (%)

15. GLOBAL AMBULATORY SURGERY CENTRES MARKET BY REGION, 2020 VS 2027 (%)

16. US ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

17. CANADA ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

18. UK ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

19. FRANCE ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

20. GERMANY ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

21. ITALY ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

22. SPAIN ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF EUROPE ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

24. INDIA ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

25. CHINA ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

26. JAPAN ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

27. SOUTH KOREA ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF ASIA-PACIFIC ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD ENT DEVICES MARKET SIZE, 2020-2027 ($ MILLION)