Epigenetics Drugs and Diagnostic Technologies Market

Global Epigenetics Drugs and Diagnostic Technologies Market Size, Share & Trends Analysis Report by Type (Histone Deacetylase (HDAC) Inhibitors, DNA Methyltransferase (DNMT) Inhibitors), by Product (Reagents, Kits, Instruments, Enzymes, and Services), by Application (Cancer Disease, Inflammatory Diseases, Infectious Diseases, Cardiovascular Diseases, Metabolic Diseases, and Other), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The epigenetics drugs and diagnostic technologies market is anticipated to grow at a significant CAGR during the forecast period. Epigenetics drugs and diagnostics technologies are used in the screening of early-stage cancer and other abnormal changes in brain cells, liver cells and skin cells among others. It is caused by different factors includes lifestyle changes along with environmental exposures. The factor such as increasing incidence of cancer with epigenetic modification base is anticipated to drive the market growth. Moreover, the presence of a large number of products under clinical trials and their commercialization is fuelling the market growth during the forecast period. For instance, Eli Lilly's Ramucirumab approved by the Food and Drug Administration (FDA) to be utilized in combination with Folfiri for the diagnosis and treatment of metastatic cancer.

Moreover, diagnostics firms are mainly focused on developing new treatments includes antibodies specific for the detection of epigenetic modifications and improved kits for the detection of biomarkers. Thus, it is likely to encourage healthcare and pharmaceutical firms to partner for the introduction of new and advanced treatment that will further boost theepigenetics drugs and diagnostic technologies market growth. Additionally, the development of advanced technological products is mostly focused on the detection of methylation markers associated with cancer development. For instance, epigenomics developed Epi prolong BL Reflex Assay that enables in lung cancer diagnosis by determining methylation of SHOX2 biomarker gene. Furthermore, the rising aging population and increasing oncology and non-oncology disorders are expected to drive the market growth. As well as, the large prevalence of cancer with the advancement in screening techniques is boosting the epigenetics drugs and diagnostic technologies market growth. However, problems associated with quality are the restraining factor for the market.

Segmental Outlook

The global epigenetics drugs and diagnostic technologiesmarket is segmented on the basis of type, application, and product. Based on type, the market is segmented on the basis of histone deacetylase (HDAC) inhibitors, DNA methyltransferase (DNMT) inhibitors. Based on the product, the market is segmented on the basis ofreagents, kits, instruments, enzymes, and services. Based on the application, the market is segmented into cancer disease, inflammatory diseases, infectious diseases, cardiovascular diseases, metabolic diseases, and others.

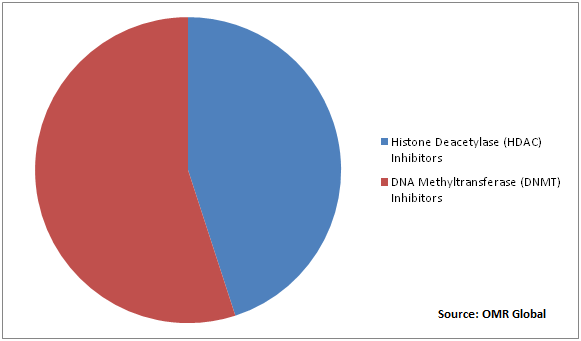

DNA Methyltransferase (DNMT) Inhibitors will be the largest segment by Type

Based on type, the market is segmented on the basis of histone deacetylase (HDAC) inhibitors, DNA methyltransferase (DNMT) inhibitors. DNMT inhibitors segment is anticipated to hold the largest market share in the market owing to the wide availability of these inhibitors and generics in most regions. DNMT inhibitors offer enhanced access for targeting the cancerous cells. Currently, FDA has approved four drugs that are commercially available and two of them are DNMT inhibitors such as Eisai's Dacogen (decitabine) and Celgene's Vidaza (azacitidine) for the diagnosis and treatment of Myelodysplastic Syndrome (MDS). Other two are HDAC inhibitors such as Celgene's Istodax (romidepsin) and Merck's Zolinza (vorinostat) both for the treatment of Cutaneous T Cell Lymphoma (CTCL).

Global Epigenetics Drugs and Diagnostic Technologies Market Share by End-Users, 2018 (%)

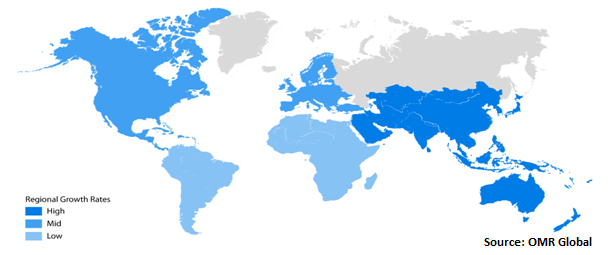

Regional Outlooks

The globalepigenetics drugs and diagnostic technologies market is further segmented based on geography including North America, Europe, Asia-Pacific and Rest of the World. North America is expected to hold the largest market share in epigenetics drugs and diagnostic technologies during the forecast period. Owing to increasing incidence of cancer and other non-oncology indications and oncology and other non-oncology indications (Alzheimer's and arthritis) are associated with epigenetics; thus the increasing incidence of cancer supports the growth of the epigenetics drugs and diagnostic technologies market over the forecast period.

Global Epigenetics Drugs and Diagnostic Technologies Market Growth, by Region 2019-2025

Asia-Pacific will augment with the fastest growth rate in the Epigenetics Drugs and Diagnostic Technologies market

The market in Asia-Pacific is anticipated to hold the fastest growth rate in the market due to the increasing incidence of cancer cases in the Asian region which would fuel the demand for epigenetics drugs. Asia accounts for nearly half of the new cancer cases across the globe. Japan, China, South Korea and Australia are the largest market for epigenetics drugs and diagnostic therapies. Japan dominates the market in the Asia-Pacific owing to the considerable presence of companies in the therapeutics segment includes Oncolys Biopharma and Eisai Pharmaceuticals. Moreover, these companies are taking initiatives for the development of epigenetic drugs. Various research institutes and investments from these companies would boost the epigenetics drugs and diagnostic technologies market.

Market Players Outlook

The key players of the epigenetics drugs and diagnostic technologies market include4SC AG,AbbVie, Inc., Abcam plc, Celgene Corp., CellCentric, Ltd., Eisai, Inc., Illumina, Inc., MDxHealth SA, Merck KGaA, Novartis AG, Otsuka Pharmaceutical Co., Ltd. and Zymo Research Corp.The market players are considerably contributing to the market growth by the adoption of various strategies including new product launch, merger, and acquisition, collaborations with government, funding to the start-ups and technological advancements to stay competitive in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global epigenetics drugs and diagnostic technologiesmarket. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Epigenetics Drugs and Diagnostic Technologies Market by Type

5.1.1. Histone Deacetylase (HDAC) Inhibitors

5.1.2. DNA Methyltransferase (DNMT) Inhibitors

5.2. Global Epigenetics Drugs and Diagnostic Technologies Market by Product

5.2.1. Reagents

5.2.2. Kits

5.2.3. Instruments

5.2.4. Enzymes

5.2.5. Services

5.3. Global Epigenetics Drugs and Diagnostic Technologies Market by Application

5.3.1. Cancer Disease

5.3.2. Inflammatory Diseases

5.3.3. Infectious Diseases

5.3.4. Cardiovascular Diseases

5.3.5. Metabolic Diseases

5.3.6. Other

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 4SC AG

7.2. AbbVie, Inc.

7.3. Abcam plc

7.4. Aurobindo Pharma USA, Inc.

7.5. Celgene Corp.

7.6. CellCentric, Ltd.

7.7. Celleron Therapeutics, Ltd.

7.8. Eisai, Inc.

7.9. EpiGentek Group, Inc.

7.10. Epizyme, Inc.

7.11. Illumina, Inc.

7.12. MDxHealth SA

7.13. Merck KGaA

7.14. Novartis AG

7.15. Oncolys BioPharma, Inc.

7.16. Otsuka Pharmaceutical Co., Ltd.

7.17. Promega Corp.

7.18. Syndax Pharmaceuticals, Inc.

7.19. Viracta Therapeutics, Inc.

7.20. Zymo Research Corp.

1. GLOBAL EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL HISTONE DEACETYLASE (HDAC) INHIBITORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL DNA METHYLTRANSFERASE (DNMT) INHIBITORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL CANCER DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL INFLAMMATORY DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL INFECTIOUS DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL CARDIOVASCULAR DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL METABOLIC DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

12. GLOBAL REAGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL KITSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL ENZYMES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. NORTH AMERICAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. NORTH AMERICAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. NORTH AMERICAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

21. EUROPEAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

23. EUROPEAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

24. EUROPEAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

29. REST OF THE WORLD EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

30. REST OF THE WORLD EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

31. REST OF THE WORLD EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

1. GLOBAL EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

4. GLOBAL EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. THE US EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

7. UK EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD EPIGENETICS DRUGS AND DIAGNOSTIC TECHNOLOGIES MARKET SIZE, 2018-2025 ($ MILLION)