Environmental Technology Market

Global Environmental Technology Market Size, Share & Trends Analysis Report, By Component (Solutions and Services), By Application (Wastewater Treatment, Sewage Treatment, Pollution Monitoring, Dust Emissions, Dry Steaming, Gas Dissolution, Precision Cooling, Solid Waste Treatment, Others), By End-User (Residential/Municipal and Industrial Transportation and Logistics), Forecast Period 2022-2028 Update Available - Forecast 2025-2031

The global environmental technology market is anticipated to grow at a moderate CAGR of 4.3% during the forecast period. The increasing global challenges including climatic changes, natural resource depletion, and rising pollution levels have created the need for environmental technology market to address the adverse environmental concerns. Moreover, the growing awareness among individuals about the consequences of environmental degradation and increasing global warming is propelling the use of environmental technology as an alternative to traditional energy sources.

Apart from this, various green initiatives undertaken by governments of several countries to promote sustainable development are positively influencing the adoption of environmental technologies to generate renewable energy. Furthermore, they are used to address the growing need for transparency and information for data management, impact quantification, and verification and traceability of goods. Besides this, the emergence of the fourth industrial revolution or Industry 4.0 is encouraging the use of environmental technology and sustainability to minimize carbon footprint and reduce power and energy bills of manufacturing processes.

Segmental Outlook

The global environmental technology market is segmented based on component, application, and end-user. The market segmentation based on the component includes solutions and services. Among components, the solution segment holds a significant share in the market. The high adoption of environmental technology solutions owing to their low cost of operation is a key factor contributing to the potential share of this segment. Based on application, the market is segmented into wastewater treatment, sewage treatment, pollution monitoring, dust emissions, dry steaming, gas dissolution, precision cooling, solid waste treatment, and others. Based on end-user, the market is segmented into residential/municipal, industrial transportation & logistics.

Industrial Transportation & Logistics Segment Held Considerable Share in the Global Environmental Technology Market

Based on end-user, the market is segmented into residential/municipal, industrial transportation & logistics. The industrial transportation & logistics segment held a considerable share based on end-user. Under the industrial segment, the power, energy & utility industry is the largest consumer of environmental technologies during the forecast period. The increasing investment by players in innovating new methods and technologies to improve the energy efficiency of their communication circuits is a key factor contributing to the high growth of this market segment. Moreover, growing energy cost across the globe is further motivating these market players to invest in environmental technology.

Regional Outlook

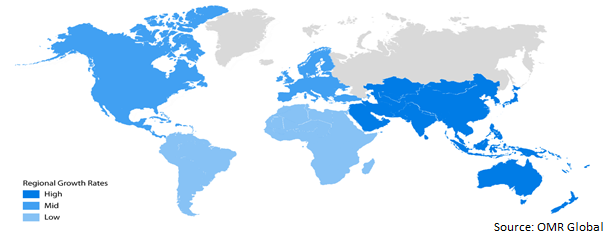

The global environmental technology market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). North America is anticipated to hold a prominent share in the global environmental technology market. The US hosts a comparatively advanced and sophisticated environmental technologies industry. The US environmental products are recognized for their excellence in innovation, engineering, and durability.

Global Environmental Technology Market Growth, by Region 2022-2028

Asia-Pacific is Anticipated to Exhibit Significant CAGR During the Forecast Period

Asia-Pacific is expected to witness a significant CAGR in the global environmental technology market during the forecast period. The growing demand for environmental technologies from end-user industries for various applications is a key factor driving the growth of the global environmental technology market. The growing investment in wastewater treatment plants is anticipated to create huge scope for the growth of the regional market.

Market Players Outlook

The major companies operating in the global environmental technology market include AECOM Inc., Lennox International Inc., Teledyne Technologies Inc., Thermo Fisher Scientific Inc., and Abatement Technologies Inc. The companies are focusing on product launches, partnerships, geographical expansions, mergers and acquisitions, and collaborations, to gain a competitive advantage. For instance, in April 2021, Veolia and Suez merged at a price of nearly $21.7 per Suez share subject to the signature of the Combination Agreement. Its scope will be the municipal water and solid waste activities of Suez in France (including CIRSEE, the main research center in France), as well as the activities of Suez in particular in water and in the following geographies, such as Italy (including the stake in Acea), the Czech Republic, Africa (including Lydec), Central Asia, India, China, Australia, and the global digital and environmental activities (SES).

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global environmental technology market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Environmental Technology Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Environmental Technology Market, By Component

4.1.1. Solutions

4.1.2. Services

4.2. Global Environmental Technology Market, By Application

4.2.1. Wastewater Treatment

4.2.2. Sewage Treatment

4.2.3. Pollution Monitoring

4.2.4. Dust Emissions

4.2.5. Dry Steaming

4.2.6. Gas Dissolution

4.2.7. Precision Cooling

4.2.8. Solid Waste Treatment

4.2.9. Others

4.3. Global Environmental Technology Market, By End-User

4.3.1. Residential/Municipal

4.3.2. Industrial Transportation & Logistics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abatement Technologies

6.2. AECOM

6.3. Arcadis N.V.

6.4. BacTech Inc.

6.5. Biffa Plc

6.6. Carbon Clean

6.7. CarbonCure Technologies Inc.

6.8. Covanta Holding Corp.

6.9. Cypher Environmental

6.10. Hitachi Zosen Corp.

6.11. Lennox International Inc.

6.12. SUEZ Inc.

6.13. Sunfire GmbH

6.14. Svante Inc.

6.15. Teledyne Technologies Inc.

6.16. Thermo Fisher Scientific Inc.

6.17. Total S.A.

6.18. TRC Companies, Inc.

6.19. Veolia Environnement S.A.

6.20. Waste Connections