EV Test Equipment Market

EV Test Equipment Market Size, Share & Trends Analysis Report by Propulsion Type (BEV, and PHEV), by Vehicle Type (Passenger Car, and Commercial Vehicle), and by Application (EV component & Drivetrain, EV Charging, and Powertrain) Forecast Period (2024-2031)

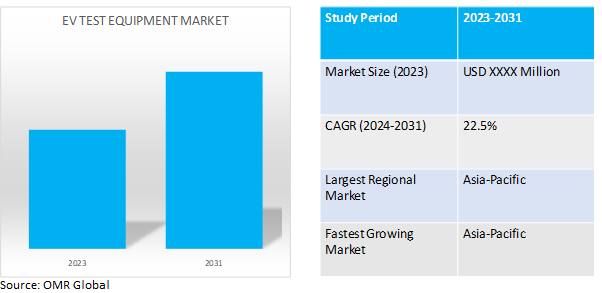

EV test equipment market is anticipated to grow at a significant CAGR of 22.5% during the forecast period (2024-2031). EV test equipment is used to check the performance and safety of EV components, such as batteries and motors. This equipment helps ensure that automotive parts are reliable, safe, and meet customer expectations. The growing EV demand to drive the growth of the global market.

Market Dynamics

The EV Boom: Fueling Demand for Specialized Testing Equipment

The burgeoning popularity of EVs is the primary catalyst propelling the growth of the EV test equipment market. For instance, in the first quarter, over 2.3 million electric cars were sold, marking a 25.0% increase compared to the same period last year. Anticipated sales by the end of 2023 are projected at 14 million, representing a 35.0% year-on-year surge, with accelerated purchases expected in the second half of the year. Consequently, electric cars could comprise 18.0% of total car sales for the entire calendar year. Traditional testing methods designed for gasoline-powered vehicles are simply inadequate for the unique technologies employed in EVs. This necessitates the development and implementation of specialized testing procedures to ensure the safety, performance, and efficiency of these next-generation vehicles. The surge in EV production across the globe has created a massive demand for a whole new set of tools, encompassing equipment to evaluate critical components like batteries and power electronics, as well as dedicated systems to assess overall vehicle safety and efficiency. As a result, the EV test equipment market is experiencing explosive growth to keep pace with the rapid adoption of electric vehicles.

A Two-Pronged Force: Regulations and Innovation Drive Testing Needs

The growth of the EV test equipment market is fueled by a powerful interplay of increasingly stringent regulations and rapid technological advancements within the electric vehicle industry. On one hand, governments worldwide are enacting stricter regulations on vehicle emissions and safety standards. This compels manufacturers to invest in advanced testing equipment to ensure their EVs comply with these ever-evolving regulations before reaching consumers. On the other hand, the EV industry is experiencing a constant wave of innovation, with breakthroughs in battery technology, power electronics, and vehicle design happening at an unprecedented pace. This rapid evolution necessitates the development of new testing methodologies and equipment to keep pace with the changing landscape of EVs. Essentially, these two forces - the push for stricter regulations and the pull of technological innovation - create a dynamic environment where the demand for sophisticated EV test equipment remains ever-present.

Market Segmentation

Our in-depth analysis of the global EV test equipment market includes the following segments by propulsion type, vehicle type, and by application:

- Based on the propulsion type, the market is sub-segmented BEV(Battery Electric Vehicle), and PHEV(Plug-In Hybrid Electric Vehicle).

- Based on vehicle type, the market is bifurcated into passenger car, and commercial vehicle.

- Based on application, the market is asub-segmented into EV component & drivetrain, EV charging, and powertrain.

BEVs: Leading the Charge in the EV Test Equipment Market

BEVs dominate EV test equipment growth, surpassing PHEVs. Their unique electric drivetrains necessitate entirely new testing equipment for batteries, electronics, and charging – a dedicated ecosystem. Government policies favoring zero-emission vehicles further fuel BEV demand, driving the need for specialized test equipment. For instance, The California Air Resources Board (ARB) offers rebates of up to $5,250 for plug-in hybrid electric vehicles, $10,000 for battery electric vehicles, and $15,000 for fuel-cell electric vehicles certified by ARB.Rapid advancements in BEV technology demand constant innovation in testing solutions. While PHEVs require a blend of traditional and EV testing methods, BEVs may offer some streamlined testing needs. Essentially, BEVs' unique technology, strong policy support, rapid progress, and potentially simpler testing solidify them as the main growth engine in the EV test equipment market.

The Rising Potential of Commercial Electric Vehicles: A Segment Analysis within the EV Test Equipment Market

Commercial electric vehicles are shifting the EV test equipment market into high gear. Battery advancements make electric trucks and buses more viable, requiring specialized testing equipment. Government incentives and stricter regulations push for cleaner commercial fleets, necessitating advanced testing solutions. For instance, in India, the Ministry of Road Transport and Highways (MoRTH) has implemented measures to tackle battery safety issues in electric vehicles. Effective from October 1, 2022, new battery safety regulations, AIS-038 Rev 2/AIS-156, have been introduced. Aligned with EU standards, these regulations encompass environmental and thermal propagation tests to ensure enhanced safety standards for electric vehicle batteries. Studies suggest electric commercial vehicles offer cost savings and require robust testing for efficiency and safety.

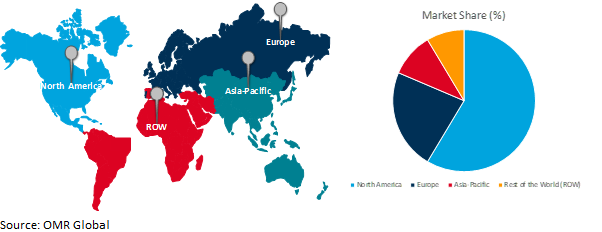

Regional Outlook

The global EV test equipment market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global EV Test Equipment Market Growth by Region 2024-2031

Asia-Pacific: Powering Ahead in the EV Test Equipment Market

The Asia-Pacific region has emerged as the dominant force in the EV test equipment market, experiencing explosive growth.. The surging EV adoption in emerging countries like China, Japan, India and South Korea is creating a vast need for equipment to ensure the safety, performance, and quality of these rapidly produced EVs. For instance, In Japan, electric car and van sales are projected to rise from 3% in 2022 to 20% in 2030 under the STEPS, aligning with 2030 fuel economy standards for passenger cars. In the APS, the electrification of LDVs is accelerating, reaching 30% by 2030, in line with government targets for passenger LDVs and light commercial vehicles. Secondly, these same countries are often manufacturing powerhouses for EVs and batteries. As their production capabilities ramp up, the demand for testing equipment at every stage of the process, from raw materials to finished vehicles, skyrockets. This growth is further bolstered by government initiatives promoting electric vehicle adoption through subsidies and infrastructure development, creating a thriving ecosystem for both EV production and the testing equipment needed to support it.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global EV Test EquipmentincludeChroma ATE Inc., HORIBA, Ltd., Schneider Electric, ZF Friedrichshafen AGamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in June 2023, Chroma showcased its High-Power Charging (HPC) test solution, combining the Chroma 8000 EVSE automatic test system, the 61800-grid simulator, and the 17040/17040E regenerative battery pack test system. With optional EV or EVSE simulators for various DC charging standards, it accommodates single or multiple-coupler high-power charging test platforms. The PowerPro 5 software allows simulation of up to four electric vehicles concurrently, optimizing testing efficiency by replicating real charging behavior. The energy recovery capability of both the grid simulator and battery simulator reduces power consumption and environmental impact.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the globalEV test equipment. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Chroma ATE Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. HORIBA, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Schneider Electric

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. ZF Friedrichshafen AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global EV Test Equipment by Propulsion Type

4.1.1. BEV (Battery Electric Vehicle)

4.1.2. PHEV (Plug-In Hybrid Electric Vehicle)

4.2. Global EV Test Equipment by Vehicle Type

4.2.1. Passenger Car (Internal Combustion Engine)

4.2.2. Commercial Vehicle

4.3. Global EV Test Equipment by Application

4.3.1. EV component & Drivetrain

4.3.2. EV Charging

4.3.3. Powertrain

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Arbin Instruments

6.2. Bitrode Corp

6.3. Comemso electronics GmbH

6.4. Crystal Instruments Corporation

6.5. Gantner Instruments

6.6. TEKTRONIX, INC

6.7. Unico, LLC.

1. GLOBAL EV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BEV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PHEV TEST EQUIPMENT MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL EV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

5. GLOBAL PASSENGER EV TEST EQUIPMENT MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL COMMERCIAL EV TEST EQUIPMENTMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL EV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBALEV COMPONENT & DRIVETRAIN TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL EV CHARGING TEST EQUIPMENTMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL EV POWERTRAIN TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBALEV TEST EQUIPMENT RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BYVEHICLE TYPE 2023-2031 ($ MILLION)

14. NORTH AMERICAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. EUROPEAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BYVEHICLE TYPE 2023-2031 ($ MILLION)

18. EUROPEAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICEV TEST EQUIPMENT RESEARCH AND ANALYSIS BYVEHICLE TYPE, 2023-2031 ($ MILLION)

22. ASIA- PACIFIC EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFICEV TEST EQUIPMENT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. REST OF THE WORLD EV TEST EQUIPMENT RESEARCH AND ANALYSIS BYVEHICLE TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD EV TEST EQUIPMENT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL EV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023 VS 2031 (%)

2. GLOBALBEV TEST EQUIPMENTMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL PHEVTEST EQUIPMENTMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL EV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023 VS 2031 (%)

5. GLOBALPASSENGEREV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBALCOMMERCIALEV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL EV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL EV COMPONENT & DRIVETRAIN TEST EQUIPMENTMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL EV CHARGING TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL EVPOWERTRAIN TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL EV TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. US EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

14. UK EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

26. THE MIDDLE EAST & AFRICA EV TEST EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)