Enterprise Network Equipment Market

Global Enterprise Network Equipment Market Size, Share & Trends Analysis Report by Type (Network Switches, Routers, Network Security, WLAN, and Other) - Forecast Period 2019-2025 Update Available - Forecast 2025-2035

The enterprise network equipment is anticipated to grow at a CAGR of 7.2% during the forecast period 2019-2025. The factor such as the rapid adoption of cloud computing technologies is shown a positive impact on the growth of the enterprise network equipment industry during the forecast period. Increasing emphasis on agile networking against the digitalization of businesses and enterprise IT is fueling the demand for enterprise network equipment. Moreover, the proliferation of virtualization is boosting the need for equipment that includes switches, WLAN and routers.

Additionally, the rise in the adoption of Bring-Your-Own-Devices (BYOD) and Choose-Your-Own-Device (CYOD) is expected to show a growth opportunity for the market in the near future. The increasing demand for connected devices across the globe is the growth factor for the enterprise network equipment industry. These devices enable in promoting real-time communication. To address and solve rising bottleneck bandwidth & network traffic problems and organizations across the globe are adopting enterprise workload management which keeps traffic flowing while managing network safety.

The growth in the amount of IoT enabled devices has rising safety hazards owing to which the organization is adopting enterprise network solutions to make unsecured applications and devices visible. However, the high installation cost of the equipment and execution of protectionist policies and regulations is hampering the growth of the enterprise network equipment market over the forecast period. For instance, the US government-imposed tariffs on the network equipment include routers and modems.

Segmental Outlook

The global enterprise network equipment market is segmented on the basis of type that includes network switches, routers, network security, and WLAN. The increasing adoption of digital platforms by enterprises creates demand for enterprise network equipment. The corporate sector has been rapidly transforming owing to the growing popularity of cloud computing and network virtualization technology that results in the increasing demand for network management & monitoring solutions.

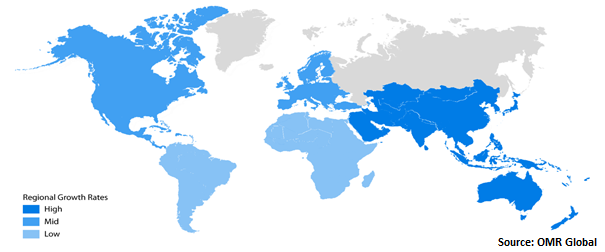

Regional Outlook

The global enterprise network equipment market is further segmented based on geography including North America, Europe, Asia-Pacific and Rest of the World. North America is expected to hold the largest market share in the market during the forecast period. The key market players of the region have gained a competitive edge in the market due to the presence of regulatory bodies and corporate policies which focus on the enhancement of the characteristics of network security and safety. The presence of such factors has been important in boosting the enterprises to spend on technology. Furthermore, the continued attack on cyberinfrastructure from the attacker’s access to intellectual property and confidential data has enabled to develop innovative security solutions in the region.

Global Enterprise Network Equipment Market Growth, by Region 2019-2025

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global enterprise network equipment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Juniper Networks, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cisco Systems, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Hewlett Packard Development, Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Huawei Technologies Co. Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Broadcom, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Enterprise Network Equipment Market by Type

5.1.1. Network Switches

5.1.2. Routers

5.1.3. Network Security

5.1.4. WLAN

5.1.5. Other Types

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. A10 Enterprise Networks, Inc.

7.2. ADTRAN, Inc.

7.3. ALE International

7.4. Arista Networks, Inc.

7.5. Broadcom, Inc.

7.6. Cisco Systems, Inc.

7.7. Dell, Inc.

7.8. D-Link Corp.

7.9. EnGenius Technologies, Inc.

7.10. Extreme Networks, Inc.

7.11. F5 Networks, Inc.

7.12. Fortinet, Inc.

7.13. Hewlett Packard Development Co.

7.14. Huawei Technologies Co. Ltd.

7.15. Juniper Networks, Inc.

7.16. Palo Alto Networks, Inc.

7.17. Qualcomm Technologies, Inc.

7.18. Riverbed Technology, Inc. (A Thoma Bravo Co.)

7.19. Trend Micro, Inc.

7.20. Ubiquiti Networks, Inc.

1. GLOBAL ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL NETWORK SWITCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ROUTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL NETWORK SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL WLAN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. NORTH AMERICA ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

8. NORTH AMERICAN ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

9. EUROPE ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. EUROPE ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

11. ASIA-PACIFIC ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. ASIA-PACIFIC ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

13. REST OF THE WORLD ENTERPRISE NETWORK EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

1. GLOBAL ENTERPRISE NETWORK EQUIPMENT MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL ENTERPRISE NETWORK EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

5. UK ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. INDIA ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD ENTERPRISE NETWORK EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)