EV (Electric Vehicle) Insurance Market

EV (Electric Vehicle) Insurance Market Size, Share & Trends Analysis Report by Coverage (First-Party Liability Coverage, Third-Party Liability Coverage, and Others), by Vehicle Age (New Vehicle and Used Vehicle), by Application (Personal and Commercial), and by Distribution Channel (Insurance Companies, Banks, Insurance Agents/Brokers, and Other Financial Institutions) Forecast Period (2024-2031)

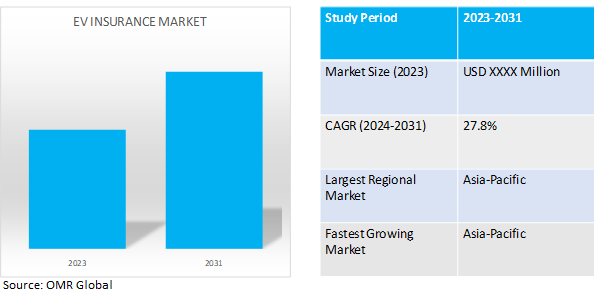

EV Insurance market is anticipated to grow at an exponential CAGR of 27.81% during the forecast period (2024-2031).Electric Vehicle (EV) Insurance provides coverage tailored specifically for electric cars, addressing unique risks such as battery damage and charging infrastructure. It safeguards against financial loss due to accidents, theft, or malfunctions.

Market Dynamics

EV Sales Take Charge: Fueling the Rise of EV Insurance

The global EV insurance market is riding a wave driven by the skyrocketing sales of EVs. For instance, the electric car industry is experiencing rapid expansion, with sales surpassing 10 million in 2022. Electric vehicles accounted for 14.0% of all new car purchases, marking a notable increase from approximately 9% in 2021 and less than 5% in 2020.As consumers increasingly embrace EVs, a vast and ever-growing pool of these vehicles requires specialized insurance coverage. This surge in EV adoption creates a natural demand for insurance products that cater to the unique needs of electric vehicles, from protecting expensive batteries to roadside assistance specific to charging stations.

Government Incentives

Governments around the world are acting as a powerful accelerators for the EV insurance market through their incentive programs. Tax breaks, purchase subsidies, and investments in charging infrastructure are making electric vehicles a more attractive option for consumers. For instance, In Indonesia, starting from 2022, government vehicles are mandated to be electric, while subsidies for electric vehicle purchases have been introduced since 2023. Meanwhile, in Seychelles, there is a target for 30% of new vehicle sales to be electric by 2030. Additionally, the upcoming National Electric Mobility Strategy aims for 100% of buses to transition to electric by 2050.As a result, EV sales soar, leading to a larger pool of vehicles needing insurance. These incentives not only increase EV adoption but also indirectly stimulate the growth of the EV insurance market. This creates a win-win situation for both environmentally conscious consumers and the insurance industry.

Market Segmentation

Our in-depth analysis of global EV insurance includes the following segments by coverage, by vehicle age, by distribution channel, and by application:

- Based on coverage, the market is sub-segmented into first-party liability coverage, third-party liability coverage, and others.

- Based on vehicle age, the market is bifurcated into new vehicles and used vehicles.

- based on application, the market is split into personal and commercial.

- Based on distribution channels, the market is sub-segmented into insurance companies, banks, insurance agents/brokers, and other financial institutions.

Rapid Growth of Personal Segment in Electric Vehicle Insurance Market

In the EV insurance market, the personal segment is experiencing faster growth compared to the commercial segment. This trend is primarily driven by increasing consumer adoption of electric vehicles for personal use and supportive government incentives aimed at individual consumers. For instance, in 2022, electric car sales reached another milestone with a 14.0% market share, encompassing both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), marking a 55.0% increase compared to 2021. In the Net Zero Scenario, projections indicate that electric car sales could constitute approximately 65.0% of total car sales by 2030.As environmental sustainability becomes a more prominent concern, more people are choosing electric vehicles for their personal transportation needs, leading to a surge in demand for personal EV insurance. Additionally, advancements in EV technology are making electric vehicles more accessible and appealing to individual consumers. While the commercial segment is also growing, factors such as longer decision-making processes and infrastructure requirements contribute to a slower rate of growth compared to the personal segment.

New VehiclesHold a Considerable Market Share

In the EV insurance market, the segment for new vehicles is experiencing notably faster growth compared to the segment for used vehicles. This acceleration is primarily attributed to several factors. Firstly, as technological advancements in EVs continue to enhance their efficiency, performance, and affordability, more consumers are opting for new electric vehicles over traditional internal combustion engine vehicles. For instance, according to the the US Department of Energy’s (DOE’s) Vehicle Technologies Office, the cost of an electric vehicle lithium-ion battery pack has decreased significantly by 89% from 2008 to 2022, when adjusted for constant 2022 dollars. As of 2022, the estimated cost stands at $153 per kilowatt-hour (kWh) on a usable energy basis for production at a scale of at least 100,000 units per year. This marks a substantial reduction from $1,355/kWh in 2008. Additionally, government incentives and subsidies often target new EV purchases, further incentivizing consumers to choose new electric vehicles. Moreover, new EV models frequently incorporate the latest safety features and technologies, which can influence insurance premiums and attract consumers seeking comprehensive coverage. Consequently, the demand for insurance tailored to new electric vehicles is surging, contributing to the rapid growth of this segment in the EV insurance market.

Regional Outlook

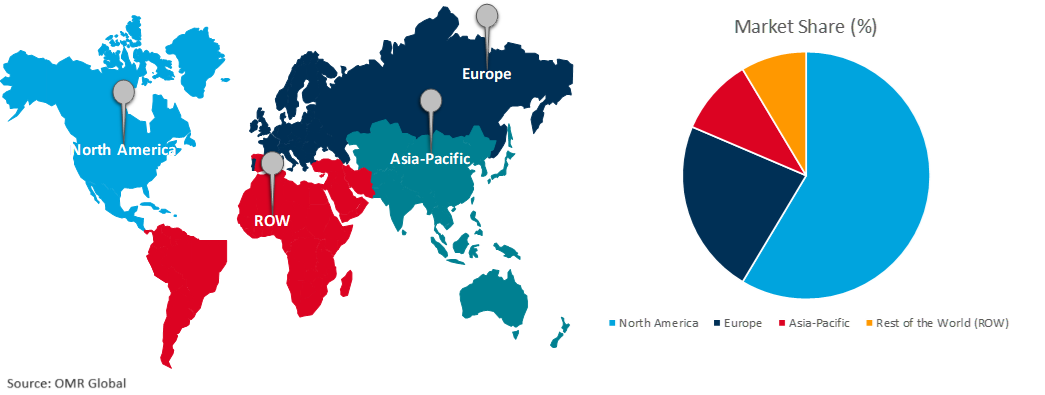

The global EV insurance market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global EV Insurance Growth by Region 2024-2031

Asia-Pacific: A Powerhouse in the Booming EV Insurance Market

The Asia-Pacific region boasts the largest and fastest-growing Electric Vehicle (EV) insurance market. The large scale adoption of EV across the region is a key contributor to the high share of this market segment.For instance, China continues to maintain its leading position, constituting roughly 60.0% of global electric car sales. More than half of the EVs worldwide are now on Chinese roads, and the country has already achieved its target for new energy vehicle sales set for 2025. This creates a naturally expanding pool of EVs requiring insurance coverage. Secondly, government policies across the Asia-Pacific actively promote EV use. These policies range from offering subsidies for purchasing EVs to restricting the use of traditional gasoline-powered vehicles. For instance, Singapore's plan to phase out diesel cars by 2040 has resulted in a dramatic increase in EV sales. As government initiatives put more EVs on the road, the demand for specialized EV insurance correspondingly expands, solidifying Asia-Pacific's position as the world's leader in this rapidly growing market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global EV Insurance include Allianz SE, Allstate Insurance Company, AXA Insurance Ltd, Liberty Mutual Insurance Company, and Progressive Casualty Insurance Company among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in September 2023, Allianz Versicherungs-AG strengthened its position in the EV insurance market through a strategic partnership with Fleetpool. The collaboration ensures exclusive insurance coverage for Fleetpool's electric vehicles, emphasizing Allianz's commitment to sustainable mobility solutions. This partnership expands access to comprehensive insurance options for customers engaging with Fleetpool's innovative car subscription models, fostering a mutually beneficial relationship in the evolving landscape of electric vehicle insurance..

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global EV Insurance based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Allianz SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Allstate Insurance Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. AXA Insurance Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Liberty Mutual Insurance Company

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Progressive Casualty Insurance Company

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global EV Insurance Market byCoverage

4.1.1. First-Party Liability Coverage

4.1.2. Third-Party Liability Coverage

4.1.3. Others

4.2. Global EV Insurance Market by Vehicle Age

4.2.1. New Vehicle

4.2.2. Used Vehicle

4.3. Global EV Insurance Market by Application

4.3.1. Personal

4.3.2. Commercial

4.4. Global EV Insurance Market by Distribution Channel

4.4.1. Insurance Companies

4.4.2. Banks

4.4.3. Insurance Agents/ Brokers

4.4.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Acko General Insurance Ltd.

6.2. Aviva plc

6.3. Bajaj Allianz General Insurance Company

6.4. Beinsure Digital Media

6.5. Direct Line Insurance Group plc

6.6. Esure Group plc

6.7. GEICO

6.8. HDFC ERGO General Insurance Company Limited

6.9. Lemonade, Inc.

6.10. State Farm Mutual Automobile Insurance Company

1. GLOBAL EV INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2023-2031 ($ MILLION)

2. GLOBAL FIRST-PARTY LIABILITY COVERAGEEV INSURANCE MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL THIRD-PARTY LIABILITY COVERAGEEV INSURANCE MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHEREV INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL EV INSURANCE MARKET RESEARCH AND ANALYSIS BYVEHICLE AGE, 2023-2031 ($ MILLION)

6. GLOBAL NEW VEHICLEEV INSURANCE MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL USED VEHICLEEV INSURANCEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL EV INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBALPERSONALEV INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL COMMERCIALEV INSURANCEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL EV INSURANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

12. GLOBAL EV INSURANCE BY INSURANCE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL EV INSURANCEBY BANKSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBALEV INSURANCEBY INSURANCE AGENTS/ BROKERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBALEV INSURANCE MARKET BY OTHERS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN EV INSURANCE RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN EV INSURANCE RESEARCH AND ANALYSIS BY COVERAGE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN EV INSURANCE RESEARCH AND ANALYSIS BYVEHICLE AGE 2023-2031 ($ MILLION)

19. NORTH AMERICAN EV INSURANCE RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN EV INSURANCE RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

21. EUROPEAN EV INSURANCE RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN EV INSURANCE RESEARCH AND ANALYSIS BY COVERAGE, 2023-2031 ($ MILLION)

23. EUROPEAN EV INSURANCE RESEARCH AND ANALYSIS BYVEHICLE AGE2023-2031 ($ MILLION)

24. EUROPEAN EV INSURANCE RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. EUROPEAN EV INSURANCE RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC EV INSURANCE RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA- PACIFIC EV INSURANCE RESEARCH AND ANALYSIS BY COVERAGE, 2023-2031 ($ MILLION)

28. ASIA-PACIFICEV INSURANCE RESEARCH AND ANALYSIS BYVEHICLE AGE, 2023-2031 ($ MILLION)

29. ASIA-PACIFICEV INSURANCE RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC EV INSURANCE RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

31. REST OF THE WORLD EV INSURANCE RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

32. REST OF THE WORLD EV INSURANCE RESEARCH AND ANALYSIS BY COVERAGE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD EV INSURANCE RESEARCH AND ANALYSIS BYVEHICLE AGE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD EV INSURANCE RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

35. REST OF THE WORLD EV INSURANCE RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL EV INSURANCEMARKET RESEARCH AND ANALYSIS BYCOVERAGE, 2023 VS 2031 (%)

2. GLOBALFIRST-PARTY LIABILITY COVERAGEEV INSURANCEMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBALTHIRD-PARTY LIABILITY COVERAGEEV INSURANCEMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHERS EV INSURANCE RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL EV INSURANCE RESEARCH AND ANALYSIS BY VEHICLE AGE, 2023 VS 2031 (%)

6. GLOBALNEW VEHICLEEV INSURANCERESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBALUSED VEHICLEEV INSURANCERESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL EV INSURANCE RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL PERSONALEV INSURANCEMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL COMMERCIALEV INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL EV INSURANCE RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

12. GLOBAL EV INSURANCEBY INSURANCE COMPANIESMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL EV INSURANCEBY BANKSMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBALEV INSURANCE BY INSURANCE AGENTS/ BROKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBALEV INSURANCEBY OTHERMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL EV INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. US EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA EV INSURANCEMARKET SIZE, 2023-2031 ($ MILLION)

19. UK EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY EV INSURANCEMARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN EV INSURANCEMARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA EV INSURANCEMARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)

31. THE MIDDLE EAST & AFRICA EV INSURANCE MARKET SIZE, 2023-2031 ($ MILLION)