Ethernet Controller Market

Global Ethernet Controller Market Size, Share & Trends Analysis Report by Bandwidth Type (Fast Ethernet, Gigabit Ethernet, Switch Ethernet) by End-User (Servers, Routers & Switches, Others) Forecast Period (2020-2026) Update Available - Forecast 2025-2035

Ethernet controller market is projected to grow at a considerable CAGR of 6.8% during the forecast period (2020-2026). Ethernet controller is a semiconductor device that controls communication over Ethernet. The rise in the adoption of networking devices such as smartphones, laptops, and PCs among others is a key factor driving the growth of the Ethernet controller devices. Failure of the Ethernet controller results in a breakdown in internet connection, due to the low cost of this device people prefer to replace this controller this factor further promotes the high sale for the device.

Industrial automation is another factor propelling the growth of the global Ethernet controller market. For industrial automation, a lot of electronic devices are connected to the network to make use of IoT technology. The high usage of the network connectivity in the industrial area is actively supporting the adoption of the Ethernet controller for the streamlined functioning. As these devices are capable of handling data of bandwidth ranging from mega to gigabit these devices are also being used in the data centers to manage a huge volume of the networking data.

Segmental Outlook

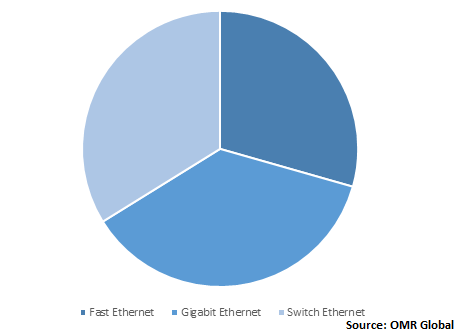

The global Ethernet controller market is classified on the basis of bandwidth type and end-user. The rapid adoption of industry 4.0 revolution and rising inclination towards industrial Ethernet physical layer (PHY) products to facilitate manufacturers in addressing challenges involved in the smart factory communication is a key factor contributing to the growth of the market. Furthermore, this physical layer involves the functioning of surrounding data integration, edge connectivity, synchronization, and system interoperability therefore this layer is highly being adopted in the manufacturing industries. Based on the bandwidth type, the market is segmented into fast Ethernet, Gigabit Ethernet, and switched Ethernet. Based on end-user, the market is segmented into servers, routers & switches, and others.

Gigabit Ethernet to be considerable segment based on bandwidth type

Gigabit Ethernet is anticipated to hold considerable market share based on the bandwidth type. The growing utility of gigabit Ethernet controller in the data centers is a key factor promoting the growth of this market segment The considerable growth in the cloud computing and analytics are expected to drive investments on large data centers which in turn will create the demand for gigabit Ethernet which in turn is further anticipated to drive the market growth of this segment.

Global Ethernet Controller Market Share by Bandwidth Type, 2019 (%)

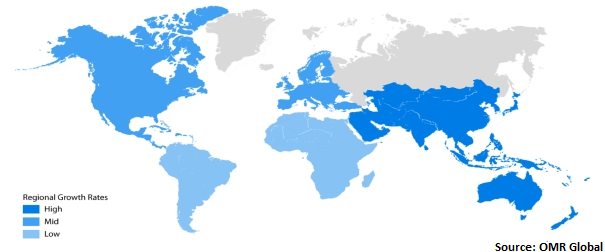

Regional Outlook

The global Ethernet controller market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is anticipated to hold a considerable market share during the forecast period. Advancement in IT infrastructure, rise in the number of connected devices and data centers are the major factors attributing to the market share of the region. Further, the presence of key market players such as Broadcomm Inc., Microchip Inc., and Texas Instrument Inc. in the region are making considerable contributions to the market share.

Global Ethernet Controller Market Growth, by Region 2020-2026

Asia-Pacific to exhibit considerable growth during the forecast period 2020-2026

Asia-Pacific is estimated to witness significant growth in the market during the forecast period owing to the increasing presence of multinational companies coupled with increasing government initiatives in the region. The significant increase in IT outsourcing services and the presence of a large number of data centers is further creating the demand of the Ethernet controllers which in turn is driving the growth of the Ethernet controller market in the Asia-Pacific region. Increase in the demand for gaming consoles, VoIP solutions, and digital signage in the region to further contributing towards the market growth in the region.

Market Players Outlook

The major players of the Ethernet controller market include Intel Corp., Broadcom Inc., OMRON Corp., Microchip Technology Inc., Cirrus Logic Inc., Texas Instruments Inc., Silicon Laboratories, Inc., Marvell Technology Group, Realtek Semiconductor Corp., Cadence Design Systems, Inc., and so on. These companies are adopting various growth strategies to stay competitive in the market. Merger & acquisition, collaboration, partnership, strategic agreement, and product launch are the key activities that the major market players are adopting to sustain their market place. For instance, in March 2020, Ethernity Networks had introduced ENET-D, an add-on Ethernet Controller technology to its ACE-NIC100 SmartNIC that efficiently processes millions of data flows and offers performance acceleration for networking and security appliances.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Ethernet controller market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Intel Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. OMRON Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Broadcom Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Microchip Technology Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Texas Instruments, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Ethernet Controller Market by Bandwidth Type

5.1.1. Fast Ethernet

5.1.2. Gigabit Ethernet

5.1.3. Switch Ethernet

5.2. Global Ethernet Controller Market by End-User

5.2.1. Servers

5.2.2. Routers & Switches

5.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Broadcom, Inc.

7.2. Cadence Design Systems, Inc.

7.3. Cirrus Logic, Inc.

7.4. Ethernity Networks, Ltd.

7.5. Futurlec Inc.

7.6. Intel Corp.

7.7. Marvell Technology Group, Ltd.

7.8. Microchip Technology, Inc.

7.9. Mindspeed Technologies, Inc.

7.10. OMRON Corp.

7.11. Realtek Semiconductor Corp.

7.12. Renesas Electronics Corp.

7.13. Siemens AG

7.14. Silicon Laboratories, Inc.

7.15. Synopsys Inc.

7.16. Texas Instruments, Inc.

1. GLOBAL ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH TYPE, 2019-2026 ($ MILLION)

2. GLOBAL FAST ETHERNET MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL GIGABIT ETHERNET MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SWITCH ETHERNET MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

6. GLOBAL SERVERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ROUTERS & SWITCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. NORTH AMERICAN ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH TYPE, 2019-2026 ($ MILLION)

11. NORTH AMERICAN ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

12. EUROPEAN ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. EUROPEAN ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH TYPE, 2019-2026 ($ MILLION)

14. EUROPEAN ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

19. REST OF THE WORLD ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD ETHERNET CONTROLLER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL ETHERNET CONTROLLER MARKET SHARE BY BANDWIDTH TYPE, 2019 VS 2026 (%)

2. GLOBAL ETHERNET CONTROLLER MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL ETHERNET CONTROLLER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ETHERNET CONTROLLER MARKET SIZE, 2019-2026 ($ MILLION)