Enterprise Asset Management Market

Global Enterprise Asset Management Market Size, Share & Trends Analysis Report by Deployment (On-Premises and Cloud-Based), and by Verticals (BFSI, Government and Utilities, Healthcare, Energy & Power, IT & Telecom, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global enterprise asset management market is anticipated to grow at a significant CAGR of 7.9% during the forecast period. The enterprise asset management (EAM) solution is an important tool and plays a vital role in handling critical asset information as well as managing assets in various industry verticals. EAM solution reduces the operational and maintenance costs and thus improves the overall return on assets, owing to which, there is increasing adoption of EAM solutions in various industries; thereby, spurring the growth of the global enterprise asset management industry.

The global enterprise asset management (EAM) market is expected to grow at a significant rate. The market growth is attributed to the rising need for increasing the lifecycle performance of the asset. Furthermore, various benefits offered by EAM solutions such as tracking of assets, improved return on assets, and reduction in the procurement and maintenance cost further give a boost to the growth of the market.

Impact of COVID-19 Pandemic on Global Enterprise Asset Management Market

The COVID-19 pandemic has wreaked havoc on practically every industry globally. Companies are experiencing serious cash flow problems as a result of the imposition of lockdowns in various regions. Reduced demand for asset management systems has resulted from the halting or slowing of electronic equipment or retail product manufacturing, as well as worldwide supply chain logistics problems caused by the outbreak of COVID-19. However, due to COVID-19, organizations now have a plethora of options for improving their client relationships owing to digitization. Asset-intensive businesses have learned that, in the face of increasing competition, tackling the difficulties associated with their management is critical to their success or failure. As a result, some asset-intensive companies are investing heavily in advanced and creative solutions to drastically modify and update their operating processes.

Segmental Outlook

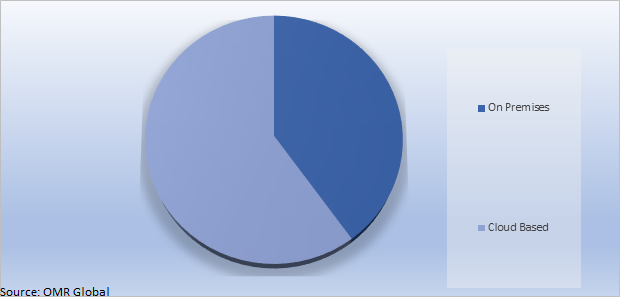

The global enterprise asset management market is segmented based on deployment and verticals. Based on deployment, the market is bifurcated into on-premises and cloud-based EAM. The cloud-based segment is anticipated to grow at a significant rate during the forecasted period. Cloud-based EAM enables the organization to collect data manually as well as by the machine which is later stored in the same space. The data stored in the cloud can be future used to design and provide better EAM services.

Global Enterprise Asset Management Market Share by Deployment, 2021 (%)

The Cloud-Based Segment is Expected to Hold a Prominent Share in the Global Enterprise Asset Management Market

Organizations are increasingly focusing on deploying their solutions on the cloud owing to various benefits offered by cloud-based deployments such as scalability, enhanced collaboration, and cost-efficiency. Deployment of cloud-based EAM solutions enables small, medium, and large enterprises to focus on their core competencies, instead of focusing on their IT processes. In addition, cloud-based enterprise asset management solutions provide a centralized way of integrating the system and its components with web and mobile applications. Organizations, with cloud-based EAM, can efficiently enhance the performance of their asset-intensive tasks.

Regional Outlooks

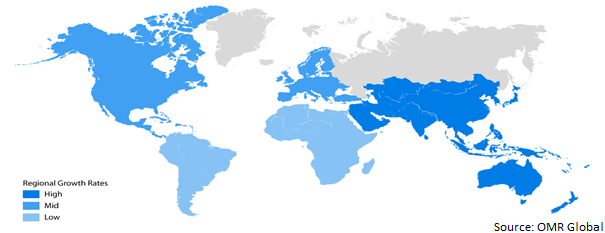

The global enterprise asset management market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North American region is anticipated to be the fastest-growing region in the cable management market owing to the presence of well-developed IT infrastructure in the region. The US is the major country in North America and is expected to dominate during the forecast period. Moreover, the presence of major market players in the region and the high penetration of cloud-based services further give a boost to the regional growth of the market.

Global Enterprise Asset Management Market Growth, by Region 2022-2028

The Asia-Pacific Region is Anticipated to hold the Prominent Share in the Global Enterprise Asset Management Market

The Asia-Pacific region is anticipated to hold a prominent share of the cable management market. The significant growth of the region is attributed to the increasing number of small and medium-sized enterprises (SMEs) in the region that are adopting EAM solutions for better management of the organization and service offerings. China along with India and Japan are significant contributors to the Asia-Pacific enterprise asset management market.

Market Players Outlook

The major companies serving the global enterprise asset management market include IBM Corp., Oracle Corp., SAP SE, and ABB Group. The companies are focusing on product innovations, expansions, mergers, and acquisitions, and finding a new market or innovation in their core competency to expand individual market share. For instance, in June 2019, Microsoft Corp. established a cloud interoperability partnership with Oracle Corp. to enable customers to migrate and run mission-critical enterprise workloads across Microsoft Azure and Oracle Cloud. Enterprises can now connect Azure services, such as Analytics and AI, to Oracle Cloud services, such as Autonomous Database.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global enterprise asset management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Electrophoresis Market

• Recovery Scenario of Global Electrophoresis Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Electrophoresis Market by Product

4.1.1. Electrophoresis Reagents

4.1.2. Electrophoresis Systems

4.1.2.1. Gel Electrophoresis Systems

4.1.2.2. Capillary Electrophoresis

4.2. Global Electrophoresis Market by Application

4.2.1. Diagnostic Applications

4.2.2. Research Applications

4.3. Global Electrophoresis Market by End-Use

4.3.1. Academic Institutions

4.3.2. Hospitals & Diagnostic Centres

4.3.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Thermo Fisher Scientific, Inc.

6.2. Agilent Technologies, Inc.

6.3. COLE PARMER

6.4. Cleaver Scientific

6.5. CBS Scientific Co., Inc.

6.6. BIO-RAD Laboratories, Inc.

6.7. GE Healthcare

6.8. Danaher Corp.

6.9. Harvard Bioscience, Inc.

6.10. Helena Laboratories

6.11. Perkinelmer, Inc.

6.12. QIAGEN N.V.

6.13. SIGMA-ALDRICH Corp.

6.14. Shimadzu Corp.

1. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL ELECTROPHORESIS REAGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ELECTROPHORESIS SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL GEL ELECTROPHORESIS SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL CAPILLARY ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL ELECTROPHORESIS FOR DIAGNOSTIC APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ELECTROPHORESIS FOR RESEARCH APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

10. GLOBAL ELECTROPHORESIS IN ACADEMIC INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL ELECTROPHORESIS IN HOSPITALS & DIAGNOSTIC CENTRES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL ELECTROPHORESIS IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

16. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

17. NORTH AMERICAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

18. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

20. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. EUROPEAN ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

28. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

29. REST OF THE WORLD ELECTROPHORESIS MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ELECTROPHORESIS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ELECTROPHORESIS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL ELECTROPHORESIS MARKET, 2022-2028 (%)

4. GLOBAL ELECTROPHORESIS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

5. GLOBAL ELECTROPHORESIS REAGENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL ELECTROPHORESIS SYSTEMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL GEL ELECTROPHORESIS SYSTEMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL CAPILLARY ELECTROPHORESIS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL ELECTROPHORESIS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL ELECTROPHORESIS FOR DIAGNOSTIC APPLICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL ELECTROPHORESIS FOR RESEARCH APPLICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL ELECTROPHORESIS MARKET SHARE BY END-USE, 2021 VS 2028 (%)

13. GLOBAL ELECTROPHORESIS IN ACADEMIC INSTITUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL ELECTROPHORESIS IN HOSPITALS AND DIAGNOSTIC CENTERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL ELECTROPHORESIS IN OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL ELECTROPHORESIS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

19. UK ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD ELECTROPHORESIS MARKET SIZE, 2021-2028 ($ MILLION)