EV Solid-State Battery Market

Global EV Solid-State Battery Market Size, Share & Trends Analysis Report by Vehicle Type (Passenger vehicle, and Commercial vehicle), and by Propulsion (Plug-in Hybrid Electric Vehicle, Hybrid Electric Vehicle, and Battery Electric Vehicle) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global EV Solid-State Battery market is anticipated to grow at a significant CAGR of 20.3% during the forecast period. One of the major factors that are fueling the market is the higher energy density as compared to the Li-ion battery that uses liquid electrolyte solution which benefits the battery with the longer the battery can emit a charge in relation to its size which is useful when there isn't much room for a battery but you need a lot of energy output. This has increased the demand for solid-state batteries in the EV market. For instance, in January 2022, Dongfeng launched Fifty Dongfeng Fengshen (Aeolus) E70 demonstration EVs with solid-state lithium batteries have been delivered by the Dongfeng Motor Corporation. The solid-state batteries were developed through a joint venture project between Dongfeng Technology Centre and Ganfeng Lithium Battery with the new E70 also able to battery swap.

Impact of COVID-19 Pandemic on Global EV Solid-State Battery Market

COVID-19 pandemic had impacted most of the industries including the global automotive industry significantly owning to the lockdown in most of the nations to control the spread of the virus. It affected the overall demand for vehicles in the market. However, the electric vehicle market showed significant growth. As per the data of the International Energy Agency (IEA) 2020, electric car sales reached 2,977,058 vehicle units globally which are 40.8% more than the sales of electric cars in 2019. Moreover, as per the annual report 2021 of Samsung SDI Co., Ltd., the company’s total revenue increased by more than 19% as compared to 2020 revenue which was also increased by more than 11% as compared to 2019 revenue.

Segmental Outlook

The global EV solid-state battery market is segmented based on vehicle type and propulsion. Based on the vehicle type, the market is segmented into passenger vehicles and commercial vehicles. Based on the propulsion, the market is sub-segmented into the plug-in hybrid electric vehicle, hybrid electric vehicle, and battery electric vehicle. The above-mentioned segments can be customized as per the requirements. Based on vehicle type, passenger vehicles dominates the market. Based on propulsion, battery electric vehicle dominates the market.

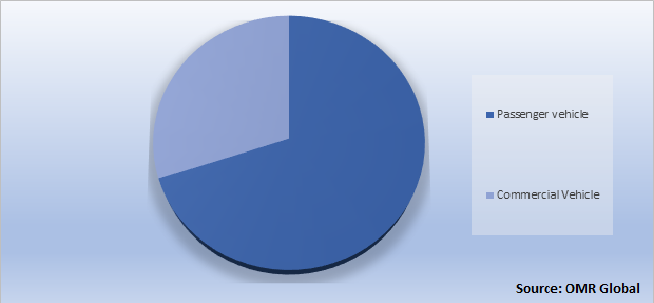

Global EV Solid-State Battery Market Share by Vehicle Type, 2021 (%)

The Passenger Vehicle Segment Holds the Major Share in the Global EV Solid-State Battery Market

Passenger vehicle holds the major in the global EV solid-state battery market and is anticipated to grow significantly during the forecast period. Passenger vehicles have been dominating the market since the inception of the vehicle industry. These vehicles are used by most people for various reasons while commercial vehicles are used by some for specific works. Its dominance has been also seen in the electric vehicle market which has a high demand for solid-state batteries. As per the International Energy Agency (IEA), 2020 data, EV cars stock is 10,228,265 units across the globe, while commercial vehicles are 637,699 units.

Regional Outlooks

The global EV Solid-State Battery market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Asia-Pacific holds the major share in the electric motor for electric vehicle market followed by Europe, and then North America.

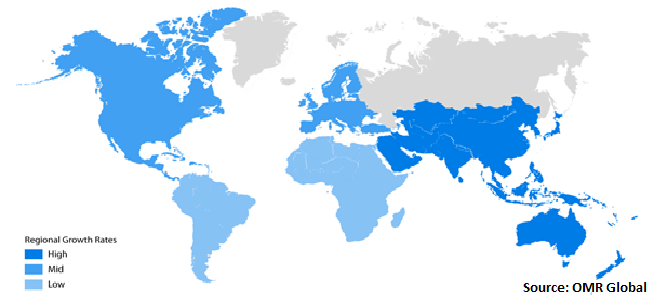

Global EV Solid-State Battery Market Growth, by Region 2022-2028

The Asia-Pacific Region Holds the Major Share in the Global EV Solid-State Battery Market

Asia Pacific region holds the major share in the EV solid-state battery market globally owing to the presence of emerging countries such as China, India, Japan, South Korea, and others. The region is the most populous and has major vehicle markets such as Toyota, Honda, Nio, Tata, and others. This has increased the sales of electric vehicles in the region exponentially and has great future potential for future electric vehicle sales, and has a huge demand for solid-state batteries. As per the data of IEA 2020, out of the total EV car stock of 10,228,265 units, China has 4,514,114 EV car stock which is more than 44% of the total EV car stocks.

Market Players Outlook

The major companies serving the global EV solid-state battery market include Hyundai Motor Group, Renault Group, Samsung SDI Co., Ltd., Toyota Motor Corp., Volkswagen Ag, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2020, Samsung Advanced Institute of Technology (SAIT) and the Samsung R&D Institute Japan (SRJ) presented research about high-performance, long-lasting all-solid-state batteries to Nature Energy, scientific journals. The research is expected to help fuel the expansion of electric vehicles (EVs). The developed prototype pouch cell enables an EV to travel up to 800km on a single charge and features a cycle life of over 1,000 charges.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global EV solid-state battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global EV Solid-State Battery Market

- Recovery Scenario of Global EV Solid-State Battery Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Hyundai Motor Group

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Renault Group

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Samsung SDI Co., Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Toyota Motor Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Volkswagen Ag

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global EV Solid State Battery Market by Vehicle Type

4.1.1. Passenger Vehicles

4.1.2. Commercial Vehicles

4.2. Global EV Solid State Battery Market by Propulsion

4.2.1. Plug-in Hybrid Electric Vehicle

4.2.2. Hybrid Electric Vehicle

4.2.3. Battery Electric Vehicle

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ford Motor Co.

6.2. General Motors

6.3. LG Chem Ltd.

6.4. Mitsubishi Motors

6.5. Stellantis N.V.

1. GLOBAL EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

2. GLOBAL PASSENGER VEHICLES EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL COMMERCIAL VEHICLES EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2021-2028 ($ MILLION)

5. GLOBAL PLUG-IN EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL HYBRID EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL BATTERY EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

11. NORTH AMERICAN EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2021-2028 ($ MILLION)

12. EUROPEAN EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. EUROPEAN EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

14. EUROPEAN EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2021-2028 ($ MILLION)

15. ASIA-PACIFIC EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2021-2028 ($ MILLION)

18. REST OF THE WORLD EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. REST OF THE WORLD EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD EV SOLID STATE BATTERY MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL EV SOLID STATE BATTERY MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL EV SOLID STATE BATTERY MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL EV SOLID STATE BATTERY MARKET, 2022-2028 (%)

4. GLOBAL EV SOLID STATE BATTERY MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

5. GLOBAL PASSENGER VEHICLES EV SOLID STATE BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL COMMERCIAL VEHICLE EV SOLID STATE BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL EV SOLID STATE BATTERY MARKET SHARE BY PROPULSION, 2021 VS 2028 (%)

8. GLOBAL PLUG-IN EV SOLID STATE BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL HYBRID EV SOLID STATE BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL BATTERY EV SOLID STATE BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL EV SOLID STATE BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

14. UK EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD EV SOLID STATE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)